From Shaboozey to Walmart, Jon Manchester, CFA, CFP® (Chief Strategist, Wealth Management) looks at consumer sentiment and market strength amid mixed economic signals.

Many years after hanging up his cleats in favor of a guitar, former linebacker Collins Obinna Chibueze still strikes a commanding presence under the bright lights. Standing 6’4″, not counting the cowboy hat, the fast-rising singer better known as Shaboozey enjoyed a breakout year in 2024, earning him a “Best New Artist” nomination for last year’s Grammy Awards. The melodious Shaboozey moniker has its own football roots, dating back to when a high school coach slapped the name on his helmet as a phonetic reading of his surname. Shaboozey has been sounding it out ever since, blending country music with elements of hip hop, rock, and other influences. At their best, Shaboozey’s songs are playful and catchy while also introspective and questioning, built atop a bassline of human struggle.

It was undeniably a doozy of a year in 2025. Bloomberg columnist Clive Crook summarized it nicely: “Over the past 12 months, the U.S. has seen…every norm of economic policy—trade policy, fiscal policy, monetary policy—blithely tossed aside. At the same time, the U.S. economy stands at the bleeding edge of what might be as consequential an economic revolution as the transition from farming to manufacturing, or from manufacturing to services—except that the AI revolution could happen much faster.”1 Besides all that, 2025 was rather uneventful! The jump in economic uncertainty clearly did not dissuade the markets. It was, perhaps, another reminder that the stock market is not the economy. Investors heard sufficient good news to drive equity prices sharply higher for a third straight year. Critically, corporate profits did not disappoint: Standard & Poor’s (S&P) currently estimates that S&P 500 Index operating earnings advanced 13% per-share in 2025. That was the bottom line, but other tailwinds including lower interest rates, AI enthusiasm, and favorable tax policies also helped equities overcome numerous obstacles last year.

Amidst all the policy upheaval and a 43-day U.S. government shutdown—longest in history—investors learned to cope at times with a dearth of information from official government agencies. Beyond minding the information gaps, the August 2025 firing of Dr. Erika McEntarfer, commissioner of the Bureau of Labor Statistics (BLS), cast a shadow across the federal data landscape. Her dismissal immediately followed the Bureau’s July employment report in which the BLS sharply revised down its estimate of jobs added in May and June by a cumulative 258k. Whether or not the administration is correct that the “BLS is broken,” the optics of the decision did not go over well.2 In fact, handing McEntarfer a pink slip via social media hours after a disappointing jobs report may end up sowing more doubt. It prompted the Bloomberg Editorial Board to caution that “In so many words, this tells financial markets that official statistics are no longer to be trusted.”3 The ultimate consequences are unclear for the investment community as 2026 gets underway, but it may encourage decision-makers to rely more heavily on private sector data, where possible. Bloomberg’s Crook suggests that investors may be “flying blind” in an environment of heightened uncertainty and confusion over the state of the economy. For the financial markets, the adage “no news is good news” doesn’t typically apply.

Dot Com Club

A pivot to using more data from the private sector could easily start in Bentonville, Arkansas at Walmart’s global headquarters. The obvious reason: sheer scale. Walmart hauls in roughly 10% of all retail spending in this country, excluding automobiles.4 With around 2.1 million employees across 19 countries worldwide, Walmart amassed a staggering $681 billion of revenue in fiscal 2025—which in Gross Domestic Product (GDP) terms would put Walmart on par with countries such as Argentina and Sweden. Avoiding the company is a logistical challenge: 90% of the U.S. lives within 10 miles of a Walmart store.5 So when Walmart talks, the markets listen. In late November, Walmart reported its third quarter results, posting sales growth of ~6% and closer to a 7% advance for earnings per share (EPS). Perhaps more telling, outgoing CEO Doug McMillon said that U.S. customers and members are “still spending with upper and middle income households driving our growth.”6 McMillon acknowledged that lower income families have been under additional pressure, but also noted that like-for-like Q3 inflation was just 1.3% for Walmart US.

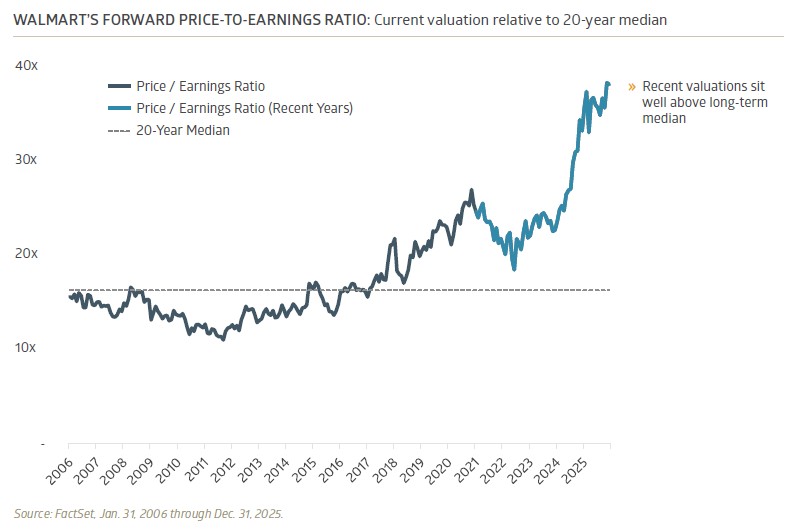

If Walmart as a tech company seems disorienting, consider that the world’s largest retailer just landed on the Nasdaq Stock Market. In December, after trading for over 50 years on the New York Stock Exchange, Walmart’s stock (WMT) migrated to the Nasdaq, joining companies such as Nvidia, Apple, Alphabet, and Microsoft. The exchange of choice for many tech companies, Nasdaq became the first U.S. stock market to trade online back in 1998. Walmart’s share price carries the sheen of a tech stock as well. After rising 23% last year, WMT finished 2025 trading at nearly 38x forward earnings, higher than many of its new Nasdaq peers.

Cold Brew

Although Walmart has managed to keep prices low via some alchemy of scale and technology, the overall inflation picture remains uncertain. Hot spots persist, including some high-profile areas. Electricity prices rose 6.9% year-over-year in November, per the BLS’s Consumer Price Index (CPI).9 Data centers are getting much of the blame, according to The Wall Street Journal, but hurricanes, wildfires, state renewable energy plans, and the replacement of aging or damaged grid equipment are all playing a role.10 California is feeling the pain more acutely than other states: power prices rose 35% inflation-adjusted over the 2019 to 2024 timeframe.

No area is getting more attention than health insurance costs. With the expiration of federal tax credits, the 24 million people that enrolled in coverage last year under the Affordable Care Act (ACA) will see their premiums increase significantly. San Francisco-based health policy organization KFF estimated that premium payments will more than double.11 For those covered under Medicare Part B, the 2026 standard monthly premium is going up nearly 10%. Employer-based health insurance is not immune, either. Mercer projects a total health benefit cost increase of 6.7% this year, pushing the average cost above $18,500 per employee.12 In 2025, Mercer’s annual survey found that the average cost of employer-sponsored health insurance rose 6%, driven in part by sharp growth in prescription drug spending with more companies including GLP-1 coverage.

Through all the noise, geopolitical tumult, and incertitude, Wall Street is uniformly optimistic. In fact, a year-end Bloomberg News survey found that all 21 strategists estimate the S&P 500 Index will post a fourth consecutive positive year in 2026.14 Wall Street analysts are estimating another strong year for corporate profits, as well, with S&P 500 earnings per share expected to increase by 14.8% on top of 2025’s already strong earnings growth.15 Again, the stock market is not the economy, but it does beg the question of whether everybody is gettin’ tipsy, to paraphrase Shaboozey. Another year of rising profits would certainly qualify as a little good news.

# # #

1 “Investors Are Flying Blind Into the ‘Golden Age,’ www.bloomberg.com, 12/26/2025.

2 “BLS Revisions Show President Trump Was Right – Again,” www.whitehouse.gov, 9/9/2025.

3 “Trusted Data Is a Vital Economic Asset,” www.bloomberg.com, 8/15/2025.

4 “How Walmart became a tech giant – and took over the world,” www.economist.com, 5/15/2025.

5 “Walmart, Inc.: Morgan Stanley Global Consumer & Retail Conference,” www.walmart.com, 12/2/2025.

6 “Walmart Inc. Q3 2026 Earnings Call,” www.walmart.com, 11/20/2025.

7 “Can Walmart Shed Its Discount Vibe?” www.nytimes.com, 6/23/2025.

8 “Heard on the Street: Should Walmart Really Be Trading Like a Tech Company?” www.wsj.com, 12/6/2025.

9 “Consumer Price Index for All Urban Consumers (CPI-U), Table 7,” www.bls.gov, 12/18/2025.

10 “Be Prepared to Keep Paying More for Electricity,” www.wsj.com, 12/29/2025.

11 “ACA Marketplace Premium Payments Would More than Double on Average Next Year if Enhanced Premium Tax Credits Expire,” www.kff.org, 9/30/2025.

12 “Mercer survey finds US employers and workers will face affordability crunch as health insurance cost is expected to exceed $18,500 per employee in 2026,” www.mercer.com, 11/18/2025.

13 “High Coffee Prices Are Changing How Consumers Take Their Daily Brew,” www.bloomberg.com, 12/16/2025.

14 “Every Wall Street Analyst Now Predicts a Stock Rally in 2026,” www.bloomberg.com, 12/29/2025.

15 FactSet, EPS One-Year Growth (%) estimated for year-end 2026, data retrieved 1/8/2026.

Specific investments described herein do not represent all investment decisions made by Bailard. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

Recent Insights

How We’ve Stayed Steady

CEO Sonya Mughal reflects on a year that called for patience and perspective, highlighting leadership continuity, thoughtful decision making, and the value of experience through changing market conditions.

January 15, 2026

A New Savings Option for Children: Understanding Section 530A Accounts

Lena McQuillen, CFP®, Director of Financial Planning, explains how Section 530A accounts work and how to evaluate them alongside more familiar savings options for children.

January 15, 2026

Avoiding Crypto Probate

Dave Jones, JD, LLM, CFP®, Bailard’s Director of Estate Strategy, provides a practical guide to wallets, exchanges, and trust planning for digital assets.

January 15, 2026

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.