Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) gets a little carried away and shares his analysis of potential cracks in the foundation of the U.S. economy.

June 30, 2022

The human propensity to overdo things can be seen in virtually every vein of life but it does seem a particularly American trait. Convenience store 7-Eleven boasts more than 13,000 locations across the U.S. and Canada and is perhaps best-known as the purveyorn of the Big Gulp® drink. Initially offered in 1976 as a 32-ounce version, the Big Gulp® expanded its waistline to a 44 ounce “Super” Big Gulp® iteration in 1983 before ultimately topping out at 64 ounces in 1988 via the Double Gulp®. When 7-Eleven decided to downsize the drink to a mere 50 ounces a decade ago—due mostly to it not fitting in car cupholders—The Atlantic pointed out that the average human stomach can hold about 32 ounces of liquid.1 This factoid has clearly not dissuaded 7-Eleven (nor consumers), which makes sense given the company is based in Texas, where we know everything is bigger. Even the store’s name itself, which originated because they opened at 7am and closed at 11pm, proved not enough as most locations are now 24/7 operations.

There are countless examples of human ingenuity getting a little carried away. An otherwise mundane trip to a Costco warehouse can be eye- (and wallet-) opening. A 72-pound wheel of Parmesan cheese can be yours for only $949.99, shipping and handling included. For the kids, a 93″ tall plush bear retails at $369.99. Perhaps nowhere is this tendency to overdo things more apparent than in the financial markets. Boom and bust, greed and fear: equities and other securities can deviate wildly from their long-term trendlines and current fundamentals.

Momentum is a powerful force that can carry markets well past where logic would dictate. The Standard & Poor’s 500 Index returned 5.7% annually on a price-only basis through the 90-year timeframe of 1927 to 2017.

That long-term average rapidly inflated to 6.2% by the end of 2021, though, following a torrid 2019-2021 period in which the S&P 500 soared 90% price-only, a steep adjustment in a short stretch relative to the full history. The gains enjoyed over the past three years likely borrowed from the future, and the first half of 2022 (in which the S&P 500 Index declined over 20%) has reinforced that notion. In other words, we got a little carried away.

Speaking of bingeing, Netflix shareholders now understand how swiftly the tide can go out. Changing sentiment has a more pronounced impact on individual stocks, and Netflix suffered from a severe case of investor disillusionment over the last six months. Entering 2022, Netflix had enjoyed a 37% annualized return during the 2017 to 2021 timeframe, a little over double what the S&P 500 delivered. The company was a big pandemic winner, with 2021 adjusted earnings per share at 232% of the 2019 level. Investors couldn’t stop buying the stock, though, and the price/earnings ratio hit nearly 54x at the end of 2021. Despite a modest projected earnings decline in 2022 off a high level, the stock fell approximately 71% in the first half of the year, another valuation victim and a reminder to check if the crowd is running in the right direction.

I Fought the Fed and the Fed Won nAt present, the burning question is to what degree will we overdo the downward correction? With equities in backpedal mode and FOMO replaced with old-fashioned fear, the valuation picture is much improved. The S&P 500 traded at nearly 23x trailing earnings as 2022 started, but finished June at 17.8x (estimated). Unfortunately, we did it the hard way: the sharp contraction in what investors were willing to pay for each dollar of earnings accounted for nearly all of the difference. Earnings for the S&P 500 over the last twelve months are projected to have only crept about 2% higher since the outset of 2022. As for how low that price/earnings multiple could go in a recession scenario, institutional research firm Strategas calculated that the average trailing price/earnings ratio for the S&P 500 at bear market bottoms is 11.7x.2 However, the average for the five most recent bear markets—starting with 1987—has been 14.4x, and the 2002 bear market bottomed at 17.6x. So while there appears to still be some excess fat in U.S. large-cap valuations, broadly speaking, the market downturn has brought the Index much closer to finding support.

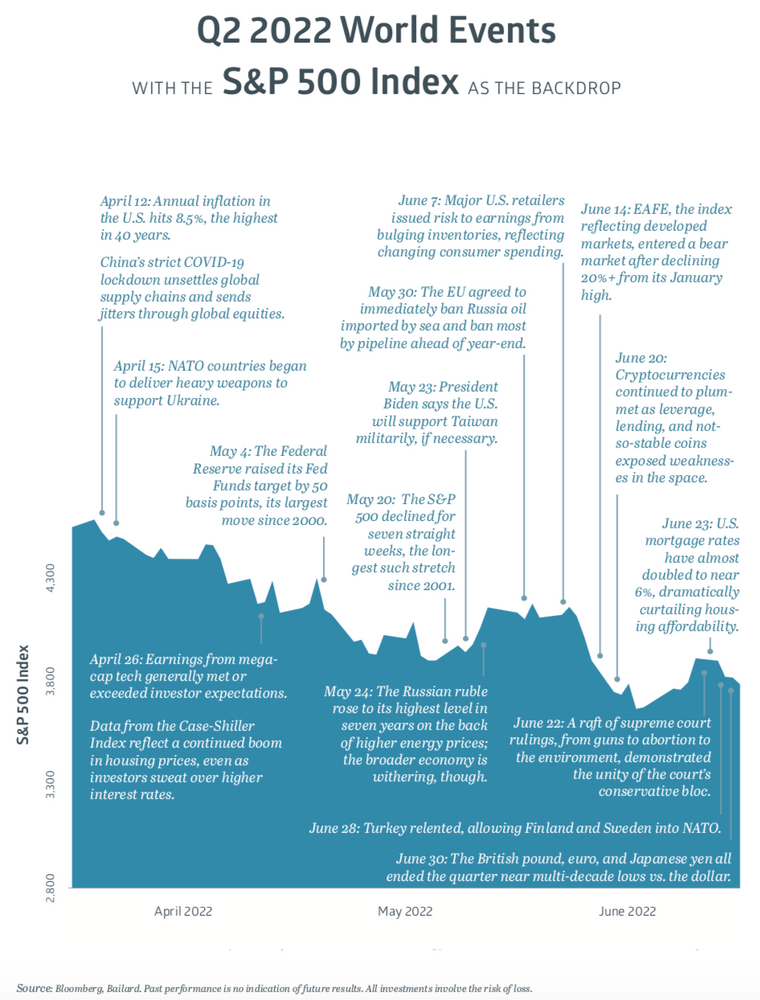

The selloff catalyst is no mystery. High and rising inflation readings sparked the sentiment switch, in conjunction with interest rates and monetary policy beginning to normalize. The adage “Don’t Fight the Fed” proved true as the Federal Reserve finally embarked on the unwinding of their extraordinarily easy money policies. To date, the Fed has hiked its Fed Funds interest rate three times, upping the magnitude each time, from 25 basis points3 to 50 and then 75. The June increase was the largest since 1994, and Chairman Jerome Powell cautioned afterwards in a hearing on Capitol Hill that “I think we’d be reluctant to cut” (the Fed Funds rate).4 Investors that are banking on the Fed reversing course are likely bound for disappointment. The Fed’s June “dot plot” indicated they expect to raise the Fed Funds rate to around 3.4% by year-end, essentially twice as high as the current 1.75% top end target, and ultimately peak at 3.8% in 2023.

Bond yields are suggesting the economy might crack before the Fed gets there. After running up to a high of 3.47% in mid-June, the 10-year U.S. Treasury Note yield retreated to 3.01% by quarter-end. This helped take some of the sting out of what was a historically-poor first half of the year for bond investors. Nonetheless, the Bloomberg Barclays U.S. Aggregate Bond Index posted a -10.4% total return over the six months. Credit spreads are also expressing concern. The Barclays Capital U.S. Corporate High Yield (junk bond) spread over the 10-year U.S Treasury reached nearly six percent, about a percent above the long-term average.

With the Fed tightening and Treasury yields dropping (at least for now), something has to give. The odds of a soft landing appear relatively low. According to Morgan Stanley’s Wealth Management chief investment officer Lisa Shalett: “Over the past 70 years, there have been 14 episodes of Fed tightening and 11 recessions, with soft landings on only three occasions, or 21% of the time.”5 That may at least partly explain why bond investors are buying at negative real (inflation-adjusted) yields.

Consumer Fatigue nInflation has clearly taken a sizeable toll on sentiment. In fact, the University of Michigan’s Consumer Sentiment Index hit a record low in June, which is amazing when you consider the Index is at a lower point than during the credit crisis. Crude oil rose a fairly modest 5% in the second quarter to $105 per barrel, but traded as high as $122 in June. Similar to Treasury yields, oil prices faded as the quarter waned, indicative of pessimism over economic growth. Food prices have also weighed heavily on consumers. The Bureau of Labor Supply reported that prices for all food consumed at home jumped 11.9% year-over-year in May, the largest twelve-month increase since April 1979. Food giant General Mills flexed some pricing power in their fiscal fourth quarter, reporting a 13% organic sales increase due entirely to higher prices and the mix of products sold.

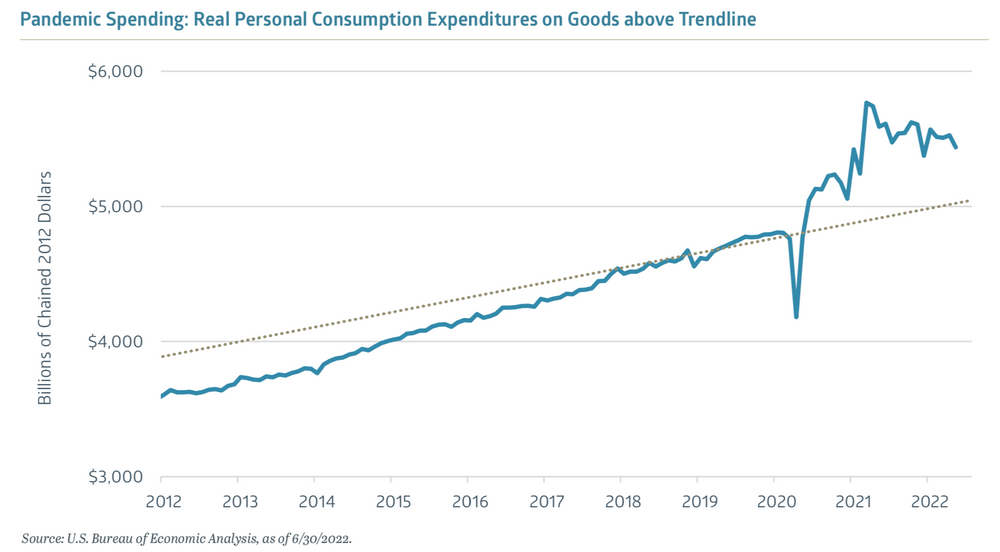

Some relief for food prices may be in the offing. The Bloomberg Agriculture Spot Index traded down 13% in June, with Bloomberg reporting that grain shortage fears were giving way to optimism that key producers will reap sufficiently large harvests.6 Continued improvement in oil and food prices would help the beleaguered consumer, but inflation has spread to virtually every category, threatening the linchpin of the American economy. Consumer spending declined 0.4% (inflation-adjusted) in May, according to the Commerce Department, the first negative reading this year. Spending on goods fell 1.6%, whereas services outlays increased 0.3%. This transition from goods to services spending has been expected. As shown in the exhibit above, real spending on goods rocketed above its trendline during the pandemic, but has eased as spending outside the home recovers.

Employment remains strong, with the unemployment rate at just 3.6% as of June. Average hourly earnings also rose 5.1% year-over-year. This should help consumer spending in the face of inflationary headwinds and declining financial asset values. Unemployment may move higher, however, as corporations deal with rising costs and attempt to maintain profitability. Some analysts are skeptical that firms will be able to pass along higher costs, leading to margin compression and lower earnings. This would also make stocks more expensive based on forward earnings. Goldman Sachs is among those wary of consensus estimates, expecting a 70 basis point decline next year for the typical S&P 500 company in the EBIT (earnings before interest and taxes) margin, assuming no recession.7 In contrast, they said, analysts expect the median stock’s EBIT margin to expand by 60 bps. nIt is possible the U.S. economy is already experiencing a recession. The Atlanta Fed’s GDPNow tracker currently estimates that second quarter real Gross Domestic Product output will have contracted by 2.1%.8 Combined with the first quarter’s 1.6% decline, the two quarters of negative growth would fit the definition of a recession, although the National Bureau of Economic Research will make the official call. Ultimately, whether or not we have an official recession will be of less importance than the depth and severity of the downturn. The cratering of the cryptocurrency markets aside, there don’t appear to be any significant fundamental cracks in the economic foundation at present. Earnings estimates for 2023 likely need to be revised lower, and interest rates will continue to be a headwind for valuations, but hopefully the markets won’t get carried away and overdo it.

1 “7-Eleven Downsizes ‘Double Gulp’ To Just 156% of Your Stomach’s Capacity,” www.theatlantic.com, 6/14/2012

2 “Daily Macro Brief,” Strategas, 6/14/2022

3 A basis point (bp) is 0.01% n4 “Fed chair Jerome Powell: Rate hikes could lead to more job losses,” www.cnn.com, 6/23/2022

5 “Is it the end of the FAANG era? Why the market has turned against tech stocks,” www.fortune.com, 5/14/2022

6 “Food Inflation Relief Is Within Sight as Crops and Crude Pull Back,” www.bloomberg.com, 6/27/2022

7 “Consensus profit margin forecasts have further to fall,” Goldman Sachs US Equity Views, 6/27/2022

8 “Atlanta Fed GDP tracker shows the U.S. economy is likely in a recession,” www.cnbc.com, 7/1/2022

Recent Insights

Quarterly Small Value ESG Equity Strategy Q2 2024

The equity markets continued to narrow in Q2. Large growth was the only winning style, and even that was deceptive as large growth returns were concentrated in the usual handful of mega caps perceived to be artificial intelligence (AI) beneficiaries. While showing some signs of weakness, economic growth remained positive while inflation continued to roughly moderate through the period. Interest rates rose in April, fell in May and were largely flat in June, ending the quarter very close to where they started.

July 19, 2024

Quarterly Technology Science Equity Strategy Q2 2024

The Bailard Technology Strategy posted a 2Q24 total return of 9.75% net of fees, ahead of both the cap-heavy benchmark index (S&P North American Technology Index) as well as the competitor-comprised benchmarks. The Morningstar U.S. Open End Technology Category returned 3.24% and the Lipper Science and Technology Fund Index returned 5.10%, while the S&P North American Technology Index generated 9.36% and the Nasdaq-100 Index returned 8.05%. Over longer time periods of 3, 5, and 10 years, the Strategy’s net returns continued to lead the competitor peer benchmarks.

July 18, 2024

The Bailard Foundation Distributes $1M in its First Five Years

Bailard, Inc. proudly announces its Bailard Foundation reached $1 million in grants and donations distributed in just its first five years. As of June 30, 2024, the Bailard Foundation has distributed $1,008,037 since its inception in June 2019, over 90% of which has directly benefited the local Bay Area community.

July 17, 2024

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.