Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) reflects on the start of America with Benjamin Franklin and the role of, and impact on, these $100 bill “Benjamins” today on trade, negotiations, and tariffs.

Founding father Benjamin Franklin wore many hats for our nascent republic, both literally and figuratively. Often depicted wearing a tricorn hat—de rigueur for the colonial era—Franklin famously donned a fur cap when he traveled to France in late 1776 as the key

His carefully cultivated homespun image, complete with the fur cap, won Franklin a great deal of popularity. Fur caps became fashionable in Paris, and his likeness was embossed on collectible candy dishes, stitched into clothing, and engraved into snuff boxes and walking sticks. In February 1778, his efforts culminated in the signing of treaties that provided for a military alliance, recognized the United States as an independent nation, and established terms of commerce. It was a remarkable coup for our fledgling country and proved instrumental in winning the Revolutionary War. To Stacy Schiff, author of “Benjamin Franklin and the Birth of America,” France’s affection for Franklin was a critical factor: “Every other American envoy who approached Versailles bungled along the way. Franklin was inventing the foreign service out of whole cloth.”1

For over a century now the $100 bill has featured Franklin’s portrait, in honor of his indispensable role in America’s push for freedom. Today, it could be said that U.S. foreign relations depend more than ever on Benjamins—meaning those crisp $100 bills that cross oceans in exchange for goods. After an extended period of globalization, the current U.S. administration appears determined to rapidly de-globalize. Longtime foreign allies are scrambling to adjust to this policy pivot and the new D.C. power brokers are clearly not afraid to ruffle diplomatic feathers. In this “America First” approach, relationships with foreign governments seem to be largely transactional in nature and ruled by protectionist instincts. It is indeed all about the Benjamins in this new world order.

As the economy struggles to adapt to this paradigm shift, even the agenda setters have warned of possible near-term pain. In a March 2025 interview with CBS News, Commerce Secretary Howard Lutnick said the administration’s economic policies are worth it even if they lead to a recession. Many economists disagree, including former Treasury Secretary Larry Summers. He referred to tariffs as “a self-inflicted supply shock” and cautioned that inflation should move higher in response. Michael Goldstein, managing partner at New York-based Empirical Research Partners, estimates that the direct tariff impacts—combined with the impact from the associated uncertainties—could reduce 2025 real GDP (Gross Domestic Product) growth to the 1.0% to 1.5% range, while adding 0.5% – 1.0% to inflation. Similarly, Goldman Sachs hiked its 2025 core PCE (Personal Consumption Expenditures) inflation forecast to 3.5% due to tariffs, and lowered its 2025 GDP growth forecast to 0.5%. In doing so, Goldman Sachs upped its twelve-month recession probability to 45%, citing the expectation for sluggish growth, a deterioration in household and business confidence, and statements from White House officials indicating a greater willingness to tolerate near-term economic weakness in pursuit of their policies.

The Tariff Gambit

If the daily barrage of tariff-related news has you confused, you’re not alone. In fact, corporate executives feel the same. According to analysis from MarketWatch, 64 companies in the Standard & Poor’s (S&P) 500 Index mentioned policy uncertainty on their quarterly earnings call with analysts, up from 33 in the prior quarter. This lack of clarity could weigh on economic activity in the near-term, simply by slowing decision-making. Gill Segal, a University of North Carolina economist, observed that “Policy uncertainty, in particular, typically leads to lower business investment and lower future GDP, as a result.”

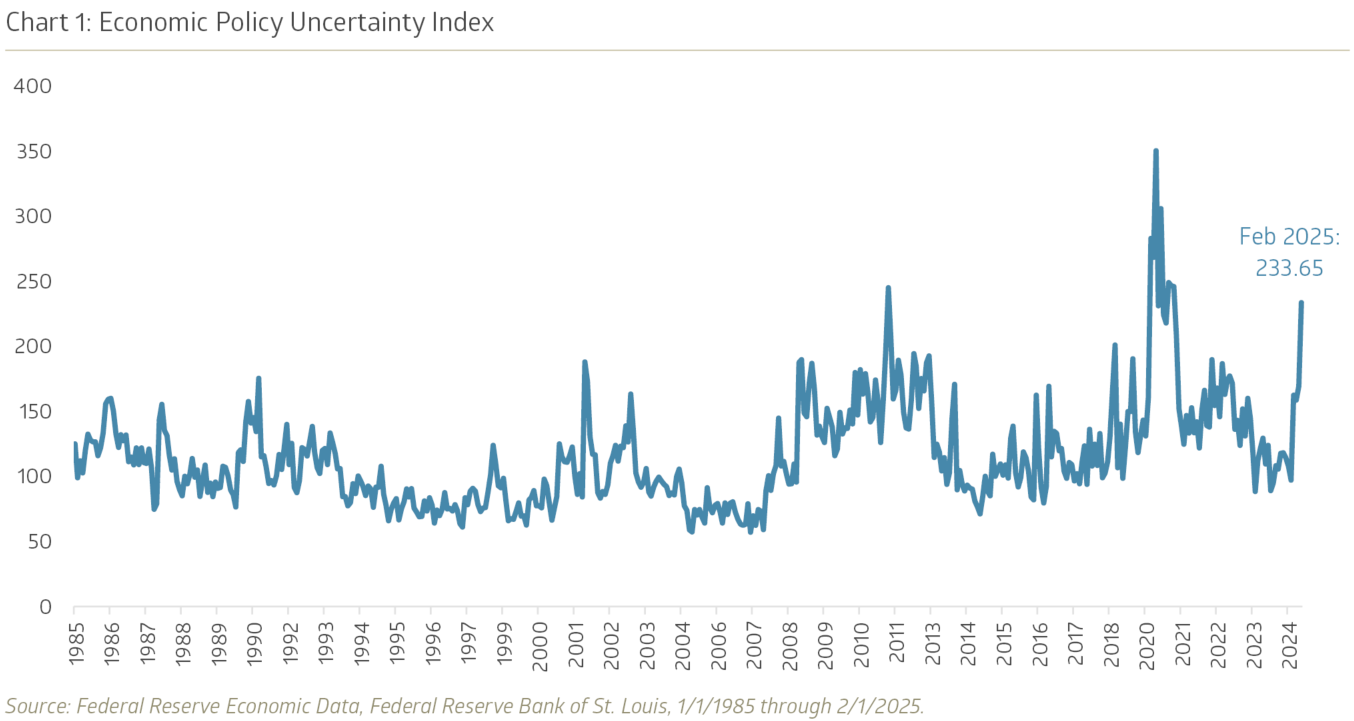

Empirical Research Partners has taken to titling their recent notes “The Fog of War.” A trade war is admittedly a different type of war, but it is sowing confusion. A trio of academics created an Economic Policy Uncertainty Index with data back to 1985. On their methodology, the level of uncertainty has only reached a higher level during the Great Financial Crisis (GFC) and the initial stages of the pandemic—both recessionary periods. Perhaps it’s not surprising that consumer sentiment readings have moved sharply lower year to date. The March 2025 reading for the University of Michigan’s Consumer Sentiment Index declined 28% year over year. In the release, Director Joanne Hsu said, “Consumers continue to worry about the potential for pain amid ongoing economic policy developments. Notably, two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009.” Speaking at the U.S. Monetary Policy Forum in March, Federal Reserve (Fed) Chairman Jerome Powell assuaged these worries somewhat, noting that “Sentiment readings have not been a good predictor of consumption growth in recent years.”

Reboot Button

Historically, political risk has been a factor that carries more weight in emerging market countries. Broadly defined as the risk that investment returns could be impacted by country instability or political changes, it has leapt up the list of concerns for investors in 2025. We don’t have to look too far back to see the political changes the market desires. In the wake of November’s election, optimism reigned around tax-friendly legislation, deregulation, inflation relief, and directional improvement in our nation’s fiscal fitness. Although the administration is working on each of those items, the checklist has clearly taken a backseat to an unwanted, deeply unpopular trade war. This is not the business-friendly approach that was promised. For a U.S. equity market that entered the year with high expectations built into valuations, this distraction (at best) has been enough to derail the market’s momentum.

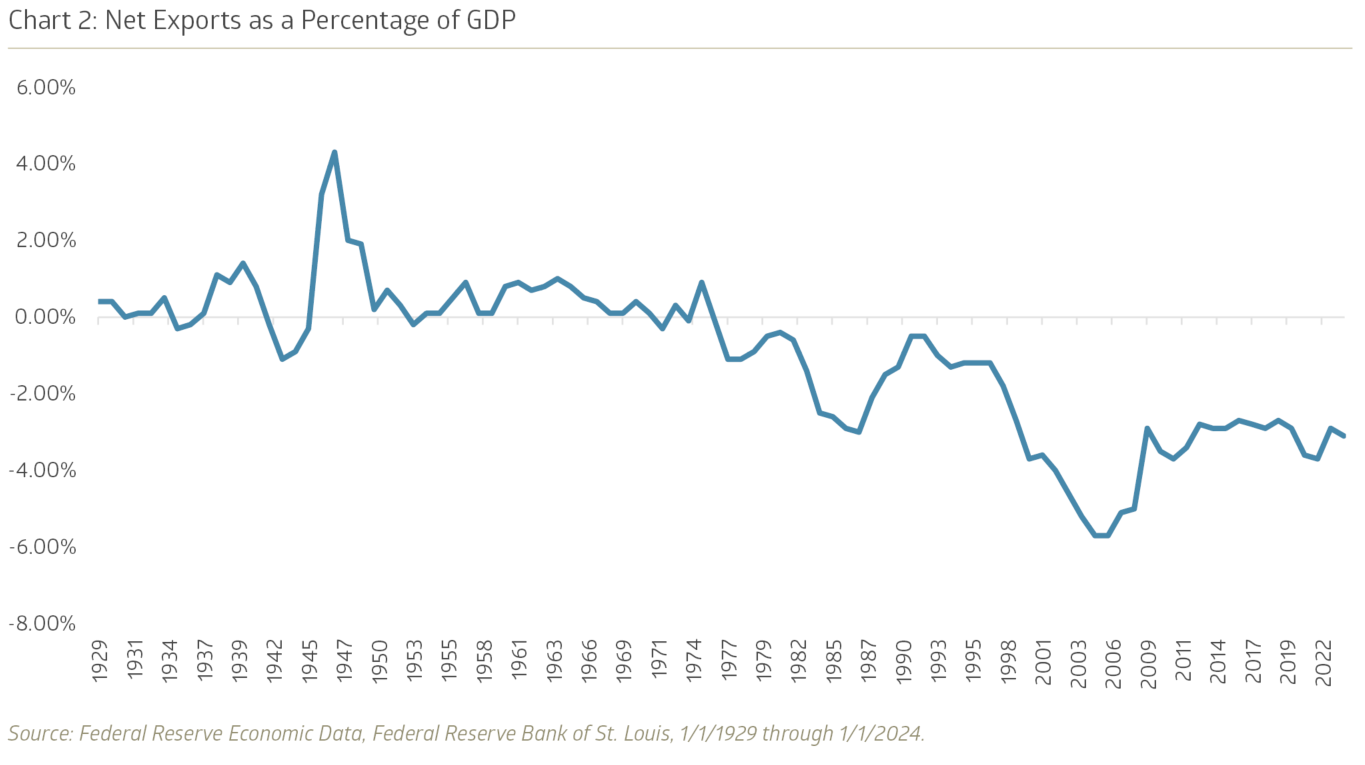

With the stroke of his pen—and President Trump has signed 109 executive orders alone thus far in his second term—we could see a realignment of the administration’s priorities. It is not too much to hope for, although the tariff troubles have already gone much further than expected. This myopic focus on our balance of trade is a bit puzzling, looking at historical data. Net exports as a percentage of GDP have drifted around the -3% territory since the Great Financial Crisis. It does subtract from U.S. GDP growth, but from a big picture standpoint the headwind is not particularly impactful. It seems like there is more risk in killing the goose that lays the golden eggs, so to speak.

Ultimately the equity markets should refocus on corporate profits, the long-term driver of stock prices. Earnings expectations for 2025 have edged lower, but only by around two percent for the S&P 500 year to date. For the multinational companies that heavily populate the large-cap universe, it will be more challenging to maintain profitability with rising input costs and reciprocal tariffs. The quarterly S&P 500 operating margin averaged close to 12% last year—but its average since 2006 has been 9.6%. To avoid an earnings shortfall versus expectations, corporations will need to carefully manage the trade off between passing prices along to customers and absorbing costs (sacrificing margins) to preserve sales. The foggy environment isn’t helping with that decision tree. Target Corporation, known for its bulls eye logo, announced in March that it will eschew offering quarterly guidance and move to only providing annual guidance numbers. Chief Financial Officer James Lee commented: “This change reflects our expectation of continued elevated volatility, which limits the effectiveness of quarterly forecasts.” Separately, Target said it would continue to move sourcing for its in-store brands, including All in Motion and Cat & Jack, away from China and toward Guatemala and Honduras.

In November 1789, about five months before his death, Benjamin Franklin wrote a letter to a French scientist. In that letter, Franklin offered what is now a famous quote: “Our new constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.” A wise man, that Franklin.

1 “Ben Franklin in Paris: How He Won France’s Support for the Revolutionary War,” www.history.com, 3/20/2024.

2 “Wall Street Journal editorial calls Trump tariffs ‘dumbest trade war in history,’ www.theguardian.com, 2/2/2025.

3 “Where We Stand: The Fog of War,” Empirical Research Partners, March 2025.

4 “US Daily: Countdown to Recession,” Goldman Sachs Investment Research, 4/6/2025.

5 “The word from U.S. companies to Wall Street in new Trump era is ‘uncertainty’,” www.morningstar.com, 3/20/2025.

6 “Surveys of Consumers,” www.sca.isr.umich.edu, March 2025.

7 “Guide to the Markets,” JPMorgan Asset Management, March 2025.

8 “S&P 500 Earnings and Estimate Report,” www.spindices.com, 3/31/2025.

9 Target Corporation Q4 2024 earnings call, 3/4/2025.

10 “Target braces for first-quarter profit pressure due to tariffs, low demand,” www.reuters.com, 3/4/2025.

11 “Benjamin Franklin’s last great quote and the Constitution,” www.constitutioncenter.org, 11/13/2023.

Recent Insights

Country Indices Flash Report – December 2025

International equities staged a major comeback in 2025, with MSCI EAFE outperforming MSCI USA by 13.9%—the widest gap since 1993—while broader MSCI ACWI ex-US outperformed by 15.1% on emerging market strength. Precious metals sparkled even more: gold climbed 65% and silver—up 27% in December alone—soared 148%. [Read more...]

December 31, 2025

Unpacking Incarcerated Labor

Read about the link between U.S. prison labor and corporate profit, and how investors can drive meaningful reform.

December 31, 2025

(Video) AI’s Next Wave: Setting up for Value Beyond Hardware

Where might the next AI investment opportunities lie beyond hardware? Bailard's Chief Investment Officer, Dave Harrison Smith, CFA offers his perspective as a seasoned technology investor and portfolio manager.

December 29, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.