Jamil Harkness, Research and Performance Associate, Real Estate

June 30, 2021

In a nearly yield-less bond environment, the need for fixed income-oriented alternatives has dramatically increased for investors starving for long-term and predictable income streams. As a result, net-leased real estate has, of late, garnered significant attention from a wide array of institutional and individual investors. Net leases—also known as “NNN” or “triple-net” leases because the tenants are typically responsible for all expenses including real estate taxes and operating and other costs so that the rent received from the tenant is truly “net” to the landlord—offer the potential for investors to get higher yields from corporate tenants than those same corporations are paying on their debt obligations that trade publicly. This is one of the reasons that net-leased properties have experienced a surge of interest from investors and enjoyed significant yield compression over the past few years.

What is a Net Lease investment?

Many perceive commercial real estate (CRE) investments as high-maintenance and risky, particularly when compared to traditional fixed income vehicles. What exactly is a net-lease investment, and how does it differ from other real estate investments? In broad strokes, as referenced above, net-leases are structured to shift many of the costs and burdens of CRE ownership away from the landlord and onto the tenant. This shift nullifies many concerns surrounding rising expenses and maintenance costs, while offering long-term income generation. Additionally, most net leases have built-in rental rate escalations. These contractual rent “bumps” usually cause the rent to increase annually by a fixed amount (e.g., 2% to 3% per year) or varying increases indexed to inflation. These escalations enable the landlord/owner to count on an increasing income stream over the life of the lease.

Net-lease structures are common in three of the four main property types (retail, office, and industrial but excluding multifamily) as well as others including data centers, healthcare, and biotech facilities with varying lease terms and with a myriad of tenants across the credit spectrum. So, for discerning investors, there is plenty to choose from in terms of risk, duration, and yield.

Comparing NNN to government & corporate bonds

The most significant driver of the voracious appetite for cash-generating alternatives to traditional “risk-free” fixed income (e.g., government debt) is the dramatic compression of bond yields over all time periods since 2000. In just the past three years, bond yields for the 30-year, 10-year, and 5-year have all “come-in” since year-end 2018, at 92, 120, and 162 basis points, respectively (a basis point, or “bp,” is 0.01%). The most commonly-used benchmark for real estate investors is the 10-year U.S. Treasury. At year-end 2001, the 10-year Treasury Note yield stood at 5.07%, 358 bps higher than it was on June 30, 2021.

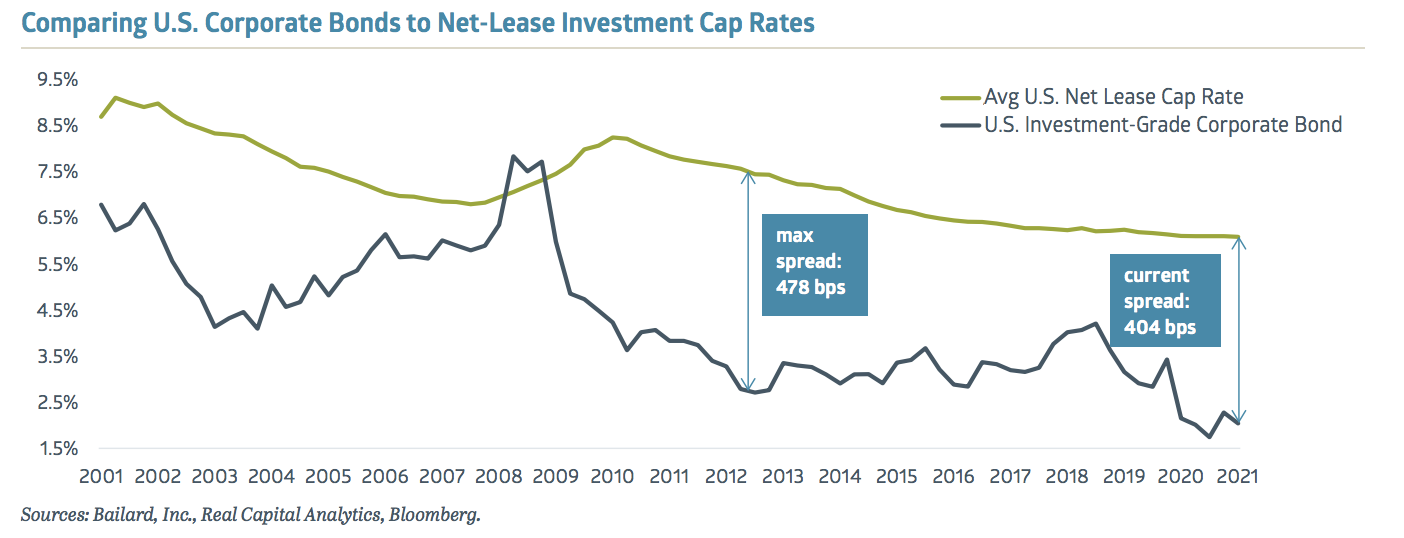

Following a similar but even more dramatic trajectory, investment-grade corporate bonds have experienced greater yield compression than government debt. High-quality corporate debt is trading at historically low yields; as of June 30, 2021, the average corporate yield was 2.04% (a compression of 433 bps and 216 bps, respectively since year-end 2001 and year-end 2018). Yield-hungry investors often favor corporate bonds over government bonds to increase income from their bond portfolio. Because of the compression in investment-grade corporate yields, the traditional “arbitrage” is less compelling than it has been historically.

But what about inflation?

It’s impossible to pick up a newspaper or catch TV and radio business news without hearing concerns about inflation. In spite of Federal Reserve Chairman Powell’s assurances to the contrary, many market observers, economists, and investors believe that massive government spending coupled with the Fed’s easy money policies are bound to trigger a run of inflation, which will erode consumer buying power and make traditional fixed-income vehicles less attractive for investors. Over the last 20 years, annual inflation has averaged 2.1%; however, in the 12 months ending May 31, 2021, inflation was 5.0%, its highest level in 13 years. Any sustained rise in inflation will eat away at bond yields at a time when bond coupons are already skimpy. This will also heighten investor’s interest in investments that have the potential to provide a “hedge” against inflation. Real estate, generally, has been viewed favorably from this perspective. Net-lease investments with contractual rent escalators as described earlier are not a perfect inflation hedge (especially if inflation starts to run away), but they are certainly much better than non-indexed traditional fixed income vehicles.

Considering risk and reward

With less incentive to invest in investment-grade corporate bonds, net leases (with an investment-grade tenant) can be a suitable alternative due to key structural similarities regarding low issuer/tenant default risk, yield generation, and perceived long-term cash flow into the future. In addition, capitalization rates (1) in the real estate market are the mirror image of bond yields in the public markets. Hence, both metrics can be understood to be a measure of the balance between risk and reward. With that said, the same structure and benefits afforded to investment-grade corporate bonds—like predictability (regarding yields) and an attractive passive payment structure focused on stable cash flow—applies to net lease investments too.

When comparing net lease cap rates against investment-grade corporate bond yields, the spread is substantially in favor of net lease investments. Like corporate bonds, net lease cap rates have compressed over the past 20 years but at a more modest rate. According to Real Capital Analytics (RCA), the average net lease cap rate was 6.1% as of Q2 2021, down 3 bps from the prior quarter. Over the last 20 years, the average yield spread between net lease cap rate and the investment-grade corporate bond yield was 294 bps. However, in the last year (ending June 30, 2021), the average spread increased to 408 bps, indicating even greater yield potential than investment-grade bonds (albeit with the slightly higher risk of leased real estate).

In the current low-yield environment, a net lease investment could be an ideal alternative investment for some investors due to higher yields vis-a-vis both corporate bonds and government bonds, as well as their inflation-hedging characteristics, achieved through rent escalation and pass-through of expense increases to the tenant. Those benefits do not come without the risk of illiquidity and re-leasing challenges in the case of a tenant default or if/when the tenant moves out at the end of its term. However, these risks are somewhat mitigated by the reality that the owner of the property (i.e., the landlord) still owns the real estate, which if they have done their due diligence properly, has significant intrinsic value. Simply put, when done carefully and prudently, net lease investments can be a relatively high-yielding and superior fixed income alternative.

1 A property’s capitalization rate, or cap rate, is a measure of its Net Operating Income relative to its market value

Recent Insights

Quarterly Small Value ESG Equity Strategy Q2 2024

The equity markets continued to narrow in Q2. Large growth was the only winning style, and even that was deceptive as large growth returns were concentrated in the usual handful of mega caps perceived to be artificial intelligence (AI) beneficiaries. While showing some signs of weakness, economic growth remained positive while inflation continued to roughly moderate through the period. Interest rates rose in April, fell in May and were largely flat in June, ending the quarter very close to where they started.

July 19, 2024

Quarterly Technology Science Equity Strategy Q2 2024

The Bailard Technology Strategy posted a 2Q24 total return of 9.75% net of fees, ahead of both the cap-heavy benchmark index (S&P North American Technology Index) as well as the competitor-comprised benchmarks. The Morningstar U.S. Open End Technology Category returned 3.24% and the Lipper Science and Technology Fund Index returned 5.10%, while the S&P North American Technology Index generated 9.36% and the Nasdaq-100 Index returned 8.05%. Over longer time periods of 3, 5, and 10 years, the Strategy’s net returns continued to lead the competitor peer benchmarks.

July 18, 2024

The Bailard Foundation Distributes $1M in its First Five Years

Bailard, Inc. proudly announces its Bailard Foundation reached $1 million in grants and donations distributed in just its first five years. As of June 30, 2024, the Bailard Foundation has distributed $1,008,037 since its inception in June 2019, over 90% of which has directly benefited the local Bay Area community.

July 17, 2024

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.