Country Indices Flash Report – July 2025

Tariff negotiations intensified as the July 9th reciprocal tariff deadline nears, though the Trump administration signaled flexibility on the cutoff for countries negotiating in “good faith.” The U.S. and China secured a high-level framework that included a key rare earths deal and a tariff truce extension to August 11th. Meanwhile, the UK finalized a 10% tariff rate after a threatened 27.5%; talks are swiftly progressing with the EU. [Read more…]

Quarterly International Equity Strategy Q2 2025

Non-U.S. equities built on a strong first quarter with continued gains in the second, albeit with significant short-term swings along the way. Trade and political uncertainties continued to weigh on the U.S. dollar, providing a boost for firms’ revenues and profits outside American borders. Similar concerns are likely to weigh on economic growth, causing convergence in GDP expectations for 2025 between the U.S. and other developed markets. By contrast, several themes have seen expectations increase year-to-date, including defense, financials, and infrastructure. These and other diverse potential catalysts support our belief that the events and strong performance of the year-to-date can be the start of a favorable long-run cycle.

Quarterly Technology Equity Strategy Q2 2025

The Bailard Technology Strategy posted a 2Q25 total return of 22.98% net of fee—slightly below the category benchmark, the S&P North American Technology Index, which returned 23.38%—but ahead of competitor benchmarks, i.e. the Morningstar U.S. Open End Technology Category, which returned 22.66% and the Lipper Science and Technology Fund Index, which returned 22.48%. Year to date, the Strategy led the NA Tech Index, Morningstar US OE Tech Category, and the Lipper Sci & Tech Index by 2.21%, 1.07%, and 2.33%, respectively. As of June 30, 2025, the Strategy’s net returns over the 3-, 5-, and 10-year periods exceeded the returns of the competitor peer benchmarks.

Quarterly Small Value Strategy Q2 2025

Investors shrugged off initial trade war panic, and risk-on sentiment dominated thereafter. Both growth stocks and low-quality “junk” stocks benefited. Barring a recession, small cap stocks are positioned to relatively benefit from tariff policy, deregulation, and interest rate cuts. Valuation differences between small caps and large caps make the relative benefits even more compelling.

GRATs: An Unexpected Bridge to Philanthropy

Our Director of Estate Strategy, Dave Jones, JD, LLM, CFP®, shares how a Grantor Retained Annuity Trust (GRAT) can offer peace of mind for family priorities, and open the door to charitable giving.

When most people hear about GRATs, they often picture billionaires using clever legal structures to dodge estate taxes. Headlines tend to frame them as loopholes for the ultra-wealthy. And yes, GRATs are best suited to individuals with substantial wealth and highly appreciating assets. But that view misses a more human, and far more common, story.

In thoughtful wealth planning, GRATs often serve a deeper purpose. They’re not just tax tools. They’re emotional bridges. For many clients, GRATs help meet near-term family priorities, ease internal concerns, and unlock a broader vision—one that may include charitable giving.

Meeting Family Needs First: The Quiet Prerequisite to Charitable Giving

Even among those with the means and potential to be transformative givers, philanthropy isn’t always the first thing on their minds. It’s not a lack of generosity. Their focus is elsewhere: on family.

There’s a quiet, internal preoccupation with unresolved family needs:

- Have I provided enough for my children’s long-term security and opportunities?

- Should I make a gift now to support my sibling if they ever face unexpected needs?

- Should I set aside resources to support my grandchildren’s future before committing to a significant charitable gift?

These are not fleeting concerns. They carry real emotional weight that can keep clients anchored in the present. Even when there’s a genuine desire to give back, that intention often sits on the sidelines until family support feels complete.

GRATs in Action: Meeting Family Needs Without Sacrificing Flexibility

A GRAT allows a person to transfer appreciating assets into a trust, retain annuity payments over a set term, and pass the remaining appreciation to beneficiaries—often family members—with minimal or no tax consequences.

GRATs work especially well for individuals with taxable estates and concentrated positions in high-growth assets, such as closely held business interests or technology stocks. These assets are ideal because even modest growth above the IRS’s assumed interest rate (the Section 7520 rate) can result in meaningful transfers outside the taxable estate.

The benefit? Clients can in many cases provide significant support for family in the near-term without needing to sell assets or tie up large amounts of cash. With that foundation in place, space can open up for longer-term goals and values-driven planning.

How GRATs Can Support Family and Philanthropy

Samantha’s story presents a hypothetical situation based on common planning scenarios; for illustrative purposes only.

Consider Samantha, a successful tech entrepreneur who built significant wealth through her company’s growth and early investments in the innovation economy. She has three adult children, two brothers, and several nieces and nephews pursuing college and professional educations. She also wanted to support first-generation college students and fund early-stage cancer research.

In many families, loved ones have different levels of comfort with giving. GRATs can help align those perspectives by addressing near-term family needs and making room for future generosity.

Despite her financial capacity, Samantha hesitated. She wanted to give roughly $5 million to each of her children, $3 million to each of her brothers, and $2 million to nieces and nephews—a total of $23 million in near-term support that would give her peace of mind. Even with the higher lifetime exemption of $15 million starting in 2026, making all of these gifts outright would trigger significant gift tax liabilities.

Working with her advisors, Samantha established a series of short-term rolling GRATs, funded with a concentrated position in a fast-growing tech stock. The GRAT structure allowed the assets’ appreciation to pass efficiently to her family with minimal tax exposure, preserving her broader financial plan.

Once her family support strategy was in place and successful, Samantha felt an emotional shift. She moved forward with a $10 million scholarship endowment and helped launch a cancer research institute—initiatives she had long intended to pursue but had put on hold.

The GRATs didn’t change her values. They simply gave her the peace of mind to act on them.

The Real Role of GRATs in Philanthropy

Despite their reputation as technical estate planning vehicles, GRATs can play a more personal role:

- They remove emotional barriers that quietly delay charitable giving

- They allow clients to support family without disrupting broader financial plans

- They provide structure and tax-efficiency, which in turn brings clarity and confidence

They aren’t the only option. Some clients choose to integrate other strategies to achieve their family and charitable goals. But in the right situations, GRATs can do more than simply transfer wealth or minimize taxes. They help clients move from uncertainty to purposeful action.

Planning With Purpose

GRATs aren’t magic. They must be carefully designed to comply with IRS rules and depend on performance of underlying assets. But when aligned with broader goals, they become more than just technical tools. They become bridges between questions and clarity, between responsibility and impact.

For many families, generosity begins with a simple question: have I done enough for the people I love?

In the hands of thoughtful clients and advisors, GRATs help answer that question. Once in place and successful, clients may find they’re ready to move beyond family giving.

And that’s what makes GRATs not just a tax strategy, but a meaningful bridge between stewardship and lasting impact.

Important: The above does not take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Bailard nor any employee of Bailard can give tax or legal advice. The contents of this document should not be construed as, and should not be relied upon for, tax or legal advice.

Economic Brief: Shadow of Doubt

Not all pauses are created equal. Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist, Wealth Management, and Portfolio Manager, Sustainable, Responsible and Impact Investing), shares how this one mattered.

There is power in the pause. Take a breath, stop to think, sleep on it. In this rapid reaction, first to land the ‘digital’ punch world, we could probably all benefit from a hesitation move. This is well understood in the field of psychology, where the late Austrian psychologist Viktor Frankl is credited with saying “Between stimulus and response, there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.” That power is also appreciated by the financial markets, particularly when the pause removes—at least temporarily—a perceived impediment. A mere week after announcing sweeping “Liberation Day” tariffs in early April, President Trump largely shelved the plan for 90 days. He explained that people “were getting a little bit yippy, a little bit afraid.” The remark, in keeping with the President’s signature off-the-cuff style, lent support to the idea of a “Trump put;” broadly meaning that the President uses the markets as a barometer for his policies and then adjusts accordingly. Equity investors clearly had a case of the yips: the Standard & Poor’s (S&P) 500 Index traded down more than 15% in response to the trade war escalation. The bond market trembled as well. The 10-year U.S. Treasury Note yield jumped roughly 30 basis points higher in a matter of days and reportedly caused Trump’s inner circle to fear sparking a financial crisis.

Wall Street does enjoy a good “kick the can down the road” party, whether it is yet another increase to the debt ceiling or an injunction delaying new regulations. This time was no different. In fact, Strategas Research Partners noted it took just 55 days for the S&P 500 to return to a new high—the fastest recovery following a 15% drawdown in history. The dizzying ascent, which resulted in the S&P 500’s best quarter since December 2023, has left some market participants puzzling over the dichotomy between what they feel and what stock prices show. Amidst the noise of an unresolved trade war, Middle East hostilities, floundering consumer confidence numbers and other disconcerting data, it is not particularly surprising that there is a degree of cognitive dissonance involved here. This mental discomfort is actually a fairly routine aspect of investing. There is always a laundry list of doubts casting a shadow over the markets, the so-called wall of worry. The dissonance is only exacerbated by inherent contradictions in the financial markets. For example, the bad news is good news phenomenon. In recent years, weak economic data (seemingly bad) has cheered investors conditioned for the sugar high of easier monetary policy or fiscal policy support. It creates confusion around exactly what we are rooting for as investors and an incongruous feeling as equities trade higher on disappointing news.

We Now Return to Our Regularly Scheduled Programming

The 90-day pause on “reciprocal” tariffs allowed the markets to refocus on corporate earnings and guidance. A notable positive in this interim was reaffirmation around the equity market’s dominant theme: artificial intelligence (AI). With doubts starting to creep in, the large-scale cloud service providers offered reassuring guidance in April regarding planned capital expenditures (capex) for 2025. Alphabet stuck with its $75 billion bogey, saying it continues to have more customer demand for Cloud services than it has capacity. Meta Platforms raised its capex guidance range to $64 to $72 billion, up from $60 to $65 billion previously. Microsoft was rumored to have cancelled projects during the quarter, but its capex spending ran at a roughly $67 billion annualized rate and the company said it expects to grow capex in fiscal 2026. The sheer magnitude of these numbers is indicative of how these companies perceive the AI opportunity. In the lull following the storm of tariff-related headlines, the announcements provided a needed dose of confidence to equity markets and reinvigorated the AI trade. By the end of the second quarter, leading AI semiconductor companies ranked among the best performers for the three-month period, including Broadcom (+65%) and NVIDIA (+46%).

The resumption of tech leadership within the S&P 500—Semiconductors and Software were the top performing industry groups last quarter—lent an air of business as usual to the markets. It also took the large-cap index back up to an elevated valuation, trading at more than 22x estimated earnings for the next 12 months. As has been the case in recent years, however, the average stock is significantly cheaper. The S&P 500 Equal Weight Index finished June with a projected 17.8x forward price/earnings multiple. Over 200 stocks in the S&P 500 declined during the second quarter, reflecting a tougher environment for companies lacking real estate on the high-priced AI (or crypto) avenues. Nonetheless, corporate earnings reports overall helped to rally the markets. First quarter operating earnings per share rose 5.3% year-over-year for the S&P 500, led by the Communication Services, Healthcare, and Technology sectors. Standard & Poor’s reports that 77% of S&P 500 companies posted higher-than-expected Q1 earnings, topping the average of roughly 73% over the trailing 13 years.

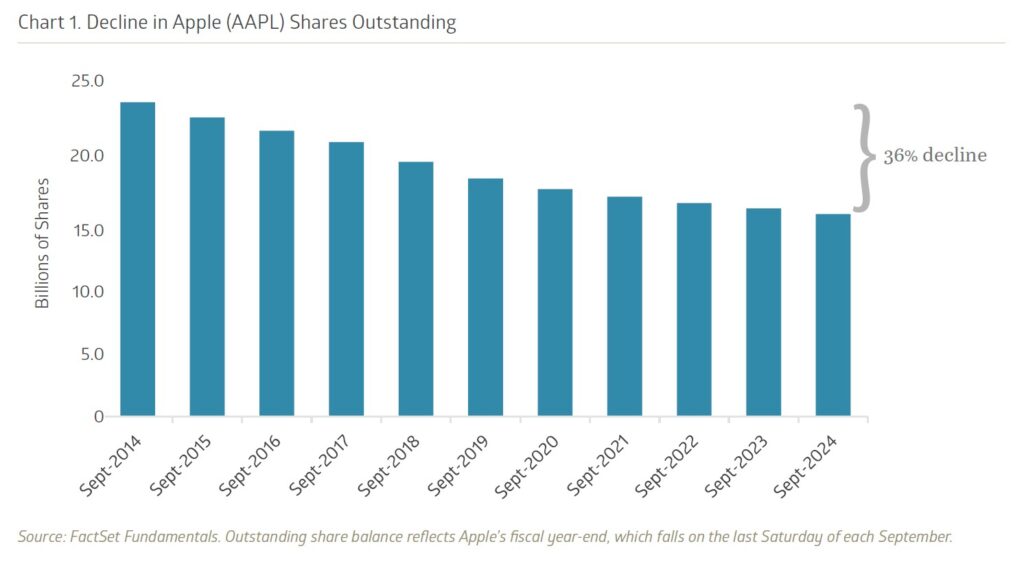

Profit growth continues to get a boost via significant share repurchases. In fact, the S&P 500 set a quarterly record for buybacks in Q1 at $293 billion, up nearly 24% year-over-year. Share buybacks—which boost earnings per share growth by reducing shares outstanding—have not been slowed by the 1% excise tax on net buybacks, part of the Inflation Reduction Act of 2022. Apple led the way with $26 billion of buybacks and amazingly holds 18 of the top 20 highest repurchase quarters. By using some of its prodigious cash flows for buybacks—the iPhone maker generated nearly $109 billion in free cash flow during fiscal 2024—Apple has been able reduce shares outstanding by nearly 36% over the past decade.

Foreign Exchange

For multinational firms with sprawling global supply chains, it was clearly a choppy first half of 2025. Some companies reacted to the policy uncertainty by throwing in the towel on providing earnings guidance, acknowledging the folly of trying to provide accurate forecasts with so many unknowns. One silver lining for these firms may have emerged from the turbulence. The U.S. dollar declined nearly 11% versus a basket of major currencies over the first six months of the year, its worst start to a year since 1973. Although a weaker dollar does make imports more expensive, it also means that revenues earned abroad in foreign currencies translate into more dollars. This is not likely to be a major tailwind, but at the margin it can be additive.

Nike, which gets more than 50% of sales from abroad, reported a roughly one percentage point negative currency impact to reported revenue growth last quarter. It hedges some of its foreign currency exposure, but for a company squarely in the path of the tariffs storm, seeing foreign exchange turn positive might ease some pain. Nike CFO Matt Friend noted on the company’s fiscal Q4 earnings call that they have “consistently been a top payer of US duties, with an average duty rate on footwear imported into the United States in the mid-teens range.” Friend added that Nike currently sources around 16% of imported footwear from China, but aims to reduce that to the high-single-digits by fiscal 2026, diversifying supply to other countries around the world.

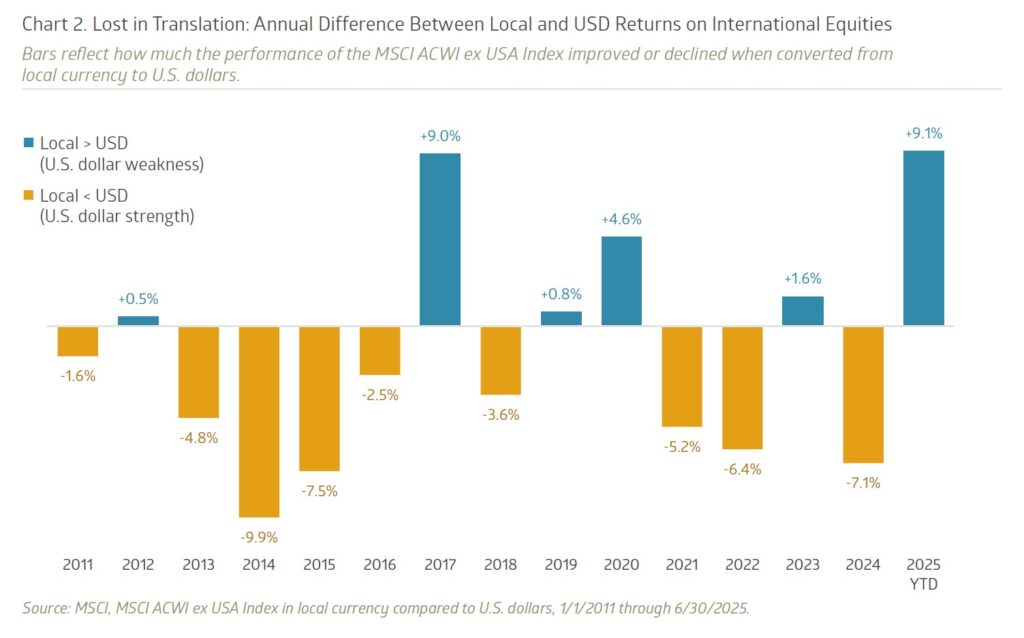

For U.S. investors, the weaker dollar has given foreign investments added allure. Through June, the MSCI ACWI ex USA Index returned a robust 8.8% in local currency terms but jumped to a 17.9% return when translated to dollars. After years of a strong dollar weighing on (unhedged) international equity returns for U.S. investors, the reversal has sharply amplified returns. Of course, the opposite is true for international investors putting assets into U.S. markets. Longer-term, we want to continue to attract capital to our shores.

The markets, as with life, never stop moving. Still, there are moments of pause, and therein lies the power. Famed economist John Kenneth Galbraith once said, “Faced with the choice between changing one’s mind and proving there is no need to do so, almost everybody gets busy on the proof.” There is power in choosing our response. Wait for it….

Spotlight: A Closer Look at the One Big Beautiful Bill

Understanding the newest wave of tax reform—and how it might affect you.

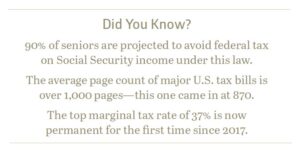

On July 4, President Trump signed the “One Big Beautiful Bill” Act into law, marking the most sweeping tax changes since the 2017 Tax Cuts and Jobs Act (TCJA). The law introduces a mix of permanent extensions, temporary enhancements, and entirely new programs.

To help make sense of what’s changed, we’ve grouped the key provisions by topic—covering individual income tax, estate planning, charitable giving, business ownership, and new savings programs for children—so you can more easily see what may apply to your financial picture.

Summary of Major Tax Reforms

INDIVIDUAL INCOME TAX

- The TCJA’s income tax brackets are now permanent; the top rate remains 37%.

- Standard deduction made permanent at $15,750 (Single) and $31,500 (Married Filing Jointly, “MFJ”).

- An extra $6,000 deduction is available for seniors; however, the provisions expire in 2028 unless extended.

- Approximately 90% of seniors are projected to avoid federal income tax on Social Security, though the benefits themselves remain taxable.

ESTATE PLANNING

The law locks in historically high estate tax exemptions, which may help high-net-worth families plan with more confidence.

- The estate tax exemption will reach $15 million per person in 2026, and is now permanent.

- Spousal portability remains, allowing a surviving spouse to inherit unused exemption amounts.

TIPS & OVERTIME INCOME

For some workers, the bill provides a new income tax exemption for tips and overtime pay, subject to income thresholds.

- Up to $25,000 in tip and overtime income is exempt from federal income tax.

- Still subject to employment tax and reporting requirements.

- This benefit expires in 2028.

STATE AND LOCAL TAX (SALT) DEDUCTION

After years of debate, the SALT deduction cap has been lifted, at least for now, for many taxpayers.

- The SALT deduction cap increases to $40,000 for AGIs under $500,000.

- It phases down to $10,000 for AGIs over $600,000.

- Applies equally to all filing statuses (marriage penalty).

- Scheduled to revert in 2030.

CHARITABLE GIVING

The law offers expanded incentives for charitable giving, including some new options for non-itemizers.

- Non-itemizers can now deduct up to $2,000 (MFJ) or $1,000 (Single) in charitable donations.

- Itemizers face a new 0.5% AGI floor for deductibility (similar to medical expense deductibility).

- The 60% AGI limit on cash donations to public charities is now permanent.

BUSINESS OWNERS

Business owners will benefit from the return of full bonus depreciation and continued access to state tax deduction strategies at the entity level.

- 100% bonus depreciation reinstated for assets placed in service after January 2025.

- Deductibility of state and local taxes via elective pass-through entity tax (PTET) regimes is preserved.

- 20% Section 199A deduction for Qualified Business Income made permanent.

“TRUMP ACCOUNTS” FOR CHILDREN

A new savings program aims to help families invest early in their children’s future.

- Children born between 2025–2028 receive a $1,000 federally funded account from the IRS.

- Parents may contribute up to $5,000/year; employers up to $2,500 (no deductions for either).

- Funds must be invested in approved U.S. mutual funds or ETFs.

- Distributions are generally prohibited before age 18 and fully taxable when withdrawn.

What This Could Mean for You

These reforms could create meaningful planning opportunities, especially for retirees, business owners, and high-income earners. But benefits vary based on your unique circumstances, and some provisions will expire unless extended.

Whether or not action is needed now, understanding how the law intersects with your financial plan can help position you more effectively for the future.

Want to Talk It Through?

If you’d like help assessing how these changes could affect your financial picture, reach out to your Bailard team or email tax@bailard.com. We’re happy to start the conversation and explore what’s possible.

Important: The above does not take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Bailard nor any employee of Bailard can give tax or legal advice. The contents of this document should not be construed as, and should not be relied upon for, tax or legal advice.

Bailard Appoints Dave Harrison Smith, CFA, as CIO

Continuity and Growth Across Our Investment Team.

SAN FRANCISCO – July 1, 2025 – Bailard is pleased to announce that, as of today, Dave Harrison Smith, CFA, has been promoted to Chief Investment Officer. He succeeds Eric Leve, CFA, who held the role for more than a decade and will continue with the firm as a portfolio manager, fully focused on international markets.

Bailard remains firmly rooted in our core values—accountability, compassion, courage, excellence, fairness, and independence—while continually positioning the firm and our clients for what’s ahead. This leadership evolution reflects both continuity in our investment philosophy and a forward-looking vision for growth.

Dave joined Bailard in 2009 and most recently served as Executive Vice President of Domestic Equities. As CIO, he now oversees all investment strategies across the firm. Eric, who helped shape Bailard’s research efforts for more than three decades, will remain a key part of the investment team, focusing on the global markets he knows so well.

“Throughout Bailard’s 50-plus-year history, we’ve approached leadership transitions with a deep respect for our values and a focus on continuity,” said Sonya Mughal, CFA, Chief Executive Officer. “Today’s news is no different. Dave’s appointment is yet another example of our ability to grow strong talent from within and our commitment to thoughtful succession. He understands who we are and where we’re going.”

A deep bench of professionals—many with years of shared experience—continues to shape Bailard’s investment process. Dave’s appointment builds on that foundation, and reflects our commitment to steady leadership, clear thinking, and delivering meaningful outcomes.

“I’ve been honored to work alongside Dave for more than a decade,” said Leve. “He brings clarity and consistency to everything he does, and I look forward to watching him shape the CIO role. For me, it’s a great moment to return my focus to international equities, a long-time passion of mine. It’s a space that demands close attention and, as recent headlines remind us, remains full of potential and complexity.”

“It’s an honor to step into this role,” said Smith. “We’ve built a disciplined process and a team that’s deeply invested in doing the work. My focus is on carrying that forward by staying curious, thinking critically, and keeping our clients’ goals front and center.”

As of the end of the second quarter, Bailard surpassed $7 billion in assets under management—marking a new high for the firm and highlighting the continued momentum Dave referenced.

Our history has been shaped by principled leadership and the courage to do what’s right for our clients. We invite you to revisit our firm’s journey as we look ahead to this exciting new chapter: https://bailard.com/our-story/.

# # #

About Bailard, Inc.

Founded in 1969, Bailard is an independent, values-driven firm serving individuals, families, and institutions. The firm delivers comprehensive wealth management alongside institutional investment strategies across public and private markets.

Bailard’s wealth management offering includes personalized financial and wealth planning, investment portfolio management, and advanced strategies for special situations. Its asset management capabilities span domestic and international equities, fixed income, sustainable and responsible investing, private real estate, and customized solutions designed to meet a diverse range of client needs.

Headquartered in the San Francisco Bay Area, Bailard is a majority employee-owned, woman-led firm with $7.1 billion in assets under management as of June 30, 2025. A Certified B Corporation™ and a signatory to the UN Principles for Responsible Investing, Bailard is proudly independent—built to put clients first, with clear values, extensive experience, and a long-standing commitment to accountability.

What Matters Most Hasn’t Changed

Editor’s Note: We’re proud to share this piece from Dave, who took the reins as Bailard’s Chief Investment Officer (CIO) on July 1, succeeding Eric Leve, CFA. With clear-eyed perspective and deep respect for what endures, he reflects on what this role means to him and how he plans to build on the firm’s strong foundation.

When I joined Bailard in 2009 as a Client Associate, I didn’t fully know what path I was setting out on. But I knew I had landed somewhere special. The role gave me a front-row seat at the intersection of research and relationships. I wasn’t just learning how the investment market works, I was learning how to make it work for real people. I was immediately drawn to Bailard’s entrepreneurial spirit and culture of shared ideas.

Over time, I gravitated toward technology investing. The pace of change and complexity captivated me, and I enjoyed the intellectual challenge of separating hype from substance. I’ve spent most of the last decade immersed in tech: first as an analyst, then a co-portfolio manager, and ultimately leading our tech strategies.

In 2021, I was promoted to Executive Vice President and began working more closely with Eric Leve, our longtime CIO. That shift didn’t take me away from research, which I still love. Instead, it gave me a broader view of our investment platform. Eric’s mentorship during this time was invaluable. As I move into the CIO role, I do so with deep appreciation for Bailard’s enduring approach and a clear understanding of what remains essential to our philosophy.

Eric has dedicated 38 years to Bailard, helping shape how we invest and playing a meaningful role in many careers. While he’s stepping back from firmwide leadership, he continues to co-manage our international portfolios. It’s a well-earned change in his career, one that reflects not just personal longevity, but the strength and depth of the firm. As our CEO, Sonya Mughal, has shared, “Careers like Eric’s don’t happen by chance. They reflect the kind of culture we’ve built at Bailard, one rooted in shared purpose where people grow and stay for all the right reasons.” Many colleagues have dedicated their professional lives here, serving clients across decades and market cycles. That kind of continuity matters.

Transitions like this are meaningful, but they don’t require a shift in philosophy. Bailard has long invested with patience, rigor, and purpose—and that won’t change. We’ll still rely on deep research and shared insight, guided by the trust clients place in us. We’ll be opportunistic when it makes sense and patient when it doesn’t.

In this new role, I bring energy and focus, with a commitment to exploring new ideas, embracing innovation, and helping ensure client portfolios are positioned for both today and tomorrow. We have a strong team in place. My job is to support them, challenge them, and help them thrive.

Peter Hill, who served as both CIO and later CEO of Bailard, was known for saying, “Always hire someone smarter than yourself.” It’s a philosophy I’ve carried with me, and one that feels especially true when I look around the table. Working with such capable and focused colleagues raises the standard in the best possible way. It’s what keeps this job both humbling and rewarding.

This transition isn’t about change for its own sake. It’s about building steadily on what works, with both continuity and care, all in the same spirit that has long defined our work. I’m grateful for the foundation that’s been laid, and for the chance to carry forward what matters most.

Thank you for your continued trust in Bailard. I’m honored to serve you in this role.