For Bailard's 50th birthday, our decades-long practices were formally defined through our core values and our dedication to community involvement. We've always been a values in-action firm, and with our B Corp Certification, we can continue to improve in these core pillars we've cared about since our inception.

For Bailard's 50th birthday, our decades-long practices were formally defined through our core values and our dedication to community involvement. We've always been a values in-action firm, and with our B Corp Certification, we can continue to improve in these core pillars we've cared about since our inception.

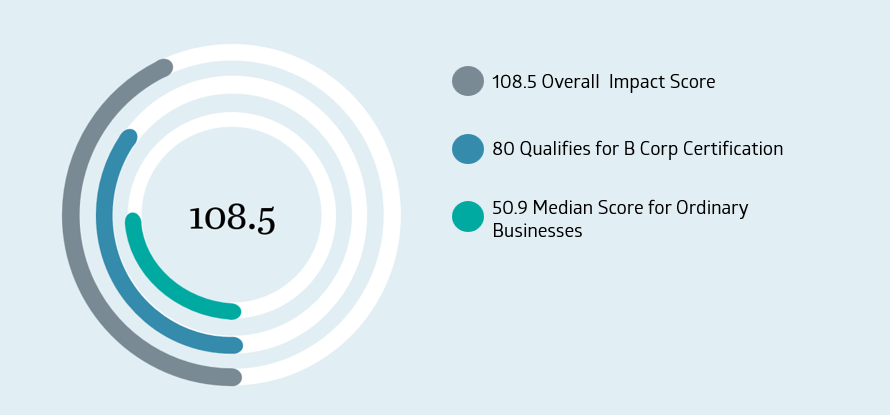

Bailard's Overall B Impact Score

To certify as a B Corp, a company needs to undergo the B Impact Assessment and receive a score of 80+ out of around 250. Five impact areas are assessed in each business: community, customers, environment, governance, and workers. A hallmark of the program is a commitment to continuous improvement and, for its first assessment, Bailard scored 108.5.

Our Score By Pillar

Customers: 41.4

Customers evaluates a company’s stewardship of its customers through the quality of its products and services, ethical marketing, data privacy and security, and feedback channels. In addition, this section recognizes products or services that are designed to address a particular social problem for or through its customers, such as health or educational products, arts & media products, serving underserved customers/clients, and services that improve the social impact of other businesses or organizations.

Workers: 32.6

Workers evaluates a company’s contributions to its employees’ financial security, health & safety, wellness, career development, and engagement & satisfaction. In addition, this section recognizes business models designed to benefit workers, such as companies that are at least 40% owned by non-executive employees and those that have workforce development programs to support individuals with barriers to employment.

Community: 16.2

Community evaluates a company’s engagement with and impact on the communities in which it operates, hires from, and sources from. Topics include diversity, equity & inclusion, economic impact, civic engagement, charitable giving, and supply chain management. In addition, this section recognizes business models that are designed to address specific community-oriented problems, such as poverty alleviation through fair trade sourcing or distribution via microenterprises, producer cooperative models, locally focused economic development, and formal charitable giving commitments.

Governance: 11.1

Governance evaluates a company’s overall mission, engagement around its social/environmental impact, ethics, and transparency. This section also evaluates the ability of a company to protect their mission and formally consider stakeholders in decision making through their corporate structure (e.g. benefit corporation) or corporate governing documents.

Environment: 7.0

Environment evaluates a company’s overall environmental management practices as well as its impact on the air, climate, water, land, and biodiversity. This includes the direct impact of a company’s operations and, when applicable its supply chain and distribution channels. This section also recognizes companies with environmentally innovative production processes and those that sell products or services that have a positive environmental impact. Some examples might include products and services that create renewable energy, reduce consumption or waste, conserve land or wildlife, provide less toxic alternatives to the market, or educate people about environmental problems.

Bailard's Committment

“Our recent certification as a B Corporation reaffirms Bailard’s commitment to values-driven wealth and asset management, and the principles ingrained in our company since its founding over 50 years ago. The rigorous certification process is a proof point that, at Bailard, we ‘walk the talk,’ too. Our dedication to making a positive impact is not just rhetoric but a reflection of the values that guide our team every day.”

— Michael J. Faust, CFA, President of Bailard Wealth Management

Questions? We Have Answers!

What is a B Corp?

Certified B Corporations™ have a powerful mission to create positive social and environmental impact. In doing so, companies have the ability to solve the most pressing global challenges. B Corps are verified through B Lab™, a nonprofit network transforming the global economy to benefit all people, communities, and the planet.

What is the Certification Process?

It’s a rigorous process – but oh, so rewarding! We completed the B Impact Assessment, measuring social and environmental performance, while exhibiting transparency and accountability in our business operations. Based on five essential pillars, a company must achieve an 80 or above and pass the risk review.

What Does This Mean?

Our B Corp Certification is a powerful tool to build our credibility, trust, and value in our mission. With our B Corp Certification, our “do-what-is-right” ethos extends from the success of our clients to the well-being of our planet.

Why Does it Matter?

With our certification, we are required to consider the impact of our decisions on stakeholders, customers, workers, communities, and the environment. Our standards of impact will not only affect our world today, but for generations to come.

Get in Touch

For individuals and institutions alike, Bailard proudly serves as a trusted partner

focused on achieving long-term results aligned with your values and goals.

Let’s find out how we can work together.

There is no guarantee Bailard or any of its strategies will achieve performance or investment objectives. Real estate is not suitable for all investors. This is not an offer. Past performance is no indication of future results. All investments have the risk of loss. There are risks involved in investing, including the risk of loss and the risk that the market value of your investments will fluctuate as the stock, bond, and real estate markets fluctuate. U.S. equity strategies are subject to style, size, and sector risks, for example the securities of technology-dependent companies tend to be substantially more volatile than the rest of the market. International and emerging market equities are subject to increased risks due to economic or political instability, differences in accounting principles, and fluctuating exchange rates, with heightened risks for emerging markets. Fixed income risks include but are not limited to interest rate, issuer, inflation, credit and liquidity risks. Real estate risks include fluctuations in supply and demand, inexact valuations, and illiquidity. An investor may lose all or a substantial portion of the investment.

These represent some, but not all, of the potential risks related to the investment areas noted; additional information is available in Bailard, Inc.’s Form ADV Part 2A. There can be no assurance that any Bailard strategy will achieve its investment or performance objectives. Bailard can give no assurances that they will achieve their investment objectives. Exchange traded funds (ETFs) incur management fees and expenses that will be in addition to Bailard’s management fees. The price at which an ETF trades on the exchange may sometimes differ significantly from its net asset value.