Jon Manchester, CFA, CFP®, Senior Vice President and Portfolio Manager – Sustainable, Responsible and Impact Investing

December 31, 2020

Economics, the so-called “dismal science,” may have met its match in 2020. In a year otherwise marked by gloom, a thunderbolt of positivity arrived in November via the highly anticipated Phase III vaccine trials data for COVID-19. Health science—both, broadly-speaking and more specifically Pfizer and Moderna—delivered much-needed hope to a besieged global community and, in doing so, justified decades of faith in synthetic messenger RNA technology. This breakthrough science has the potential to lift the dark clouds that hung over 2020, and appears to be a clear triumph of human ingenuity.

Thanks largely to the innovative gene-based technology, scientists rolled out these vaccines in mere months when previously the fastest we’d developed a new vac- cine was four years. In fact, after BioNTech, Pfizer’s Germany-based partner, punched the genetic code for the spike protein into its computers in January 2020, their CEO reportedly designed 10 vaccine candidates himself in a single day.(1) As a result, in the not-so-distant future, the armchair epidemiologists among us could (thankfully) be out of a fake job. Perhaps we will even cut back on doomscrolling, a popular “Word of the Year” candidate referring to our propensity to binge on bad news. The overwhelming deluge of data concerning the pandemic prompted the World Health Organization to “flatten the infodemic curve” by offering steps to navigate the wave of COVID-19 information. It has been a lot to process.

Speaking of misinformation, the U.S. presidential election came and sort-of went, leaving a trail of fruitless legal challenges from the incumbent and an unusual focus on the actual Electoral College vote and certification. If nothing else, 2020 affirmed that political theater is alive and well, sadly, while the actual theatrical arts remain on life support. At least initially, equity markets appear sanguine following the early January runoff elections in Georgia that effectively handed full control of Congress to the Democrats, perhaps due to the belief that additional fiscal stimulus will follow. In reality, investors may simply be relieved that the elections are over, and another piece removed from the proverbial “wall of worry” that markets have climbed.

Amidst the rays of hope, we must also acknowledge the enormous toll on humanity that this novel coronavirus continues to impose. Records number of people in the U.S. are currently hospitalized with COVID-19, with the numbers continuing to climb. Globally, the World Bank warns that the pandemic has pushed an additional 88 million people into extreme poverty, defined as living on less than $1.90 per day. (2) It also anticipates lasting impacts on this generation of students, food in- security, and gender gaps, among other concerns.

Easy Street The economic devastation and upheaval of our social fabric only makes the domestic stock market’s stunning rally all the more disconcerting, of course. With the monetary and fiscal spigots turned up, dollars have clearly found their way into risky assets. In the closing days of the year, Bloomberg reported that U.S. companies had raised a record $435 billion via equity sales in 2020, far above the prior high-water mark of $279 billion set in 2014. (3) Some of the equity issuance came from a position of weakness (airlines, for example) but around $100 billion went to traditional Initial Public Offerings (IPOs) including the December debut for DoorDash. The largest U.S. food delivery company soared 86% on its first day of trading and initially carried a market valuation greater than Chipotle and Domino’s Pizza combined. (4) This transpired despite DoorDash having lost $149 million over the first nine months of the year in a highly favorable stay-at-home environment where orders and revenue surged.

Signs of froth are seemingly everywhere: Bitcoin, junk bonds, and blank-check companies. Shares of Tesla rocketed more than 700% higher in 2020, and the New York Stock Exchange’s FANG+ Index of 10 tech giants gained roughly 103% after jumping 40% in 2019. So much for the ongoing threat of Big Tech regulation. Indicators of euphoria are likewise flowing, including a record $722 billion of margin debt in the U.S., mean- ing investors borrowing against their portfolios. (5) Call options—which provide the right to buy shares at a set price—hit record-high trading volumes in late 2020, another potentially worrisome data point. On the scorecard, market-based gauges suggest some caution heading into the new year.

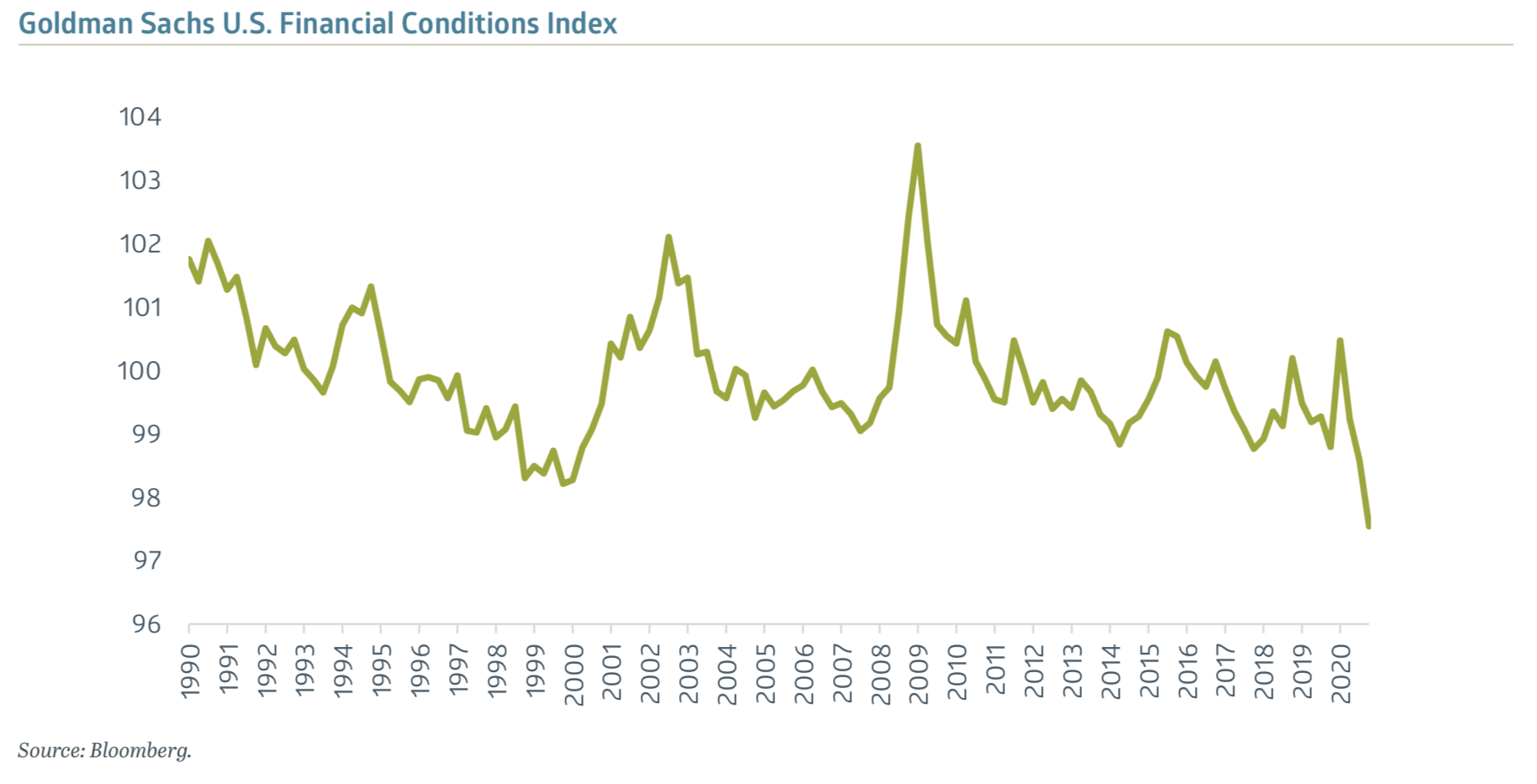

The effervescence across various markets can be linked to the aforementioned easy money policies. Goldman Sachs maintains a U.S. Financial Conditions Index dating back to 1990, which derives the bulk of its composite score from the 10-Year U.S. Treasury Yield and a corporate bond spread. Reflected in the chart below, that Index reached a new all-time low recently—below its 1998/1999 levels—suggesting that financial conditions are more supportive than at any time in past 30 years. This may help to foster economic growth in 2021, while also running the risk of creating financial market bubbles. Goldman economists are forecasting U.S. Gross Domestic Product (GDP) growth of 5.9%, versus the 3.9% consensus estimate. Their Chief Economist, Jan Hatzius, expects a 2021 “vaccine boost” and a “significant amount of accumulated ex- cess savings” to provide tailwinds. (6)

Relief Spending With 10.7 million officially unemployed in the U.S. as of December, and the employment-to-population ratio of 57.4%, nearly four points lower than in February, it doesn’t quite follow that there would be “significant ex- cess savings” to tap into. However, the Personal Saving Rate calculated by the Bureau of Economic Analysis spiked to 33% in April. While it has normalized some- what since, the saving rate ended November at roughly 13%, still elevated compared to the 7% to 8% rate seen in recent years. Unfortunately, as you might guess, the savings have accrued predominantly to higher-income households. The pandemic has weighed most heavily, at least financially speaking, on those with the least capacity to absorb the blow. From an inequality and societal perspective, this remains problematic.

The cold calculus of economic growth, however, points to a much healthier U.S. economy in 2021. This is helped by the estimated 3.5% GDP decline in 2020, naturally, as well as the $900 billion COVID-19 relief bill that will boost disposable income in the first quarter. This fiscal aid is sorely needed with the pandemic still raging and disposable income down in three of the last four months. Personal Consumption Expenditures (PCE) fell in November for the first time since April, strengthening the case for more stimulus.

Other economic markers in the U.S. are largely point- ing north. The S&P CoreLogic Case-Shiller 20-City Home Price Index advanced 8% year-over-year in October, its biggest gain since 2014. West Texas Crude Oil drifted higher during the fourth quarter but, priced at approximately $48 per barrel, it doesn’t pose inflationary concerns at this point. The Institute for Supply Management (ISM) indices for Manufacturing and Services remain in growth territory. With low interest rates and tame inflation, plus substantial fiscal and monetary support, the economy appears primed to rebound. This tidy story diminishes, though, if the vaccines’ rollout falters in any meaningful way.

Not-So-Graceful Brexit It only took four-and-a-half years and three Prime Ministers! Brexit is finally a reality, albeit a somewhat incomplete one given that Britain’s services sector— which accounts for roughly 80% of the economy—was largely omitted from the 1,246-page deal. (7) Nonetheless, once important details such as which species of fish can be caught were ironed out, Britain and the European Union (EU) have a trade agreement.

Rather unkindly, a Bloomberg Opinion piece referred to it as the “most regressive trade settlement seen be- tween modern democratic nations.”(8) On the plus side, the agreement does allow for goods to trade without tariffs or quotas, assuming the United Kingdom (UK) maintains current standards on the environment, labor, and other areas. Moving those goods, however, will involve a considerable amount of red tape. Citizens on both sides won’t have freedom of movement either, and the fate of migrants appears muddled at this point.

Equity investors have yet to fully embrace the UK sovereignty story. The FTSE 100 Index declined 14% (price-change only) in 2020, making it one of the worst-performing major markets in the world. Skepticism abounds regarding Britain’s ability to pull off this conscious uncoupling, although to be fair the FTSE 100 Index’s relatively low weight in technology companies and higher allocation to “old economy” industries played a significant role. For the British pound, it was a split decision in 2020, approximately 3% appreciation versus the U.S. dollar but a 6% decline versus the euro.

History will determine whether Brexit should be viewed as “Cameron’s Folly” (former Prime Minister David Cameron) or the dawn of a bright new future. In all likelihood, it will fall somewhere in between, with the UK forced to adapt to its imperfect new reality, just as all of us did in an absolute Zoom bomb of a year.

Sources:

1 “How Pfizer Delivered a Covid Vaccine in Record Time: Crazy Deadlines, a Pushy CEO,” wsj.com, 12/11/20

2 “2020 Year in Review: The impact of COVID-19 in 12 charts,” blogs.worldbank.org, 12/14/20 3 “IPO Euphoria Drives Record $435 Billion in U.S. Stock Sales,” Bloomberg.com, 12/21/20 4 “DoorDash Soars in First Day of Trading,” nytimes.com, 12/9/20 5 “Investors Double Down on Stocks, Pushing Margin Debt to Record,” wsj.com, 12/27/20 6 “Goldman Sachs is even more bullish on the power of a COVID-19 vaccine,” yahoo.com, 12/7/20

7 “Brexit Deal Done, Britain Now Scrambles to See How It Will Work,” nytimes.com, 12/25/20 8 “Now We Know How Boris Johnson’s Movie Ends,” Bloomberg.com, 12/24/20

Recent Insights

Bailard Appoints Dave Harrison Smith, CFA, as Chief Investment Officer

Bailard is pleased to announce that, as of today, Dave Harrison Smith, CFA, has been promoted to Chief Investment Officer. He succeeds Eric Leve, CFA, who held the role for more than a decade and will continue with the firm as a portfolio manager, fully focused on international markets.

July 1, 2025

Country Indices Flash Report – June 2025

Tariff negotiations intensified as the July 9th reciprocal tariff deadline nears, though the Trump administration signaled flexibility on the cutoff for countries negotiating in “good faith.” The U.S. and China secured a high-level framework that included a key rare earths deal and a tariff truce extension to August 11th. Meanwhile, the UK finalized a 10% tariff rate after a threatened 27.5%; talks are swiftly progressing with the EU.

June 30, 2025

Mike Faust Awarded 2025 Advisors to Watch by AdvisorHub

Michael Faust, CFA, ranked in the top five of AdvisorHub’s Advisors to Watch for the second year—recognizing his standout leadership at Bailard.

June 24, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.