Closing Brief - Bailard’s View on the Economy: Supply-Chained

This quarter, Jon Manchester, CFA, CFP® (Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing) tackles inflation, supply chain concerns, and the step up in regulatory maneuvers from China.

September 30, 2021

If any company should serve as the proverbial “canary in a coal mine” for inflation, Dollar Tree appears to be about the ideal candidate. With over 15,000 stores and a coast-to-coast logistics network, Dollar Tree has the requisite scale for purchasing power. However, unlike nearly every other Fortune 500 company, their business model effectively kneecaps their ability to pass rising costs along to consumers via higher prices. When the value proposition is largely predicated on selling items at $1 or less, that price ceiling puts a lot of pressure on the company to keep a lid on costs, no matter how many six packs of Moon Pie mini marshmallow sandwiches they hawk at a buck apiece.

Not surprisingly, Dollar Tree is acutely aware of this issue. In 2019, they satiated activist investor Starboard Value by agreeing to test out multi-price point offerings. Recently, Dollar Tree announced they will accelerate the rollout of stores offering $3 and $5 products and even floated the groundbreaking possibility of $1.25 and $1.50 price points. This latest backpedal from their dollar standard came after reporting a fiscal second quarter gross margin decline of 110 basis points(1) versus a year ago, primarily due to higher freight costs. Dollar Tree noted that spot market rates for ocean freight from China increased 20% just since May, and now expect its regular carriers will only fulfill 60% to 65% of their contractual commitments. The Dollar Tree business, they acknowledged, is “highly sensitive to freight costs.” It looks like the net result will be declining profits for Dollar Tree this year, despite higher revenues. This hasn’t escaped investors, who drove the stock down roughly 29% from its April 2021 peak level before a late September rally, spurred by the pricing moonwalk.

Rising costs are prevalent, with seemingly every company citing heightened supply chain challenges and steeper input prices. Retailer Bed Bath & Beyond, home of the 20% off coupon, expected a 240 basis point increase in freight costs last quarter, and instead experienced a larger 360 basis point jump. This helped to dent their adjusted gross margin by 190 basis points compared to a year earlier. Even relatively small margin changes can make a big difference on the bottom line. Bed Bath & Beyond said 100 basis points of margin variation impacts their earnings per share (EPS) by approximately $0.50, which is significant considering they previously projected EPS of around $1.48 for all of fiscal year 2021. Shareholders threw in the (bath) towel, sending the stock down 22% on earnings day.

Understandingly, Wall Street analysts tend to obsess over margins and the various levers at a company’s disposal to sustain or increase those margins. Companies, for their part, end up spending an inordinate amount of time outlining plans to achieve cost efficiencies and revenue synergies. In aggregate, this seems to be working. The Standard & Poor’s 500 Index established a record-high 14.4% operating margin last quarter. History would suggest a reversion ahead, closer to the 31+ year median operating margin of 12.3%. However, technology continues to play an outsized role in this story. The high-margin Information Technology sector now represents 27.6% of the S&P 500 Index versus 17.0% a decade ago, and that doesn’t include companies such as Amazon and Facebook that happen to be classified in other sectors. The other factor, of course, is the use of technology to operate more efficiently. As one example, market intelligence firm International Data Corporation (IDC) estimated in 2018 that organizations who migrated to Amazon Web Services (AWS) Cloud would save 31% on average in infrastructure costs. (2)

Inflate-gate

On a secular basis, technology can help minimize costs but, in the short-term, inflation is clearly here. The Federal Reserve’s (the “Fed’s”) preferred inflation gauge—the Personal Consumption Expenditures (PCE) Price Index—rose at a 4.3% rate in August 2021, its highest in 30 years. Eurozone inflation hit a 13-year high at 3.4% for September. The debate remains how long it will persist. Fed Chairman Jerome Powell admitted that “it’s frustrating to see the bottlenecks and supply chain problems not getting better – in fact at the margins apparently getting a little bit worse. We see that continuing into next year probably, and holding up inflation longer than we had thought.”(3) The Fed now projects 4.2% inflation in 2021, then cooling to 2.2% next year.

One key inflation metric is wage growth and, on that front, there is room for concern. The Labor Department reported a 4.3% increase in average hourly earnings for August 2021 compared to a year ago, up from a 4.0% rate the month prior. It’s difficult to dismiss rising wages as transitory. However, it’s expected that labor supply constraints should ease in the months ahead. Further, Goldman Sachs estimates that labor costs represent only ~13% of revenues for the median S&P 500 stock. (4) They note that—based on historical correlations—S&P 500 companies are relatively insulated from wage pressures, and their analysis suggests a 100 basis point acceleration in wage growth would translate to just a 1% reduction in S&P 500 EPS, all else equal. Smaller companies are generally more exposed to rising wages, according to Goldman Sachs, in large part because they have lower profit margins.

With inflation worries comes the potential for rising interest rates, and we did see the 10-year U.S. Treasury Note yield pop higher at the end of September. That said, its 1.49% yield was only slightly higher than the 1.47% starting point for the quarter, and still well below this year’s 1.74% March high point. The bond market remains fairly sanguine about longer-term inflation and, for that matter, regarding credit risk. High yield (junk) bond spreads remained tight, with the Barclays Capital U.S. Corporate High Yield Index trading 256 basis points above the 10-year U.S. Treasury Note yield by quarter-end, well below its 421 bp average over the past decade. We are watching credit spreads closely, as a potential leading (or at least coincident) indicator for equity markets stress. Credit Suisse research indicates that high yield credit tends to peak around six months ahead of major turning points in equities.(5)

A sustained move higher for interest rates could mean at least temporary pain for stocks and bonds. Earnings growth has been superb, with S&P 500 projected 2021 earnings now pegged at $198 per share versus $164 at the outset of the year, nearly 21% higher. This has taken the price/earnings ratio for the S&P 500 down to 21.7x from 22.8x, still elevated versus its 16x long-term average. Investors are willing to fly premium class in this market in part because of low rates. Savita Subramanian, Bank of America’s head of U.S. equity and quantitative strategy, compared the S&P 500 to a 36-year, zero-coupon bond, meaning the Index is vulnerable to rising rates. “Any move higher in the cost of capital via interest rates, credit spreads, equity risk premia, that’s basically going to be a huge knock on the market relative to the sensitivity we’ve seen in the past,” she said. (6) How huge a knock will ultimately depend on a number of variables, including whether earnings growth can hold up in the face of rising costs.

Common prosperity

It was a summer of tough love in Beijing. At the end of June, ride-hailing company Didi, boasting nearly 90% of the Chinese market, went public on the New York Stock Exchange (NYSE). Didi handled roughly 25 million rides per day in China during the first quarter of 2021, compared to 16 million globally for Uber.(7) Two days after Didi’s initial public offering (IPO), regulators in China ordered app stores to remove Didi pending a cybersecurity review, and instructed Didi to halt new registrations. The stock quickly dropped nearly 20%, and closed Q3 about 44% lower than its IPO price, undermined in part by China’s ambivalence toward its tech companies listing their shares overseas.

In July, China banned companies that teach the school curriculum from making profits, raising capital, or going public. By doing so, they upended China’s $100 billion education tech sector, and left foreign investors in limbo. A month later, regulators announced new rules for China’s videogames industry, including limiting minors to one hour on Fridays, weekend days, and public holidays. This after Chinese state-owned media described videogames as “spiritual opium.”

The list of regulatory crackdowns goes on. Meant to ensure common prosperity and wrest some control back from (largely) tech companies, this campaign has unsettled market participants and renewed doubts about investing in China. Most major equity markets posted double-digit positive returns over the first nine months of 2021, but the MSCI China Index declined 17.6% in U.S. dollar terms. Internet stocks Tencent and Alibaba account for nearly 24% of the Index, and both stocks have felt the pressure of Beijing’s regulatory roulette.

San Francisco-based investment group Matthews Asia has been investing in the region for over 30 years and ridden out regulatory cycles before. In August, their chief investment officer, Robert Horrocks, said he doesn’t believe the recent flurry of regulatory moves has changed the absolute investment case for China.(8) Horrocks noted that some of the well-known Chinese stocks were trading at 20% to 30% discounts on price-to-earnings ratios versus global peers, while acknowledging that China will continue to be active on the regulatory front. He also pointed out that regulated companies in China enjoy a bit of a competitive moat, in that China wants a limited number of large companies to help them control what they perceive as inappropriate outcomes from pure market competition.

Beijing’s regulatory reawakening has clearly rattled investors and upped the perceived risks to investing and operating in the world’s second-largest economy. China’s sheer market size remains tantalizing for U.S. multinational corporations, but the central government’s increasingly heavy-handed approach may sideline some. From an asset allocation standpoint, China’s slowing economic growth and heightened political risk does give us pause. Investing in the region may require more nimbleness in the near-term, with colder winds blowing from the eas

1 One basis point (bp) equals 0.01%.

2 “Why migrate to the AWS Cloud?”, www.aws.amazon.com/cloud-migration, February 2018.

3 “Fed Chair Powell calls inflation ‘frustrating’ and sees it running into next year,” www.cnbc.com, 9/29/2021.

4 “Labor costs and US equities: Temporarily transitory,” Goldman Sachs Portfolio Strategy Research, 9/13/2021.

5 “Global Equity Strategy: Credit remains the risk to equity,” www.credit-suisse.com, 9/21/2021.

6 “BofA’s Subramanian Likens S&P 500 to 36-Year, Zero-Coupon Bond,” www.bloomberg.com, 9/9/2021.

7 “The Rise and Fall of the World’s Ride-Hailing Giant,” www.nytimes.com, 8/27/2021.

8 “China’s Regulatory Announcements Part II,” www.matthewsasia.com, 8/19/2021.

Corporate Engagement Update Q3 2021

The 2021 Proxy Season is coming to a close, and early reviews are proving positive for ESG issues. Similar to last year, climate change, diversity, and corporate political spending were the most active topics. According to Proxy Preview, this year’s record 34 majority votes thus far has greatly outpaced last year’s 21 majority votes. We are also seeing a strong increase in the level of those majority votes. So far, six votes have received over 90% support, of which four had the support of management. This is a first in the U.S. amongst environmental and social resolutions. Overall, it has been a pretty stellar year for ESG shareholder resolutions.

ESG Issue Brief: Can Green Be the Color of Cryptocurrency Too?

In addition to the potential benefits of cryptocurrency as a decentralized payment system, there are a few downsides. Foremost is the massive carbon footprint it leaves in its trail.

Does Company Size Bias in ESG Scores Impact Small Cap Investors?

While it is well known that ESG scores tend to have a size bias which favors the larger companies among the universe of large capitalization stocks – does this bias exist in the small cap space? Published in The Journal of Impact and ESG Investing, our small cap value ESG equity team examines this topic and how investors can create better performing, size-neutral small cap portfolios in “How Company Size Bias in ESG Scores Impacts the Small Cap Investor.”

Deconstructing Small Cap & How ESG Scoring Can Mitigate Risk

Osman Akgun, PhD, CFA, Vice President, Domestic Equities

June 30, 2021

Small cap stands for small market capitalization, where a company’s market capitalization is the product of its share price multiplied by the number of outstanding shares. On the size spectrum, small cap is the moniker afforded to companies with a market capitalization of roughly $300 million to $2 billion. These are generally young companies with strong growth potential, but small caps also are typically less stable than their larger, more established peers. While this usually leads to more dramatic short-term price fluctuations and volatility, over longer evaluation periods, there is a greater likelihood that small cap stocks will outperform large caps.

Unfortunately, small cap stocks have a bad reputation

The increased volatility inherent in younger companies—primarily driven by the frequency with which new ventures go bankrupt—means that small cap investors must be willing to accept an increased measure of risk in exchange for higher potential gains.

Yet the risks may be exaggerated. News headlines focus on the negative, from claims of unchecked fraud to an unacceptable standard of corporate operations. The truth is, these are important considerations when investing in a company of any size. And, the relative performance of the Russell 2000 Index as compared to the Russell 1000 Index from 1979 to 6/30/2021 shows that individual small-cap stocks higher growth potential pays off in the long run, as small caps have outperformed large caps over time.(1)

Mitigating risk with an ESG overlay

By and large, Wall Street analysts are skeptics. Such was the reception when socially responsible investing (SRI) introduced the concept of limiting an investable universe to values-based themes over 50 years ago. In the decades since—and as SRI has built a long-term track record—investor interest has grown by leaps and bounds with Wall Street trailing begrudgingly behind. As the lens has broadened from values-based investing alone to include the evaluation of corporate data that shines a light on potential risk control and return benefits, the tide has shifted. Today we see a coalescing of investor interest hand in hand with financial institutions recognizing that returns need not be sacrificed in the pursuit of socially responsible investing.

A fundamental concept of sustainable investing is that firms with better environmental, social, and governance issues (ESG) practices tend to fare better over the long run; think of the investment risks posed by poor corporate governance or climate change. To quote Morningstar, “Funds with higher ESG ratings also bested their benchmarks by larger average margins than funds with lower ESG ratings. In other words, there was a better average payoff to investing in funds that courted less ESG risk.”(2)

Applying ESG to small cap

As one might imagine, ESG factor data has been easier to gather for mid- and large-cap companies than their small brethren. With that, SRI and ESG factor scoring’s early days began with the largest companies (for the largest impact) and has been filtering down the market cap size spectrum since. This historical large cap stock focus has served investors well in the past, but if we return to a period of small cap outperformance, it is time to pointedly shift attention to ESG scoring in the small cap universe.

And, as described earlier, utilizing an ESG framework can help mitigate the risk inherent in smaller companies and has yielded higher investment returns over time.

Understanding ESG score bias

Biased scoring on environmental, social, and governance issues may present a distorted picture for ESG investors, making some stocks appear more attractive or less risky than they actually are. Importantly, there are three main varieties of bias for investors to consider related to ESG scoring: industry bias, country bias, and size bias. For example, there is a well-known bias within the large cap space: larger-sized companies generally have higher ESG scores. That is, bigger companies have greater resources to address and report on ESG concerns and factors.

Yet, this bias is not as strong in the small cap space because the relative size difference of companies in the $300 million to $2 billion range is not as great. Bailard’s research concludes that, unlike with large cap companies, ESG scoring bias within the small cap universe is insignificant.(3) This is good news for ESG investors.

For a deeper dive

This summer, The Journal of Impact & ESG Investing published an important piece from Bailard’s research team that examines one of the three main ESG scoring biases. While we encourage you to visit Bailard’s website for the full investigation, in summary, our research supports the view that investors should feel more confident in ESG scores within the small cap investing space without having to worry about size bias.

1 Source: Bloomberg. Russell began tracking the performance of small-cap stocks in 1979. Past performance is not a guarantee of future results.

2 https://www.morningstar.com/articles/1016714/did-esg-pay-off-for-fund-investors-last-year-yes-and-no

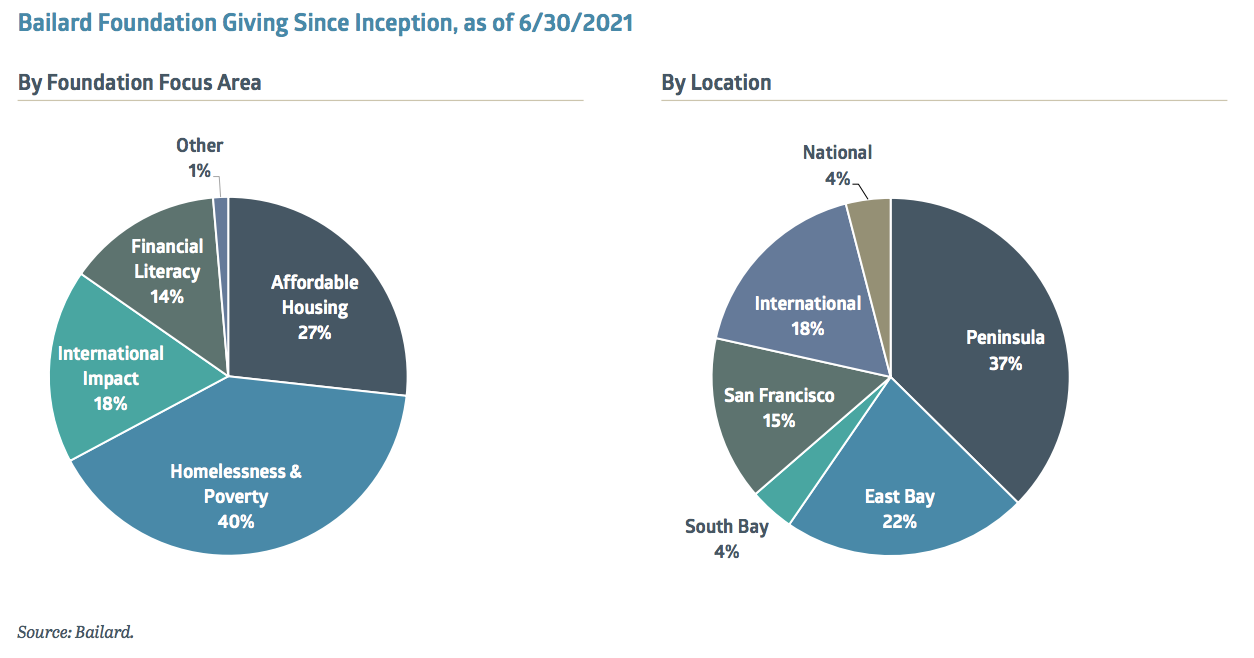

The Bailard Foundation Annual Update

June 30, 2021

Serving the community in which we live has long been ingrained in the values of Bailard and the mindset of its employees. The desire and effort of helping our communities was foundational for the company, but there had never before been a formal channel to organize or amplify Bailard’s service. To solidify the company’s commitment to our communities and increase the impact of what Bailard, its employees, and clients support, the Bailard Foundation was created in May of 2019 in tandem with the Firm’s 50th Anniversary. The Bailard Foundation supports initiatives that the Firm, its employees, and its clients value, as we seek to collectively improve the communities in which we live, work, and engage. The four focus donation areas of the Bailard Foundation are Affordable Housing, Homelessness & Poverty, Financial Literacy, and International Impact projects. Since inception, the Foundation has donated $126,508 to various grantees and remains appreciative of the incredible support received by clients, employees, and friends of the Firm.

Giving Highlights

Pandemic Relief: The pandemic drove a number of the Bailard Foundation’s charitable strategies over the past year. Given exceptional economic need, the Foundation focused on accelerating grant giving within its core values of Homelessness & Poverty and Affordable Housing. The jeopardizing of basic human needs such as shelter and food steered the Foundation’s giving to a number of food banks including SF-Marin Food Bank, Second Harvest Silicon Valley, Alameda County Community Food Bank, and the Food Bank of Contra Costa & Solano Counties. The Foundation also gave to a several San Francisco Bay Area grantees addressing homelessness, including First Place for Youth, Glide Foundation, and Larkin Street Youth.

Black Lives Matter Movement: In regards to the Black Lives Matter movement, the Foundation implemented a number of initiatives beginning in the summer of 2020, starting with a $500 match on any employee gift to an organization that seeks to address and end systematic racism and oppression of Black, Indigenous and People of Color (BIPOC). Additionally, the Foundation gave new contributions in support of Larkin Street Youth Services, Hope SF, and the San Francisco Bay Area chapters of 100 Black Men and 100 Black Women. Through both campaigns, nine organizations received close to $19,000 in grants.

New Grantees: The Bailard Foundation’s new grantees over the past year spanned all four focus areas of Financial Literacy, Affordable Housing, Homelessness & Poverty, and International Impact. A notable new grantee within the Homelessness & Poverty focus area includes First Place for Youth, which helps Bay Area foster youth transition to responsible adulthood. In regards to International Impact, the Foundation granted $5,000 to Raising the Village, which partners with rural communities in Uganda on economic self-sufficiency initiatives, helping lift villages out of poverty. On the Financial Literacy front, the Foundation made a new $5,000 grant to Able Works, which supplies youths and young families with financial education and life skills to help overcome economic hardship.

Grantee Highlight – First Place for Youth

Mission: First Place for Youth helps foster youth build the skills they need to make a successful transition to self-sufficiency and responsible adulthood.

Services: Each year, more than 25,000 young people “age out” of the foster care system and face the prospect of independent living. First Place for Youth steps in to support young people coming of age in the foster care system whose families can’t be there for them. Beginning with safe places to live, program participants are then matched with mentors, housing and employment specialists and youth advocates who help them to persist and succeed in school, build life and job skills, and work toward careers in high-growth fields.

Grantee Highlight – The Samburu Project

Mission: To provide access to clean water and continue to support well communities with initiatives that promote health, education, women’s empowerment and general well-being.

Bailard’s Involvement: In 2020, The Samburu Project drilled seven new wells that now provide clean water to communities in Samburu, Kenya. One of these wells was co-funded by the Bailard Foundation, and will support the 670 people of the Pasinae Self Help Group of Lechur Village.

The Bailard Foundation supports initiatives that the firm, its employees, and its clients value, as we seek to collectively improve the communities in which we live, work, and engage. The Bailard Foundation has a board of directors that is led by chairwoman Terri Bailard, widow of firm co-founder Tom Bailard, and features both select friends of Bailard, Inc. and employees.

Predatory Lending: An Important but Often Overlooked ESG Investment Consideration

More than a year into the COVID-19 public health crisis, it is clear that while lifestyle disruptions were universal, the economic upheavals caused by the virus fell largely on the less financially secure members of society. Anyone unable to work remotely has faced rising odds of layoffs or reduced hours, particularly in lower paying service jobs deemed “non-essential” by authorities.

Human Trafficking: Issue Brief

The modern investor doesn’t often think about slavery. They may even think it ended with the 13th Amendment in 1865. But even as the effects of slavery in the United States still impact the African American community today, modern slavery menaces the lives of millions of people across the globe despite largely being hidden from the public eye or the brokerage statement.

Corporate Engagement Update Q1 2021

We’ve recently been reviewing our proxy voting from last year, specifically the cases where we voted against our third party proxy voting vendor’s standard policy. For example, there was a shareholder proposal put forth at Adobe’s annual meeting, requesting the company to disclose median gender pay gap across race and ethnicity. Bailard voted against the standard policy and management, because “increased disclosure would allow shareholders to fully understand the steps the Company is taking to ensure equitable compensation”. At the end of 2020, Adobe announced that their female employees earn 99% as much as their male employee counterparts. We applaud their disclosure, and look forward to a further disclosure that includes race and ethnicity details.

Chat with the CIO: Shifting Tides in the ESG Landscape

September 30, 2021

Eric P. Leve, CFA: You’ve been in the ESG business since the 1990s Blaine, what’s your perspective on the increased interest from investors?

Blaine Townsend, CIMA®: ESG investing has been around as a truly professional investment offering for 50 years, but in the past 18 months we’ve seen a total capitulation in the market. I think it was a collision of long-held and hard-fought wins by the ESG (environmental, social, and governance) and socially-responsible investing (SRI) community validated by external factors too hard to ignore; I’ll name climate risk, gender and ethnic inequality, and poor corporate governance for just a few. There has come a maturation of thinking, and a recognition that balancing social well-being and economic growth should not be seen as mutually exclusive.

Eric: Let’s spend some time with the first factor you just mentioned. Where does climate rank amongst the ESG factors investors should consider?

Blaine: It is at the top of the list. It has the potential to totally transform markets over the next 10 or 20 years and long-term investors must understand the level of climate risk in their portfolios.

If you’ll give me a moment to elaborate, forward-looking ESG analysis works to assess the materiality of nontraditional data and determine which companies are best prepared to compete in the world ahead. This framework is built on identifying long-term risk factors and then identifying investment opportunities based on these risks.

With respect to climate, scrutiny around the potential long-term risks here has been building like steam in a kettle for some time. Climate scientists were concerned by what their models were showing as early as the 1980s, yet public debate has raged in the decades since.

Eric: So tell me then, why climate now? Is this just a question of stranded assets and exposure to oil and gas majors? Or are there other implications?

Blaine: The growing focus on limiting climate change is expected to decrease demand for coal, oil, and gas, as well as the infrastructure required to get them out of the ground. This can then turn these commodities into “stranded assets” that will never be fully utilized. The stranded assets argument is a good starting point, because all that’s required for that thesis to play out is for regulators around the world to make it harder and more expensive to take carbon out of the ground. That is already happening. The stage is set for further transformation.

2021 has certainly seen growing support for “Net Zero” commitments being made by countries, municipalities, and companies around the world to counterbalance the emissions released with those removed by 2050. To paraphrase the words of the United Nations, for a livable world, these Net Zero commitments must be backed by true action. If market participants genuinely commit to Net Zero and work to limit the rise in global emissions to 1.5 degrees Celsius by 2050, the markets can’t help but be reshaped in 20 years. Energy transition and decarbonization will become massive drivers of capital investment and will reshape the market. For example, there will be entire new segments of the market focusing on transitional energy and carbon sequestration. Net Zero cannot happen any other way.

Eric: Clearly, this could be transformational. So Blaine, tell me what you see next on the horizon.

Blaine: There are solutions that are market ready but not deployed. For example, don’t be surprised if we soon see vertical farming or mandates on buildings to sequester carbon. There will be entire value chains created to support these industries. There will be new tools designed to measure and improve efficiency in business, in the home, and within transportation. Consider that the electric vehicle revolution hasn’t even really started yet. We really don’t even have widespread charging stations and, there’s many yet-to-be built businesses and processes there. Consumer products and consumer behavior will be reshaped by this transition. The industry sectors and market leaders 20 years from now may look nothing like they do today… much like the leadership of the Dow Jones Index has changed so dramatically over the past half a century.

Eric: How is the investing community impacted by the regulatory backdrop on climate?

Blaine: For many of the most important climate related disclosures, the framework is still evolving. The Securities and Exchange Commission (SEC) recognized climate change in 2010 as a material risk that should be disclosed, but the regulators are just now moving toward substantial change. It is a tricky situation because we remain stuck in an era of voluntary reporting on many crucial climate-related issues that are financially material to investors – and the clock is running.

For example, take what are called Scope 3 emissions. These are the emissions related to the entire value chain of a product or service and make up the lion’s share of a company’s emissions. From some oil majors, for example, Scope 3 emissions account for 90% of their total emissions. Very few companies have pledged to disclose their Scope 3 emissions, much less reduce them. And, as I said, if they do disclose them, it is purely voluntary. The good news is that, by and large, the market players want the regulatory regimes to make disclosure mandatory. There is evidence of this in every major jurisdiction around the world. Investors want to know which companies are reporting their emissions, and which aren’t.

The SEC’s comments I mentioned reflect a long and sustained movement by responsible investors who maintain that environmental, social, and governance issues are material to the long-term performance of a stock. By contrast, Wall Street has only recently turned its considerable intellect to this type of analysis, but the shift is gaining momentum. I firmly believe climate will be the single-biggest influence on investment performance out of any other factor over the next 25 to 30 years. It has moved from a political and cultural debate to a reality that companies, governments, and individuals alike are facing.

The fact that non-traditional risk factors like climate change have become widely accepted as real risks to financial and business returns makes sense. It is based on empirical observation, not emotional reaction.

Eric: This makes for a strong argument that the tides have turned. We are seeing the confluence of a growing body of data from companies, increasing investor interest, and a global recognition of the need to address our long-term risks. Thanks, as always, Blaine for leading the charge.