Country Indices Flash Report – October 2025

The Federal Reserve cut its benchmark rate for the first time this year, joining other central banks in the global easing cycle. Gold surged to a record $3,800/oz, up 45% year to date, as rate cuts, political uncertainty, and rising debt levels bolster its appeal. [Read more…]

Earning Our Place Among America’s Top RIA Firms

More than 50,000 firms were nominated. Thirty-three thousand interviews were conducted. Only 250 firms made the list.

More than 50,000 firms were nominated. Thirty-three thousand interviews were conducted. Only 250 firms made the list.

Among them: Bailard.

We are proud to be recognized among Forbes’ America’s Top RIA Firms. The honor reflects a long tradition of teamwork, integrity, and care for our clients’ success.

What matters more than the recognition itself are the quiet moments that make it possible. It’s listening closely, planning carefully, and following through on every promise. That is where trust is built and where the work truly matters.

“Awards come and go, but what endures is how we treat our clients and colleagues,” said Sonya Mughal, CFA, Chief Executive Officer. “That’s the part I’m most proud of.”

This honor follows other 2025 distinctions, including Barron’s Top 100 RIA Firms and the San Francisco Business Times’ Top Bay Area Corporate Philanthropists list. Each reflects the same foundation of steady leadership and a shared commitment to doing what is right for those we serve.

# # #

About Bailard, Inc.:

Founded in 1969, Bailard is an independent, values-driven firm serving individuals, families, and institutions with comprehensive wealth management and investment strategies across public and private markets. Headquartered in the San Francisco Bay Area, the woman-led, majority employee-owned firm manages over $7 billion in assets as of September 30, 2025. A Certified B Corporation™ and signatory to the UN Principles for Responsible Investing, Bailard combines deep expertise with a long-standing commitment to putting clients first.

Past performance is no indication of future results. All investments have the risk of loss. These awards do not evaluate the quality of services provided to clients and are not indicative of Bailard’s future performance. There was no cost to enter any of the recognitions described herein.

About Forbes’ 2025 America’s Top RIA Firms: Bailard ranked 91 out of 250 firms in the 2025 Forbes Top RIA Firms and 90 out of 250 firms in the 2024, each announced in October. The ranking, developed by SHOOK Research, is based on qualitative interviews and quantitative data, weighing factors such as revenue trends, assets under management, compliance records, and industry experience. More information is available here: https://www.forbes.com/sites/rjshook/2025/10/01/methodology-americas-top-ria-firms-2025/

About Barron's Top 100 RIA Firms: Announced in September 2025, 2024, 2023, and 2021 by Barron’s. Bailard ranked 92 out of 100 on the 2025 list; 88 in 2024; 99 in 2023; and 98 in 2021. Advisors who wish to be ranked complete a 102-question survey; Barron’s then verifies that data and applies its rankings formula to generate a ranking. The formula features three major categories of calculations: assets, revenue, and quality of practice with multiple sub-calculations in each. https://www.barrons.com/advisor/report/top-financial-advisors/ria?

About San Francisco Business Times’ Top 100 Corporate Philanthropists: Annual award, given in July of each year, SFBT recognizes the top 100 for-profit companies and nonprofit healthcare institutions based on the year’s cash donations to charitable organizations across the Greater Bay Area, including the counties of Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma. Bailard ranked #65 in 2025, #71 in 2024, #79 in 2023; #82 in 2022; and #89 in 2021. There was no fee to enter. Please visit the SFBT for more information: https://www.bizjournals.com/sanfrancisco/subscriber-only/2025/08/01/the-top-corporate-philanthropists-in-the-bay-area.html

Globalization, Reshoring, and the Cost of Stability

This quarter, Bailard’s SRII team looks at the forces reshaping global trade ,the costs that follow, and what these shifts might mean for investors.

Globalization and reshoring are pulling in different directions, yet both are shaping the future. One expanded U.S. GDP more than eightfold since 1950,1 lowered costs for consumers, and lifted millions worldwide out of poverty.2 The latter, however, left supply chains exposed to shocks from health crises, geopolitical tensions, and other global disruptions.

The contrast came into sharp focus during the pandemic. Lockdowns froze much of the global economy, exposing supply chain weakness while also delivering unexpected environmental benefits, from cleaner air and water to quieter oceans.3,4

The U.S. has since leaned into reshoring, encouraging companies to bring production back to domestic soil. Tariffs, subsidies, and industrial incentives are being used to reduce dependence on foreign suppliers and strengthen domestic industry. The goal is stronger supply chains and local jobs, even if it means higher costs.

Globalization’s gains and the costs that follow

Global trade delivered faster innovation and affordable goods while sharply reducing global poverty.5 Standardized shipping containers, introduced by Malcom McLean in 1956, slashed transport costs and accelerated the spread of global commerce.6

But those same connections created fragility. Millions of U.S. manufacturing jobs moved overseas, especially after China joined the World Trade Organization (WTO) in 2001.7 The pandemic highlighted the risk, exposing shortages of semiconductors, medical supplies, and basic goods.8 Geopolitical conflicts have since added strain, from sanctions on Russia to attacks near the Suez Canal.

Shipping, the backbone of global trade, carries environmental costs too. It produces about 3% of global carbon emissions each year, enough to rank as the world’s six-largest emitter if it were a country.9 The 2020 slowdown showed how quickly those impacts can change when trade contracts.

The vulnerabilities often surface as volatility, underscoring the need to diversify exposures across supply chains and regions.

Reshoring promises stability, with trade-offs

What began as a political slogan has become economic strategy. The U.S. is leaning on tariffs, subsidies, and industrial policies to bring production closer to home. For markets, this creates both winners and losers.

The 25% tariff on imported steel and aluminum10 is one example. While designed to reduce dependence on foreign suppliers, it raises costs for manufacturers and, ultimately, consumers. A modeled 25% auto tariff could increase car prices by about 13.5%, or about $6,400 on a new car,11 feeding directly into inflation.

The burden does not fall on the U.S. alone. Many lower-income countries depend on manufacturing jobs to reduce poverty. Reshoring could shift that balance, removing opportunities for millions in exchange for stability at home.

Reshoring does not end globalization, it changes its shape. The balance is moving toward security and away from pure cost efficiency. It makes global diversification and pricing power especially important.

Technology adds a wildcard

Advances in artificial intelligence (AI) may tilt this balance further. These tools can make global networks more adaptive, or reduce the appeal of offshoring by lowering labor costs. At the same time, AI’s productivity gains may ease inflationary pressures, though the benefits are likely to be concentrated in the firms sectors best able to deploy it. Large-cap technology and industrial automation companies, for example, may capture disproportionate value compared to smaller peers.

Market signals to watch

- Equities: Sectors with U.S. exposure and policy support—like semiconductors, clean energy, and logistics—may gain, while multinationals face higher costs.

- Fixed income: Inflation-linked bonds can offer protection if input costs rise, while credit markets may reward companies with strong balance sheets.

- Real assets and private markets: Infrastructure and logistics could stand to benefit, particularly as AI improves efficiency.

Inflation and wealth planning implications

Reshoring’s push for stronger domestic supply is not cost-free. Tariffs and subsidies raise costs, which companies often pass on to consumers. A study by the Federal Reserve Bank of San Francisco found that most of the wealth U.S. households built up early in the pandemic had vanished by late 2022 once inflation was considered.12 Real household net worth has grown only modestly since, despite strong nominal gains.13 Inflation continues to erode purchasing power.

These pressures are already shaping portfolio allocations. Many investors are favoring inflation-sensitive assets such as real estate, commodities, and inflation-linked bonds.14 They’re emphasizing sectors with durable pricing power to help portfolios hold value as higher input costs spread through the economy.

Long-term wealth planning must account for costs that rise faster than income, preserve purchasing power, and align exposures to higher trade and supply expenses. Philanthropic goals face similar choices: commit capital now while dollars stretch further, or preserve flexibility for future needs.

Preparation matters most

Globalization brought decades of growth and efficiency, but also fragility and uneven outcomes. Reshoring aims for stability, though at a higher price. Even small policy shifts in the world’s largest economy can ripple across workers, companies, and consumers worldwide.

The key is not to view globalization or reshoring as absolutes. Portfolios and plans should prepare for a mix of both. They should be positioned for opportunity where policy creates tailwinds, protected against higher costs, and built to weather shifts in markets and policy over generations.

Globalization’s path will keep shifting, sometimes gradually and sometimes abruptly, with technology shaping how costly or adaptive those shifts prove to be. Portfolios built for resilience can thrive whether globalization accelerates or reshoring takes hold.

1Amadeo, K. (2022). “An Annual Review of the U.S. Economy Since 1929.” The Balance.

2Our World in Data. (2021). “World population living in extreme poverty.”

3Arter, He, Holmes, Tull, et al. (2024). “Air Pollution Benefits from Reduced On-Road Activity Due to COVID-19 in the U.S.” PNAS Nexus 3(4).

4BBC News. (29 Apr 2020). “Wild Animals Enjoy Freedom of a Quieter World.”

5World Bank. (2015). “Poverty Headcount Ratio at $2.15 a Day (2017 PPP) (% of Population).” World Development Indicators.

6Blume Global. (2022). “The History and Evolution of the Global Supply Chain.”

7CGTN. (11 Dec 2024). “China’s promotion of economic globalization 23 years after accession to WTO.” CTGN.

8U.S. Intl Trade Commission. (2020). “Impact of the COVID-19 Pandemic on Freight Transportation Services and U.S. Merchandise Imports.”

9International Maritime Organization. (2014). “Third IMO GHG Study 2014.”

10Picchi, A. (10 Feb 2025). “Trump orders 25% tariffs on steel and aluminum.” CBS News.

11The Budget Lab at Yale. (2025). “The Fiscal, Economic, and Distributional Effects of 25% Auto Tariffs.” Yale University.

12Federal Reserve Bank of San Francisco. (Feb 2024). “The Rise and Fall of Pandemic Excess Wealth.” FRBSF Economic Letter.

13Advisor Perspectives. (12 Sept 2025). “Household Net Worth (Q2 2025).” Advisor Perspectives.

14AInvest. (Feb 2025). “Paradox of Wealth: High-Net-Worth Individuals Remain Financially Insecure in an Era of Inflation.”

Year-End Planning in a New Tax Landscape

Bailard’s financial planning and tax strategy teams help make sense of the One Big Beautiful Bill Act, so you can plan confidently for what lies ahead.*

As 2025 comes to a close…

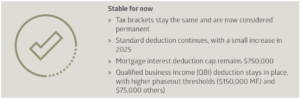

Year-end planning takes on added importance with the passage of the One Big Beautiful Bill Act (OBBBA). This sweeping legislation brings both clarity and complexity to the tax landscape, introducing notable changes while leaving other familiar provisions intact. With some rules already in effect and others beginning in 2026, now is the time to take stock and ensure your financial plan remains well positioned.

Here’s a high-level overview of what’s changed—and what hasn’t—under the OBBBA, in three timely themes to consider before December 31:

- Accelerate charitable giving

- Leverage the expanded SALT deduction

- Consider Roth conversions

1) Accelerate charitable giving before the new AGI floor

For many families, charitable giving is both a personal priority and a key planning tool. Beginning in 2026, charitable contributions for those who itemize deductions will only be deductible to the extent they exceed 0.5% of adjusted gross income (AGI).

While that may sound modest, it adds another hurdle for higher earners who regularly itemize. The good news: for 2025, gifts remain fully deductible up to current limits without the AGI floor. That makes this year a smart time to “lump” several years’ of donations into 2025. Doing so can help maximize deductions under today’s rules and reduce taxable income more effectively than spreading gifts across future years.

A donor advised fund (DAF) can make this easier. It allows you to make a larger, deductible contribution now while granting to charities gradually over time.

» Here’s how it works:

A high-income earner with $1,000,000 of AGI who typically donates $50,000 each year will, starting in 2026, only be able to deduct the portion exceeding $5,000 (0.5% of AGI). Their $50,000 annual gift would yield only a $45,000 deduction going forward.

By instead contributing three years’ worth of giving ($150,000) to a DAF in 2025, they can take the full deduction this year—without the AGI floor—and still direct $50,000 per year to their chosen causes. They’ve captured a larger deduction upfront, and likely lowered their 2025 tax bill in a meaningful way.

While itemizers face the new AGI floor starting in 2026, non-itemizers will gain a new opportunity to deduct up to $1,000 ($2,000 for married couples filing jointly, or MFJ) of charitable giving on cash contributions. Donations to a DAF or private foundation will not be eligible for this new deduction. It’s a small but welcome benefit for those who take the standard deduction.

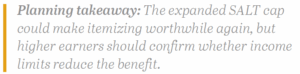

2) Leverage the expanded state and local taxes (SALT) deduction

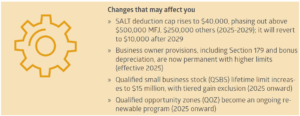

One of the more notable OBBBA provisions is the temporary expansion of the state and local tax deduction cap. For tax years 2025 through 2029, the cap increases from $10,000 to $40,000 for both single and joint filers who itemize.

However, this benefit begins to phase out at $500,000 of AGI and fully reverts to the $10,000 limit once income reaches $600,000 or more. After 2029, the $10,000 cap returns unless further legislation is passed.

The higher SALT cap could make itemizing more attractive, especially for those living in high-tax states with sizable income and property tax bills. But it’s not just high earners who should take notice. Many households have defaulted to taking the standard deduction in recent years (currently $15,750 for single filers and $31,500 for MFJ), yet the higher SALT limit could make itemizing worthwhile again.

» Planning strategies if you’re near the phaseout:

If your income falls near the $500,000 to $600,000 phaseout range, there are ways to remain eligible for the full deduction this year and beyond:

- Defer income such as bonuses or business earnings into the following year

- Maximize pre-tax contributions to 401(k), 403(b), HSA, and similar employer retirement plans

- Use qualified charitable distributions (QCDs) if you’re subject to required minimum distributions (RMDs). QCDs allow you to donate up to $108,000 per year directly from an IRA to a qualified charity, satisfying all or part of your RMD while reducing AGI

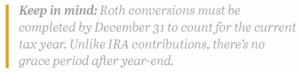

3) Consider Roth conversions wile rates remain low

While the OBBBA makes today’s tax brackets “permanent,” that doesn’t mean they’ll stay that way. For now, rates remain historically low, offering an opportunity for proactive long-term tax planning.

For individuals with significant pre-tax retirement savings in traditional IRAs or 401(k)s, Roth conversions can be a powerful way to manage future taxes. RMDs can substantially increase taxable income once they begin, potentially pushing retirees into higher tax brackets, even under current rates.

The years between retirement and the start of RMDs or Social Security often present a valuable window. Many retirees fall into a lower tax bracket than during their working years, or after RMDs begin. That gap creates an opportunity to convert pre-tax retirement assets to Roth accounts, recognizing income at lower rates now to avoid higher rates later.

» Why Roth conversions can help:

- Qualified Roth withdrawals are tax-free in retirement

- Roth accounts aren’t subject to future RMDs, which allows longer tax-free growth

- Conversions may help offset potential tax increases after 2025, particularly for those expecting higher future income or estate tax exposure

If you’re nearing retirement or already retired but not yet taking Social Security or RMDs, consider whether a Roth conversion makes sense. Today’s low tax rates won’t last indefinitely, and acting now could make a lasting difference over time. Taking time to plan ahead now can make future withdrawals, and your overall tax picture, far more manageable.

Let’s make the most of 2025’s planning opportunities

The OBBBA has ushered in both new opportunities and new complexities in tax planning. Perhaps the clearest takeaway is this: AGI matters more than ever. From the new charitable giving floor to the expanded SALT deduction, many of the law’s most impactful provisions hinge directly on income thresholds.

That makes 2025 a pivotal year to manage income and deductions with care. Coordinating charitable giving, income timing, and retirement strategies can help keep your plan aligned with your goals while maintaining flexibility for what’s ahead.

Every household’s situation is unique, but preparation and foresight go a long way. A steady approach, informed by thoughtful planning, can help you feel confident that you’re well-positioned for what’s ahead.

Let’s talk.

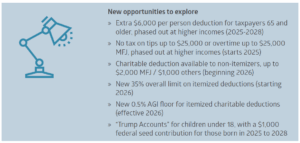

OBBBA Snapshot: What’s changed and what’s new?

* Neither Bailard nor any employee of Bailard can give tax or legal advice. Please consult your tax or legal professional for such advice.

Economic Brief: Gold Rush

From gold to gigabytes, Jon Manchester, CFA, CFP® (Chief Strategist, Wealth Management) draws a line from California’s first gold rush to today’s race for artificial intelligence, exploring the optimism, risk, and reinvention that come with every new boom.

From its very beginning, California has attracted dreamers and schemers. In early February 1848, the Mexican-American War concluded, with Mexico ceding the territory of Alta California along with Texas and other parts of the west. In exchange, the U.S. paid $15 million and forgave $3.25 million of debt. Just over a week prior to that formative event in our nation’s history, an itinerant carpenter named James Marshall had discovered gold in Coloma, CA, as he endeavored to build a sawmill for the landowner, John Sutter. Word of Marshall’s find quickly spread—at least by mid-19th-century communication speeds—kicking off a mad scramble to this new land of opportunity. In The Age of Gold, author H.W. Brands characterized the Forty-Niners: “All sought wealth; nearly all sought adventure too. The news from California was the most exciting most of them had ever heard; the rush to California promised to be the event of their lifetime. Like little boys hurrying to greet the circus, to catch a glimpse of the mighty elephant, the emigrants of 1849 couldn’t bear to miss out – and in fact the phrase ‘to see the elephant’ became a cliché on the trail.”1

In a sense, that fear of missing out continues to typify those who travel long distances to try their luck in the Golden State. The elephant has evolved over time. The birth of the semiconductor industry gave way to the dot-com craze and then the rise of social media. Today, artificial intelligence (AI) is the glittery object which has a new generation of dreamers affixing “California or Bust” bumper stickers to their (probably electric) wagons. It is the singularly dominant theme in capital markets, with vast and seemingly ever-growing tentacles across disparate industries.

During the gold rush, demand for clipper ships exploded as prospectors sought to find quick passage to San Francisco Bay. Similarly, AI is creating enormous demand for an ecosystem of adjacent businesses providing infrastructure to support the buildout. Spending continues to spike on data centers and for the power required to run those facilities. Brookfield Asset Management estimates that ultimately around $7 trillion will be needed to finance the growth of AI.2 The so-called hyperscalers—Microsoft, Amazon, Alphabet, and Meta Platforms—are projected to outlay roughly $340 billion on capital expenditures this year, increasing to $400 billion in 2026.3 BlackRock, the world’s largest asset manager, formed an AI partnership last year to raise $100 billion with the intent to invest in data centers, joining a crowded field with big players including Apollo, Blackstone, and many others hoping to strike a vein of digital gold.

This “build it and they will come” approach takes a certain boldness, a disregard for potential failure. Brands described the same mindset as occurring during the gold rush: “Where life was a gamble and success a matter of stumbling on the right stretch of streambed, old standards of risk and reward didn’t apply. In the goldfields a person was expected to gamble, and to fail, and to gamble again and again, till success finally came – success likely followed by additional failure, and additional gambling – or energy ran out. Where failure was so common, it lost its stigma. No one in California counted the failures, only the rich strikes that rewarded the tenth or hundredth try.”4

It seems likely that failure will eventually follow for some amidst this tidal wave of AI expenditures: buy now, pay later? Hedge fund manager David Einhorn cautioned recently that “there’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”5 Amazon founder Jeff Bezos acknowledged that AI spending resembles an “industrial bubble” in which “investors have a hard time in the middle of this excitement distinguishing between the good ideas and the bad ideas.”6 However, he also thinks “the benefits to society from AI are going to be gigantic.” Beyond the bubble worries, there is some uneasiness around the financing of all of these projects, with large tech companies increasingly relying on debt.

While we impatiently wait for AI to pan out, the markets continue to handsomely reward the companies in the fight. According to JPMorgan strategist Michael Cembalest: “AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending since ChatGPT launched in November 2022.”7 OpenAI, the owner of ChatGPT, is not publicly traded, but its private market valuation has soared to a reported $500 billion. Bloomberg notes that ChatGPT has about 700 million weekly users—making it one of the fastest-growing consumer products in history.8

What’s Old is New Again

A funny thing happened on the way to coronate our new AI ruling class, though. Investors have once again developed a gold crush. In fact, the price of the alluring metal—which has captured imaginations for thousands of years—outpaced the stock market over the trailing three years, roughly since ChatGPT launched. The following page’s exhibit shows that gold soared 133% over that timeframe, ahead of the S&P 500 Index’s 95% total return. Not typically mistaken for a growth stock, it has been a goldilocks environment for the yellow metal. The Consumer Price Index (CPI) hit a peak of 9.0% year-over-year inflation in mid-2022, highest in over 40 years. This pushed some investors into gold as a store of value, or a way to avoid a loss of purchasing power. Inflation has normalized since, decelerating to 2.9% growth as of August 2025, but it has not reversed, which means prices continue to climb overall.

A further catalyst for gold’s relentless rise has been motivated buyers in the form of other central banks looking to diversify reserves. China’s central bank has been an aggressive buyer since 2023, according to Reuters, aiming to reduce its reliance on the U.S. dollar. Despite China’s buying spree, its gold position is currently smaller than five other countries, plus the International Monetary Fund, and accounts for just seven percent of China’s total reserves.9 Whether central banks will keep buying with gold near $4,000 per ounce is a viable question, but their concerted efforts to stockpile gold has clearly underpinned the bullion market.

Expense Card

The stock market’s brief April 2025 foray into bear market territory (>20% decline) now seems a distant memory. Tariffs remain a risk to profitability, but corporations have thus far largely managed to defray or offset the additional costs. Favorable tax policies outside of the trade realm clearly continue to help. The 2017 Tax Cuts and Jobs Act reduced the corporate tax rate from a high of 35% to a flat 21%, while this year’s One Big Beautiful Bill Act (OBBBA) permanently restored the ability for corporations to immediately expense domestic research and development (R&D) costs and returned to 100% deduction on qualifying business expenses, such as new computers, machinery, or other equipment.

According to Standard & Poor’s, the S&P 500 operating margin was 12.5% in the second quarter, its highest since 2021. Operating profits per share rose nearly 10% year-over-year in Q2 and growth is projected to accelerate to the 13% to 14% range over the final two quarters of 2025. Resilient corporate earnings growth and solid economic activity have taken recession odds sharply lower. The Bureau of Economic Analysis (BEA) recently revised up its Q2 Gross Domestic Product (GDP) growth estimate to 3.8% inflation-adjusted, a rebound from a small first quarter decline. Nonresidential fixed investment jumped 7.3%, buoyed by strong AI-related equipment spending. The U.S. consumer also did its part, propelled by high earners. Moody’s Analytics chief economist Mark Zandi calculated that the top ten percent of income earners now account for just over 49% of total expenditures – highest since 1989.10

What remains is a fully priced U.S. large-cap equity market. The S&P 500 entered the final quarter of 2025 trading at nearly 23x estimated earnings over the next 12 months. Fed Chair Jerome Powell acknowledged as much in a late September speech: “…by many measures, for example, equity prices are fairly highly valued.” Investors seem willing to pay the price, however, emboldened by both the long-term promise of AI and rosy estimates for near-term earnings growth. S&P tabulates that S&P 500 earnings per share growth for 2026 is currently tracking at more than 17%. It could prove overly optimistic, but it does help explain why valuations are rich in an environment where the Fed is also cutting interest rates. Valuations remain much more restrained outside of the tech-heavy S&P 500 Index, with smaller company stocks and foreign equities relatively attractive.

Plenty of hurdles remain. We’re keeping a close eye on debt, whether at the federal, corporate, or individual levels. There will no doubt be those that misprice or underestimate risk and lose it all in a futile attempt to catch a glimpse of the mighty elephant. Buyer beware; yet remember that investing involves calculated risk.