Real Estate Requires a Deeper Dive Beyond Interest Rates

Jamil Harkness, Research and Performance Associate – Real Estate, digs into the relationship between capitalization rates, interest rates, and important additional dynamics in commercial real estate.

June 30, 2022

The U.S. economy is plagued with inflationary pressures that businesses and consumers haven’t experienced since the 1980s. The reasons for the surge in prices are numerous and complex. To begin with, the Federal government overstimulated the economy with big spending programs long after the economy had roared to life in the wake of the pandemic-induced recession. The Federal Reserve (the “Fed”) kept interest rates too low for too long and maintained its bond buying programs much longer than necessary. Oil and gas producers, who have been whip-sawed by politicians and government regulators over the past few years, are stifled in their ability to satisfy American’s thirst for oil, oil-based products, and gas for their vehicles. To round it out, supply chain disruptions further limited the supply of everything from electronics to toys to apparel, starving consumers of too many of the very things they were lining up to purchase.

That litany aside, the simplest definition of inflation is “too much money chasing too few goods,” which certainly describes the U.S. economy at the moment. Consequently, the Fed is playing catch up to tame inflation without tipping the economy into recession. The first salvos in the Fed’s battle are to raise interest rates, which they have done three times so far this year. Market observers expect several more rate increases to the Fed Funds Rate through the balance of the year.

The General Concern when Interest Rates Rise

Institutional and private real estate investors alike are closely watching the Fed, fearing that rising interest rates portend higher capitalization rates1 that, in the absence of accelerating rents, could lead to declining values for real estate. There are two interrelated concerns running through investors’ minds.

-

- The first is debt becoming more expensive that makes owning real estate, with leverage, more expensive overall. According to Real Capital Analytics, U.S. commercial mortgages originated in 2021 priced at 3.7% for 10-year fixed rate loans. Those same loans are now at 4.4%.2 An ancillary consideration is that continued interest rate increases will erode the spread between cap rates and mortgage rates, creating valuation challenges if property income can’t grow enough in the interim to compensate for higher debt service costs.

-

- The second fear is that, as interest rates rise on U.S. Treasuries, the return on those risk-free investments becomes competitive with other riskier asset classes and begins to look more attractive, potentially slowing demand for real estate assets. Such an issue could create an environment where the real estate market would have to undergo repricing to be able to continue to attract both debt and equity investors.

The Real Correlation Between Interest Rates and Cap Rates

These concerns certainly ring true when holding all other factors constant. But the reality is, the correlation between cap rates and interest rates (using the 10-year U.S. Treasury yield) have fluctuated frequently in the last 40 years with some 5- and 10-year periods having an inverse correlation. This variability in the correlation is supported by observing the 10-year yield and cap rate movements. Over the last 40 years, there have been 13 times when the 10-year yield increased more than 100 basis points3 (from quarter-end trough-to-peak for periods with a minimum of three quarters). In eight cases, cap rates compressed, while in the other five cases, cap rates increased. These inconsistent patterns support the fluctuation in the correlation coefficient. Further, it indicates that while the 10-year Treasury does play a part in cap rate movement, many other factors should also be considered. Just looking to interest rate movement alone as a gauge for cap rate movement does not provide the full picture.

Rising Interest Rates Are Not the Sole Determining Factor

Building out the analysis beyond cap rates alone, five additional considerations factor into the equation. The first is traditional commercial real estate fundamentals. Triggered by a fall in demand from users and/or an oversupply by real estate developers, an imbalance in supply and demand that causes higher vacancies can lead to lower rents, impacting net operating income (NOI) and hitting investors’ confidence. This could lead to investors requiring higher returns, which drives cap rate expansion and lower values. Over the last 20 years, real estate vacancy and cap rates have generally declined together due to strong demand, facilitating strong rent growth and higher property income. If the latter can be sustained, the increase in property income can offset the impact of rising interest rates.

Secondly, growth expectations play a role. Higher growth occurs when the economy is on an expansionary trajectory, as it has been for most of the past two years despite slowing of late due to interest rate hikes. Investors use expected growth to justify paying more for commercial properties on a price per square foot basis, which is up 23.0% year-over-year as of Q2 2022, as per RCA.

Market liquidity, or capital availability/appetite, serves as a measure of the supply of, and demand for, real estate opportunities by the providers of equity and debt capital. On the equity side, for example, if there aren’t enough opportunities for investors to put money to work, pricing will go up and yields will compress. The overall amount of commercial debt also has an important impact. The percentage of commercial mortgage debt to gross domestic product (GDP) has a strong negative correlation to cap rates. A recent publication by Dr. Peter Linneman concluded that an increase in the commercial mortgage debt as a percentage of GDP puts downward pressure on cap rates.4 Furthermore, the ability to refinance plays a crucial role in real estate pricing, and there is nearly $2.3 trillion in loans set to mature over the next five years.5 That said, debt cycles are important to cap rates and real estate pricing because conditions depend on supply and demand. It also depends on or whether (or not) there will be an adequate number of buyers and sellers ready, willing, and able to trade.

Another contributing factor is capital flows into the U.S. In general, domestic cap rates relative to foreign cap rates have made U.S. assets more attractive for some time now (leading to $45.0 billion in cross-border sales during Q2 2022, up 101% year-over-year, according to Real Capital Analytics). The sustained inflows of capital over the last 25 years, especially during periods of growth, have been another tailwind putting downward pressure on yields and sending pricing spiraling upwards.

And finally, investor confidence stands as an important consideration for any asset type, and particularly for real estate, which cannot offer the liquidity of stocks and bonds. There are two views of investor confidence. First, there is a tangible way to gauge confidence in commercial real estate, as real estate “houses the economy.” During times of economic expansion, there has always been a need/demand for additional space in all property types. Second, the credit spread (or yield spread between the 10-year Treasury and cap rates) serves as a good representation of investor confidence. As of Q2 2022, the credit spread was the lowest it has been since Q3 2018. However, in the absence of a recession, investors have shown to be willing to accept narrower spreads, much like they did during 2018, due to stability and confidence in the trajectory of the economy. changing, and meaningfully determinant of cap rates and cap rate movements. The collective impact of these factors can—and often does—offset or completely nullify the effect of interest rate movements. As we move through 2022 and into next year with a somewhat cloudy crystal ball, it is far from assured that rising interest rates will trigger cap rate expansion and a decline in property values.

Conclusion

Traditionally, a simplified narrative presumes that rising interest rates are correlated with higher capitalization rates. Cap rates are a function of many variables, not just interest rates. Real estate supply and demand fundamentals, the health of the U.S. economy, growth expectations, market liquidity, capital inflows, and investor confidence are interrelated, constantly changing, and meaningfully determinant of cap rates and cap rate movements. The collective impact of these factors can—and often does—offset or completely nullify the effect of interest rate movements. As we move through 2022 and into next year with a somewhat cloudy crystal ball, it is far from assured that rising interest rates will trigger cap rate expansion and a decline in property values.

As of right now, cap rates in Q2 2022 continued to compress. According to RCA, commercial cap rates were down four bps quarter-over-quarter and 16 bps year-over-year due to ongoing stability regarding the impact of the broader factors listed above. However, shifts in one aspect (if not all) could result in a modest uptick in cap rates in the future, while a further positive shift could result in the exact opposite. While we don’t exactly know what will happen, we do know what to look for to obtain the necessary additional insight for guidance in a rising interest rate environment.

1 A property’s capitalization rate, or cap rate, is a measure of its Net Operating Income relative to its market value.

2 Real Capital Analytics, https://app.rcanalytics.com/#/trends/insights/20390

3 A basis point is 0.01%.

4 The Determinants of Capitalization Rates: Evidence from the US Real Estate Markets by Peter Linneman & Matt Larriva, 2021

5 https://www.trepp.com/trepptalk/cre-loan-growth-outstanding-debt-reaches-5-trillion-in-q3-2021

Country Indices Flash Report – June 2022

EAFE’s sharp June decline capped off the worst six month start to a year in the index’s 50+ year history, attributable to shrinking valuations. On aggregate, companies have not (yet) reported significant earnings pain or margin compression.

Creating a Framework for Impactful ESG Data

Blaine Townsend, CIMA®, Director of Bailard’s Sustainable, Responsible, and Impact Investing Group, dives into the SEC’s proposed rule for the enhancement and standardization of climate-related disclosures to better inform investors.

June 30, 2022

For long-term investors, understanding risks associated with climate change has become more than just a driving force behind ESG investing. It now stands as a central focus in the capital markets. In fact, the importance of digging into climate-related risks has helped ESG investors put a spotlight on the need for better disclosure across a broad array of environmental, social, and governance issues. Much of the ESG-related data is disclosed voluntarily by corporations—and certainly not standardized—which poses a real data reliability challenge to investors. Particularly for data that relates to climate, the stakes are too high to keep disclosures voluntary.

Creating a standardized framework for disclosure is no easy task, but the Securities and Exchange Commission (SEC) is attempting to do it this year via The Enhancement and Standardization of Climate-Related Disclosures for Investors. This Proposed Rule would require companies to disclose their greenhouse gas emissions so that investors can utilize that information in their decision-making.

The material financial risks associated with climate change are two-fold. The risk of future regulation could affect a company’s bottom line if they’re not compliant. Additionally, climate change also poses a physical risk to a company’s facilities, operations, and supply chain. At this point, some companies are releasing their greenhouse gas emissions data and some are not. For those that are, the way they’re releasing the data or making the calculations is inconsistent. Investors want consistent, comparable greenhouse gas emissions data in order to make the most financially-sound investment decisions.

The SEC’s Proposed Rule was published in March and investors were given 90 days to review and comment. Bailard—along with its stakeholder partners, ICCR, Ceres, As You Sow, CDP, and PRI—submitted comment letters to the SEC first and foremost to support the rule. But the comment letters also served to provide input on how to strengthen the rule further, including:

-

- All companies, no matter their size, should be required to disclose their scope 3 (supply chain and customer) emissions, if they are deemed material

-

- The SEC should guide materiality determinations, and companies should disclosure their rationale when scope 3 emissions are deemed immaterial

-

- Phase out the safe harbor from liability for scope 3 emissions data over time, as it reduces the motivation to seek and report precise information

-

- Corporate boards should be required to assess the alignment of climate lobbying and advocacy positions with climate transition plans

-

- Companies should disclose which board directors and committees have climate lobbying and policy oversight and accountability

-

- Climate change and emissions-related risks to fenceline communities caused by corporate operations should be disclosed

-

- Corporate disclosure of whether or not (and, if so, how) executive compensation is tied to climate-related performance

The SEC’s Proposed Rule is already strong and would fill a crucial gap for investors as they attempt to make informed, long-term decisions about investment portfolios. These amendments would create an even more robust, standardized Final Rule, allowing investors to better assess climate-related risks.

Now that the public comment period is over, the SEC is assessing the comment letters received and will incorporate the feedback into its Final Rule, which would take effect by year-end. With that, larger public companies would start reporting in 2024 with the smaller companies beginning to report in 2026.

Closing Brief - Bailard’s View on the Economy: Watching the Pendulum Swing

Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) gets a little carried away and shares his analysis of potential cracks in the foundation of the U.S. economy.

June 30, 2022

The human propensity to overdo things can be seen in virtually every vein of life but it does seem a particularly American trait. Convenience store 7-Eleven boasts more than 13,000 locations across the U.S. and Canada and is perhaps best-known as the purveyorn of the Big Gulp® drink. Initially offered in 1976 as a 32-ounce version, the Big Gulp® expanded its waistline to a 44 ounce “Super” Big Gulp® iteration in 1983 before ultimately topping out at 64 ounces in 1988 via the Double Gulp®. When 7-Eleven decided to downsize the drink to a mere 50 ounces a decade ago—due mostly to it not fitting in car cupholders—The Atlantic pointed out that the average human stomach can hold about 32 ounces of liquid.1 This factoid has clearly not dissuaded 7-Eleven (nor consumers), which makes sense given the company is based in Texas, where we know everything is bigger. Even the store’s name itself, which originated because they opened at 7am and closed at 11pm, proved not enough as most locations are now 24/7 operations.

There are countless examples of human ingenuity getting a little carried away. An otherwise mundane trip to a Costco warehouse can be eye- (and wallet-) opening. A 72-pound wheel of Parmesan cheese can be yours for only $949.99, shipping and handling included. For the kids, a 93″ tall plush bear retails at $369.99. Perhaps nowhere is this tendency to overdo things more apparent than in the financial markets. Boom and bust, greed and fear: equities and other securities can deviate wildly from their long-term trendlines and current fundamentals.

Momentum is a powerful force that can carry markets well past where logic would dictate. The Standard & Poor’s 500 Index returned 5.7% annually on a price-only basis through the 90-year timeframe of 1927 to 2017.

That long-term average rapidly inflated to 6.2% by the end of 2021, though, following a torrid 2019-2021 period in which the S&P 500 soared 90% price-only, a steep adjustment in a short stretch relative to the full history. The gains enjoyed over the past three years likely borrowed from the future, and the first half of 2022 (in which the S&P 500 Index declined over 20%) has reinforced that notion. In other words, we got a little carried away.

Speaking of bingeing, Netflix shareholders now understand how swiftly the tide can go out. Changing sentiment has a more pronounced impact on individual stocks, and Netflix suffered from a severe case of investor disillusionment over the last six months. Entering 2022, Netflix had enjoyed a 37% annualized return during the 2017 to 2021 timeframe, a little over double what the S&P 500 delivered. The company was a big pandemic winner, with 2021 adjusted earnings per share at 232% of the 2019 level. Investors couldn’t stop buying the stock, though, and the price/earnings ratio hit nearly 54x at the end of 2021. Despite a modest projected earnings decline in 2022 off a high level, the stock fell approximately 71% in the first half of the year, another valuation victim and a reminder to check if the crowd is running in the right direction.

I Fought the Fed and the Fed Won nAt present, the burning question is to what degree will we overdo the downward correction? With equities in backpedal mode and FOMO replaced with old-fashioned fear, the valuation picture is much improved. The S&P 500 traded at nearly 23x trailing earnings as 2022 started, but finished June at 17.8x (estimated). Unfortunately, we did it the hard way: the sharp contraction in what investors were willing to pay for each dollar of earnings accounted for nearly all of the difference. Earnings for the S&P 500 over the last twelve months are projected to have only crept about 2% higher since the outset of 2022. As for how low that price/earnings multiple could go in a recession scenario, institutional research firm Strategas calculated that the average trailing price/earnings ratio for the S&P 500 at bear market bottoms is 11.7x.2 However, the average for the five most recent bear markets—starting with 1987—has been 14.4x, and the 2002 bear market bottomed at 17.6x. So while there appears to still be some excess fat in U.S. large-cap valuations, broadly speaking, the market downturn has brought the Index much closer to finding support.

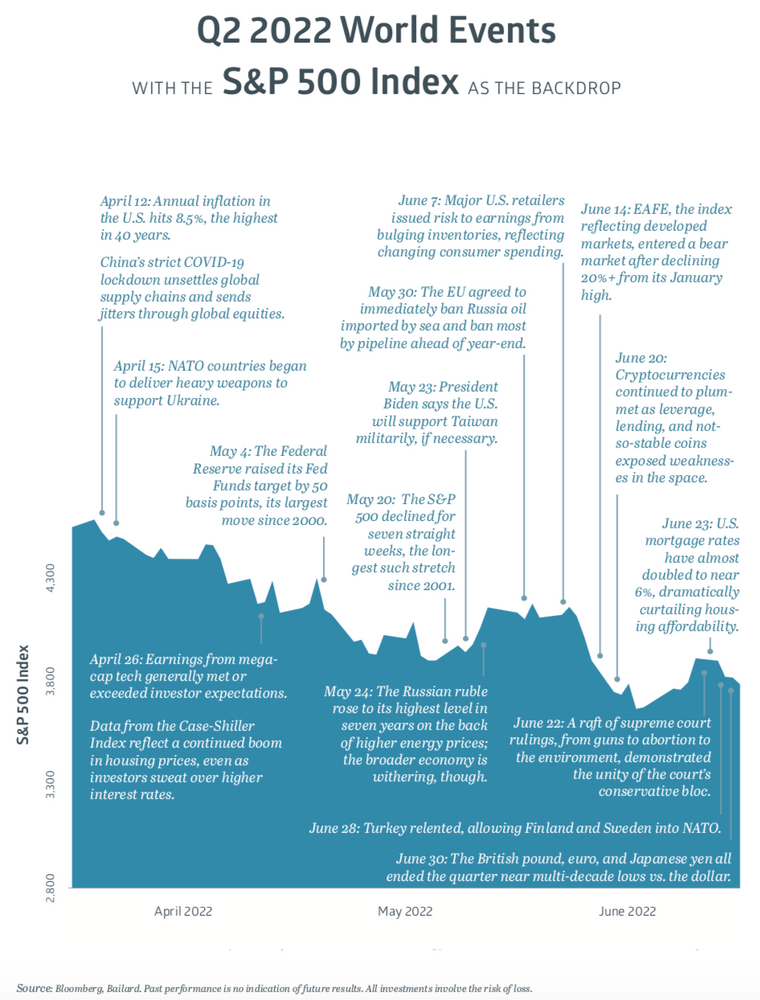

The selloff catalyst is no mystery. High and rising inflation readings sparked the sentiment switch, in conjunction with interest rates and monetary policy beginning to normalize. The adage “Don’t Fight the Fed” proved true as the Federal Reserve finally embarked on the unwinding of their extraordinarily easy money policies. To date, the Fed has hiked its Fed Funds interest rate three times, upping the magnitude each time, from 25 basis points3 to 50 and then 75. The June increase was the largest since 1994, and Chairman Jerome Powell cautioned afterwards in a hearing on Capitol Hill that “I think we’d be reluctant to cut” (the Fed Funds rate).4 Investors that are banking on the Fed reversing course are likely bound for disappointment. The Fed’s June “dot plot” indicated they expect to raise the Fed Funds rate to around 3.4% by year-end, essentially twice as high as the current 1.75% top end target, and ultimately peak at 3.8% in 2023.

Bond yields are suggesting the economy might crack before the Fed gets there. After running up to a high of 3.47% in mid-June, the 10-year U.S. Treasury Note yield retreated to 3.01% by quarter-end. This helped take some of the sting out of what was a historically-poor first half of the year for bond investors. Nonetheless, the Bloomberg Barclays U.S. Aggregate Bond Index posted a -10.4% total return over the six months. Credit spreads are also expressing concern. The Barclays Capital U.S. Corporate High Yield (junk bond) spread over the 10-year U.S Treasury reached nearly six percent, about a percent above the long-term average.

With the Fed tightening and Treasury yields dropping (at least for now), something has to give. The odds of a soft landing appear relatively low. According to Morgan Stanley’s Wealth Management chief investment officer Lisa Shalett: “Over the past 70 years, there have been 14 episodes of Fed tightening and 11 recessions, with soft landings on only three occasions, or 21% of the time.”5 That may at least partly explain why bond investors are buying at negative real (inflation-adjusted) yields.

Consumer Fatigue nInflation has clearly taken a sizeable toll on sentiment. In fact, the University of Michigan’s Consumer Sentiment Index hit a record low in June, which is amazing when you consider the Index is at a lower point than during the credit crisis. Crude oil rose a fairly modest 5% in the second quarter to $105 per barrel, but traded as high as $122 in June. Similar to Treasury yields, oil prices faded as the quarter waned, indicative of pessimism over economic growth. Food prices have also weighed heavily on consumers. The Bureau of Labor Supply reported that prices for all food consumed at home jumped 11.9% year-over-year in May, the largest twelve-month increase since April 1979. Food giant General Mills flexed some pricing power in their fiscal fourth quarter, reporting a 13% organic sales increase due entirely to higher prices and the mix of products sold.

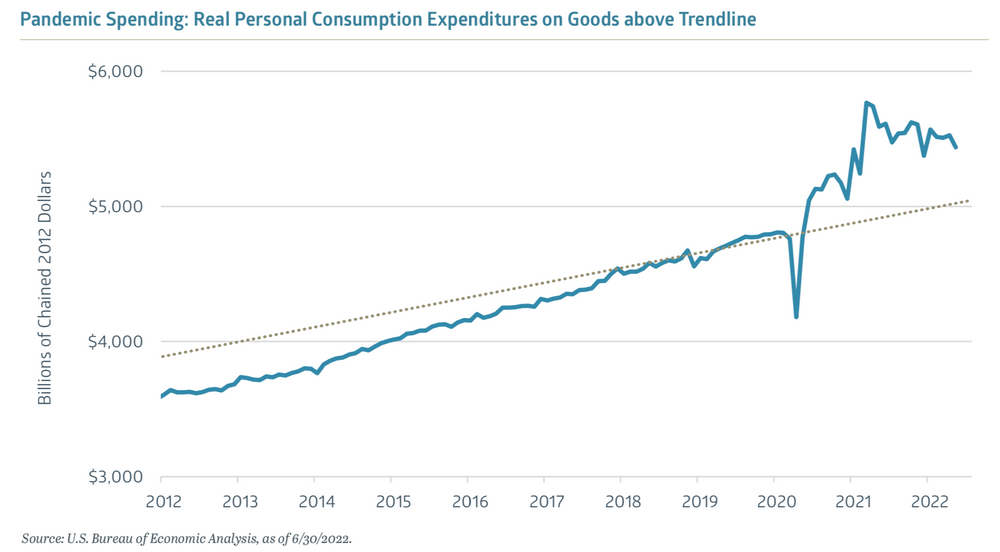

Some relief for food prices may be in the offing. The Bloomberg Agriculture Spot Index traded down 13% in June, with Bloomberg reporting that grain shortage fears were giving way to optimism that key producers will reap sufficiently large harvests.6 Continued improvement in oil and food prices would help the beleaguered consumer, but inflation has spread to virtually every category, threatening the linchpin of the American economy. Consumer spending declined 0.4% (inflation-adjusted) in May, according to the Commerce Department, the first negative reading this year. Spending on goods fell 1.6%, whereas services outlays increased 0.3%. This transition from goods to services spending has been expected. As shown in the exhibit above, real spending on goods rocketed above its trendline during the pandemic, but has eased as spending outside the home recovers.

Employment remains strong, with the unemployment rate at just 3.6% as of June. Average hourly earnings also rose 5.1% year-over-year. This should help consumer spending in the face of inflationary headwinds and declining financial asset values. Unemployment may move higher, however, as corporations deal with rising costs and attempt to maintain profitability. Some analysts are skeptical that firms will be able to pass along higher costs, leading to margin compression and lower earnings. This would also make stocks more expensive based on forward earnings. Goldman Sachs is among those wary of consensus estimates, expecting a 70 basis point decline next year for the typical S&P 500 company in the EBIT (earnings before interest and taxes) margin, assuming no recession.7 In contrast, they said, analysts expect the median stock’s EBIT margin to expand by 60 bps. nIt is possible the U.S. economy is already experiencing a recession. The Atlanta Fed’s GDPNow tracker currently estimates that second quarter real Gross Domestic Product output will have contracted by 2.1%.8 Combined with the first quarter’s 1.6% decline, the two quarters of negative growth would fit the definition of a recession, although the National Bureau of Economic Research will make the official call. Ultimately, whether or not we have an official recession will be of less importance than the depth and severity of the downturn. The cratering of the cryptocurrency markets aside, there don’t appear to be any significant fundamental cracks in the economic foundation at present. Earnings estimates for 2023 likely need to be revised lower, and interest rates will continue to be a headwind for valuations, but hopefully the markets won’t get carried away and overdo it.

1 “7-Eleven Downsizes ‘Double Gulp’ To Just 156% of Your Stomach’s Capacity,” www.theatlantic.com, 6/14/2012

2 “Daily Macro Brief,” Strategas, 6/14/2022

3 A basis point (bp) is 0.01% n4 “Fed chair Jerome Powell: Rate hikes could lead to more job losses,” www.cnn.com, 6/23/2022

5 “Is it the end of the FAANG era? Why the market has turned against tech stocks,” www.fortune.com, 5/14/2022

6 “Food Inflation Relief Is Within Sight as Crops and Crude Pull Back,” www.bloomberg.com, 6/27/2022

7 “Consensus profit margin forecasts have further to fall,” Goldman Sachs US Equity Views, 6/27/2022

8 “Atlanta Fed GDP tracker shows the U.S. economy is likely in a recession,” www.cnbc.com, 7/1/2022

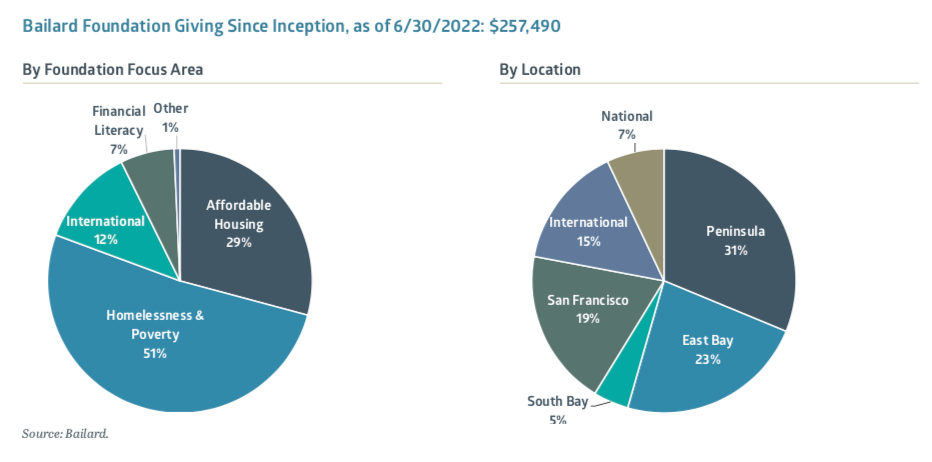

The Bailard Foundation Annual Update

June 30, 2022

The Bailard Foundation celebrated its third anniversary in May. Bailard’s values shine through in many ways at the firm and the Foundation has quickly become another way for Bailard to exemplify its values of compassion, courage, and fairness. The Foundation channels Bailard’s strong commitment to the community through three focus areas: affordable housing, homelessness and poverty, and financial literacy. Since inception, the Foundation has donated $257,490 to grantees and remains appreciative of the incredible support receivedn by clients, employees, and friends of the firm during several challenging years. As we look to the future, the Foundation remains committed to building out additional in-person employee volunteer opportunities and expanding our grantee partnerships.

Giving Highlights

Employee Drives: The Foundation has conducted seven employee fundraising drives over the past three years, raising nearly $50,000 between employee contributions and the Foundation’s match. Our most successful drive to date was in March 2022 to support the ongoing crisis in Ukraine and highlights our employees’ commitment and generosity. In December 2021, we also held our Annual Holiday Drive, where employees received a match for contributions to their local food bank.

Volunteer Events: The Foundation held its inaugural in-person volunteer day on June 30 at Second Harvest of Silicon Valley. Fourteen Bailard employees gathered to sort 6,000 pounds of food for those facing food insecurity in the Bay Area. The Foundation looks forward to many future volunteer events around the Bay Area, underscoring our ultimate goal to build material relationships with our grantees by going beyond financial support and giving our direct time and effort. The next employee event will be at the SF-Marin Food Bank later in the summer.

Grantee Highlight – St. Francis Center

Mission: St. Francis Center provides opportunity for families living in Redwood City and the surrounding communities to live with dignity and build self-sufficient livelihoods.

Services: In addition to supplying food, housing, clothing and other essential services, the thriving community-based center seeks to reduce the cycle of poverty through skill building courses, mentorship programs and social services.

Grantee Highlight – World Central Kitchen

Mission: World Central Kitchen (WCK) works to provide food to global communities during crises, by being at the frontlines providing meals and by helping build resilient food systems in areas with chronic food system challenges.

Services: Founded in 2010 by Chef José Andrés, WCK is first to the frontlines, providing meals in response to humanitarian, climate, and community crises while working to build resilient food systems with locally led solutions. WCK has served more than 100 million fresh meals to people impacted by natural disasters and other crises around the world. WCK’s Resilience Programs strengthen food and nutrition security by training chefs and school cooks; advancing clean cooking practices; and awarding grants to farms, fisheries, and small food businesses while also providing educational and networking opportunities.

The Bailard Foundation supports initiatives that the firm, its employees, and its clients value, as we seek to collectively improve the communities in which we live, work, and engage. The Bailard Foundation has a board of directors that is led by chairwoman Terri Bailard, widow of firm co-founder Tom Bailard, and features both select friends of Bailard, Inc. and employees.

Photo credit: World Central Kitchen/WCK.org.

Chat with the CIO: Can Bonds be the Comeback Kid for 2022?

Bailard’s SVP and Director of Fixed Income, Linda Beck, CFA, chats with Chief Investment Officer, Eric Leve, CFA, about the wild ride for bonds on the back of inflation and recession concerns.

June 30, 2022

Eric P. Leve, CFA: Linda, thanks so much for sitting down to talk about the bond market. Overall, it’s been a rather shocking first half of the year. The S&P 500 Index’s nearly 20% decline was propelled in part by actions from the Federal Reserve (the “Fed”) to rein in the highest inflation rates seen in decades. This, in turn, drove up borrowing costs for individuals and corporations alike, and made stocks somewhat less attractive relative to fixed-income investments.

One of the most important considerations for investors now is a little different than it might have been six or eight months ago. My question is, can bonds again provide the historical diversification benefits versus equities given the level of yields?

Linda Beck, CFA: As you know, stocks and bonds typically move inversely over longer time periods, which is why a balanced portfolio of stocks and bonds reduces portfolio volatility and is beneficial to investors. 2022 has proven an exception thus far, with stocks and bonds trending together and both posting negative returns. This has been largely driven by two unusual circumstances. First, neither stocks nor bonds were in demand. In riskier times, investors generally turn to bonds in search of lowered volatility. This year, investors reduced their demand for stocks but did not subsequently increase their appetite for bonds due to the very low-rate environment.

Second, beyond the demand equation, investors also acknowledged the rapidly rising inflation and its potentially long-term effects. Generally, longer-dated bonds are more stable, and their value will appreciate as investors price in future lower growth and inflation affecting stocks (as well as short-term bonds). This drives the normally inverse relationship. However, when there is a big jump in inflation—or even just inflation expectations—both asset classes can decline together. If the Fed’s monetary policy can slow inflation without causing major shocks, we could be in a better position for stocks and bonds to regain that inverse relationship. This will allow the bond market to better serve its traditional role as a cushion if stocks continue to deteriorate.

Eric: Given the caveat that 90% of people have gotten inflation wrong at some point in the last couple of years, I’ll ask you this. Do you think the Fed has been behind the curve, or could we have expected anything more of it in this cycle?

Linda: Yes, the Fed has been slow to act, but it had forewarned the markets of its plans to let the economy run hot for a longer period than normal in order to exit the low growth, low inflation environment of the last 20 years. Now, it is clearly playing catch up to maintain economic growth as well as contain inflation as evidenced by its more aggressive monetary tightening. The Fed is in an unenviable position. Trying to navigate a so-called soft landing that doesn’t tip the economy into a recession is very difficult. It is often hard for the Fed to tell that it has over-corrected until it is too late.

Eric: No easy feat. Do you think we’re nearing peak inflation? That is, could the Fed’s job be done in the next six months?

Linda: It’s possible. Some of the cyclical measures of economic health will come in weaker after these significant rate increases, relieving inflation to some degree. However, we might have somewhat stickier long-term inflation, which I believe warrants adjusting the historical 2% inflation goal. If the Fed pushes sufficiently hard to achieve that low of a target, then I’d expect a hard, and not just a soft, recession.

Eric: Indeed, and let’s dive into that a little deeper. Tell me more about your rationale for adjusting inflation expectations up from that historical 2% target?

Linda: The Fed has the greatest control over cyclical inflation, affecting the demand for goods and services. Beyond that, however, there’s three overarching dynamics largely outside the Fed’s purview. To start, the U.S. is experiencing a demographic shift. The baby boomers are retiring, and there’s a smaller proportion of young people entering the workforce. This sets up a long-term tailwind for wage inflation over the next ten years or so.

Next, current conditions regarding commodities also suggest a higher baseline inflation rate. There’s an intense need for core commodities like aluminum, copper, and iron driven by advances ranging from the 5G buildout and energy infrastructure to a spectacular growth in electric vehicles.

Eric: That alone would drive higher long-term inflation. But it’s important to mention that’s also independent of the commodities price acceleration we’ve seen this year due to Russia’s invasion of Ukraine.

Linda: Indeed. And my third and final argument for a higher baseline rate centers on a broad supply chain transformation. In contrast to the past 30 years, which aspired to very tight just-in-time inventory management and sourcing materials from the cheapest foreign source, we are now in a time when we don’t want to be beholden to nations that are geopolitically unaligned with us. We’re willing to pay more to shorten supply lines by producing more goods here in the U.S. Prices are higher, but they do not carry as much of a risk of supply being cut off when relations with foreign suppliers sour. The supply chain shocks related to the pandemic are continuing to work themselves out, but there’s been an overarching shift in the way we manage our supply chain.

Eric: That’s a compelling case for a targeted inflation rate along the lines of 2.5% to 3.5% being more realistic. With that in mind, I’m going to put you on the spot here a bit. What’s your greatest fear right now? Inflation, recession, or stagflation?

Linda: I’d say that runaway inflation is the most worrisome, but I don’t think we’re going down that road. A recession feels in order, however, we don’t yet have both of the usual precursors. Generally, a recession is preceded by slowing economic output combined with a deteriorating job market. The recently released June jobs report was again positive, as the U.S. extended its streak of strong labor-market gains. Regardless, I’m hoping for a normal level of inflation we can all live with. Inflation will most likely be more than we have experienced in the past 20 years but, still, I’m hopeful it does not get out of control or become too entrenched in investors’ psychology.

After this year’s events, the markets and the Fed are viewed with a negative lens. However, the Fed is primarily re-normalizing the monetary environment. It is much healthier for the economy and for investors to have positive bond yields. Over the prior decade, we have suffered very low or, in Europe, even negative yields. With 10-year U.S. Treasury yields closer to 3.5%, we are in a much healthier state, from both a monetary and an investor’s point of view.

Eric: Agreed. That’s a really good point. Ever since the Great Financial Crisis, the Fed has wanted to renormalize policy and has not been able to achieve that goal. This may be a chance to get to a much healthier middle ground that will give the Fed more policy flexibility going forward.

Linda: And for bond investors, they’ve been hit hard this year with unusually negative bond returns. It’s hard to keep in mind that we came off an abnormally low yield base. Now that we’re back up to a more moderate level of yield, bond investors have an income cushion to help offset further price deterioration.

Eric: With respect to those uncommonly negative bond returns, how have corporate and municipal bonds behaved this year? Can you describe the dynamics in those two markets?

Linda: Both corporate and municipal bonds are deemed credit products in the bond world and in 2022 credit risk has started to become more of a concern. Corporate bonds are evaluated on a corporation’s ability to pay back its principal and coupon payments. So as the economy slows down, there’s concern that corporate profits and balance sheets will weaken. This has caused corporate credit spreads to widen significantly this year.

Municipal bonds are impacted by the same economic events as corporates, but with a greater time lag. The credit health for many municipal bonds relies on taxes, so they are in their best shape once taxes are paid. Tax receipts over these last two years have been exceptionally strong, driven by capital gain and sales tax revenue. As we think about portfolio structure over the rest of the year, we believe it makes sense for investors to take a bit more duration, or interest rate, risk but keep credit risk curtailed.

Eric: You’re talking about getting closer to neutral duration. What type of bonds do you think are likely to perform best for the rest of 2022?

Linda: As economic growth slows, we want to hold securities that are highly rated. This includes Treasuries and strongly-rated government bonds as well as select corporate bonds. We’re laser-focused on quality, particularly for our corporate bond exposure. The silver lining is that companies are exhibiting relatively strong long-term fundamentals, as they were just stress-tested through the pandemic.

Eric: Thanks, Linda. We’ll take a silver lining where we can find one! We are perhaps seeing a slowdown in the rate of inflation, but the job’s not done, and indicators of recession continue to rear their heads. In our long-term view, we believe the markets are beginning a journey to a more normalized and sustainable destination. Unfortunately, coming out of a cycle where low rates were artificially maintained by the Fed, it will be a bumpy road with heightened volatility and liquidity challenges. We will continue our focus on quality, with fixed income as a key income generator for diversified portfolios.