This quarter, we feature the economic perspective of Jon Manchester, CFA, CFP®, Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing.

March 31, 2023

When U.S. president Franklin Delano Roosevelt (FDR) first took office in March 1933 he was 51 years old and tasked with the monumental challenge of somehow lifting the country out of the Great Depression. He had work to do on nearly every front. At the top of that list, however, was shoring up the nation’s beleaguered banking system. Roughly 4,000 banks had closed in the first few months of 1933 alone, adding to a series of bank runs and failures in prior years.1 One of FDR’s first moves was to declare a national banking holiday, a euphemism for temporarily shutting down the banking system. That was followed days later by the passage of the Emergency Banking Act (EBA), which importantly gave Federal Reserve Banks the right to issue emergency currency to struggling banks in the form of Federal Reserve Bank Notes. His inaugural “Fireside Chat” took place on March 12, 1933 and began with FDR calmly saying over the airwaves, “My friends, I want to talk for a few minutes with the people of the United States about banking.”2

By June 1933, FDR was only three months into his term, but it may have felt like three years to him, following what is now considered the most productive first 100 days of any presidency and the benchmark against which all future presidents would be measured. Congress passed 77 laws during that frenetic special session, including 15 landmark bills that were the bedrock of FDR’s First New Deal. Among the flurry of legislation were bills creating the first of what some referred to as FDR’s alphabet agencies: the Civilian Conservation Corps (CCC), Tennessee Valley Authority (TVA), and others. For a man known by his initials, perhaps it was fitting that his office spawned a whole host of federal government agencies known primarily by theirs. Not everyone was a fan of the bulked-up bureaucracy. Former New York governor Al Smith reportedly groused that Roosevelt’s government was “submerged in a bowl of alphabet soup.”3

By June 1933, FDR was only three months into his term, but it may have felt like three years to him, following what is now considered the most productive first 100 days of any presidency and the benchmark against which all future presidents would be measured. Congress passed 77 laws during that frenetic special session, including 15 landmark bills that were the bedrock of FDR’s First New Deal. Among the flurry of legislation were bills creating the first of what some referred to as FDR’s alphabet agencies: the Civilian Conservation Corps (CCC), Tennessee Valley Authority (TVA), and others. For a man known by his initials, perhaps it was fitting that his office spawned a whole host of federal government agencies known primarily by theirs. Not everyone was a fan of the bulked-up bureaucracy. Former New York governor Al Smith reportedly groused that Roosevelt’s government was “submerged in a bowl of alphabet soup.”3

One of those 15 landmark bills was the Banking Act of 1933, enacted that June. It established the Federal Deposit Insurance Corporation (FDIC), another of the alphabet agencies, and a particularly critical one viewed from the lens of today, 90 years later. Informally called the Glass-Steagall Act after its sponsors—Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama—its main purpose was to separate commercial banking from investment banking. Interestingly, the provision that created the FDIC was much more controversial, even drawing veto threats from FDR.4 He signed the bill, however, and the FDIC was born, with deposits insured up to $2,500 initially at member banks. That coverage was soon doubled to $5,000 in 1935 and is $250,000 today.

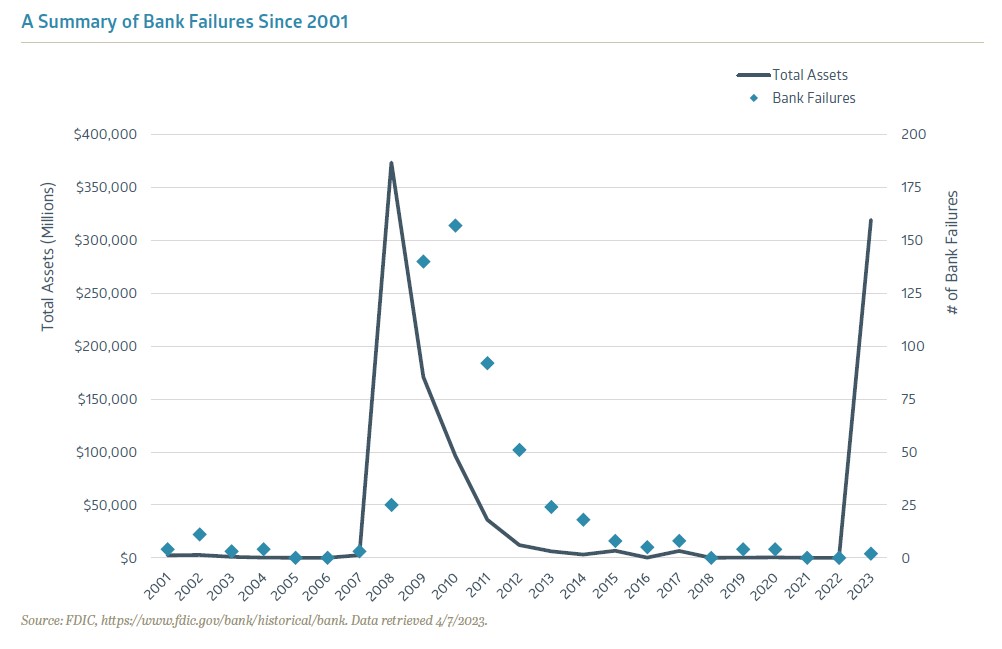

The sudden demise of both Silicon Valley Bank (SVB) and Signature Bank in March 2023 were stark reminders of both the importance of FDIC insurance and its limitations. As the second and third-largest bank failures in U.S. history, trailing only Washington Mutual in 2008, government officials determined the one-two punch required a new approach to stabilize the banking system. In a joint statement between the Treasury department, the Federal Reserve, and the FDIC, it was announced all depositors would be made whole as a “systemic risk exception.”5 In other words, the $250,000 FDIC insurance cap was waived, in an effort to prevent a widespread banking panic. The FDIC has travelled a great deal from its humble roots as a late add-on to the Glass-Steagall Act.

Available for Sale

Whether the banking turmoil ultimately proves a tempest in a teapot seems largely dependent on the same variables we’ve been discussing for a while now: inflation and interest rates. Persistently high inflation and a sharply inverted yield curve is not the desired formula. Shortly after the bank failures, the Federal Open Market Committee (FOMC) decided to continue the inflation fight by raising the target Fed Funds rate to an upper limit of 5.00%. Some expected the Fed to pause in the wake of the banking instability, but in their statement the Committee said they remain highly attentive to inflation risks. They did acknowledge that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”6 Meanwhile, longer-term interest rates declined in March. The benchmark 10-year U.S. Treasury Note yield fell from nearly 4% at the beginning of the month to below 3.5% when the first quarter hit the finish line.

Nonetheless, the 10-year U.S. Treasury Note yield remains well above its levels from 2020-21, when it didn’t top 2% and spent much of 2020 below 1%. Therein lies a significant part of the problem for Silicon Valley Bank and other banks who invested heavily in low-yielding government paper during that time frame. According to the Federal Reserve Bank of St. Louis, just prior to the pandemic, roughly 20% of bank assets consisted of investment securities – primarily mortgage-backed and U.S. Treasury bonds.7 By the end of 2021, security holdings had increased to 25%, and many of the purchases were longer maturity bonds, which are more vulnerable to rising interest rates. When Silicon Valley Bank depositors fled in mass, the bank was left technically insolvent due to significant losses on the bonds in its investment portfolio. Although you can argue that uninsured SVB depositors were acting rationally, it brings to mind the famous quote often attributed (perhaps wrongly) to famed British economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

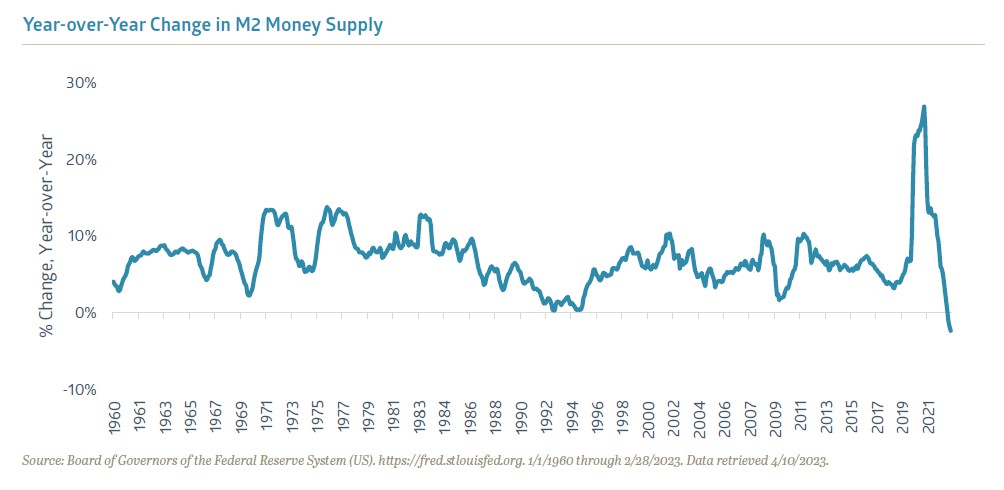

The tighter credit conditions mentioned by the Fed could pose a challenge for economic growth and corporate earnings. Notably, after an enormous spike in money supply during 2020—as measured by M2, which includes cash, bank deposits, money market funds, and other types of deposits readily convertible to cash including certificates of deposit—it is now falling at the fastest rate since the 1930s.8 This can be partly attributed to a normalization of money supply following the extraordinary fiscal and monetary stimulus measures during the pandemic, but it is something to monitor as 2023 progresses.

Higher borrowing rates and tighter lending standards have the potential to dampen economic growth in a hurry. The Chicago Fed’s National Financial Conditions Index takes into account 105 indicators of financial activity, a wide variety of interest rate and credit spreads, plus other metrics. It has been moving higher over the past year, indicating tighter financial conditions, which the Fed wants to see for the inflation fight, but runs the risk of inducing the much anticipated recession.

Market Incongruences

While the yield curve continues to suggest a slowdown lies ahead, equities shrugged off the banking tremors and put together a surprisingly strong first quarter. In fact, in case your phone didn’t notify you, the tech-heavy Nasdaq 100 Index hit bull market territory near the end of March. The Standard & Poor’s 500 Index returned 7% price-only in Q1-23, with last year’s sector laggards—Communication Services, Technology, and Consumer Discretionary—the leaders as part of a fairly strong rotation into growth stocks.

The equity market’s resilience seems underpinned by a familiar carrot: the promise of lower interest rates. According to the CME FedWatch Tool, Fed Funds futures are now pricing in a greater than 50% probability that the FOMC pauses at 5.00% over the next two meetings in May and June, respectively, before potentially cutting the target rate in the back half of 2023.9 The highest probability currently assigned to the December FOMC meeting is 4.25%. This rising expectation that the Fed will reverse course has encouraged investors to move into longer duration, growth stocks.

History shows that equities tend to perform well following a peak in the Fed Funds rate. This doesn’t hold 100% of the time, however, and there are reasons to be cautious this time around. Inflation isn’t kicked yet, for starters. The Consumer Price Index (CPI) was still running at +6.0% year-over-year as of February, and the Personal Consumption Expenditures (PCE) core price index at +4.6%. Both have improved, but the Fed knows it isn’t time to declare victory yet. They may be able to pause, but the futures market could be mistaken in projecting a lower Fed Funds rate this year. Equity market valuations are another potential headwind. The S&P 500 Index closed Q1-23 at nearly 19x projected 2023 operating earnings. The excess valuation levels of 2021 have been corrected, but U.S. large-cap stocks are not cheap. In fact, Goldman Sachs Research said in late March that the S&P 500’s forward valuation ranked in the 82nd percentile since 1980.10 Other areas of the equity markets are less demanding from a valuation perspective.

With the fixed income and equity markets offering contrasting signals, it would seem one group of investors has to be wrong, assuming returns don’t move in tandem as they did in 2022. The odds appear more stacked against equities given restrictive monetary policy and what’s expected to be a more cautious lending environment, plus modestly elevated valuations as a starting point. Economic growth in the U.S. may be muted. The Conference Board’s Leading Economic Indicators (LEI) Index declined for an eleventh-straight month in February 2023. Per the release: “The Conference Board forecasts rising interest rates paired with declining consumer spending will most likely push the US economy into recession in the near term.”11 They expect just 0.7% real GDP growth this year.

It is safe to assume that FDR would strike an optimistic tone at this moment. Perhaps we could all use a genial Fireside Chat to remind us that the employment picture is exceedingly strong, housing prices were up 3.8% year-over-year in January, according to the S&P Case-Shiller Home Price Index, and the banking system remains sound in part thanks to an alphabet agency created 90 years ago. This doesn’t look like another credit crisis, but even FDR would admit there are obstacles to overcome if risky assets are to perform well.

1 “The First Fifty Years: A History of the FDIC 1933-1983,” www.fdic.gov

2 FDR Fireside Chat, www.fdr.blogs.archives.gov, 3/12/1933

3 “Safire’s Political Dictionary,” William Safire

4 “Banking Act of 1933 (Glass-Steagall),” www.federalreservehistory.org

5 “Joint Statement by Treasury, Federal Reserve, and FDIC,” www.federalreserve.gov, 3/12/23

6 “Federal Reserve issues FOMC statement,” www.federalreserve.gov, 3/22/23

7 “Rising Interest Rates Complicate Banks’ Investment Portfolios,” www.stlouisfed.org, 2/9/23

8 “Column: US money supply falling at fastest rate since 1930s,” www.reuters.com, 3/30/23

9 FedWatch Tool,” www.cmegroup.com, 4/4/23

10 “US Weekly Kickstart,” Goldman Sachs Research, 3/24/23

11 “LEI for the U.S. Continued to Decline in February,” www.conference-board.org, 3/17/23

Recent Insights

Quarterly Small Value ESG Equity Strategy Q2 2024

The equity markets continued to narrow in Q2. Large growth was the only winning style, and even that was deceptive as large growth returns were concentrated in the usual handful of mega caps perceived to be artificial intelligence (AI) beneficiaries. While showing some signs of weakness, economic growth remained positive while inflation continued to roughly moderate through the period. Interest rates rose in April, fell in May and were largely flat in June, ending the quarter very close to where they started.

July 19, 2024

Quarterly Technology Science Equity Strategy Q2 2024

The Bailard Technology Strategy posted a 2Q24 total return of 9.75% net of fees, ahead of both the cap-heavy benchmark index (S&P North American Technology Index) as well as the competitor-comprised benchmarks. The Morningstar U.S. Open End Technology Category returned 3.24% and the Lipper Science and Technology Fund Index returned 5.10%, while the S&P North American Technology Index generated 9.36% and the Nasdaq-100 Index returned 8.05%. Over longer time periods of 3, 5, and 10 years, the Strategy’s net returns continued to lead the competitor peer benchmarks.

July 18, 2024

The Bailard Foundation Distributes $1M in its First Five Years

Bailard, Inc. proudly announces its Bailard Foundation reached $1 million in grants and donations distributed in just its first five years. As of June 30, 2024, the Bailard Foundation has distributed $1,008,037 since its inception in June 2019, over 90% of which has directly benefited the local Bay Area community.

July 17, 2024

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.