Bailard’s Director of Fixed Income, Linda M. Beck, CFA, breaks down the impacts of the COVID-19 pandemic on the financial condition of state and local governments, with a special look at the State of California.

The COVID-19 pandemic took an exceptional toll on the national economy, as well as the economies of state and local government that rely heavily on tax revenue for funding. Even before the pandemic, receipts had become volatile largely due to economic and policy changes, as well as evolving consumer behavior. The pandemic and ensuing economic shutdowns caused tax revenues in the second quarter of 2020 to drop precipitously compared to the same period in 2019. Job losses by the end of April 2020 had driven the U.S. unemployment rate higher than any other time since the Great Depression. Some of the revenue losses were due to government-imposed restrictions, and others due to collections being deferred to later dates.

Although tax revenues dropped significantly, overall state revenues were more stable due to increased federal transfers to states and businesses. Intergovernmental federal transfers represent a large source of funding for states, which added some stability to most state’s revenue base and offset the declines. In hindsight, revenues were stronger coming out of the depths of the pandemic than initially feared. As COVID-related supplemental federal transfers wane, it is important for many municipalities to have their tax revenues rebound from the weak levels of early 2020.

A recovering, but inconsistent, economy

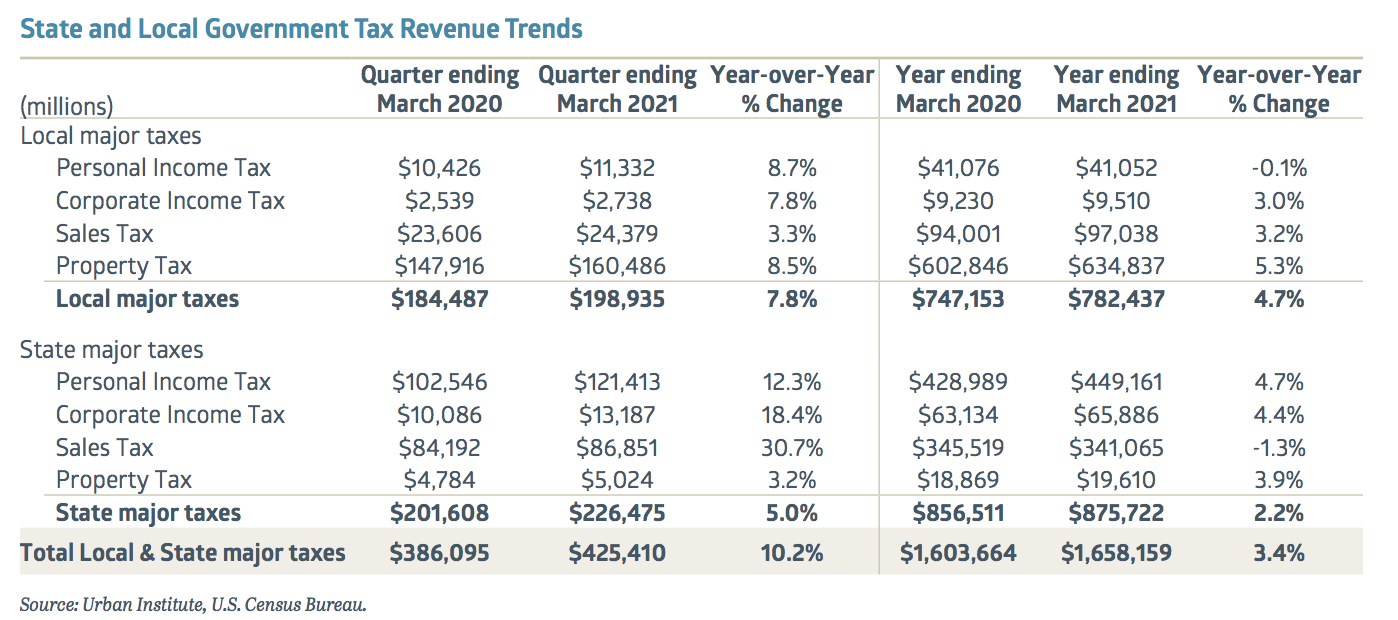

State and local governments’ main revenue sources are taxes on personal income, corporate income, sales, and property. After declining steeply in early 2020, these taxes had recovered by 3.4% based on a full year. This recovery had been progressively strengthening over the prior twelve months and was up 10.2% based solely on the first quarter. In part, the rebound was enabled by federal aid early in the pandemic, which helped stem the collapse in business activity. The ability of labor forces in some areas of the economy to work remotely further supported growth and, therefore, tax receipts.

Overall, the economy is recovering strongly and, though there is a lag, tax receipts reflect as such. The strength of the recovery has varied significantly, due to the diverse state and local policy decisions related to the pandemic, shutdowns, and differing responses of each area’s population to the pandemic. States like Idaho and Utah have recovered all their jobs, whereas Wyoming, Alaska, Mississippi, and Louisiana are experiencing the slowest rates of job growth in the nation, as a percent of pre-pandemic employment.

Personal income taxes top the list for states

Breaking down the tax receipts, the table on the next page illustrates that total personal income taxes not only had a 4.7% increase for the year ending March 31, 2021, but also represented the largest tax source for most states. Forty-two states and many localities impose an income tax; for the eight states that do not, they make up for these revenues through other sources, such as excise taxes. Economic growth was strong enough to support a staggering 30.7% increase in state corporate income taxes during Q1 2021.

While many industries have fully recovered from the shutdowns, the leisure and hospitality sectors are examples of industries that have not. Sales tax receipts plunged dramatically in early 2020 as new shutdowns led individuals, businesses, and governments to dramatically curtail business activity. They posted only modest gains, growing 3.2% during the first quarter of 2021 while declining slightly for the trailing year (down 1.3%). While not all states impose a sales tax, it should be noted that the majority do (45 in total). These numbers were boosted by the fact that sales tax is now also charged on all online purchases.

Local governments fueled by property taxes

Property taxes consistently provide the main source of revenue for local governments, and this has served as a buffer through the pandemic. Overall revenue from property taxes grew by 8.5% by the end of Q2, 2021, supported by a 7.2% increase in average home prices. This has been the strongest housing market in terms of home prices since 2006. All 50 states reported year-over-year growth in home prices in the first quarter of 2021, with four states reporting double-digit growth.

In absence of measures put in place during the early pandemic—such as eviction moratorium and rent forbearance—we could experience a rise in business and home foreclosures. As learned from the 2004-2006 housing crisis, even if this was to occur, most property taxes would continue to be paid for by the banks and investors repossessing them, mitigating downward stress to municipalities. These receipts show evidence of a healthy rebound in taxes to fund municipalities.

A slow but strong recovery in California

The pandemic caused violent swings in states’ economic activity, which consequently affected tax revenues. Specific to the country’s largest state in terms of both population and GDP, we wanted to highlight the pandemic’s impact on California, home to 40 million residents and generates $3.2 trillion of the nation’s GDP, or 14.6%. Historically, California has enjoyed a stronger-than-average employment rate. However, due to harsher COVID restrictions, California has experienced a slower relative job recovery.

Despite this sluggish labor market recovery, the state’s finances have remained solid. It has a large share of high-wage jobs, which have been more insulated from layoffs than lower-wage jobs. TaxFoundation.org ranks California as fifth in the nation for its combined state and local tax burden, with one of the most progressive state income tax structures. California residents with over $1 million in income are taxed at a top marginal rate of 13.3%. Unlike the federal government, California makes no distinction between short-term and long-term capital gains. All capital gains are taxed as income, using the same rates and brackets as the regular state income tax. This is a boon to the state during bull markets such as what we are in now. California’s state tax system is more reliant on income taxes than most other states. While this has resulted in significant revenue volatility, it also enabled revenues to surge an expected 25%, or $35 billion, this upcoming fiscal year.

In aggregate, state and local government tax revenues from the four major sources were higher than in the prior year, even given the large variation in performance across municipalities. Preliminary data since the most recent reporting period (Q1, 2021) shows continued strong growth in overall state and local tax collections. While the worst fears did not come to fruition, the impact of the COVID-19 pandemic on revenues will continue, and it will also continue to vary widely across municipalities depending on the economy, government policy and, crucially, public health.

Recent Insights

Bailard Appoints Dave Harrison Smith, CFA, as Chief Investment Officer

Bailard is pleased to announce that, as of today, Dave Harrison Smith, CFA, has been promoted to Chief Investment Officer. He succeeds Eric Leve, CFA, who held the role for more than a decade and will continue with the firm as a portfolio manager, fully focused on international markets.

July 1, 2025

Country Indices Flash Report – June 2025

Tariff negotiations intensified as the July 9th reciprocal tariff deadline nears, though the Trump administration signaled flexibility on the cutoff for countries negotiating in “good faith.” The U.S. and China secured a high-level framework that included a key rare earths deal and a tariff truce extension to August 11th. Meanwhile, the UK finalized a 10% tariff rate after a threatened 27.5%; talks are swiftly progressing with the EU.

June 30, 2025

Mike Faust Awarded 2025 Advisors to Watch by AdvisorHub

Michael Faust, CFA, ranked in the top five of AdvisorHub’s Advisors to Watch for the second year—recognizing his standout leadership at Bailard.

June 24, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.