The pursuit of excellence – as a manager, partner, and employer – drives everything we do. We also value accountability, compassion, courage, fairness, and independence. And these values manifest in our thoughtful, high-touch service; in our firm-wide intellectual curiosity and deep industry expertise; and in our transparency with both clients and colleagues. Empathy is not a hindrance, nor is it incompatible with risk and investing. In fact, we think it provides an edge.

A key differentiator is our stability, which stems from our independent ownership. We’re largely employee-owned and aren’t beholden to the interests of a corporate parent. Therefore, we’re able to maintain an entrepreneurial zeal that allows us to pursue the best opportunities in the marketplace as we see them arise. Our independence and spirit of innovation have driven remarkable employee tenure, which helps reduce turnover risk for our clients.

Wealth Management

Comprehensive planning and investing, delivered with compassion

Over Bailard’s more than 50-year history, we’ve served a broad range of clients from entrepreneurs, experienced executives, medical professionals, individuals undergoing an IPO, founders, and multi-generational families to foundations and endowments. The core of our multi-faceted approach is understanding what matters to you.

Asset Management

Innovative approaches designed to enhance returns and manage risk

Bailard pursues opportunities where we perceive a definable advantage across public and private markets. We build upon innovative approaches that seek to enhance returns and manage risks while helping meet our clients’ needs. As a values-driven firm, we are proud of our decades-long history of managing assets for a diverse client base that includes corporations, endowments/foundations, and government entities as well as individuals and families.

Thought Leadership

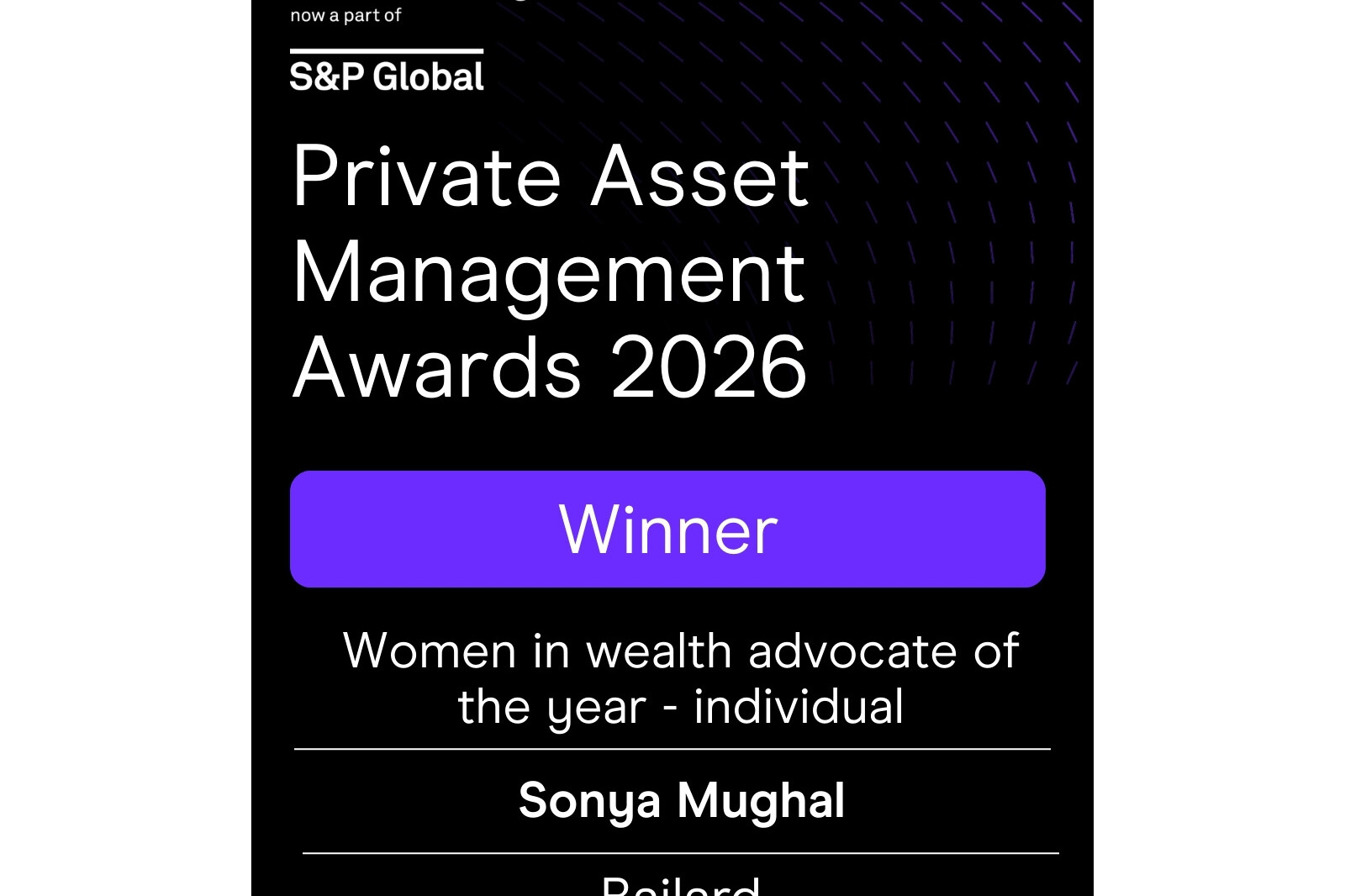

Sonya Mughal Named Women in Wealth Advocate of the Year at 2026 Private Asset Management Awards

February 25, 2026

Bailard CEO Sonya Mughal, CFA, has been named Women in Wealth Advocate of the Year – Individual at the 2026 Private Asset Management (PAM) Awards, presented by With Intelligence.

CNBC: “Tech IPO hype gets drowned out on Wall Street by prospect of $1 trillion in debt sales”

February 13, 2026

Dave Harrison Smith, CFA, Bailard's CIO, weighs in on AI debt in this CNBC piece.

Reuters: “US software stocks slammed on mounting fears over AI disruption, lose $1 trillion in week”

February 5, 2026

Dave Harrison Smith, CFA, Bailard's CIO, weighs in on the software stock selloff in this Reuters piece.

There is no guarantee Bailard or any of its strategies will achieve their performance or investment objectives. Past performance is no indication of future results. All investments have the risk of loss. Neither Bailard nor any employee of Bailard can give tax or legal advice. Please consult your tax or legal professional for such advice.