Jamil Harkness, Research and Performance Associate – Real Estate, digs into the ways in which 2022’s aggressive interest rates hikes are affecting lending in commercial real estate.

One year after commercial real estate lending volume peaked, the robust recovery coming out of the short but painful pandemic-induced recession has come to a halt. Intensifying inflation during 2022—which the Federal Reserve (the “Fed”) insisted would be “transitory”—has turned out to be more persistent and systemically rooted in the U.S. economy than previously thought. This prompted the Fed to embark on an aggressive rate-hiking strategy to stanch demand and cool the economy. The dramatic shift to monetary policy tightening took the form of seven rate hikes in 2022. The rapid movement brought the Federal Funds target rate to a range of 4.25% to 4.50% by year-end, capping the fastest one-year increase since the early 1980s. Undoubtedly, these rate increases affected both the debt markets and investor sentiment and, as a result, the conversation around continuing impacts to commercial real estate (CRE) debt and equity markets, as well as valuations, has become a focal point.

The Tie that Binds

While the Federal Funds rate itself is not used as an index in CRE mortgage lending, it does influence the index rates that are, both directly and indirectly. The Secured Overnight Financing Rate (SOFR), which replaced LIBOR in 2022 as the benchmark rate for the floating-rate debt market, moves nearly in lockstep with the Fed Funds Rate. Shorter-term government debt (i.e., 2-year treasuries) also tends to closely track the Federal Funds Rate, and longer-dated government bonds (5 to 30 years) are directionally impacted, to a lesser degree. These rate movements have been the primary driver for dramatic increases in the overall borrowing costs in CRE in just the past six months.

As an example, just twelve months ago, a creditworthy borrower seeking a mortgage loan (up to 65% loan-to-value) secured by a high-quality commercial property could secure 5 to 10-year fixed-rate financing at an all-in annual rate between 2.75% and 3.25%. Now, that same financing is likely to have an interest rate in the range of 5.75% to 6.50% (an increase of 300 to 375 basis points).1 Similarly, floating rate debt has seen all-in interest rates rise between 350 to 400 basis points.2

Stricter Underwriting from Lenders

On top of the rate increases hitting real estate borrowers, lenders are also shrinking loan proceeds available to borrowers in two ways: limiting mortgages to 55% to 60% loan-to-value, and more conservative loan appraisals leading to a lower “value” against which a lender will lend. In a nutshell, financing has become more challenging and expensive for borrowers, forcing all real estate investors who utilize debt to adjust their underwriting. Given the Federal Reserve’s stated intention to continue hiking rates and to keep them elevated until inflation is definitively slayed, the cost of financing real estate transactions is likely to remain higher for the foreseeable future.

Tighter credit standards imposed by lenders, along with wider spreads and moderated liquidity, have caused lending activity to drop considerably. According to CBRE Research, the U.S. Lending Momentum Index registered a value of 359 at the close of Q3 2022, down 18.0% from its peak in Q1.3 Increased borrowing costs are leading lenders to focus on Debt-Service-Coverage-Ratios (ratio of property net operating income over the annual cost for a borrower to service the debt) and Debt Yields (ratio of property net operating income over total loan balance) as limiting factors. The combination of higher costs and lower proceeds is putting pressure on buyers, especially those that rely on debt to drive investment returns.

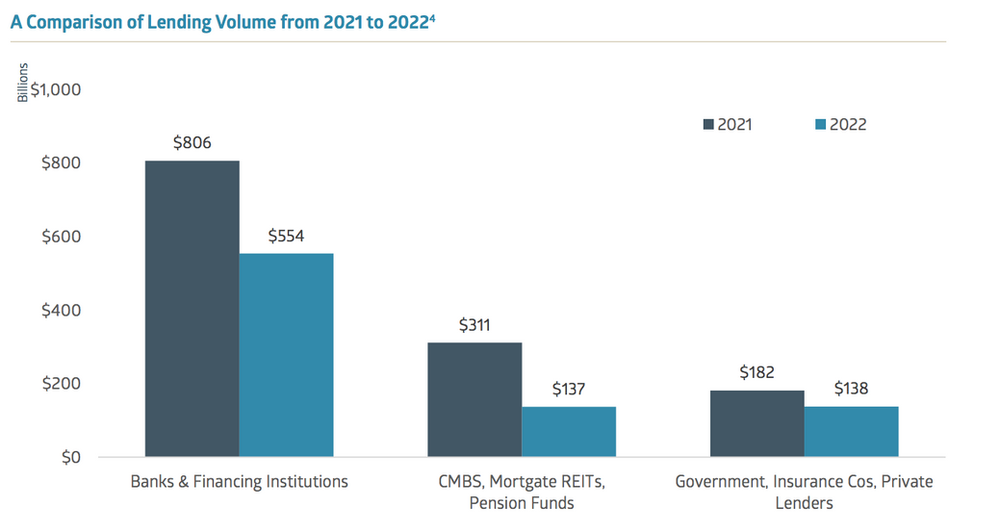

Though final 2022 lending statistics are several weeks out, anecdotal evidence from lenders, mortgage bankers/brokers, and peers described lending volume in the final quarter of the year as having “fallen off a cliff.” Based on preliminary data from Real Capital Analytics (RCA), banks and financing institutions dominated the landscape in 2022, lending an aggregated $554 billion, a 31.0% decline over 2021. The lending groups with the most significant drop year-over-year were issuers of Commercial Mortgage-Backed Securities (CMBS), Mortgage REITs, and pension funds, down 56% compared to 2021. All other debt capital sources (government, insurance companies, and other private lenders) dished out a combined $138 billion in 2022, down 24.0% compared to the prior year.4

Impacts on Pricing and Transaction Activity

Beyond concerns around rates and proceeds in the debt markets, there are nascent signs of pricing issues as the “bid/ask” spread between sellers and buyers is creating stand-offs and impacting transaction volume. Many investors headed to the sidelines during the summer of 2022 and, over the last six months of the year, there was a perceptible “shallowing” of buyer pools and a corresponding increase in deals that were either re-traded, didn’t close, or were pulled from the market by an unsatisfied seller. Many industry participants are pointing to the evolving debt landscape as the critical factor, as prospective buyers find it more challenging and/or impossible to achieve targeted return thresholds given the lower leverage at higher rates. Although investment sales activity in the first two quarters of 2022 was robust, the latest data from RCA reflects a national slowdown during the third quarter, with transactions off 23.0% year-over-year.5 Bailard believes that Q4 statistics will show an even more precipitous drop in investments.

No property type is immune from movement in interest rates and, in the absence of a compelling property-specific story, most lenders remain very selective on weaker sectors such as hotels, office, and retail. As a result, lenders have divided the CRE market into the “haves” and “have-nots” by deal profile, property type, borrower, and sub-market. Most lenders prefer multifamily and industrial, followed by the alternative asset sectors such as life science, data centers, and self-storage. With lenders taking a more cautious approach than in recent years, many industry participants expect that traditional lenders (i.e., banks and insurance companies) will continue to emphasize lower leverage, first mortgage loans on high-quality properties with the most credit-worthy borrowers.

Outlook for 2023

Looking ahead, it is still unclear how high-interest rates will go… and how long they will stay there. The combination of stubbornly-sticky inflation and the continued upward trajectory for interest rates with the macro outlook for economic growth to trend down (or contract) means it’s unlikely that the cost of debt for real estate investors will improve in early 2023.

For things to change course, it will take a meaningful, perceptible, and durable drop in inflation. When that happens, the Fed should feel the pressure to take its foot off the brake and begin easing monetary policy. Even with the current headwinds of higher interest rates and lower loan proceeds, debt liquidity should show a modest improvement in early 2023, as lenders who hit “pause” at year-end 2022 begin to look for debt investing opportunities again.

Despite the challenges currently facing the debt markets, real estate fundamentals have remained stable for most property types. However, a deep recession caused by inflation, higher interest rates, and a drop in economic activity and demand would certainly hurt CRE fundamentals and further complicate the commercial real estate lending landscape.

1 A basis point (bp) is 0.01%

2 https://www.cushmanwakefield.com/en/united-states/services/capital-markets/equity-debt-and-structured-finance, 10/11/2022

3 CBRE U.S. Lending Figures Q3 2022 – ,https://www.cbre.com/insights/figures/q3-2022-us-lending-figures

4 Real Capital Analytics (RCA) Investors Universe –,https://app.rcanalytics.com/#/investorUniverse

5 Real Capital Analytics (Trend Tracker) –,https://app.rcanalytics.com/trendtracker/Default.aspx

Recent Insights

Country Indices Flash Report – June 2025

Tariff negotiations intensified as the July 9th reciprocal tariff deadline nears, though the Trump administration signaled flexibility on the cutoff for countries negotiating in “good faith.” The U.S. and China secured a high-level framework that included a key rare earths deal and a tariff truce extension to August 11th. Meanwhile, the UK finalized a 10% tariff rate after a threatened 27.5%; talks are swiftly progressing with the EU.

June 30, 2025

Mike Faust Awarded 2025 Advisors to Watch by AdvisorHub

Michael Faust, CFA, ranked in the top five of AdvisorHub’s Advisors to Watch for the second year—recognizing his standout leadership at Bailard.

June 24, 2025

Why International Equities Deserve a Fresh Look in Today’s Market

As international equities begin to show signs of leadership again, investor sentiment and capital flows can accelerate these trends.

June 16, 2025

Keep Informed

Get the latest News & Insights from the Bailard team delivered to your inbox.