Not all pauses are created equal. Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist, Wealth Management, and Portfolio Manager, Sustainable, Responsible and Impact Investing), shares how this one mattered.

There is power in the pause. Take a breath, stop to think, sleep on it. In this rapid reaction, first to land the ‘digital’ punch world, we could probably all benefit from a hesitation move. This is well understood in the field of psychology, where the late Austrian psychologist Viktor Frankl is credited with saying “Between stimulus and response, there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.” That power is also appreciated by the financial markets, particularly when the pause removes—at least temporarily—a perceived impediment. A mere week after announcing sweeping “Liberation Day” tariffs in early April, President Trump largely shelved the plan for 90 days. He explained that people “were getting a little bit yippy, a little bit afraid.” The remark, in keeping with the President’s signature off-the-cuff style, lent support to the idea of a “Trump put;” broadly meaning that the President uses the markets as a barometer for his policies and then adjusts accordingly. Equity investors clearly had a case of the yips: the Standard & Poor’s (S&P) 500 Index traded down more than 15% in response to the trade war escalation. The bond market trembled as well. The 10-year U.S. Treasury Note yield jumped roughly 30 basis points higher in a matter of days and reportedly caused Trump’s inner circle to fear sparking a financial crisis.

Wall Street does enjoy a good “kick the can down the road” party, whether it is yet another increase to the debt ceiling or an injunction delaying new regulations. This time was no different. In fact, Strategas Research Partners noted it took just 55 days for the S&P 500 to return to a new high—the fastest recovery following a 15% drawdown in history. The dizzying ascent, which resulted in the S&P 500’s best quarter since December 2023, has left some market participants puzzling over the dichotomy between what they feel and what stock prices show. Amidst the noise of an unresolved trade war, Middle East hostilities, floundering consumer confidence numbers and other disconcerting data, it is not particularly surprising that there is a degree of cognitive dissonance involved here. This mental discomfort is actually a fairly routine aspect of investing. There is always a laundry list of doubts casting a shadow over the markets, the so-called wall of worry. The dissonance is only exacerbated by inherent contradictions in the financial markets. For example, the bad news is good news phenomenon. In recent years, weak economic data (seemingly bad) has cheered investors conditioned for the sugar high of easier monetary policy or fiscal policy support. It creates confusion around exactly what we are rooting for as investors and an incongruous feeling as equities trade higher on disappointing news.

Not all pauses are embraced equally, however. In another high-profile pause, the Federal Reserve (the “Fed”) has been in wait-and-see mode. After cutting the target Fed Funds rate from 5.5% to 4.5% in late 2024, the Fed has held steady at four subsequent meetings, citing “somewhat elevated” inflation. This pause has greatly displeased President Trump, to say the least, who wants to see an aggressive rate cutting approach by the Fed, posthaste. Current Fed Chair Jerome Powell—who Trump appointed in 2018—wisely avoids comment on government policy, but the reality is the administration’s tariffs are clouding the inflation outlook, forestalling what otherwise might be easier monetary policy. This has the potential to create another shadow—in this case, a shadow Fed Chair. Powell’s term as Chair is slated to end in May 2026, but Trump is threatening to name a replacement soon, creating an extended lame duck situation. According to CNN, announcing a successor this far in advance “would be an unprecedented development in the central bank’s 111-year history.” This may end up being simply a further attempt by Trump to jawbone monetary policy, but it certainly has the potential to further muddy the waters at a time where uncertainty is already running high.

Not all pauses are embraced equally, however. In another high-profile pause, the Federal Reserve (the “Fed”) has been in wait-and-see mode. After cutting the target Fed Funds rate from 5.5% to 4.5% in late 2024, the Fed has held steady at four subsequent meetings, citing “somewhat elevated” inflation. This pause has greatly displeased President Trump, to say the least, who wants to see an aggressive rate cutting approach by the Fed, posthaste. Current Fed Chair Jerome Powell—who Trump appointed in 2018—wisely avoids comment on government policy, but the reality is the administration’s tariffs are clouding the inflation outlook, forestalling what otherwise might be easier monetary policy. This has the potential to create another shadow—in this case, a shadow Fed Chair. Powell’s term as Chair is slated to end in May 2026, but Trump is threatening to name a replacement soon, creating an extended lame duck situation. According to CNN, announcing a successor this far in advance “would be an unprecedented development in the central bank’s 111-year history.” This may end up being simply a further attempt by Trump to jawbone monetary policy, but it certainly has the potential to further muddy the waters at a time where uncertainty is already running high.

We Now Return to Our Regularly Scheduled Programming

The 90-day pause on “reciprocal” tariffs allowed the markets to refocus on corporate earnings and guidance. A notable positive in this interim was reaffirmation around the equity market’s dominant theme: artificial intelligence (AI). With doubts starting to creep in, the large-scale cloud service providers offered reassuring guidance in April regarding planned capital expenditures (capex) for 2025. Alphabet stuck with its $75 billion bogey, saying it continues to have more customer demand for Cloud services than it has capacity. Meta Platforms raised its capex guidance range to $64 to $72 billion, up from $60 to $65 billion previously. Microsoft was rumored to have cancelled projects during the quarter, but its capex spending ran at a roughly $67 billion annualized rate and the company said it expects to grow capex in fiscal 2026. The sheer magnitude of these numbers is indicative of how these companies perceive the AI opportunity. In the lull following the storm of tariff-related headlines, the announcements provided a needed dose of confidence to equity markets and reinvigorated the AI trade. By the end of the second quarter, leading AI semiconductor companies ranked among the best performers for the three-month period, including Broadcom (+65%) and NVIDIA (+46%).

The resumption of tech leadership within the S&P 500—Semiconductors and Software were the top performing industry groups last quarter—lent an air of business as usual to the markets. It also took the large-cap index back up to an elevated valuation, trading at more than 22x estimated earnings for the next 12 months. As has been the case in recent years, however, the average stock is significantly cheaper. The S&P 500 Equal Weight Index finished June with a projected 17.8x forward price/earnings multiple. Over 200 stocks in the S&P 500 declined during the second quarter, reflecting a tougher environment for companies lacking real estate on the high-priced AI (or crypto) avenues. Nonetheless, corporate earnings reports overall helped to rally the markets. First quarter operating earnings per share rose 5.3% year-over-year for the S&P 500, led by the Communication Services, Healthcare, and Technology sectors. Standard & Poor’s reports that 77% of S&P 500 companies posted higher-than-expected Q1 earnings, topping the average of roughly 73% over the trailing 13 years.

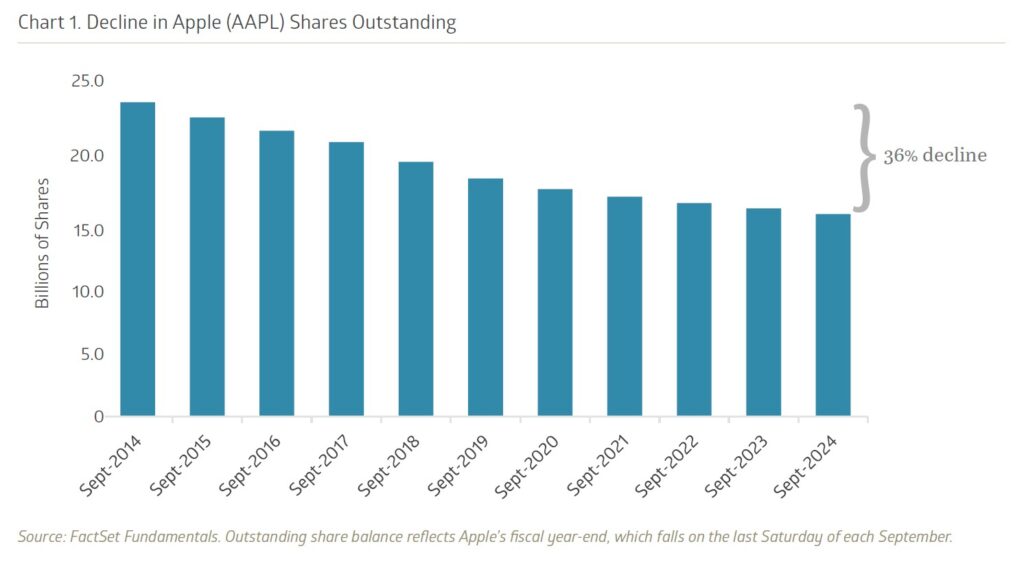

Profit growth continues to get a boost via significant share repurchases. In fact, the S&P 500 set a quarterly record for buybacks in Q1 at $293 billion, up nearly 24% year-over-year. Share buybacks—which boost earnings per share growth by reducing shares outstanding—have not been slowed by the 1% excise tax on net buybacks, part of the Inflation Reduction Act of 2022. Apple led the way with $26 billion of buybacks and amazingly holds 18 of the top 20 highest repurchase quarters. By using some of its prodigious cash flows for buybacks—the iPhone maker generated nearly $109 billion in free cash flow during fiscal 2024—Apple has been able reduce shares outstanding by nearly 36% over the past decade.

Favorable tax policies are likewise helping firms pad the bottom line. In 2024, the S&P 500 tax rate was a little above 19%, well below the 30% average rate since 1993. The Tax Cuts and Jobs Act of 2017 lowered the statutory corporate tax rate to 21% from 35% previously, boosting net margins and providing companies with added capital that they can use to repurchase shares, pay out dividends, or reinvest in the business. Meta Platforms, which earns significant revenues overseas, said it expects a 2025 tax rate in the 12% to 15% range—this after paying a 9% effective tax rate in the first quarter. Some of those tax savings likely went toward the $13.4 billion of share buybacks Meta executed over the first few months of the year.

Favorable tax policies are likewise helping firms pad the bottom line. In 2024, the S&P 500 tax rate was a little above 19%, well below the 30% average rate since 1993. The Tax Cuts and Jobs Act of 2017 lowered the statutory corporate tax rate to 21% from 35% previously, boosting net margins and providing companies with added capital that they can use to repurchase shares, pay out dividends, or reinvest in the business. Meta Platforms, which earns significant revenues overseas, said it expects a 2025 tax rate in the 12% to 15% range—this after paying a 9% effective tax rate in the first quarter. Some of those tax savings likely went toward the $13.4 billion of share buybacks Meta executed over the first few months of the year.

Foreign Exchange

For multinational firms with sprawling global supply chains, it was clearly a choppy first half of 2025. Some companies reacted to the policy uncertainty by throwing in the towel on providing earnings guidance, acknowledging the folly of trying to provide accurate forecasts with so many unknowns. One silver lining for these firms may have emerged from the turbulence. The U.S. dollar declined nearly 11% versus a basket of major currencies over the first six months of the year, its worst start to a year since 1973. Although a weaker dollar does make imports more expensive, it also means that revenues earned abroad in foreign currencies translate into more dollars. This is not likely to be a major tailwind, but at the margin it can be additive.

Nike, which gets more than 50% of sales from abroad, reported a roughly one percentage point negative currency impact to reported revenue growth last quarter. It hedges some of its foreign currency exposure, but for a company squarely in the path of the tariffs storm, seeing foreign exchange turn positive might ease some pain. Nike CFO Matt Friend noted on the company’s fiscal Q4 earnings call that they have “consistently been a top payer of US duties, with an average duty rate on footwear imported into the United States in the mid-teens range.” Friend added that Nike currently sources around 16% of imported footwear from China, but aims to reduce that to the high-single-digits by fiscal 2026, diversifying supply to other countries around the world.

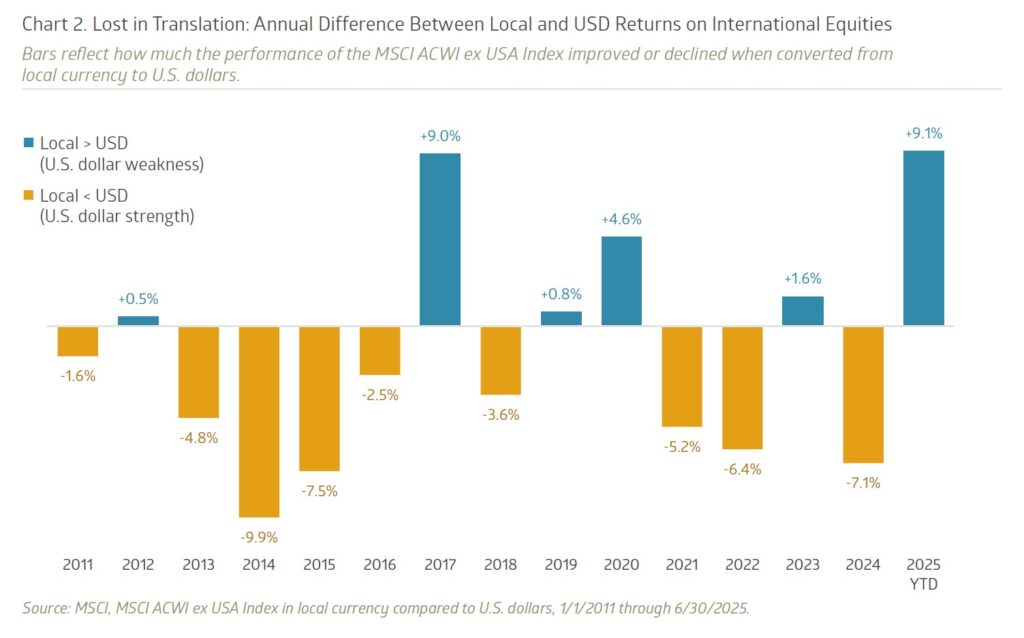

For U.S. investors, the weaker dollar has given foreign investments added allure. Through June, the MSCI ACWI ex USA Index returned a robust 8.8% in local currency terms but jumped to a 17.9% return when translated to dollars. After years of a strong dollar weighing on (unhedged) international equity returns for U.S. investors, the reversal has sharply amplified returns. Of course, the opposite is true for international investors putting assets into U.S. markets. Longer-term, we want to continue to attract capital to our shores.

The markets, as with life, never stop moving. Still, there are moments of pause, and therein lies the power. Famed economist John Kenneth Galbraith once said, “Faced with the choice between changing one’s mind and proving there is no need to do so, almost everybody gets busy on the proof.” There is power in choosing our response. Wait for it….

Recent Insights

What Matters Most Hasn’t Changed

In his first 9:05 piece as CIO, Dave Harrison Smith, CFA, reflects on Bailard’s enduring philosophy and what lies ahead.

July 14, 2025

GRATs: An Unexpected Bridge to Philanthropy

Our Director of Estate Strategy, Dave Jones, JD, LLM, CFP®, shares how a Grantor Retained Annuity Trust (GRAT) can offer peace of mind for family priorities, and open the door to charitable giving.

July 14, 2025

Spotlight: A Closer Look at the One Big Beautiful Bill

Spotlight: A Closer Look at the One Big Beautiful Bill. Understanding the newest wave of tax reform, and how it might affect you.

July 14, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.