Lena McQuillen, CFP® Director of Financial Planning, delves into why not reviewing your health insurance coverage each year could be costing you, as well as various considerations for picking a health insurance plan. Plus, sign up for a Medicare or a Marketplace Open Enrollment webinar.

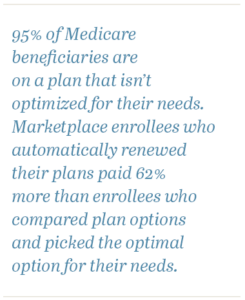

Do you review your health coverage each year? Most people don’t. In fact, 90% of Medicare beneficiaries don’t review their drug coverage, and 95% are on a plan that isn’t optimized for their needs.

As for Marketplace insurance, enrollees who automatically renewed their plans paid 62% more than enrollees who compared plan options and picked the optimal option for their needs.

No one wants to pay more than is necessary for health coverage, and most would more than likely prefer to be on a plan that’s optimized to their needs, but with many different options available, choosing health coverage can be overwhelming—if you’re not equipped with the information and tools needed.

Selecting the right health insurance plan involves careful consideration of several key factors. As we approach the open enrollment season1, it’s important to start thinking now about the healthcare you’ve needed so far2 and what you might expect to want or need in the coming year. Identifying and prioritizing your personal preferences when looking at each plan will be crucial to optimal decision-making.

Below are other key considerations to explore that will help you make an informed decision during open enrollment.

When selecting a health insurance plan, consider whether your current doctors, pharmacies, and hospitals are part of the plan’s network. Insurance companies establish networks with healthcare providers to offer better rates for services within the network. It’s important to verify if your preferred doctors participate in-network to maximize your plan’s benefits and minimize out-of-pocket costs. (Covered plan providers can change every year, so you will want to confirm if your current providers are still covered for the upcoming year.)

Some plans require a referral from your primary care physician to see a specialist, while others offer direct access to specialists. If you anticipate needing services of a specialist such as dermatologists, cardiologists, neurologists, etc., considering a plan without referral requirements may be preferable for easier access to specialized care. (It should be noted that a referral by your primary care physician does not guarantee coverage under your plan, and you should always check with your insurance before you attend an appointment.)

You will also want to consider your travel habits within the United States. Plans may offer a regional or a nationwide network of doctors. Regional networks are limited to a specific geographic area and are often more cost-effective, while nationwide networks allow flexibility to see in-network doctors in any of the U.S. states and territories. For frequent travelers, nationwide coverage can give you access to in-network care outside your home region if you need treatment for a cold or to refill a prescription. (In an emergency, ambulances and medical treatment at the emergency room will be covered even if you go outside the network, based on your plan deductibles and co-pay.)

When deciding on a health insurance plan from a financial perspective, consider your approach to upfront costs. Would you prefer a plan with higher monthly premiums but lower out-of-pocket expenses for each medical service? This option can be advantageous if you prioritize predictable budgeting and prefer minimal financial surprises when accessing healthcare. Conversely, opting for a plan with lower monthly premiums and higher costs at time of service might appeal to you if you’re generally healthy and have the financial flexibility to manage occasional higher expenses.

Another financial consideration is your preference regarding the payment structure for doctor visits. Some plans offer a flat-rate copayment per visit, which simplifies budgeting and is ideal for frequent visits to in-network doctors. These plans typically come with higher premiums or fixed costs. Alternatively, plans with percentage-based coinsurance on medical bills provide flexibility, potentially lowering monthly expenses if you’re comfortable with varying costs per visit based on services rendered. Choosing between copayments and coinsurance largely depends on your healthcare usage patterns and financial comfort level with fluctuating out-of-pocket costs.

Go Beyond Healthcare Premiums

The out-of-pocket maximum is the most you will pay out of your pocket for covered health services in a given year and includes your deductible, any copayments, and coinsurance that you pay for medical care. Because out-of-pocket expenses are variable, it’s important that you understand your total potential healthcare expenses: your “worst-case scenario.”

If you have a sense of what your healthcare needs are in the next 12 months (such as having a baby or surgery, etc.), you can proactively plan for these healthcare events when selecting your health insurance plan. You’ll want to understand your deductible and potential out-of-pocket costs, and have this information saved where it can be easily accessible.

Optimize Your Health Plan

Health insurance plans change every year which can impact your premiums, in-network doctors and pharmacies, drug costs, and more. Proactive planning during open enrollment is especially important to evaluate new health plan options that fit your budget, personal preferences, and health needs. Even if your current needs have not changed (no change in health, doctors, prescriptions, etc.), it’s possible that the plans available to you have changed, including the one you are currently enrolled in. There may even be a better suited plan for you. Prioritize your preferences and choose a plan that is going to suit your needs for the upcoming year. You can always make a new election during the next open enrollment period.

Upcoming Webinar on Medicare and Marketplace Open Enrollment

To assist our clients with healthcare planning, we have partnered with Caribou, a healthcare planning company that works exclusively with financial advisors to help their clients plan for current and future healthcare costs. We will be hosting the two webinars listed on the right with Caribou to go over the fundamentals of Medicare and The Marketplace, so that you can make an informed decision that meets your health needs, preferences, and financial goals. Bailard Wealth Management clients can register for either, or both, by clicking on the titles of either in the box below.

Complete a Health Planning Analysis, at No Extra Cost to Bailard Wealth Management Clients

If you would like to take it a step further, ask your Investment Counselor about completing a Health Planning Analysis. Caribou can provide support in this complex decision process by finding health plan options tailored to your needs and preferences at no extra cost to you.

1 Insurance plans cannot be changed outside of the annual open enrollment period, except for qualifying life events that can trigger unique enrollment opportunities. Changes to your current health status may not align with either of these timeframes, so it’s important you have a plan that covers you, your spouse, and your dependents for any eventuality.

2 Most doctor offices now offer a mobile app where you can look up your past medical history, past and upcoming medical appointments, and current medications in one location. .

Recent Insights

(Video) AI’s Next Wave: Setting up for Value Beyond Hardware

Where might the next AI investment opportunities lie beyond hardware? Bailard's Chief Investment Officer, Dave Harrison Smith, CFA offers his perspective as a seasoned technology investor and portfolio manager.

December 29, 2025

Bailard Recognized as the #1 Firm for Best RIAs to Work For

Landing at No. 1, the result reflects something we've built over decades: a culture where talented people want to stay, grow, and do their best work. Long tenure has helped create continuity that clients and partners often value in enduring relationships.

December 11, 2025

Bailard Recognized as One of P&I’s Best Places to Work

Named among Pensions & Investments’ Best Places to Work in Money Management for the eighth year running, our people and their commitment allows us to stay independent and serve clients with real care.

December 8, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.