Thomas J. Mudge, III, CFA is a Senior Vice President and Director of Domestic Equity Research at Bailard

March 31, 2019

The current bull market celebrated its tenth birthday this March. The reason people find that significant has a lot to do with the anatomy of the investors that have participated in the market’s rise.

Human energy and focus are both limited resources; mental and observational shortcuts save precious brainpower for other pursuits. One universal shortcut is our reliance on round numbers. It is easier to remember round numbers and they offer us satisfactory approximations of necessary information without overtaxing our brains.

Humans primarily count in base 10, and the reason why can be grasped by your fingertips. Our tendency to focus on and assign importance to anything that is a 10 or a multiple of 10 is why we’re inordinately focused on this otherwise arbitrary anniversary. So, can we at least learn something now that we have chosen to expend the energy to direct our gaze toward the stock market?

Defining a Bull Market

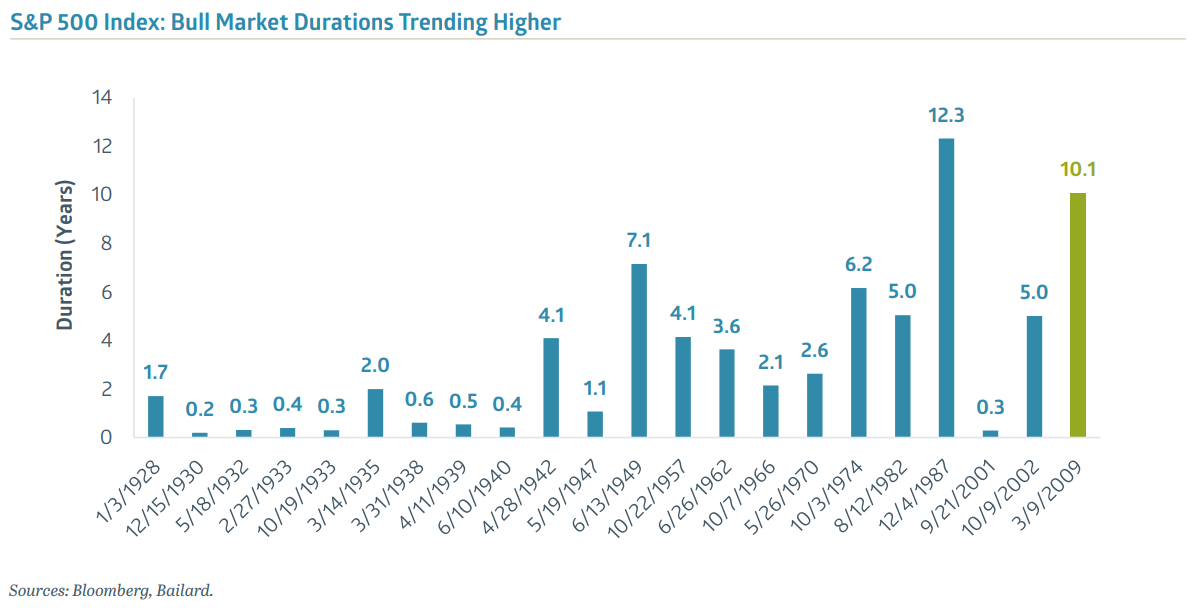

The commonly accepted definition of a bull market is a 20% or greater rise in the price of a group of stocks uninterrupted by a price decline of 20% or more. Ninety-one years of price data for the S&P 500 Index show 22 bull markets with an average duration of 3.2 years. The longest bull market lasted 12.3 years and the shortest was a brief 2.5 months. By this measure, the current bull market is the second longest ever and has lasted far longer than the 3.2-year average.

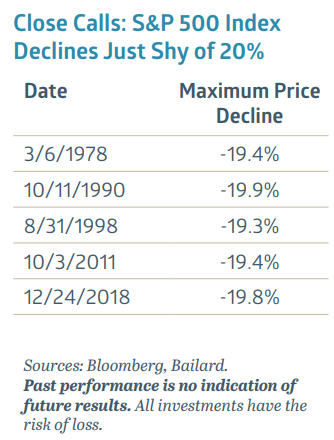

I’ll pause to point out that the 20% gain and decline definition of a bull market again uses round numbers.

In this case, that may hide as much as it reveals. The table at right reflects times when the market declines fell just shy of ending a bull market at that 20% decline cutoff.

Many investors view the S&P 500 Index as a proxy for the overall U.S. stock market but the basket of 500 public companies represents a large cap, growth-tilted slice of the entire market. This distinction is important because this portion of the market does not always move in sync with rest. While the S&P 500 Index is—by the +/-20% definition—still in a decade-long bull market, the Wilshire 5000 Total Market Index (a much more complete representation of the overall stock market) peaked in September of last year. This 5000-member index entered a bear market in late December 2018 and has rallied into a brand-new bull market as of late February 2019.

Regardless of how you define a bull market, stocks have risen substantially over the past ten years, with the S&P 500 Index returning over 17% annually over that time, far above its historical average of 10% per year (price change only). Is this a market long overdue for a major correction, or one just hitting its prime?

Perhaps dabbling in another human tendency of anthropomorphizing (or assigning human characteristics to non-human objects or animals) may reveal the bull market’s currently condition and potential fate? Just as baby boomers wistfully ask if “60 is the new 40” when it comes to life quality and expectancy, could “ten be the new seven” when it comes to bull markets?

Examining Wellness and Longevity

While chronological age is certainly a contributing factor to a person’s general health and eventual demise, the concept of biological age has gained acceptance as an important determinant of wellness and longevity. Diet, exercise, genetics, exposure to risk factors and medical treatment are just some of the influences that may differentiate between what the calendar indicates and the mirror reveals. People are generally living longer and healthier lives than at any time in history. The current bull market is long in the tooth from a chronological standpoint; could it be similarly blessed with a significantly-younger biological age?

A checkup of sorts may help to reveal just how biologically old this bull market really is. Just as people need nourishment, so does the stock market. The fuel that feeds stock prices is earnings growth, which has been positive and largely stable through most of this decade. Though productivity gains can help, the primary source of earnings growth is economic activity. A strong economy spurs robust earnings growth while a weak economy slows, or even shrinks, it.

Economic cycles are typically longer now than they have been historically and, if the current economic expansion lasts through June of 2019, this cycle will become the longest in U.S. post-war history. Due in some measure to either deft or fortuitous moves by central bankers to regulate economic activity, the boom-and bust pattern of the past has been altered in favor of longer expansions that should accommodate longer bull markets. Recently, earnings growth has slowed and brought predictions for lethargic results through the end of the year. A reacceleration in earnings may be needed to keep this bull market in good health.

Just as baby boomers wistfully ask if “60 is the new 40” when it comes to life quality and expectancy, could “ten be the new seven” when it comes to bull markets?

On the other hand, major risk factor exposures for people include smoking, excessive stress and accidents. All are bad in isolation and can trigger a cascade of other problems. Similarly, primary risk exposures for stocks include uncertainty, negative news and excessive enthusiasm. Uncertainty is ever-present but stoked by events like wars (trade or otherwise), politics, market volatility or any sort of rapid change. Negative news can be market specific, industry or economy wide. Beyond that, natural or man-made disasters, criminal behavior, accidents or simply poor or worsening corporate results can all cause investors to reassess their situations. Excessive enthusiasm usually manifests itself either through an unsustainably rapid rise in stock prices, historically high relative valuations, or both.

The bull market’s check-up reveals limited symptoms from these risks. Uncertainty has continued to be quite low, as measured by VIX, the Chicago Board Options Exchange Volatility Index that gauges the market’s anxiety level. Negative news has been sporadic and not pervasive. Enthusiasm has generally remained contained when measured by price trends or by valuation measures: the S&P 500 Index’s current price level below that of six months ago, its price-to-earnings ratio is very near the average level of the past 35 years and its earnings yield is well above the Ten-Year U.S. Treasury yield.

In Search of Treatment

Medical treatment for people can soothe, or sometimes entirely cure, ailments. For the stock market, excess monetary liquidity—driven by central bank quantitative easing (QE) and historically-low interest rates—works in a similar fashion. Spurred by the GFC, central banks flooded the market with liquidity in order to reduce panic and restore order. With the Federal Reserve (the Fed) aggressively buying bonds, cash has flowed into investors’ hands. Low interest rates made alternative investments like cash and bonds appear relatively unattractive. Eventually, stocks remained as the only liquid asset providing either yield, return or both. While the Fed kept buying, the cash kept coming. And, just as certain medications can reduce anxiety, so too can regular doses of liquidity help to keep the stock market calm and rising.

While the Fed continues to play doctor, its range of treatment options has been reduced to mostly palliative care. Interest rates that have been generally rising for several years are now well above their historical lows. The Fed is also eager to unwind some of those past bond purchases it made during quantitative easing, essentially to restore its arsenal if required to step in again in the future. Should the market need treatment, the Fed may not have a complete cure this time.

After a thorough examination, a reasonable diagnosis seems to be that—while no longer young—the bull market remains reasonably healthy for one of such an advanced calendar age. Circumstances can always change quickly but, as of this moment, ten really is the new seven for this bull market.

Recent Insights

Bailard CEO Ft. in Forbes, “Three Ways To Put Your Values And Your Team First In A Competitive Market”

Bailard's CEO Sonya Mughal, CFA offered three insightful ways leaders in the industry can fortify their culture and step up their communication practices to attract and retain high-performing teams.

May 2, 2024

Country Indices Flash Report – April 2024

The Japanese yen hit its lowest level versus the dollar since the 1980s late in the month, followed by a sharp bounce in the currency, which most suspect was driven by official intervention.

April 30, 2024

Quarterly International Equity Strategy Q1 2024

The global economic environment changed dramatically in the first quarter as bond yields, which had marched down in the 4th quarter on the belief that central bank pivots were fast approaching, reversed course. Prospects for mid-year reductions in short-term interest rates remain high for Europe and the UK, but persistent strength in the U.S. labor market has pushed prospects for a shift there closer to the end of 2024. Still, non-U.S. equities found purchase in solid earnings even as they faced headwinds from a strong dollar due to the evolving central bank dynamics and heightened geopolitical risks. As noted below, we see a range of foreign stocks that can flourish in the current environment and remain excited for the potential of stocks both in developed and emerging markets to compete well against U.S. peers.

April 25, 2024

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.