From gold to gigabytes, Jon Manchester, CFA, CFP® (Chief Strategist, Wealth Management) draws a line from California’s first gold rush to today’s race for artificial intelligence, exploring the optimism, risk, and reinvention that come with every new boom.

From its very beginning, California has attracted dreamers and schemers. In early February 1848, the Mexican-American War concluded, with Mexico ceding the territory of Alta California along with Texas and other parts of the west. In exchange, the U.S. paid $15 million and forgave $3.25 million of debt. Just over a week prior to that formative event in our nation’s history, an itinerant carpenter named James Marshall had discovered gold in Coloma, CA, as he endeavored to build a sawmill for the landowner, John Sutter. Word of Marshall’s find quickly spread—at least by mid-19th-century communication speeds—kicking off a mad scramble to this new land of opportunity. In The Age of Gold, author H.W. Brands characterized the Forty-Niners: “All sought wealth; nearly all sought adventure too. The news from California was the most exciting most of them had ever heard; the rush to California promised to be the event of their lifetime. Like little boys hurrying to greet the circus, to catch a glimpse of the mighty elephant, the emigrants of 1849 couldn’t bear to miss out – and in fact the phrase ‘to see the elephant’ became a cliché on the trail.”1

In a sense, that fear of missing out continues to typify those who travel long distances to try their luck in the Golden State. The elephant has evolved over time. The birth of the semiconductor industry gave way to the dot-com craze and then the rise of social media. Today, artificial intelligence (AI) is the glittery object which has a new generation of dreamers affixing “California or Bust” bumper stickers to their (probably electric) wagons. It is the singularly dominant theme in capital markets, with vast and seemingly ever-growing tentacles across disparate industries.

During the gold rush, demand for clipper ships exploded as prospectors sought to find quick passage to San Francisco Bay. Similarly, AI is creating enormous demand for an ecosystem of adjacent businesses providing infrastructure to support the buildout. Spending continues to spike on data centers and for the power required to run those facilities. Brookfield Asset Management estimates that ultimately around $7 trillion will be needed to finance the growth of AI.2 The so-called hyperscalers—Microsoft, Amazon, Alphabet, and Meta Platforms—are projected to outlay roughly $340 billion on capital expenditures this year, increasing to $400 billion in 2026.3 BlackRock, the world’s largest asset manager, formed an AI partnership last year to raise $100 billion with the intent to invest in data centers, joining a crowded field with big players including Apollo, Blackstone, and many others hoping to strike a vein of digital gold.

This “build it and they will come” approach takes a certain boldness, a disregard for potential failure. Brands described the same mindset as occurring during the gold rush: “Where life was a gamble and success a matter of stumbling on the right stretch of streambed, old standards of risk and reward didn’t apply. In the goldfields a person was expected to gamble, and to fail, and to gamble again and again, till success finally came – success likely followed by additional failure, and additional gambling – or energy ran out. Where failure was so common, it lost its stigma. No one in California counted the failures, only the rich strikes that rewarded the tenth or hundredth try.”4

It seems likely that failure will eventually follow for some amidst this tidal wave of AI expenditures: buy now, pay later? Hedge fund manager David Einhorn cautioned recently that “there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”5 Amazon founder Jeff Bezos acknowledged that AI spending resembles an “industrial bubble” in which “investors have a hard time in the middle of this excitement distinguishing between the good ideas and the bad ideas.”6 However, he also thinks “the benefits to society from AI are going to be gigantic.” Beyond the bubble worries, there is some uneasiness around the financing of all of these projects, with large tech companies increasingly relying on debt.

While we impatiently wait for AI to pan out, the markets continue to handsomely reward the companies in the fight. According to JPMorgan strategist Michael Cembalest: “AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending since ChatGPT launched in November 2022.”7 OpenAI, the owner of ChatGPT, is not publicly traded, but its private market valuation has soared to a reported $500 billion. Bloomberg notes that ChatGPT has about 700 million weekly users—making it one of the fastest-growing consumer products in history.8

What’s Old is New Again

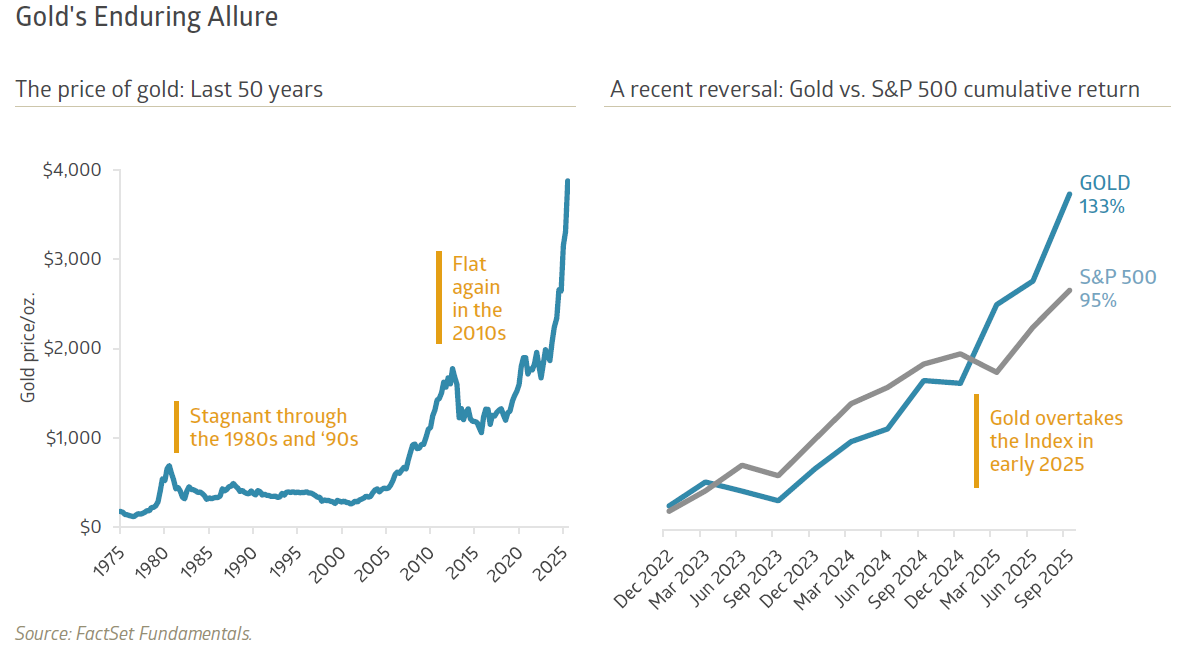

A funny thing happened on the way to coronate our new AI ruling class, though. Investors have once again developed a gold crush. In fact, the price of the alluring metal—which has captured imaginations for thousands of years—outpaced the stock market over the trailing three years, roughly since ChatGPT launched. The following page’s exhibit shows that gold soared 133% over that timeframe, ahead of the S&P 500 Index’s 95% total return. Not typically mistaken for a growth stock, it has been a goldilocks environment for the yellow metal. The Consumer Price Index (CPI) hit a peak of 9.0% year-over-year inflation in mid-2022, highest in over 40 years. This pushed some investors into gold as a store of value, or a way to avoid a loss of purchasing power. Inflation has normalized since, decelerating to 2.9% growth as of August 2025, but it has not reversed, which means prices continue to climb overall.

A further catalyst for gold’s relentless rise has been motivated buyers in the form of other central banks looking to diversify reserves. China’s central bank has been an aggressive buyer since 2023, according to Reuters, aiming to reduce its reliance on the U.S. dollar. Despite China’s buying spree, its gold position is currently smaller than five other countries, plus the International Monetary Fund, and accounts for just seven percent of China’s total reserves.9 Whether central banks will keep buying with gold near $4,000 per ounce is a viable question, but their concerted efforts to stockpile gold has clearly underpinned the bullion market.

Expense Card

The stock market’s brief April 2025 foray into bear market territory (>20% decline) now seems a distant memory. Tariffs remain a risk to profitability, but corporations have thus far largely managed to defray or offset the additional costs. Favorable tax policies outside of the trade realm clearly continue to help. The 2017 Tax Cuts and Jobs Act reduced the corporate tax rate from a high of 35% to a flat 21%, while this year’s One Big Beautiful Bill Act (OBBBA) permanently restored the ability for corporations to immediately expense domestic research and development (R&D) costs and returned to 100% deduction on qualifying business expenses, such as new computers, machinery, or other equipment.

According to Standard & Poor’s, the S&P 500 operating margin was 12.5% in the second quarter, its highest since 2021. Operating profits per share rose nearly 10% year-over-year in Q2 and growth is projected to accelerate to the 13% to 14% range over the final two quarters of 2025. Resilient corporate earnings growth and solid economic activity have taken recession odds sharply lower. The Bureau of Economic Analysis (BEA) recently revised up its Q2 Gross Domestic Product (GDP) growth estimate to 3.8% inflation-adjusted, a rebound from a small first quarter decline. Nonresidential fixed investment jumped 7.3%, buoyed by strong AI-related equipment spending. The U.S. consumer also did its part, propelled by high earners. Moody’s Analytics chief economist Mark Zandi calculated that the top ten percent of income earners now account for just over 49% of total expenditures – highest since 1989.10

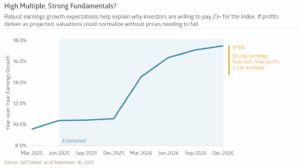

What remains is a fully priced U.S. large-cap equity market. The S&P 500 entered the final quarter of 2025 trading at nearly 23x estimated earnings over the next 12 months. Fed Chair Jerome Powell acknowledged as much in a late September speech: “…by many measures, for example, equity prices are fairly highly valued.” Investors seem willing to pay the price, however, emboldened by both the long-term promise of AI and rosy estimates for near-term earnings growth. S&P tabulates that S&P 500 earnings per share growth for 2026 is currently tracking at more than 17%. It could prove overly optimistic, but it does help explain why valuations are rich in an environment where the Fed is also cutting interest rates. Valuations remain much more restrained outside of the tech-heavy S&P 500 Index, with smaller company stocks and foreign equities relatively attractive.

Plenty of hurdles remain. We’re keeping a close eye on debt, whether at the federal, corporate, or individual levels. There will no doubt be those that misprice or underestimate risk and lose it all in a futile attempt to catch a glimpse of the mighty elephant. Buyer beware; yet remember that investing involves calculated risk.

Recent Insights

Issue Brief: Will Nuclear Energy Make a Comeback?

What advancing technology and new federal support could mean for the future of nuclear energy in the U.S.

December 2, 2025

Country Indices Flash Report – November 2025

Nvidia’s strong earnings reignited enthusiasm across AI-linked names. The euphoria quickly faded, as concerns over high valuations, ballooning AI capex, and potentially circular investments dampened sentiment, bringing MSCI EAFE’s tech sector and other AI-linked industries down with it in November. [Read more...]

November 29, 2025

BusinessWire: “Bailard Completes Three Strategic Property Acquisitions in Q3”

Bailard Real Estate Fund announces three U.S. property acquisitions in Q3 2025, highlighting disciplined real estate investing and portfolio growth.

November 19, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.