Understanding the terminology and technology behind cryptocurrency

Eric Greco, Portfolio Associate

December 31, 2020

The surge in cryptocurrency prices witnessed in the second half of 2020 is not just a flashback to 2017 Bitcoin mania. While a number of cryptocurrencies have seen prices rise past their all-time highs achieved in late-2017, what truly distinguishes this run-up from 2017 is the level of institutional investor participation. Major financial institutions such as JPMorgan, Goldman Sachs, Grayscale, and Guggenheim have either announced large-scale purchases of Bitcoin or come out with more amenable commentary towards cryptocurrencies.

DLT: The Machinery Behind it All While readers might be familiar with the term blockchain, and its association with Bitcoin and other major cryptocurrencies, it represents just one type of distributed ledger technology. Let’s take a moment to dive into the lesser-known, but fundamentally important, distributed ledger technology behind cryptocurrency. Also known as “DLT,” distributed ledger technology is a decentralized database spread across various network participants (computers referred to as “nodes”) who authenticate and validate transactions. This decentralization eliminates the role of a central authority that manages and maintains the value of that currency.

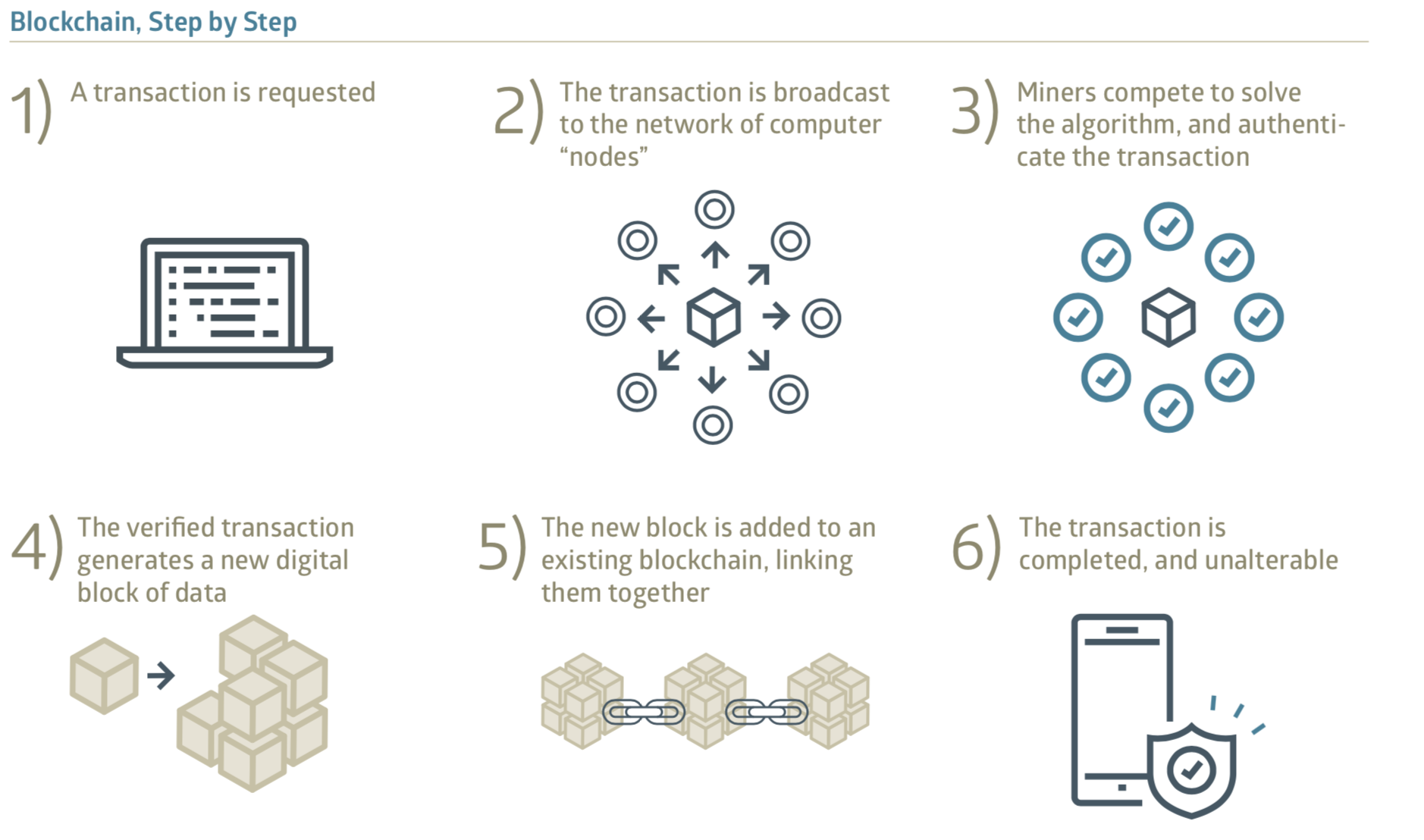

Blockchain Is a Type of DLT Where blockchain builds on the concept of distributed ledger technology is its use of additional cryptography. It utilizes a proof-of-work consensus algorithm to verify transactions. Select network participants, called miners, compete with one another to solve complex mathematical equations in order to add new transaction data, via a “digital block,” to the public ledger. In order to solve the equation, the miner must enter the correct hash, a mathematical function that references the transaction data contained within the new block. It takes exceptional computational power and whoever solves the equation first adds the new block to the end of the existing blockchain. Miners are incentivized to solve the equation by a Bitcoin reward received for adding a new block to the blockchain.

In addition to transaction data, each block contains the hash of the previous block, assuring the integrity of the transactions. Any modifications to the transactions in a block will cause the hash in the next block to be invalidated, and it will also affect the subsequent blocks in the blockchain (1), alerting network participants of the malicious behavior. At its core blockchain advances solutions, offering enhanced security and speed, and more efficient infrastructure, thereby reducing costs.

Cryptocurrency Is Stored in a Blockchain The most well-known application of blockchain is cryptocurrency. By creating and storing financial transactions with the encryption techniques described above, network participants play an active role in the generation of units of currency and verification of the transfer of funds. Further, by operating through a decentralized protocol, the currency supply of these cryptocurrencies is not determined by a central bank.

By utilizing DLT, cryptocurrencies function in a way that is, frankly, foreign to our fiat-based systems (that is, currencies based on faith in the issuing government). The four categorical differences from the traditional system include:

- Decentralization – an ability to operate without a central coordinating body (i.e., a government or business);

- Transparency – the entire transaction ledger gets broadcasted to all network participants;

- Security – each transaction is time stamped using a unique cryptographic digital signature (2); and

- Speed – operational 24/7 with network participants competing to process transactions as quickly as possible.

An Immature Market DLT is key to the appeal of cryptocurrencies such as Bitcoin and Ether, the native currency of Ethereum.

Cryptocurrencies remain a very nascent asset class. And, not surprisingly, given their exploding popularity and value, governments aren’t ignoring the space. Even as major institutional investors exhibit increased openness to crypto assets such as Bitcoin—and as we gain more clarity around how governments plan to potentially regulate them—any imposed changes have the potential to shock the system and lead to continued volatility in the short term.

Importantly, blockchain is not singularly useful for Bitcoin and other cryptocurrencies; its applications go well beyond that. The potential use cases are numerous and extend from banking and finance to voting, healthcare, and automotive uses just to name a few. In the words of blockchain’s creator, Satoshi Nakamoto, it is “… an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”(3) At this point, the applications for secure, efficient, and cost-effective exchanges are only limited by our imagination.

Sources: 1 https://blog.ndcconferences.com/understanding-blockchain/ 2 https://www.businessinsider.com/distributed-ledger-technology-blockchain

3 https://bitcoin.org/bitcoin.pdf

Recent Insights

Built on Trust – Guided by Values: Q&A with Mary Bersot, CFA and Bailard CEO, Sonya Mughal, CFA

After founding and leading Bersot Capital Management for nearly two decades, Mary Bersot, CFA, joined Bailard this spring with her long-standing clients and colleague Nicholas Risser. In this Q&A with Bailard CEO Sonya Mughal, CFA, Mary reflects on the decision, the values she’s carried throughout her career, and what this next chapter means for her and those she serves.

June 9, 2025

Country Indices Flash Report – May 2025

The UK and EU reached a new agreement to ease trade restrictions and boost cooperation on security and energy, marking a significant step towards improved relations since Brexit. [See more...]

May 30, 2025

Animal Testing Issue Brief

Artificial intelligence may soon end animal testing practices if the recent announcement by the Food and Drug Administration (FDA) reaches fruition.

May 29, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.