Understanding the newest wave of tax reform—and how it might affect you.

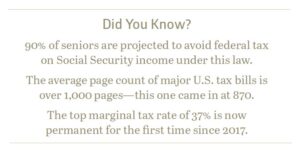

On July 4, President Trump signed the “One Big Beautiful Bill” Act into law, marking the most sweeping tax changes since the 2017 Tax Cuts and Jobs Act (TCJA). The law introduces a mix of permanent extensions, temporary enhancements, and entirely new programs.

To help make sense of what’s changed, we’ve grouped the key provisions by topic—covering individual income tax, estate planning, charitable giving, business ownership, and new savings programs for children—so you can more easily see what may apply to your financial picture.

Summary of Major Tax Reforms

INDIVIDUAL INCOME TAX

Many of the temporary provisions from the 2017 tax law are now permanent, including current tax brackets and the expanded standard deduction. These changes are expected to benefit a broad range of taxpayers, especially retirees.

Many of the temporary provisions from the 2017 tax law are now permanent, including current tax brackets and the expanded standard deduction. These changes are expected to benefit a broad range of taxpayers, especially retirees.

- The TCJA’s income tax brackets are now permanent; the top rate remains 37%.

- Standard deduction made permanent at $15,750 (Single) and $31,500 (Married Filing Jointly, “MFJ”).

- An extra $6,000 deduction is available for seniors; however, the provisions expire in 2028 unless extended.

- Approximately 90% of seniors are projected to avoid federal income tax on Social Security, though the benefits themselves remain taxable.

ESTATE PLANNING

The law locks in historically high estate tax exemptions, which may help high-net-worth families plan with more confidence.

- The estate tax exemption will reach $15 million per person in 2026, and is now permanent.

- Spousal portability remains, allowing a surviving spouse to inherit unused exemption amounts.

TIPS & OVERTIME INCOME

For some workers, the bill provides a new income tax exemption for tips and overtime pay, subject to income thresholds.

- Up to $25,000 in tip and overtime income is exempt from federal income tax.

- Still subject to employment tax and reporting requirements.

- This benefit expires in 2028.

STATE AND LOCAL TAX (SALT) DEDUCTION

After years of debate, the SALT deduction cap has been lifted, at least for now, for many taxpayers.

- The SALT deduction cap increases to $40,000 for AGIs under $500,000.

- It phases down to $10,000 for AGIs over $600,000.

- Applies equally to all filing statuses (marriage penalty).

- Scheduled to revert in 2030.

CHARITABLE GIVING

The law offers expanded incentives for charitable giving, including some new options for non-itemizers.

- Non-itemizers can now deduct up to $2,000 (MFJ) or $1,000 (Single) in charitable donations.

- Itemizers face a new 0.5% AGI floor for deductibility (similar to medical expense deductibility).

- The 60% AGI limit on cash donations to public charities is now permanent.

BUSINESS OWNERS

Business owners will benefit from the return of full bonus depreciation and continued access to state tax deduction strategies at the entity level.

- 100% bonus depreciation reinstated for assets placed in service after January 2025.

- Deductibility of state and local taxes via elective pass-through entity tax (PTET) regimes is preserved.

- 20% Section 199A deduction for Qualified Business Income made permanent.

“TRUMP ACCOUNTS” FOR CHILDREN

A new savings program aims to help families invest early in their children’s future.

- Children born between 2025–2028 receive a $1,000 federally funded account from the IRS.

- Parents may contribute up to $5,000/year; employers up to $2,500 (no deductions for either).

- Funds must be invested in approved U.S. mutual funds or ETFs.

- Distributions are generally prohibited before age 18 and fully taxable when withdrawn.

What This Could Mean for You

These reforms could create meaningful planning opportunities, especially for retirees, business owners, and high-income earners. But benefits vary based on your unique circumstances, and some provisions will expire unless extended.

Whether or not action is needed now, understanding how the law intersects with your financial plan can help position you more effectively for the future.

Want to Talk It Through?

If you’d like help assessing how these changes could affect your financial picture, reach out to your Bailard team or email tax@bailard.com. We’re happy to start the conversation and explore what’s possible.

Important: The above does not take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Bailard nor any employee of Bailard can give tax or legal advice. The contents of this document should not be construed as, and should not be relied upon for, tax or legal advice.

Recent Insights

Country Indices Flash Report – August 2025

President Trump met President Putin in Alaska to discuss the Russia-Ukraine war, then later met in DC with Ukrainian President Zelenskyy and the leaders of several major European countries. Nothing definitive has emerged yet, with the attacks unrelenting.

August 29, 2025

Bailard Earns Global Recognition for Philanthropy and National Ranking Among Top RIAs

This summer brought two honors that speak to who we are at Bailard. The Bailard Foundation was recognized with Best Philanthropic Initiative (Americas) at the global 2025 WealthBriefing Wealth for Good Awards, highlighting our community impact in the Bay Area. And once again, Bailard was named to Financial Advisor Magazine’s Top RIA Ranking, marking our fifth straight year in the Top 100.

August 27, 2025

Why International Equities Deserve a Fresh Look in Today’s Market

As international equities begin to show signs of leadership again, investor sentiment and capital flows can accelerate these trends.

August 14, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.