Lena McQuillen, CFP®, Vice President and Director of Financial Planning, outlines the distinctions between Traditional and Roth retirement strategies, when each is most effective, the implications of new laws, and ways to share these insights with your family.

For those who have already built their wealth, the focus shifts to preserving it, optimizing its use in retirement, and empowering future generations to achieve financial success in a tax-efficient manner. Many readers will have already made key decisions about their retirement accounts—such as 401(k)s, 403(b)s, or 457(b)s—during their working years. Now, the opportunity lies in maximizing those decisions to enhance your family’s financial well-being. Just as you’ve built and managed your wealth, you can pass on the knowledge and strategies to help your family achieve similar success. The choice between Traditional and Roth accounts remains pivotal, offering different advantages for optimizing outcomes both now and in the future. Understanding these options can help refine your strategy and empower your heirs, equipping them with the tools to build on your financial legacy.

Understanding the Basics

A Traditional 401(k) allows contributions on a pre-tax basis, reducing taxable income during your working years. Over time, these funds grow tax-deferred, but taxes are owed on withdrawals. Required minimum distributions (RMDs) begin at age 73 (or age 75 if born in 1960 or later), impacting your taxable income in retirement.

Roth 401(k) contributions, made with after-tax dollars, offer a different advantage: earnings grow tax-free, and qualified withdrawals are not taxed if the account has been open for at least five years and withdrawals are made after age 59½. Additionally, Roth accounts bypass RMDs, allowing assets to grow tax-free indefinitely—a benefit particularly valuable for estate planning. For families managing wealth across generations, Roth accounts can provide a powerful vehicle for tax-free growth over your lifetime.

How Much Can You Contribute?

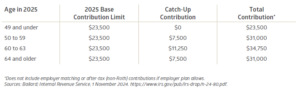

The SECURE 2.0 Act has introduced new opportunities for optimizing retirement accounts. In 2025, enhanced catch-up contributions allow individuals aged 60 through 63 to contribute up to $11,250 beyond the $23,500 base limit. If your children or grandchildren are early in their careers, encouraging them to maximize contributions to their own accounts can set the stage for long-term financial security.

Additionally, employers now have the option to match contributions to Roth accounts, providing additional flexibility for wealth transfer and reinforcing the value of maximizing contributions to these accounts early.

How Much Should You Contribute?

- While contributing the maximum may no longer apply to you personally, consider how these strategies can be leveraged for your family: For Children and Grandchildren: Encourage them to maximize Roth contributions early in their careers, reaping the benefits of tax-free growth over decades. Highlight the importance of contributing enough to qualify for employer matching funds—essentially free money that accelerates their savings—to make the most of their retirement plans. Also encourage them to evaluate their living expenses relative to their salary for a sustainable savings rate that balances immediate needs with long-term goals.

- Managing Your RMDs: Strategically converting portions of Traditional accounts to Roth during years with lower taxable income can reduce the impact of future RMDs. For your heirs, guiding them in understanding how RMDs may affect inherited accounts and encouraging early planning can optimize their tax efficiency, supporting a smoother transfer of wealth.

- Integrating Contributions: Use your resources to gift or match contributions to family members’ retirement accounts, fostering their financial independence. Consider offering a dollar-for-dollar match on your grandchild’s Roth IRA contributions. For instance, if they contribute $3,000 from their summer job earnings, you match it with another $3,000 (up to their total earnings or annual limit, whichever is less). This not only incentivizes their savings habit but also allows them to maximize tax-free growth potential from a young age, leveraging decades of compounding.

These actions not only benefit your family but also extend the tax-efficient strategies that have supported your success. If contributing the maximum feels daunting to your younger loved ones, suggest they start small. Gradually increasing the allocation as income rises or debts are paid off can ease the transition while building wealth consistently.

Factors to Consider: Maximizing Family Wealth

When planning for your family’s financial future, understanding the role of Traditional and Roth accounts is critical. These tools offer unique advantages that can help optimize your wealth strategy and leave a lasting legacy.

Traditional Pre-Tax Accounts

Traditional Pre-Tax Accounts

Traditional 401(k) accounts are effective for managing current cash flow but require thoughtful tax planning to maximize their benefits and minimize liabilities. By reducing adjusted gross income (AGI), they can also provide additional flexibility for managing tax brackets. Converting funds to Roth accounts during low-income years can mitigate RMD impacts and leave more tax-efficient assets to heirs.

Roth Accounts

Roth 401(k)s offer significant flexibility for legacy planning. Contributions grow tax-free, withdrawals are not taxed, and they provide a strategic tool for multi-generational wealth transfer. Encouraging younger family members to prioritize Roth contributions amplifies these benefits.

Splitting Contributions Between Pre-Tax and Roth Accounts

Allocating contributions across pre-tax and Roth accounts provides flexibility to adapt to tax law changes or shifting financial priorities. This approach helps families draw funds in the most tax-efficient manner. Additionally, starting in 2026, catch-up contributions for high earners must be directed to Roth accounts, highlighting the importance of considering both account types in your overall strategy.

An Example of Strategic Allocation in Action

Meet Chloe and Nathan: Recently retired professionals, Chloe and Nathan transitioned from high-earning careers to focusing on wealth preservation and supporting their family’s financial growth. With significant Traditional and Roth retirement accounts, their approach emphasizes tax efficiency and legacy planning.

- Strategic Conversions: During low-tax years, they convert portions of their Traditional 401(k) accounts to Roth accounts. This minimizes future RMDs, maximizes tax-free growth, and provides greater flexibility for drawing retirement income.

- Legacy Planning: Chloe and Nathan prioritize leveraging their Roth accounts to create tax-efficient wealth transfer opportunities. This strategy enables their heirs to benefit from tax-free growth while supporting the family’s long-term financial goals.

- Mentoring the Next Generation: They mentor their adult children on the importance of early saving and tax diversification, particularly through Roth contributions, fostering strong financial habits and long-term independence.

Chloe and Nathan’s thoughtful strategy not only secures their retirement but also sets up their family for financial success, illustrating how retirement planning evolves with life’s stages.

Next Steps

Managing wealth in retirement involves more than sustaining your lifestyle; it’s about building a foundation for future generations to thrive financially. Consider these steps:

- Evaluate Family Tax Strategies: Collaborate with your Investment Counselor to optimize tax efficiency for both current and future generations. For individuals in a higher tax bracket now, contributing to a Traditional 401(k) may make the most sense. Conversely, for those currently in a lower tax bracket, Roth contributions may be more advantageous.

- Foster Financial Education: Use your experience to mentor younger family members on the value of Roth accounts, tax diversification, and long-term planning. Estimate retirement income needs and work with your Investment Counselor to model various scenarios. This includes understanding the impact of diverse income sources such as Social Security and investments.

- Reassess Regularly: Life events, tax law changes, and shifting priorities necessitate periodic adjustments to any strategy. Annual check-ins help keep your plan aligned with financial objectives.

For those no longer contributing to a 401(k), integrating these practices helps you leave a legacy that supports your family’s financial success while minimizing tax burdens.

Conclusion

Choosing between a Traditional pre-tax 401(k) or a Roth 401(k) is not a one-size-fits-all decision; it depends on your unique financial situations, long-term goals, and tax environment. As you transition into retirement, the focus shifts from building wealth to preserving it and empowering your family. Thoughtful planning and informed choices today lay the groundwork for a secure tomorrow. Working closely with a trusted partner helps to ensure that your legacy not only supports your heirs but also instills financial independence and security for generations to come.

Recent Insights

Bailard Appoints Dave Harrison Smith, CFA, as Chief Investment Officer

Bailard is pleased to announce that, as of today, Dave Harrison Smith, CFA, has been promoted to Chief Investment Officer. He succeeds Eric Leve, CFA, who held the role for more than a decade and will continue with the firm as a portfolio manager, fully focused on international markets.

July 1, 2025

Country Indices Flash Report – June 2025

Tariff negotiations intensified as the July 9th reciprocal tariff deadline nears, though the Trump administration signaled flexibility on the cutoff for countries negotiating in “good faith.” The U.S. and China secured a high-level framework that included a key rare earths deal and a tariff truce extension to August 11th. Meanwhile, the UK finalized a 10% tariff rate after a threatened 27.5%; talks are swiftly progressing with the EU.

June 30, 2025

Mike Faust Awarded 2025 Advisors to Watch by AdvisorHub

Michael Faust, CFA, ranked in the top five of AdvisorHub’s Advisors to Watch for the second year—recognizing his standout leadership at Bailard.

June 24, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.