Charitable Gift Annuities in a High Interest Rate Environment

By Sam Crawford and Dave Jones, JD, LLM, CFP®

With rising interest rates, Charitable Gift Annuities are emerging as a beneficial option for charitable planning. One can think of a Charitable Gift Annuity (CGA) as a loan between a donor and a non-profit organization. In this arrangement, the donor provides the principal (their gift), and in return the non-profit offers interest payments to the donor for life. However, the unique twist is that the non-profit gets to retain the principal upon the donor’s passing. In the current higher interest rate environment, CGAs present a distinct opportunity to donate to a non-profit while still maintaining income.

The role of interest rates in shaping the attractiveness of Charitable Gift Annuities is twofold: they impact both the annuity’s payout rate and the deduction a donor can claim. First, the payout rate is largely based on the American Council on Gift Annuities (ACGA) suggested maximum rates. While there are a variety of factors that influence the rates, the current federal funds rate is an important input in determining the suggested maximum rate. Other factors that influence the payout rate include the donor’s age and whether a donor wants to defer their first income payment. ACGA rates are designed to assume 50% of the grantee’s donation transfers to the charity upon the donor’s passing. Second, donors receive a one-time tax deduction based on the present value of the annuity or the present value of the money the IRS deems will be given to the charity. While the specifics of the deduction are intricate, one thing is clear: the deduction is highly sensitive to interest rates. A donor will find their deduction significantly diminished in a low interest rate environment compared to the deduction they would receive at a high rate.

Another attractive feature of CGAs is that donors receive a portion of the annual income payment tax-free. Though we recommend individuals work with their tax advisors when considering a CGA, many non-profit organization’s websites feature calculators which can be used to estimate the tax-free component of their CGA. As an example, let’s suppose a 75-year-old individual, in a high-tax bracket, is looking to donate $500,000 cash via a CGA to Harvard Medical School in August 2023. Using Harvard’s CGA calculator, the donor will receive a deduction of approximately $216,500. Additionally, they will receive $33,500 in annual income of which approximately $22,850 will be tax-free annually for their lifetime.

As if rising interest rates were not incentive enough, the SECURE Act 2.0, signed by President Biden in 2022, allows a one-time transfer of $50,000 of a Qualified Charitable Distribution to what the IRS defines as a new split interest entity. As background, a Qualified Charitable Distribution is a tool that individuals aged 70 ½ or older can use to give up to $100,000 annually directly to charity from their IRA. The individual does not pay income tax on the distribution, but also cannot take a charitable deduction for the gift. Split interest entities are structures that benefit both the donor and the non-profit. In this application, the vehicles that make the most sense to consider pairing with a Qualified Charitable Distribution are either a Charitable Remainder Trust or a CGA. Because CGAs do not require legal counsel to draft a trust document or ongoing accounting like Charitable Remainder Trusts, CGAs are the simper choice.

One clear risk of a CGA is the reliance on the non-profit to maintain payments for the rest of the donor(s) life. Although non-profits may allocate a portion of the donated funds for immediate use, they are required to maintain adequate reserves, as dictated by state laws, to meet the obligations of the gift annuities and comply with the diverse regulatory requirements in each state where they offer CGAs. Additionally, some states, including California, have investment restrictions that aim to protect the corpus of a non-profit’s CGA pool from suffering catastrophic market losses. In today’s landscape of rising interest rates, Charitable Gift Annuities (CGAs) are emerging as an increasingly attractive option for individuals seeking to combine charitable giving with financial security. By viewing CGAs as a unique partnership between donors and non-profit organizations, we can appreciate their potential to provide income for life while leaving a lasting philanthropic legacy.

Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. This publication has been distributed for informational purposes only and is not a recommendation of, or an offer to sell or solicitation of an offer to buy any particular security, strategy, or investment product. Neither Bailard nor any employee of Bailard can give tax or legal advice. The contents of this piece should not be construed as, and should not be relied upon for, tax or legal advice.

2023 Proxy Season Review Issue Brief

The 2023 proxy season: More shareholder proposals, tougher proposals, and less support.

Bailard Recognized as a Top Bay Area Corporate Philanthropist

Foster City, CA — August 3, 2023 — Bailard today announced that it has, for the third year in a row, been ranked among the San Francisco Business Times’ annual top 100 Bay Area Corporate Philanthropists List. This year, Bailard earned 79th place, joining many of the Bay Area’s top companies including Salesforce, Google, and the San Francisco 49ers.

The Corporate Philanthropy Awards, list, and supplement celebrates the Bay Area’s most generous corporate citizens and recognizes those companies that also give their time, talent, and resources. The annual list recognizes 100 top corporate philanthropists ranked by local cash giving. It includes for-profit companies and nonprofit health care organizations that made contributions to Bay Area-based charitable organizations in the following counties: San Francisco, San Mateo, Alameda, Contra Costa, Marin, Napa, Santa Clara, Solano, and Sonoma. This year’s winners were recognized at the Corporate Philanthropy Summit on July 27.

“Bailard’s generosity helps to raise the bar on corporate philanthropy and inspires more giving,” said Mary Huss, Publisher of the San Francisco Business Times. “Their participation in this program helps challenge others to do more.”

“Corporate philanthropy goes beyond just financial contributions,” said Bailard’s Chief Executive Officer Sonya Mughal. “It’s about touching lives and igniting hope in our community, and also empowering our employees to demonstrate the compassion that runs deep for all of us at Bailard. We are pleased to be recognized among the leaders of the Bay Area, knowing that our collective efforts inspire others to embrace the transformative power of giving.”

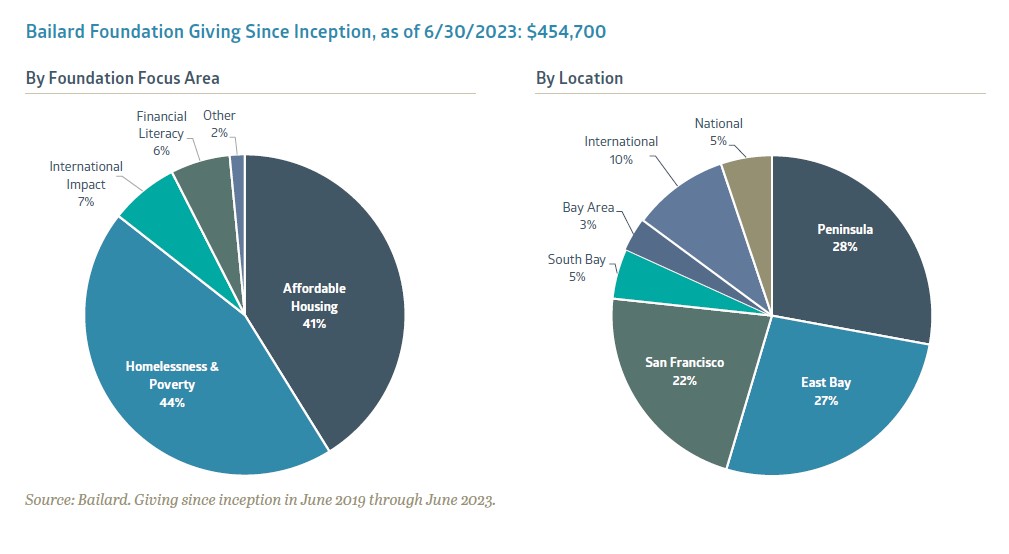

The recognition highlights the efforts of both Bailard, Inc. and the Bailard Foundation. The Bailard Foundation has donated $454,700 in impact grants (as of 6/30/2023) since its 2019 launch, with 85% of funds going to Bay Area grantees. The Bailard Foundation supports three core focus areas of affordable housing, homelessness & poverty, and financial literacy. To learn more about the Bailard Foundation, please visit the 2023 Annual Update here. Dive deeper into Bailard’s dedication to impact here.

About Bailard, Inc.

Founded in 1969, Bailard is an independent asset and wealth management firm serving individuals, families, and institutions alike. Bailard has built a long‐term asset management track record across domestic and international equities, fixed income, and private real estate, as well as robust, in-house sustainable, responsible and impact investing expertise. Through it all—and in line with its core principles and strong ESG mindset—Bailard works with clients to align their financial goals with their values. With $5.5 billion in assets under management as of 6/30/2023, Bailard is a majority employee-owned and women-led firm, and a Principles of Responsible Investing (PRI) signatory. A values-driven firm based in the San Francisco Bay Area, Bailard has its own private charitable foundation* and is deeply committed to its core values of accountability, compassion, courage, excellence, fairness, and independence.

* The Bailard Foundation supports initiatives that the Firm, its employees, and its clients value, as we seek to collectively improve the communities in which we live, work, and engage. The Bailard Foundation has a board of directors that is led by chairwoman Terri Bailard, widow of Firm co-founder Tom Bailard, and features both select friends of Bailard, Inc. and employees.

About the Corporate Philanthropy Awards

For 23 years the San Francisco Business Times has published the Corporate Philanthropists List. The list features 100 top corporate philanthropists in the Bay Area ranked by local cash giving. It includes for-profit companies and nonprofit health care organizations that made contributions to Bay Area-based charitable organizations in the following counties: San Francisco, San Mateo, Alameda, Contra Costa, Marin, Napa, Santa Clara, Solano, and Sonoma. The Corporate Philanthropy Awards program was founded in partnership with Northern California Grantmakers. A portion of the proceeds goes to NCG to fund the Corporate Philanthropy Institute, with the mission to educate more companies about effective giving and best philanthropy practices. The aim is to honor those who give the most and in doing so to help raise the bar and inspire more giving. This achievement does not evaluate the quality of services provided to clients and is not indicative of Bailard’s future performance. The San Francisco Business Times Top 100 Bay Area Corporate Philanthropists is an annual award, given to Bailard by the San Francisco Business Times in July 2023, July 2022, and July 2021. Each year, 100 firms appeared in the San Francisco Business Times list. Bailard ranked #79 in 2023; #82 in 2022; and #89 in 2021. There was no fee to enter.

ISSB’s Inaugural Global Sustainability Disclosure Standards Issue Brief

On June 26, 2023, the International Sustainability Standards Board (ISSB) released its much anticipated inaugural sustainability standards. The standards were launched by the IFRS Foundation, the non-profit, public-interest arm of the ISSB. The standards were launched at COP26 with the purpose of establishing a global baseline of sustainability-related disclosure standards.

As the governing body of the International Accounting Standards Board, the IFRS Foundation should be well-positioned to oversee global standards. The International Accounting Standards Board determines the accounting rules for financial statements of public companies used by most developed countries. The release of these standards followed a comprehensive consultation period that allowed global stakeholders to weigh in on the proposed standards. The standards integrate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) as well as the Sustainability Accounting Standards Board’s industry-based disclosure requirements.

The Bailard Foundation Annual Update 2023

The Bailard Foundation continues to be a bright spot of the Bailard community. In the last year, the Foundation donated over $197,200 to 22 charities and held seven successful volunteer events. The Bailard Foundation highlights the best of Bailard in a genuine way by putting its community first, showing compassion to those in need, and always going the extra mile for others.

The focus areas of giving for the Foundation remain affordable housing, homelessness and poverty, and financial literacy. In its four years since inception, the Foundation has made over $454,700 in impact grants. This giving is a combination of support from Bailard, its clients, employees, and friends of the Firm.

In this fourth year, the members of the Board worked to increase community engagement with additional volunteer opportunities. In-person engagement became easier as COVID subsided across the country and the Bailard team took full advantage of the ability to be in person. Volunteer opportunities included teaching financial literacy to high school students, volunteering twice with Bay Area food banks, physical labor with Habitat for Humanity of Greater San Francisco, and co-hosting two Pride celebrations for a homeless shelter network in San Francisco alongside Bailard’s Diversity, Equity, and Inclusion committee.

The Foundation also worked to establish routine donations for ten charities to provide consistent financial support, while maintaining a portion of its annual funds to be used for just-in-time donations. This allows the charities to rely on funding as part of their annual budgets and helps disseminate the funds in a reliable way, while preserving our ability to react to real-time needs as they arise. In the coming year, the Foundation will continue to evaluate new charities and offer new volunteer events.

The Foundation held its largest volunteer event in April with Habitat for Humanity Greater San Francisco: 33 Bailard colleagues participated, representing over half of the Firm’s locally-based employees. In what is also a treasured opportunity to work together, the group designed and constructed three playhouses, which were donated to Mission Neighborhood Center and also provided funds to help build eight permanently affordable homes in the Bay Area.

The Foundation’s most recent volunteer event was held in late June in conjunction with Bailard’s Diversity, Equity and Inclusion committee in celebration of Pride Month. Bailard teammates helped to bring a celebration of the Month to A Woman’s Place. A Woman’s Place provides the only 24-hour supportive residential services in San Francisco, providing emergency shelter and long-term treatment to all women, regardless of their special needs.

Bailard has collectively donated more than 240 volunteer hours since it began hosting employee events one year ago in June 2022.

The Bailard Foundation supports initiatives that the Firm, its employees, and its clients value, as we seek to collectively improve the communities in which we live, work, and engage. The Bailard Foundation has a board of directors that is led by chairwoman Terri Bailard, widow of Firm co-founder Tom Bailard, and features both select friends of Bailard, Inc. and employees.

Tax Transparency Issue Brief

This Issue Brief explores tax avoidance by corporations, and reporting initiatives to help with tax transparency.

Economic Brief: Alphabet Soup

This quarter, we feature the economic perspective of Jon Manchester, CFA, CFP®, Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing.

March 31, 2023

When U.S. president Franklin Delano Roosevelt (FDR) first took office in March 1933 he was 51 years old and tasked with the monumental challenge of somehow lifting the country out of the Great Depression. He had work to do on nearly every front. At the top of that list, however, was shoring up the nation’s beleaguered banking system. Roughly 4,000 banks had closed in the first few months of 1933 alone, adding to a series of bank runs and failures in prior years.1 One of FDR’s first moves was to declare a national banking holiday, a euphemism for temporarily shutting down the banking system. That was followed days later by the passage of the Emergency Banking Act (EBA), which importantly gave Federal Reserve Banks the right to issue emergency currency to struggling banks in the form of Federal Reserve Bank Notes. His inaugural “Fireside Chat” took place on March 12, 1933 and began with FDR calmly saying over the airwaves, “My friends, I want to talk for a few minutes with the people of the United States about banking.”2

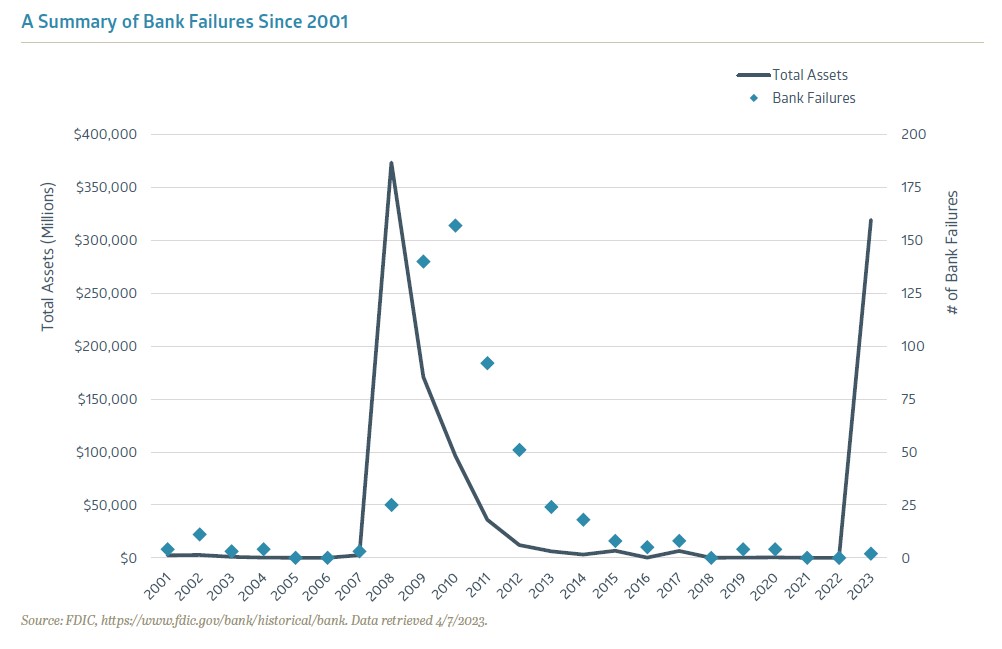

One of those 15 landmark bills was the Banking Act of 1933, enacted that June. It established the Federal Deposit Insurance Corporation (FDIC), another of the alphabet agencies, and a particularly critical one viewed from the lens of today, 90 years later. Informally called the Glass-Steagall Act after its sponsors—Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama—its main purpose was to separate commercial banking from investment banking. Interestingly, the provision that created the FDIC was much more controversial, even drawing veto threats from FDR.4 He signed the bill, however, and the FDIC was born, with deposits insured up to $2,500 initially at member banks. That coverage was soon doubled to $5,000 in 1935 and is $250,000 today.

The sudden demise of both Silicon Valley Bank (SVB) and Signature Bank in March 2023 were stark reminders of both the importance of FDIC insurance and its limitations. As the second and third-largest bank failures in U.S. history, trailing only Washington Mutual in 2008, government officials determined the one-two punch required a new approach to stabilize the banking system. In a joint statement between the Treasury department, the Federal Reserve, and the FDIC, it was announced all depositors would be made whole as a “systemic risk exception.”5 In other words, the $250,000 FDIC insurance cap was waived, in an effort to prevent a widespread banking panic. The FDIC has travelled a great deal from its humble roots as a late add-on to the Glass-Steagall Act.

Available for Sale

Whether the banking turmoil ultimately proves a tempest in a teapot seems largely dependent on the same variables we’ve been discussing for a while now: inflation and interest rates. Persistently high inflation and a sharply inverted yield curve is not the desired formula. Shortly after the bank failures, the Federal Open Market Committee (FOMC) decided to continue the inflation fight by raising the target Fed Funds rate to an upper limit of 5.00%. Some expected the Fed to pause in the wake of the banking instability, but in their statement the Committee said they remain highly attentive to inflation risks. They did acknowledge that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”6 Meanwhile, longer-term interest rates declined in March. The benchmark 10-year U.S. Treasury Note yield fell from nearly 4% at the beginning of the month to below 3.5% when the first quarter hit the finish line.

Nonetheless, the 10-year U.S. Treasury Note yield remains well above its levels from 2020-21, when it didn’t top 2% and spent much of 2020 below 1%. Therein lies a significant part of the problem for Silicon Valley Bank and other banks who invested heavily in low-yielding government paper during that time frame. According to the Federal Reserve Bank of St. Louis, just prior to the pandemic, roughly 20% of bank assets consisted of investment securities – primarily mortgage-backed and U.S. Treasury bonds.7 By the end of 2021, security holdings had increased to 25%, and many of the purchases were longer maturity bonds, which are more vulnerable to rising interest rates. When Silicon Valley Bank depositors fled in mass, the bank was left technically insolvent due to significant losses on the bonds in its investment portfolio. Although you can argue that uninsured SVB depositors were acting rationally, it brings to mind the famous quote often attributed (perhaps wrongly) to famed British economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

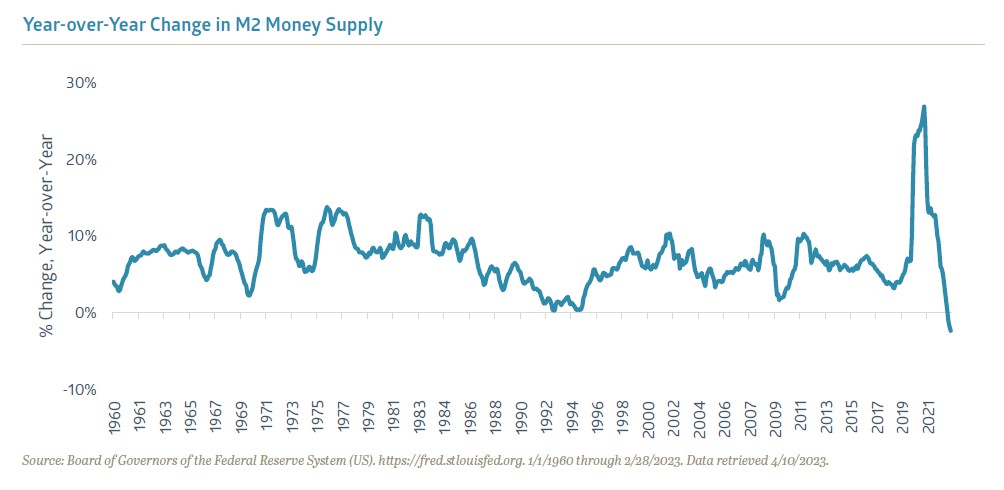

The tighter credit conditions mentioned by the Fed could pose a challenge for economic growth and corporate earnings. Notably, after an enormous spike in money supply during 2020—as measured by M2, which includes cash, bank deposits, money market funds, and other types of deposits readily convertible to cash including certificates of deposit—it is now falling at the fastest rate since the 1930s.8 This can be partly attributed to a normalization of money supply following the extraordinary fiscal and monetary stimulus measures during the pandemic, but it is something to monitor as 2023 progresses.

Higher borrowing rates and tighter lending standards have the potential to dampen economic growth in a hurry. The Chicago Fed’s National Financial Conditions Index takes into account 105 indicators of financial activity, a wide variety of interest rate and credit spreads, plus other metrics. It has been moving higher over the past year, indicating tighter financial conditions, which the Fed wants to see for the inflation fight, but runs the risk of inducing the much anticipated recession.

Market Incongruences

While the yield curve continues to suggest a slowdown lies ahead, equities shrugged off the banking tremors and put together a surprisingly strong first quarter. In fact, in case your phone didn’t notify you, the tech-heavy Nasdaq 100 Index hit bull market territory near the end of March. The Standard & Poor’s 500 Index returned 7% price-only in Q1-23, with last year’s sector laggards—Communication Services, Technology, and Consumer Discretionary—the leaders as part of a fairly strong rotation into growth stocks.

The equity market’s resilience seems underpinned by a familiar carrot: the promise of lower interest rates. According to the CME FedWatch Tool, Fed Funds futures are now pricing in a greater than 50% probability that the FOMC pauses at 5.00% over the next two meetings in May and June, respectively, before potentially cutting the target rate in the back half of 2023.9 The highest probability currently assigned to the December FOMC meeting is 4.25%. This rising expectation that the Fed will reverse course has encouraged investors to move into longer duration, growth stocks.

History shows that equities tend to perform well following a peak in the Fed Funds rate. This doesn’t hold 100% of the time, however, and there are reasons to be cautious this time around. Inflation isn’t kicked yet, for starters. The Consumer Price Index (CPI) was still running at +6.0% year-over-year as of February, and the Personal Consumption Expenditures (PCE) core price index at +4.6%. Both have improved, but the Fed knows it isn’t time to declare victory yet. They may be able to pause, but the futures market could be mistaken in projecting a lower Fed Funds rate this year. Equity market valuations are another potential headwind. The S&P 500 Index closed Q1-23 at nearly 19x projected 2023 operating earnings. The excess valuation levels of 2021 have been corrected, but U.S. large-cap stocks are not cheap. In fact, Goldman Sachs Research said in late March that the S&P 500’s forward valuation ranked in the 82nd percentile since 1980.10 Other areas of the equity markets are less demanding from a valuation perspective.

With the fixed income and equity markets offering contrasting signals, it would seem one group of investors has to be wrong, assuming returns don’t move in tandem as they did in 2022. The odds appear more stacked against equities given restrictive monetary policy and what’s expected to be a more cautious lending environment, plus modestly elevated valuations as a starting point. Economic growth in the U.S. may be muted. The Conference Board’s Leading Economic Indicators (LEI) Index declined for an eleventh-straight month in February 2023. Per the release: “The Conference Board forecasts rising interest rates paired with declining consumer spending will most likely push the US economy into recession in the near term.”11 They expect just 0.7% real GDP growth this year.

It is safe to assume that FDR would strike an optimistic tone at this moment. Perhaps we could all use a genial Fireside Chat to remind us that the employment picture is exceedingly strong, housing prices were up 3.8% year-over-year in January, according to the S&P Case-Shiller Home Price Index, and the banking system remains sound in part thanks to an alphabet agency created 90 years ago. This doesn’t look like another credit crisis, but even FDR would admit there are obstacles to overcome if risky assets are to perform well.

1 “The First Fifty Years: A History of the FDIC 1933-1983,” www.fdic.gov

2 FDR Fireside Chat, www.fdr.blogs.archives.gov, 3/12/1933

3 “Safire’s Political Dictionary,” William Safire

4 “Banking Act of 1933 (Glass-Steagall),” www.federalreservehistory.org

5 “Joint Statement by Treasury, Federal Reserve, and FDIC,” www.federalreserve.gov, 3/12/23

6 “Federal Reserve issues FOMC statement,” www.federalreserve.gov, 3/22/23

7 “Rising Interest Rates Complicate Banks’ Investment Portfolios,” www.stlouisfed.org, 2/9/23

8 “Column: US money supply falling at fastest rate since 1930s,” www.reuters.com, 3/30/23

9 FedWatch Tool,” www.cmegroup.com, 4/4/23

10 “US Weekly Kickstart,” Goldman Sachs Research, 3/24/23

11 “LEI for the U.S. Continued to Decline in February,” www.conference-board.org, 3/17/23

Economic Brief: Portfolio Theory

This quarter’s economic perspective of Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) runs the gamut from Harry Markowitz to Taylor Swift.

In late June, at 95 years old, Nobel prize-winning economist Harry Markowitz passed away in San Diego, CA. He leaves behind an immense legacy in the investment field, with his fingerprints in virtually all professionally-managed portfolios today. As the Financial Times put it: “The study of finance can easily be split into two eras: before and after Harry Markowitz.”1 Prior to the 1952 publication of his groundbreaking University of Chicago PhD dissertation titled “Portfolio Selection,” investment portfolios tended to be assembled in a somewhat haphazard manner, a collection of individual securities each assessed in isolation from a risk and return perspective with scant attention paid to how the puzzle pieces fit together. Diversification was a well-known concept, but Markowitz’s work provided a mathematical approach to evaluate risk/return tradeoffs holistically, at the portfolio level. Rob Arnott, founder of asset management firm Research Affiliates, noted “Before Harry, investing was a bunch of rules of thumb.”2

In awarding him the 1990 Alfred Nobel Memorial Prize in Economic Sciences—shared with Merton Miller and William Sharpe for separate (but in Sharpe’s case, related) achievements—the Royal Swedish Academy of Sciences lauded Markowitz’s pioneering contributions to portfolio choice. Importantly, Markowitz illustrated the importance of how each asset in a portfolio contributes to the overall risk by considering how the securities move in relation to one another. In other words, how correlated are the assets in a given portfolio? This had significant and enduring implications for portfolio management. Adding a high-risk biotechnology stock to a portfolio otherwise composed entirely of low-risk, regulated utilities stocks could in fact lower the risk of the overall portfolio compared to a broad equity benchmark, given the low correlation between the price movements of the two vastly different industries. This enabled investment managers to evaluate a potential investment in the context of the overall risk picture, and gave rise to the construction of more well-diversified portfolios across asset classes.

The adoption was not immediate, however. According to a Financial Analysts Journal article, Markowitz’s ideas took more than 20 years to catch on.3 It required the “shock wave of the early 1970s stock market selloff and the passage of ERISA” to compel investors to build sturdier portfolios, plus the eventual development of faster computing power to handle the necessary calculations.

The investment world has, not surprisingly, evolved at a dizzying pace in the half-century since the inflationary 1970s, but Markowitz’s core architecture of creating optimal, efficient portfolios across the risk-return spectrum still has a place in the latest iterations of his Modern Portfolio Theory (MPT). It does not necessarily help CNBC gain viewers, though, which is why a recent Bloomberg opinion piece on Markowitz observed that “most investment coverage today is about which securities will go up or down in price, not which ones are shrewd bets, and definitely not which ones have desirable correlations to be part of portfolios with attractive risk/return ratios.”4

The Big Seven

One can’t help but wonder how Markowitz would assess the current state of the U.S. large-cap equity market. As someone who was reportedly consumed with the statistical properties of portfolios of securities, it’s probably safe to assume he would be intrigued by the very narrow band of stocks carrying the overall Standard & Poor’s 500 Index. The Index returned 8.7% including dividends in the second quarter, taking its year-to-date total return up to 16.9%. Nearly three-quarters of the Index’s 2023 return thus far can be attributed to just seven stocks: Apple, Microsoft, Nvidia, Amazon, Meta Platforms, Alphabet, and Tesla. Three of those companies—Nvidia, Meta Platforms, and Tesla—saw their stock prices soar more than 100% higher during the first half of 2023. Media outlets have started referring to this group as either the “Big Seven” or sometimes the “Magnificent Seven,” which in itself is concerning. When stocks have done well enough collectively to earn a nickname, it might suggest that future profits are fairly well discounted in the stock prices. At present, the Big Seven trades for an average forward price/earnings ratio of roughly 36x. The overall Index trades at a robust 20.5x estimated 2023 operating earnings per share, and Morgan Stanley calculates that the median S&P 500 stock valuation lands in the 89th percentile historically.5

Despite the AI frenzy, research from Strategas points out that the real bull market has been in money market flows. Since the S&P 500’s low point last October, investors have directed four times as much into money market funds as compared to equity exchange-traded funds.7 Strategas believes those flows reflect a “ton of equity market apathy,” but sharply higher money market yields are no doubt a major factor as well, plus the scramble to avoid holding bank cash above limits insured by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve’s (the Fed’s) monetary tightening campaign has lifted short-term yields up near 5%, attracting the income-focused crowd. Meanwhile, the distrusted rally in equities continues to climb the wall of worry that Bloomberg outlined, and it has the potential to continue as more investors get off the sidelines and belatedly look to participate in further upside. There are some signs of froth in the markets, however, whether it’s increasingly rich valuations paid for growth stocks or the mid-June initial public offering (IPO) of unprofitable restaurant chain CAVA Group, which saw the stock nearly double on its first day of trading amidst a dearth of listings.

Mind the Lag

Economic growth in the U.S. has aided the markets thus far in 2023 by being neither too hot nor too cold, the precise porridge that can keep bears at bay. Gross Domestic Product (GDP) rose at a 2% annualized pace in the first quarter, adjusted for inflation, and the Atlanta Fed’s GDPNow estimate for second quarter growth is about the same. With many economists initially projecting a mild recession during 2023, the economic data thus far has proved better-than-feared. Bloomberg’s ECO Surprise Index measures the aggregate differentials between the actual values of economic releases and analyst forecasts. After a flattish start to the year, the ECO Surprise Index moved steadily higher in May and June to its highest level since April 2021. While asking if it’s time to cancel the recession altogether, Bloomberg columnist Jonathan Levin observed that economists have started throwing in the towel on a recession starting in the third quarter.8 The consensus estimate for Q3 real GDP annualized growth is now roughly flat, up from a trough forecast of -0.9% in May.

There remain ample reasons to be pessimistic. Chief among those is the Fed’s yet unfinished inflation battle. Although inflation has shown significant improvement—with the headline Consumer Price Index (CPI) decelerating to a 4.0% year-over-year growth rate in May—the Fed’s dot plot indicates it expects to raise the target Fed Funds rate by another 50 basis points9 to 5.75% at the upper end. Whether or not that happens, there is concern that the economy has yet to truly feel the impacts of tighter monetary policy. There is typically a lag between the policy changes and when economic metrics start to reflect those moves. Given the Fed lifted its target rate by five percentage points between March 2022 and May 2023, the fastest hiking pace in over four decades, it seems reasonable to withhold judgement before declaring the economy immune to higher rates.

This dour outlook for economic growth remains at odds with the surprisingly sanguine economic data we’ve seen. Notably, few cracks have emerged in the all-important labor market. Retail sales advanced at a 1.7% year-over-year rate in the three months ending in May, which might qualify as desirably lukewarm. Perhaps music superstar Taylor Swift deserves some credit for the economic resilience. As her current tour rolls around the country providing a boost to local economies—which some have compared to hosting the Super Bowl—one study estimated the Swifties will generate $5 billion in economic impact, more than the GDP of 50 countries.11 While admittedly small in the context of a roughly $26 trillion U.S. economy, Swiftonomics is clearly not the problem. We just need her to continue touring the states indefinitely, until generative AI is ready to take over completely.

1 “Harry Markowitz, economist, 1927-2023,” www.ft.com, 6/30/2023.

2 Ibid.

3 “Harry M. Markowitz: Profile of an Industry Leader,” www.cfainstitute.org, Q4 2017.

4 “Nobel Laureate Harry Markowitz Was a Misunderstood Economist,” www.bloomberg.com, 6/26/2023.

5 “US Equity Strategy,” Morgan Stanley Research, 6/26/2023.

6 “Big Seven Powering $5 Trillion Nasdaq 100 Rally,” www.bloomberg.com, 6/30/2023.

7 “Key Charts For 1H Client Letters & Look Ahead,” Strategas ETF Research, 6/27/2023.

8 “Is It Time to Cancel the Recession Altogether?,” www.bloomberg.com, 6/27/2023.

9 A basis point (bp) is 0.01%.

10 “LEI for the U.S. Declined Further in May,” www.conference-board.org, 6/22/2023.

11 “Generating $5 billion, the Taylor Swift The Eras Tour has an Economic Impact Greater than 50 Countries,” www.bloomberg.com, 6/8/2023.