Lena McQuillen, CFP®, Director of Financial Planning, explains how Section 530A accounts work and how to evaluate them alongside more familiar savings options for children.

When new savings rules are introduced, families often ask a simple question: Is this right for us? The recently created Section 530A account, also known as a “Trump Account,” is no exception.

While the name has drawn attention, the more practical question is how this account fits alongside familiar options such as 529 plans, custodial accounts, and Roth IRAs for children. Like most planning tools, 530A accounts come with trade-offs, and understanding those trade-offs helps families decide whether, and how, this option belongs in a broader strategy.

This article explains how 530As work, where they may fit, and how to think about them alongside other savings tools when deciding where to save for a child.

What Is a 530A Account?

What makes these accounts distinct is how they are funded, invested, and accessed during childhood. Until the year a child reaches age 18, 530As follow special rules that do not apply to traditional IRAs. Beginning in the age-18 year, the account transitions and becomes subject to the standard traditional IRA rules.

How 530A Accounts Are Funded

Contribution rules are one of the most important distinctions between 530A accounts and other savings vehicles for children. Contributions may come from several sources, with different rules applying before and after age 18.

Federal Contribution

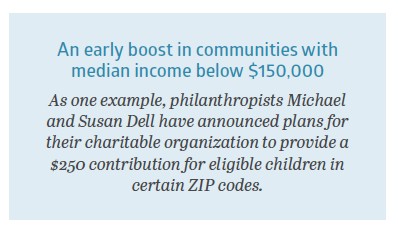

Eligible children born between January 1, 2025, and December 31, 2028, may receive a one-time $1,000 Federal contribution. The child must be a U.S. citizen with a valid Social Security number, and an election must be made on IRS Form 4547. Although eligibility is tied to births beginning in 2025, contributions cannot be made before July 4, 2026.

Personal Contributions

Parents, grandparents, or any other individuals may contribute on a child’s behalf. Unlike traditional and Roth IRAs for children, earned income is not required, and there are no income limits for contributors. Total personal contributions from all sources are capped at $5,000 per year (lower than traditional and Roth IRA limits) and must be made by December 31 of the applicable year. Personal contributions are made with after-tax dollars and are not deductible.

Employer Contributions

Employers may contribute up to $2,500 per year for an employee or an employee’s dependent. These contributions count toward the $5,000 annual personal contribution limit and are not included in the employee’s taxable income.

Certain governmental entities and charitable organizations may also contribute to 530A accounts for a qualified class of beneficiaries under age 18. These contributions are not subject to dollar limits and do not count toward the annual personal contribution cap.

Contributions Beginning at Age 18

In the age-18 year, 530A accounts transition to a standard traditional IRA framework. Contributions must be supported by the beneficiary’s earned income and are subject to standard IRA limits and deductibility rules.

Investment Rules

While the beneficiary is under age 18, 530A accounts are limited to low-cost mutual funds or ETFs that track the S&P 500 Index, or other qualifying U.S. equity indexes. Individual securities, sector-specific funds, and fixed income investments are not permitted during this period.

Beginning in age-18 year, these restrictions are lifted and the account may be invested like any other traditional IRA, allowing for greater flexibility and alignment with the beneficiary’s time horizon, risk tolerance, and financial goals.

Access and Tax Treatment

530As are subject to a strict lock-up period during childhood. No withdrawals are permitted before age 18, and there are no hardship or special exceptions.

Beginning January 1 of the year the beneficiary turns 18, funds may be withdrawn for any purpose. Distributions generally follow traditional IRA rules, including ordinary income taxation and a potential 10% early withdrawal penalty before age 59½, unless an exception applies. 530A accounts are also subject to required minimum distribution (RMD) rules.

Personal contributions are made with after-tax dollars and create basis in the account. These amounts are not taxed again when distributed, though earnings are taxable and subject to early-withdrawal penalties. Contributions from the Federal government, employers, and charitable organizations (and earnings from these contributions) are treated as pre-tax dollars and are fully taxable when distributed.

All distributions follow pro-rata rules, meaning each withdrawal reflects a mix of taxable and after-tax amounts, rather than allowing personal contributions to be withdrawn first. This calculation applies only to the 530A account itself and does not aggregate other traditional IRAs.

How 530A Accounts Compare to Other Options

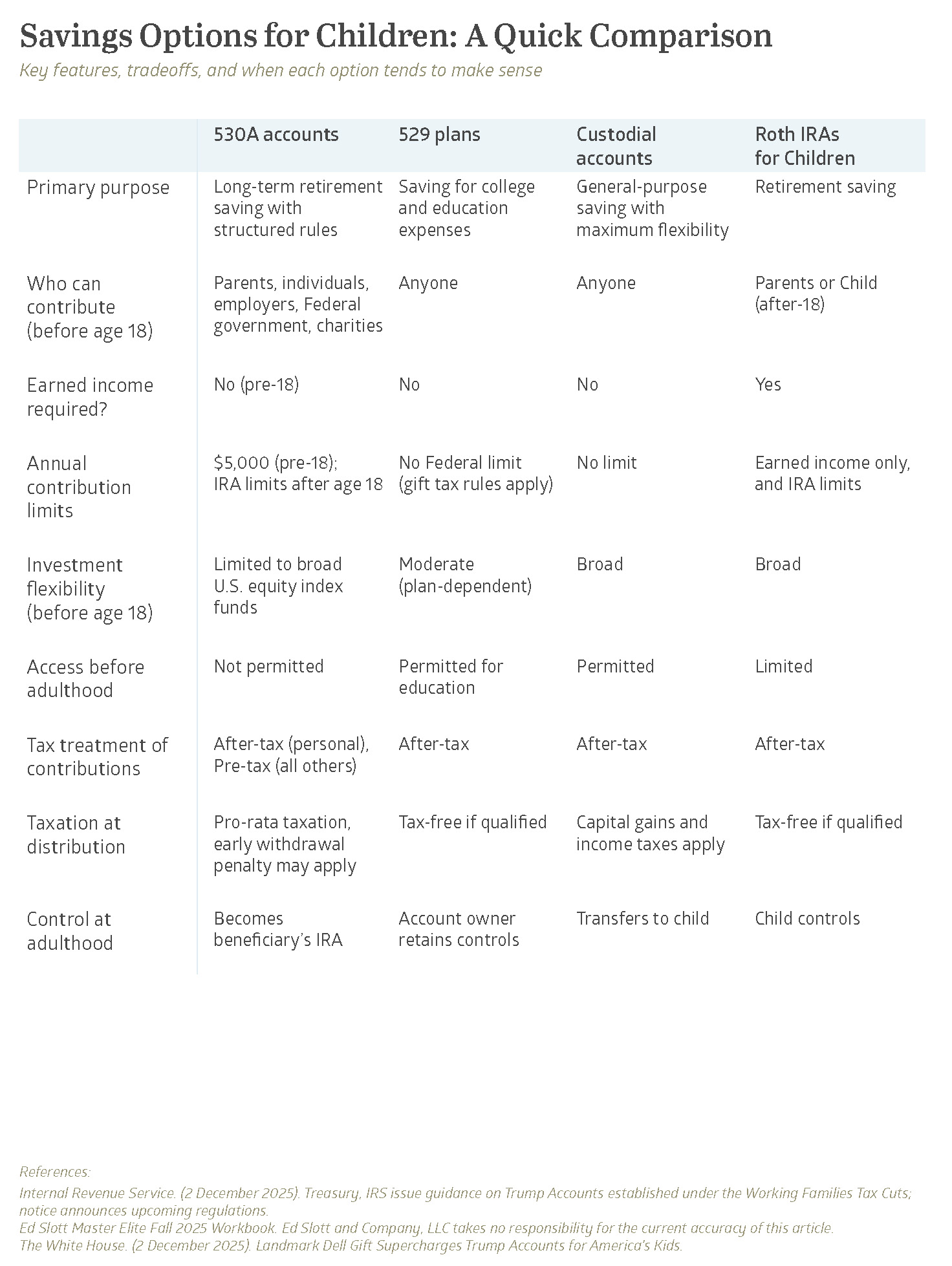

Families typically have several tools available when saving and investing for children, each designed for different goals and tradeoffs. The right choice depends on how flexible the funds need to be, how they are expected to be used, and when access may be required.

At a high level:

- 530A accounts emphasize long-term growth with limited flexibility during childhood.

- 529 college savings plans are designed specifically for education-related expenses and often offer the most favorable tax treatment.

- Custodial accounts (UTMA/UGMA) provide broad flexibility but transfer control to the child at the age of majority.

- Roth IRAs for children can be effective when earned income is available and retirement savings is a priority.

The table below summarizes key differences across these options to help frame the trade-offs at a glance. In practice, many families use a combination of strategies rather than relying on a single account type.

Final Thoughts

While they add a tax-advantaged planning option for families, Trump Accounts are not a universal solution. Their usefulness depends on a family’s goals, time horizon, and how much flexibility is needed during childhood.

530A accounts are best viewed as a complement to existing strategies such as 529 plans, custodial accounts, or Roth IRAs for children. In many cases, the most effective approach is not choosing one account over another, but understanding how different tools can work together based on how and when funds are expected to be used.

References:

Internal Revenue Service. (2 December 2025). Treasury, IRS issue guidance on Trump Accounts established under the Working Families Tax Cuts; notice announces upcoming regulations.

Ed Slott Master Elite Fall 2025 Workbook. Ed Slott and Company, LLC takes no responsibility for the current accuracy of this article.

The White House. (2 December 2025). Landmark Dell Gift Supercharges Trump Accounts for America’s Kids.

Recent Insights

How We’ve Stayed Steady

CEO Sonya Mughal reflects on a year that called for patience and perspective, highlighting leadership continuity, thoughtful decision making, and the value of experience through changing market conditions.

January 15, 2026

Economic Brief: A Little Good News

From Shaboozey to Walmart, Jon Manchester, CFA, CFP® (Chief Strategist, Wealth Management) looks at consumer sentiment and market strength amid mixed economic signals.

January 15, 2026

Avoiding Crypto Probate

Dave Jones, JD, LLM, CFP®, Bailard’s Director of Estate Strategy, provides a practical guide to wallets, exchanges, and trust planning for digital assets.

January 15, 2026

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.