This quarter, Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) delves into the paradoxes of momentum investing, inflation’s persistent influence, and the resilience of the U.S. economy in an era of shifting market dynamics.

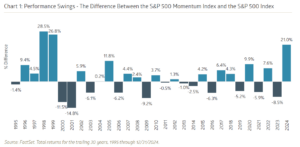

Contrarians are not having a moment. Those resolute and hardy investors who row against the tide of popular opinion—shunning trendy stocks and embracing the unloved—found themselves sinking in 2024. A tidal wave of capital flowed into the fashionable set of equities, largely comprised of companies with a plausible artificial intelligence (AI) story. Winners kept on winning, resulting in a historic rout for momentum investing. In fact, the Standard & Poor’s (S&P) 500 Momentum Index had its best year relative to the overall S&P 500 Index since 1999. It soared 46%, including dividends, outpacing the benchmark S&P 500 by 21 percentage points.

and embracing the unloved—found themselves sinking in 2024. A tidal wave of capital flowed into the fashionable set of equities, largely comprised of companies with a plausible artificial intelligence (AI) story. Winners kept on winning, resulting in a historic rout for momentum investing. In fact, the Standard & Poor’s (S&P) 500 Momentum Index had its best year relative to the overall S&P 500 Index since 1999. It soared 46%, including dividends, outpacing the benchmark S&P 500 by 21 percentage points.

Launched a decade ago—but recalculated back to 1994—the S&P 500 Momentum Index includes the top quintile of the S&P 500 based on trailing 12-month price performance. The Index is rebalanced on a semi-annual basis. As investment concepts go, it does not get any simpler than selecting stocks solely based on price strength. It also challenges conventional thinking: buy low, sell high. Nonetheless, momentum investing has worked over longer timeframes (see Chart 1), although the approach can suffer painful reversals and has not outperformed in more than two consecutive years since the late 1990s. Academics have struggled to pinpoint why momentum investing succeeds. The performance edge is well-documented with a long track record. A 1993 article in the Journal of Finance is cited as the pioneering study on momentum.1 The authors presented data showing that buying recent stock winners and selling losers produced significantly higher short-term returns than the overall U.S. stock market during the 1965 to 1989 time period. This ongoing performance anomaly could be partly attributed to behavioral factors such as FOMO (fear of missing out) and a bandwagon effect.2 The “Big Mo” might also reflect fundamental strength (rising sales, e.g.) already embedded in prices that can persist in the short-term.

Akin to a snowball rolling downhill, momentum investing is driving ever-larger market capitalizations and a more concentrated U.S. large-cap stock market. As one example, the four largest holdings in the S&P 500 Momentum Index—Amazon.com, NVIDIA, Broadcom, and Meta Platforms—carry a combined market capitalization of $8.2 trillion, greater than the cumulative market cap of roughly the bottom 64% of the S&P 500. Morgan Stanley equity strategist Mike Wilson touched on the intersection between momentum and market concentration in a December note. “Another consideration is the growing propensity of investors to use price momentum as a key factor in their investment strategy. Rebalancing has also been de-emphasized as many investors have let their winners run, given the lack of mean reversion in the past several years. This all helps to explain the extreme concentration we’re seeing in many equity markets, not just in the United States.”3

To borrow from Sir Isaac Newton, momentum is the product of mass times velocity, so perhaps this makes some sense. We have exceptionally large companies moving at a fast pace and creating the momentum that helped lift the S&P 500 Index to a greater than 20% return in 2024 for the third time in the last four years. These market moves have been underpinned by robust asset flows into U.S. equities. According to The Wall Street Journal, investors added over $1 trillion to U.S.-based exchange-traded funds (ETFs) last year, shattering the previous record set in 2021.4 Not surprisingly, momentum ETFs were a popular choice. Invesco’s S&P 500 Momentum ETF pulled in over $3 billion of net purchases over the first 11 months of 2024—incredible growth considering the fund now has around $4 billion under management.5 The hot money trades seeking instant gains may prove ill-timed if the AI trade falters, but until then investors are siding with inertia. As the late New York Yankee great Yogi Berra once said: “Nobody goes there anymore. It’s too crowded.”

The Real Return

A leading kryptonite candidate for the equity markets could be higher-than-expected interest rates. The post-COVID inflation shock still reverberates today, even though the Consumer Price Index (CPI) year-over-year growth rate peaked in mid-2022. As of November 2024, the CPI growth rate was down to 2.7%, a full point below the 50-year average of 3.7%. Price growth has clearly decelerated, but not reversed, and the cumulative impact has made life uncomfortable for policymakers. There is a compelling argument that inflation cast a deciding vote in the recent presidential election. U.S. Federal Reserve Chair Jerome Powell acknowledged in his December press conference that inflation “remains somewhat elevated relative to our two percent longer-run goal.”6 This comment followed after the Fed’s decision to cut the Federal Funds target range to an upper limit of 4.5%, marking a third consecutive easing from its peak of 5.5%.

Any enthusiasm for the (expected) rate cut was quickly doused when Fed watchers realized that the updated Federal Open Market Committee (FOMC) projections implied only two additional rate cuts in 2025. Questioned on this in the press conference, Powell flagged the uncertain inflation outlook. He continued: “And, you know, the point of that uncertainty is it’s kind of common sense thinking that when the path is uncertain you go a little bit slower. It’s not unlike driving on a foggy night or walking into a dark room full of furniture. You just slow down.” An apt metaphor with wonderful imagery, but investors were not impressed. The S&P 500 Index traded down 2.95% in response, the second-worst trading session of 2024 and one of only four greater than 2% daily declines for the year.

Rate anxiety is real. With a more cautious FOMC outlook, the 10-year U.S. Treasury Note yield rose 78 basis points,7 or 0.78%, during the fourth quarter, finishing at 4.57%. The S&P 500 Equal Weighted Index declined 2.3% price-only in Q4, perhaps illustrating the perceived impact of higher rates on the average (smaller) S&P 500 company. Further down the market cap spectrum, the S&P SmallCap 600 Index declined 1.0% over the final quarter of 2024. Ebbing inflation will obviously continue to be a key to interest rate stability in 2025. Without further disinflation progress, bond investors may require a higher real, or inflation-adjusted, return. Longer-term rates may rise regardless, considering our country’s inconvenient $36 trillion (and counting) debt load. This has some analysts watching the horizon for the return of the “bond vigilantes,” those disaffected bond traders who sell bonds—driving yields higher—to signal unhappiness with fiscal and/or monetary policies.

Over the last 30 years, as seen in Chart 2, the median spread between the 10-year U.S. Treasury Note yield and the Fed Funds target rate has been 121 bps. At year-end 2024 the spread was a miniscule 8 bps. The most straightforward path to normalize that relationship is further easing by the FOMC, combined with a steady 10-year yield. However, as the Fed would say, this will all be data dependent. Inflation will need to cool further, which would allow the FOMC to proceed on its intended rate cut plan. Any missteps could result in higher long-term yields, harming not only the bond market, but equities as well. With the S&P 500 Index trading at nearly 22x projected 2025 operating earnings—versus a long-term median of approximately 17x—there is not a lot of room for error.

Steady as She Goes

Although inflation dominated headlines again in 2024, particularly during the run-up to the presidential election, overall U.S. economic growth has been resilient. Gross Domestic Product (GDP) grew at a roughly 3% inflation-adjusted rate over the middle six months of 2024, and is estimated to have decelerated to a still solid 2.4% growth rate in Q4.8 The ongoing struggle to foster economic gains for a wider swath of the population continues. While the service economy chugs along, the goods-producing sector remains stuck in neutral. The Institute for Supply Management (ISM) reported that economic activity in the manufacturing sector declined for a ninth consecutive month in December.9 ISM’s survey has actually indicated a manufacturing contraction for 25 of the last 26 months, although the December reading did include some green shoots with new orders and production both in expansion territory.

The U.S. economy is much more dependent on services than goods, of course. In 2023, over 67% of Personal Consumption Expenditures (PCE) went to services, with goods accruing the other 33%.10 According to BlackRock’s Rick Rieder, head of global asset allocation, we may be needlessly worrying about whether the economy will experience a hard or soft landing. Instead, he suggests we think about the U.S. economy as a satellite: “Satellites don’t land. They just get tired over time, and they need a bit more energy…The Fed raises rates 500 basis points, and it doesn’t make a difference, and it’s because the service economy is not cyclical. Goods are hugely cyclical.”11

Rieder’s argument feels like a trap: an explanation designed to fit the narrative since we have only experienced one, technically brief (COVID) recession over the trailing 15 years. It likely contains some truth, however. The economy has recently weathered some “rolling recessions” in which only certain sectors experience a downturn. Perhaps our predominantly service economy can help minimize overall cyclicality, outside of the black swan events. Disappointingly, it will not remove uncertainty, unless AI solves that problem, too. To pull another Yogiism, or pearl of wisdom from Yogi Berra: “It’s tough to make predictions, especially about the future.”

Rieder’s argument feels like a trap: an explanation designed to fit the narrative since we have only experienced one, technically brief (COVID) recession over the trailing 15 years. It likely contains some truth, however. The economy has recently weathered some “rolling recessions” in which only certain sectors experience a downturn. Perhaps our predominantly service economy can help minimize overall cyclicality, outside of the black swan events. Disappointingly, it will not remove uncertainty, unless AI solves that problem, too. To pull another Yogiism, or pearl of wisdom from Yogi Berra: “It’s tough to make predictions, especially about the future.”

1 “Momentum Investing: It Works, But Why?”, www.anderson-review.ucla.edu/momentum, 10/31/2018.

2 “Momentum Investing: what it is, why it works and what to buy,” www.moneyweek.com, 6/15/2018.

3 “What Is Breadth Telling Us?”, Morgan Stanley Research Sunday Start, 12/22/2024.

4 “A Record-Shattering $1 Trillion Poured Into ETFs This Year,” www.wsj.com, 12/30/2024.

5 “Investors Are Looking to Momentum ETFs in 2024,” www.etftrends.com, 11/29/2024.

6 “Transcript of Chair Powell’s Press Conference,” www.federalreserve.gov, 12/18/2024.

7 A basis point (bp) is 0.01%.

8 GDPNow, www.atlantafed.org, 1/3/2025.

9 “Manufacturing PMI® at 49.3%,” www.ismworld.org, 1/3/2025.

10 “Gross Domestic Product (Third Estimate), Third Quarter 2024,” www.bea.gov, 12/19/2024.

11 “DealBook: R.T.O. battle,” www.nytimes.com, 10/12/2024.

Recent Insights

Quarterly Small Value Strategy Q2 2025

Investors shrugged off initial trade war panic, and risk-on sentiment dominated thereafter. Both growth stocks and low-quality “junk” stocks benefited. Barring a recession, small cap stocks are positioned to relatively benefit from tariff policy, deregulation, and interest rate cuts. Valuation differences between small caps and large caps make the relative benefits even more compelling.

July 18, 2025

What Matters Most Hasn’t Changed

In his first 9:05 piece as CIO, Dave Harrison Smith, CFA, reflects on Bailard’s enduring philosophy and what lies ahead.

July 14, 2025

GRATs: An Unexpected Bridge to Philanthropy

Our Director of Estate Strategy, Dave Jones, JD, LLM, CFP®, shares how a Grantor Retained Annuity Trust (GRAT) can offer peace of mind for family priorities, and open the door to charitable giving.

July 14, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.