In this quarter’s closing brief Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) takes a look at the difficulties of defining, and returning to, normal.

In the 1920 United States presidential election, 55-year-old Ohio Republican Senator Warren G. Harding handily defeated Ohio’s Democratic Governor James Cox, winning 37 states and amassing 60.4% of the popular vote. Two-term incumbent Woodrow Wilson—eligible to run again—had been brushed aside by the Democratic party after suffering a severe stroke and amidst tepid enthusiasm for his foreign policies in the wake of World War I. The election was notable for many reasons. It closely followed the passage of the Nineteenth Amendment to the U.S. Constitution, giving women the right to vote in all 48 states (at the time). That greatly helped in boosting the total number of voters by over eight million, or nearly 45%, compared to the 1916 election. The 1920 ballot also featured two future presidents as vice presidential candidates in Republican Calvin Coolidge and Democrat Franklin D. Roosevelt.

When voters went to the polls in November 1920, the U.S. was mired in a recession marked by sharp deflation, an overcorrection from high wartime inflation. The nascent Federal Reserve, founded seven years prior to stabilize the banking system, had hiked its lending rate as high as 7% in mid-1920 in an attempt to temper what had been rising prices. Nobel-prize winning economist Milton Friedman and colleague Anna Schwartz later argued in a landmark 1963 book titled A Monetary History of the United States that the Fed miscalculated the lag times associated with monetary policy changes, resulting in the central bank still raising rates during the early stages of the recession.1 Unemployment jumped higher, and the Dow Jones Industrial Average sank nearly 30% over the twelve months leading up to the election. Tensions ran high seemingly everywhere: labor strife, race riots, plus a bombing on Wall Street that killed 40 and injured hundreds.

Meanwhile, the world was still reeling from the Great Influenza pandemic. An estimated 500 million people worldwide were infected by the virus in the 1918 to 1920 timeframe, or roughly one-third of the world’s population.2 A staggering 50 million or more died, including approximately 675,000 in the United States. In comparison, the World Health Organization (WHO) currently estimates 6.67 million have died globally from COVID-19.3 Needless to say, it was a challenging time.

In retrospect, then, it doesn’t seem particularly surprising that Harding’s main campaign slogan was “return to normalcy.” It had a simple, timeless appeal. Malleable and open to interpretation, normalcy is somewhat in the eye of the beholder. A main facet of Harding’s pitch was to put America first, a phrase which ironically Wilson had used to justify staying out of World War I in its initial years. In a May 1920 speech in Boston, Harding suggested America’s present need was “not submergence in internationality, but sustainment in triumphant nationality.”4 For a nation weary from battles both home and abroad, the message resonated sufficiently to carry Harding and Coolidge to the White House.

Back to the Future

A century later, with the COVID-19 pandemic hopefully on the wane and the Fed again in inflation-battling mode, there appears to be some clear parallels to that time. One interesting link from a societal standpoint—although certainly not unique to either time period—is the collective yearning to see things get back to some version of normal (however defined). We’ve been through this before, whether it was the aftermath of 9/11 or the credit crisis. In each instance, what follows seems to be a race to declare a “new normal” has arrived. There is some truth to this, of course. The COVID-19 pandemic has likely indelibly altered the way we work, for instance. Other behaviors, such as returning to crowded arenas or airports, quickly revert.

Each crisis alters the landscape in its own way. Roughly three years past the onset of the COVID-19 pandemic, the global economy is still trying to find its footing. In a November 2022 outlook piece, the Organization for Economic Co-Operation and Development (OECD) projected global real GDP (gross domestic product) growth of just 2.2% in 2023. Per the OECD: “Tighter monetary policy and higher real interest rates, elevated energy prices, weak household income growth, and declining confidence are all expected to take a toll on growth, especially in 2023.”5 For the U.S., they estimate scant 0.5% growth this year, followed by still negligible 1.0% growth in 2024.

Any economic growth in the U.S. for 2023 might be viewed as a minor victory. The consensus view seems to be coalescing around a shallow recession at some point this year. The Bloomberg Economics team foresees a 0.9% GDP contraction in the second half of 2023, driven by an investment downturn as companies reduce inventories amidst slower consumer spending.6 They also expect a decline in residential investment due to higher interest rates, and note that U.S. home prices would need to fall around 15% to restore the housing market to equilibrium. This is not 2008, Bloomberg assures us: a structural undersupply of houses and higher credit quality of mortgage borrowers limit the downside and the spillover risks to the wider economy. After 124 consecutive months of growth for the Case-Shiller U.S. National Home Price Index, October 2022 marked four straight months of declines. Before we hit the panic button, the Index was still up 9.2% on a year-over-year basis.

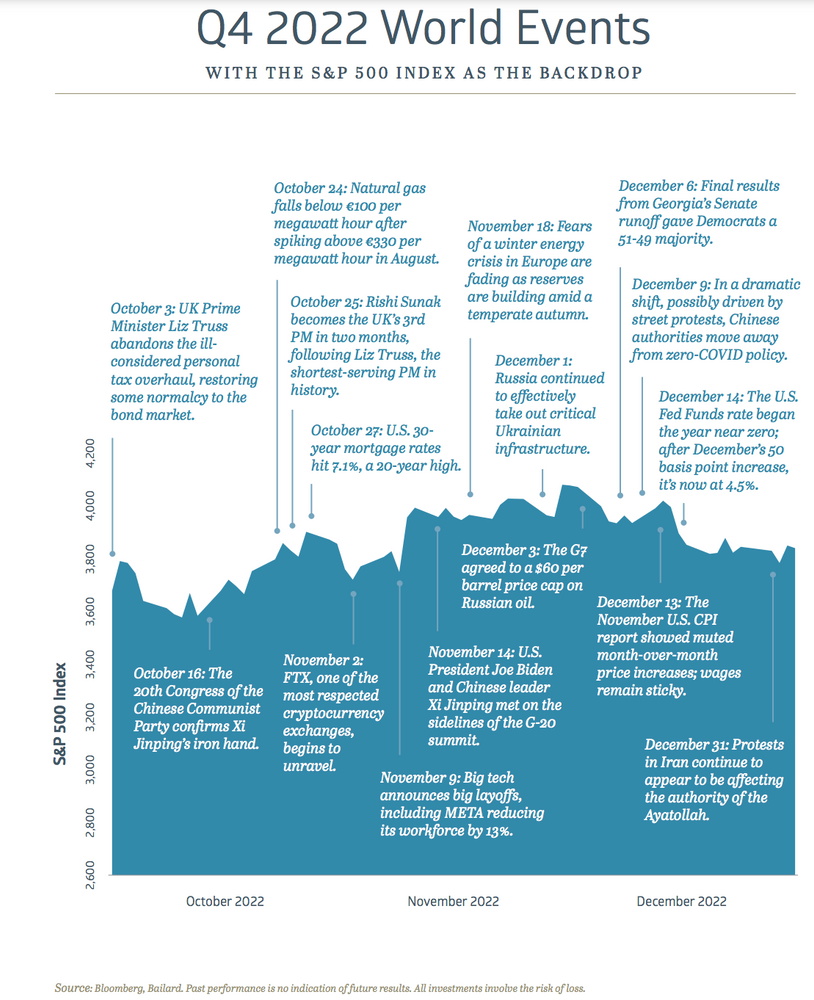

The big question remains whether the Fed’s rate hiking campaign will tip the U.S. economy into recession, as it did in 1920. Faced with inflation not seen since the early 1980s, the Fed was forced last year to rapidly raise the Fed Funds target rate from 0.25% all the way to 4.5%. In December, the Fed’s projections indicated a peak rate in the 5% to 5.25% range. That is well above the 2.5% level that the Fed considers neutral—meaning neither accommodative or restrictive—when inflation is at 2%. With the Consumer Price Index (CPI) running at +7.1% year-over-year in November, though, the Fed has to play bad cop until prices cool further. Attempting to define what is “normal” for the Fed Funds rate is highly dependent on the time frame. Over the last 50 years, the average Fed Funds rate has been approximately 4.9%. Shortening the time horizon to the last 20 years, however, the average rate was just 1.4%. Tricky word, normal.

The big question remains whether the Fed’s rate hiking campaign will tip the U.S. economy into recession, as it did in 1920. Faced with inflation not seen since the early 1980s, the Fed was forced last year to rapidly raise the Fed Funds target rate from 0.25% all the way to 4.5%. In December, the Fed’s projections indicated a peak rate in the 5% to 5.25% range. That is well above the 2.5% level that the Fed considers neutral—meaning neither accommodative or restrictive—when inflation is at 2%. With the Consumer Price Index (CPI) running at +7.1% year-over-year in November, though, the Fed has to play bad cop until prices cool further. Attempting to define what is “normal” for the Fed Funds rate is highly dependent on the time frame. Over the last 50 years, the average Fed Funds rate has been approximately 4.9%. Shortening the time horizon to the last 20 years, however, the average rate was just 1.4%. Tricky word, normal.

Too Much of a Good Thing?

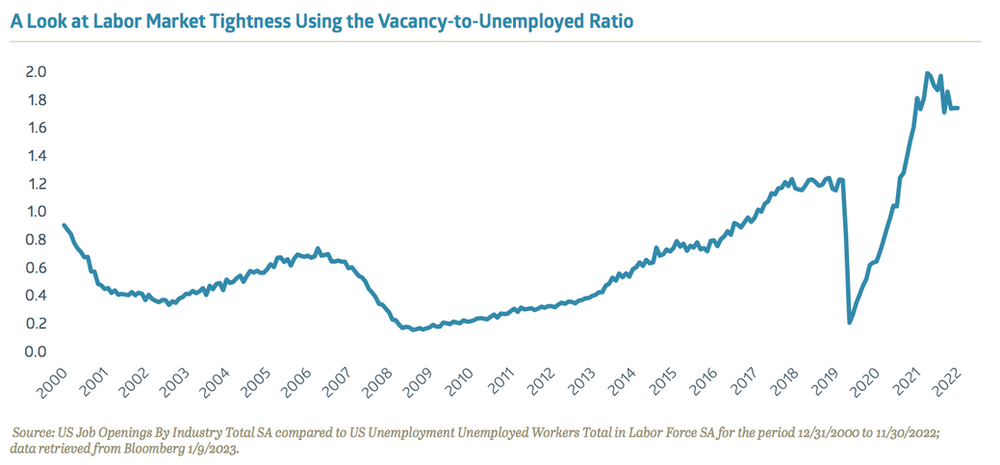

nKeeping inflation in check remains the Fed’s primary focus, but its other mandate is to maximize sustainable employment. With the unemployment rate at just 3.5% nationally as of December, matching a five-decade low, you’d have to say that box is checked. However, Fed Chair Powell has been clear that the labor market is too tight. Job openings have slowed, but remain elevated at roughly 10.5 million as of November. The Fed’s favored gauge for labor market tightness—shown below—is the vacancy-to-unemployed ratio, which was 1.74 versus 1.15 at the end of 2019.7 This excess demand for workers puts upward pressure on wages, and makes the Fed’s inflation-fighting job more difficult.

The December jobs report provided some good news. Average hourly earnings rose 4.6% year-over-year, a deceleration from +4.8% in November and a continuation of a slowing trend that saw this metric hit a 2022 high point at +5.6% last March. If sustained, this is the formula that could potentially deliver a “soft landing” for the economy: unemployment remains low, but wage growth and inflation moderate. As former Fed governor Randall Kroszner said: “It’s not that the Fed wants fewer jobs. What they want is lower wage growth more because they’re worried about persistent inflation.”8

If employment stays strong and housing prices remain resilient, it’s hard to imagine a near-term recession. Layoffs have picked up, but at a reasonable clip. According to the data firm Challenger, U.S. companies announced 320,173 layoffs over the first eleven months of 2022, a six percent increase. Just over 25% of those occurred in the tech sector where Amazon, Facebook, and others are attempting to right-size their operations. Despite the pressure on tech companies, California’s unemployment rate declined 1.7 points over the twelve months ending with November 2022 to 4.1%. The lowest state unemployment rates were in Utah (2.2%), Minnesota (2.3%), and North Dakota (2.3%).

Transitioning away from ultra-low interest rates never promised to be an easy road. This process of normalization took some prisoners in 2022. The tech-heavy Nasdaq Composite Index sank 33% on a price-only basis as investors repriced high growth, high valuation stocks. Some of the biggest winners in 2021 dropped to the bottom of the 2022 scoreboard, including California-based chipmaker Nvidia, which soared 125% two years ago before a 50% plunge in 2022. The lone S&P 500 Index sector that posted a positive price-only return in 2022 was Energy. The closing price of West Texas Intermediate (WTI) crude oil jumped as high as $123/barrel last March, up 64% from its year-end 2021 level, before fading to $80/barrel when 2022 came to a close. Nevertheless, the S&P 500 Energy sector returned 59% price-only last year, helped by attractive dividends and low valuations. It was an abnormal year, as usual.

A couple years after that 1920 presidential election, poet Robert Frost composed “Stopping by Woods on a Snowy Evening” at his home in Vermont. It contained the famous concluding (and repeated) line “And miles to go before I sleep.” That is a pretty apt saying for the markets in 2023. Many challenges remain for corporate America: higher interest rates, higher input costs, and likely lower margins. The easy money era is over.

1 “In the Shadow of the Slump: The Depression of 1920-1921,” www.econreview.berkeley.edu, 3/18/2021

2 “History of the 1918 Flu Pandemic,” www.cdc.gov

3 “WHO Coronavirus (COVID-19) Dashboard,” www.covid19.who.int, 1/4/2023

4 “Warren G. Harding’s pledge to ‘return to normalcy’,” www.britannica.com

5 “OECD Economic Outlook, Volume 2022 Issue 2,” www.oecd-ilibrary.org, 11/22/2022

6 “US Growth Outlook 2023,” Bloomberg Intelligence, 12/29/2022

7 “US REACT: Quitters Make It Hard for Fed to Cool Wages,” www.bloomberg.com, 1/4/2023

8 “Fed Gets ‘Goldilocks’ Report: Slower Wage Growth, Solid Hiring,” www.bloomberg.com, 1/6/2023

Recent Insights

Quarterly Small Value ESG Equity Strategy Q2 2024

The equity markets continued to narrow in Q2. Large growth was the only winning style, and even that was deceptive as large growth returns were concentrated in the usual handful of mega caps perceived to be artificial intelligence (AI) beneficiaries. While showing some signs of weakness, economic growth remained positive while inflation continued to roughly moderate through the period. Interest rates rose in April, fell in May and were largely flat in June, ending the quarter very close to where they started.

July 19, 2024

Quarterly Technology Science Equity Strategy Q2 2024

The Bailard Technology Strategy posted a 2Q24 total return of 9.75% net of fees, ahead of both the cap-heavy benchmark index (S&P North American Technology Index) as well as the competitor-comprised benchmarks. The Morningstar U.S. Open End Technology Category returned 3.24% and the Lipper Science and Technology Fund Index returned 5.10%, while the S&P North American Technology Index generated 9.36% and the Nasdaq-100 Index returned 8.05%. Over longer time periods of 3, 5, and 10 years, the Strategy’s net returns continued to lead the competitor peer benchmarks.

July 18, 2024

The Bailard Foundation Distributes $1M in its First Five Years

Bailard, Inc. proudly announces its Bailard Foundation reached $1 million in grants and donations distributed in just its first five years. As of June 30, 2024, the Bailard Foundation has distributed $1,008,037 since its inception in June 2019, over 90% of which has directly benefited the local Bay Area community.

July 17, 2024

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.