In this quarter’s closing brief Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) dives into the factors continuing to affect the economic environment.

September 30, 2022

The honeymoon appears to be over for FedEx newbie CEO Raj Subramaniam. Shortly after he ascended to the post on June 1, taking over for founder and longtime CEO Fred Smith, FedEx announced a 53% dividend hike and the appointment of two new board members put forth by activist investor, D.E. Shaw group. The stock soared over 14% on that day, its largest one-day increase since 1986. A couple of weeks later, Subramaniam and his management team hosted an upbeat Investor Day – the company’s first such event in a decade – in which they laid out a set of ambitious targets for fiscal year 2025. Among those targets was the projection that FedEx would grow adjusted earnings per share (EPS) in the 14% to 19% range annually, aided by higher profit margins. It was a heady first month on the job for Subramaniam, although some analysts hoped for bolder structural changes for a business that has struggled to operate at the same profitability levels as its peer United Parcel Service.

Less than three months after providing the bullish Investor Day outlook, Subramaniam was forced to withdraw FedEx’s fiscal 2023 guidance while warning that Q1-23 revenues would fall roughly $800 million short of expectations. He said “macroeconomic trends significantly worsened later in the quarter,” and FedEx acknowledged that volumes declined faster than they could reduce costs.1 Operating expenses remained high relative to demand, which is not a phrase that investors like to hear, particularly when it comes about 11 weeks after the company guided to improved profitability. The mid-September warning sent the share price plunging to a level roughly 20% below where it traded prior to the buzzy, shareholder-friendly moves. It also reverberated throughout equity markets, with The New York Times noting “As an economic bellwether, FedEx’s troubles are a gloomy sign for the U.S. economy.”2

Although FedEx fell short of first quarter revenue expectations, it still managed a 5% sales increase versus the prior year. Earnings, however, proved problematic. Adjusted EPS sank 21% year-over-year, and the adjusted operating margin declined 150 basis points3 to 5.3%—a far cry from the 10% operating margin target identified in FedEx’s fiscal 2025 plan. This atypical relationship between sales and earnings growth—with sales growth outpacing earnings—has been fairly common for companies this year due largely to inflation’s impact on the cost of doing business. Firms attempt to pass along the elevated costs to consumers, but either there is a lag in implementation or they lack the pricing power to do so. As an example, Q2 2022 Standard & Poor’s 500 Index sales per share growth was approximately 4.3% versus the first quarter, but operating earnings dropped 5% sequentially. Normally firms benefit from positive operating leverage in a healthy demand environment, with earnings growth running ahead of top-line growth. We are experiencing the other side of that coin currently, and investors are less willing to pay higher valuations for businesses which are incrementally less profitable.

Latest Obsession: Dot Plot

Former Federal Reserve (Fed) chairman Ben Bernanke is credited with spearheading the Fed’s drive for enhanced transparency. He started holding quarterly press conferences to explain the Federal Open Market Committee’s (FOMC) decisions, adopted a formal inflation target of two percent, and provided forward guidance on short-term interest rates.4 That forward guidance on the projected trajectory of the Fed Funds (short-term) interest rate was beefed up in 2012 via the introduction of the “dot plot” chart. The dot plot illustrates where FOMC members think the Fed Funds rate will be over the next four calendar years, plus a longer-run estimate. With 19 FOMC members, the estimates can vary considerably, which is why investors tend to focus on the median forecast. As of September, the FOMC’s median Fed Funds forecast for year-end 2022 was 4.375%, which suggests the Fed could hike the rate by another 100 to 125 basis points by December from the current 3.25% top-end target.

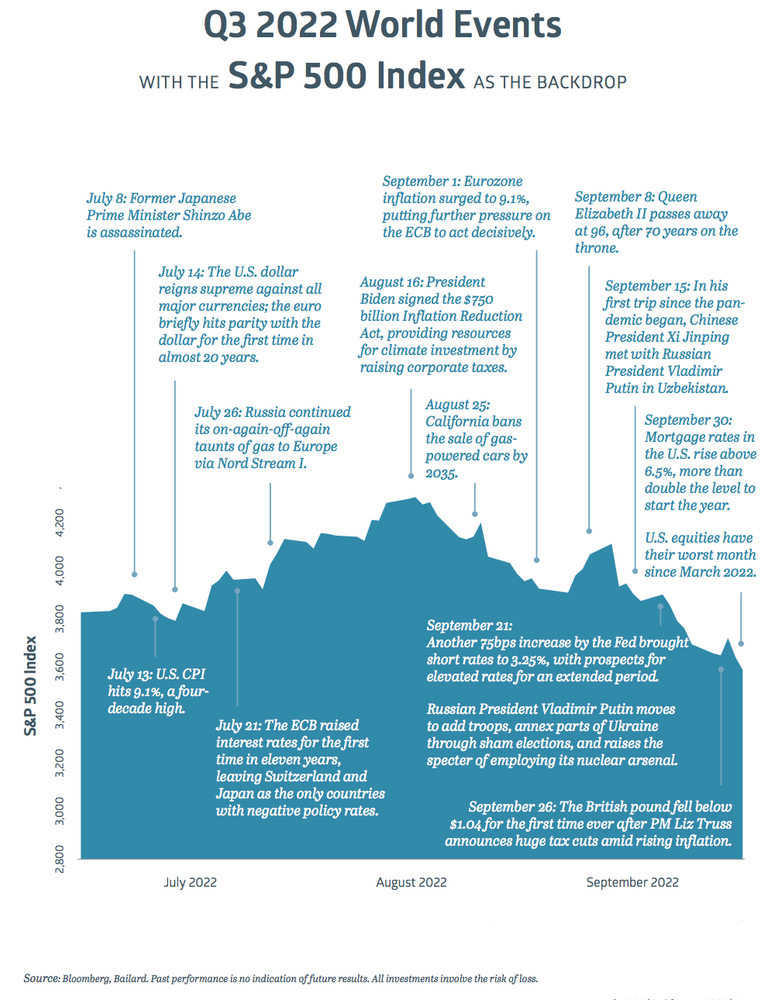

With inflation still running hot, the Fed seems to have little choice. The September 2022 Consumer Price Index (CPI) reading was up 8.2% year-over-year, trending lower from its recent peak of 9.1% in June. However, core CPI (excluding food and energy) has gone the other direction and at +6.6% is at its highest level since the early 1980s. Regardless of how you parse the data in search of signs of cooling prices, inflation remains uncomfortably high. FOMC members have repeatedly tried to make it clear that they intend to tighten monetary policy until inflation is firmly under control, more or less regardless of the consequences. Federal Reserve Bank of New York President John Williams said recently that the Fed Funds target rate needs to rise to around 4.5% over time, adding “Right now the focus is getting inflation back down to 2%.”5 Minneapolis Fed President Neel Kashkari thinks “we’re quite a ways from a pause,” with respect to the Fed halting its rate hiking campaign.6

Investors can’t seem to shake the idea that the Fed will ride to the rescue. This has not escaped the attention of the Fed. Kashkari tried injecting a dose of reality: “I fully expect there are going to be some losses and there are going to be some failures around the global economy as we transition to a higher interest rate environment, and that’s the nature of capitalism.”5) The latest job markets data hasn’t particularly helped the case for those hoping the Fed will pivot and abandon its tough love stance. Non-farm payrolls rose 263,000 in September, and the unemployment rate dropped back down to 3.5%, as low as it has been since the late 1960s. The labor force participation rate remains stuck in the low 62% territory, in part due to demographic forces, which has put upward pressure on wages. Although the Fed won’t outright say they are rooting for the job market to soften, these monthly readings remain a key input in their assessment of how monetary policy is playing out in real life.

Bad News is Good News

To paraphrase one of New Jersey’s famous bands, Bon Jovi, there remains a cohort of financial markets participants who are “Livin’ on a Prayer” that the Fed will bow to pressure and reverse course. We see this dynamic almost daily in equity prices, which tend to trade higher on disappointing economic news. This counterintuitive trading pattern has been in place for a long time now. Mixed economic data in the U.S. has cut both ways in recent weeks, muddling the picture for the Fed and investors alike. The Conference Board’s Leading Economic Index (LEI) fell for a sixth consecutive month in August, prompting the Conference Board to “project a recession in the coming quarters” with LEI’s six-month annualized growth rate down more than 5%—a level which has coincided with recessions in the past.7 In the housing market, the S&P CoreLogic Case-Shiller 20-city Index fell 0.4% in July, amazingly its first decline since March 2012. Nonetheless, housing prices clearly remain elevated, despite the spike in mortgage rates. The average rate for a 30-year mortgage hit 6.7% near the end of the third quarter, its highest since 2007.

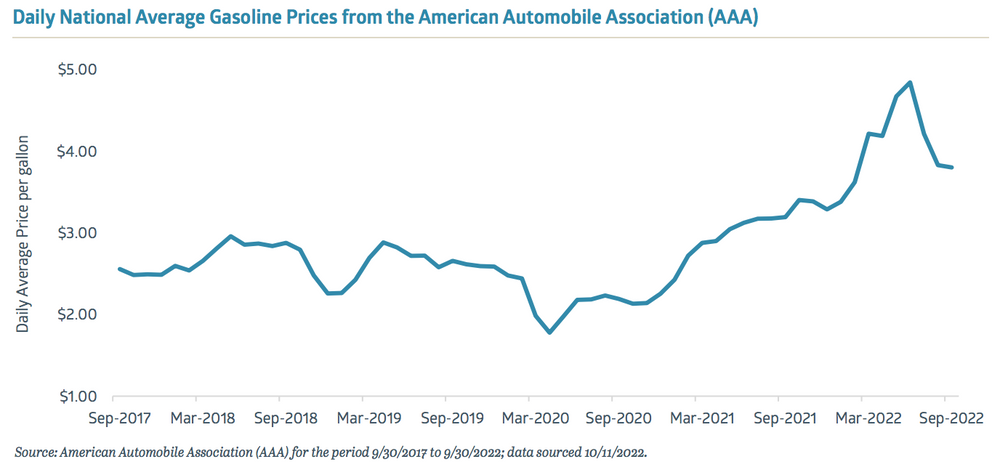

One source of short-term relief for consumers amidst this inflationary wave has been gasoline prices. The U.S. average price of regular gasoline peaked at $5.01/ gallon in mid-June before easing to $3.80/gallon by quarter-end, softening for 14 straight weeks before a late September bounce. The Organization of the Petroleum Exporting Countries and its allies (OPEC+) responded by announcing in early October that they intend to cut crude production by two million barrels per day this fall. Whether this pushes gasoline prices back up remains to be seen. According to the American Automobile Association, gas prices may not be impacted due to the combination of OPEC+ members already struggling to meet production quotas, the potential for a recession to weigh on crude oil demand, and a seasonal decline in driving.8

Following two straight negative growth quarters for U.S. real Gross Domestic Product (GDP), it appears the third quarter may flip back to positive. The Federal Reserve Bank of Atlanta’s GDPNow model estimate for Q3 real GDP growth was 2.7% as of October 7. Goldman Sachs chief economist Jan Hatzius boosted his estimate to 1.9% in early October, citing stronger than anticipated economic data. Goldman Sachs still assigns roughly a 35% probability of a recession for the U.S. economy over the next twelve months. Consumer spending is facing stiff inflationary headwinds, and a growing number of consumers seem to be turning to debt to finance their purchases. According to Federal Reserve data, total credit rose $32 billion in August from the prior month, including the third-largest monthly advance on record for revolving credit (including credit cards).9

From a big picture perspective, it doesn’t appear anything existential has arisen yet to threaten financial stability, outside of the madness of Vladimir Putin. Instead, we continue to experience this painful process of normalization, in which interest rates have moved swiftly back toward historical average levels. Inflation remains a significant and thorny issue, and the battle to take it off boil has the potential to further devalue financial assets in the near-term. Markets have suffered through a fairly major valuation correction, but corporate earnings and employment have thus far remained stubbornly strong. Morgan Stanley equity strategist Michael Wilson said the light at the end of the tunnel is an earnings recession train the Fed can’t stop.10 A bit dramatic, perhaps, but macroeconomic conditions don’t appear particularly favorable for a sustained rally in risky assets.

1 “FedEx Reports Preliminary First Quarter Financial Results and Provides Update on Outlook,” www.investors.fedex.com , 9/15/22

2 “FedEx Slashes Earnings Forecast, Citing Slowdowns in Asia and Europe,” www.nytimes.com, 9/16/22

3 A basis point (bp) is 0.01%

4 “Ben S. Bernanke,” www.federalreservehistory.org

5 “Fed’s Williams Sees Rates Heading to Around 4.5% Over Time,” www.bloomberg.com, 10/7/22

6 “Kashkari Says Fed Is ‘Quite a Ways Away’ From Pausing Rate Hike,” www.bloomberg.com, 10/6/22

7 “US Leading Indicators,” www.conference-board.org/topics/us-leading-indicators, 9/22/22

8 “Gas Demand Spikes, Contributing To Rising Pump Prices,” www.gasprices.aaa.com, 10/6/22

9 “US Consumer Borrowing Rises More Than Forecast on Credit Cards,” www.bloomberg.com, 10/7/22

10 “Weekly Warm-up: The Light at the End of the Tunnel Is an Earnings Recession Train the Fed Can’t Stop,” Morgan Stanley Research, 10/3/22

Recent Insights

Quarterly Small Value Strategy Q2 2025

Investors shrugged off initial trade war panic, and risk-on sentiment dominated thereafter. Both growth stocks and low-quality “junk” stocks benefited. Barring a recession, small cap stocks are positioned to relatively benefit from tariff policy, deregulation, and interest rate cuts. Valuation differences between small caps and large caps make the relative benefits even more compelling.

July 18, 2025

What Matters Most Hasn’t Changed

In his first 9:05 piece as CIO, Dave Harrison Smith, CFA, reflects on Bailard’s enduring philosophy and what lies ahead.

July 14, 2025

GRATs: An Unexpected Bridge to Philanthropy

Our Director of Estate Strategy, Dave Jones, JD, LLM, CFP®, shares how a Grantor Retained Annuity Trust (GRAT) can offer peace of mind for family priorities, and open the door to charitable giving.

July 14, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.