COVID-19: The Latest from All Corners of the Market

In this special COVID-19 update, we begin with an overarching view of the economy and investment markets. Then we dive into a broad array of our researchers across different specialties to glean insights from various corners of the market, from science to tech to fixed income and real estate. While we know these are turbulent times, we also know from our decades of experience that within the markets opportunities will arise. With that, we’re keeping our eyes focused on both the short- and long-term, staying the course for the long run but acting as necessary in the short-term to capitalize on, or avoid, losses.

Economic Cybernation

Jon Manchester, CFA, CFP® | Senior Vice President | Portfolio Manager, Sustainable, Responsible and Impact Investing

Frank Marcoux, CFA | Senior Vice President | Portfolio Manager, Sustainable, Responsible and Impact Investing

The bear market’s record-long winter—eleven years of hibernation—ended in historically swift fashion. In just sixteen trading days, the aged bull market received what appears to be its final rites, taken down by the one-two punch of Coronavirus and Crude Oil. In truth, it was a vulnerable bull market, wobbly on its feet after enduring trade wars and tariffs, an inverted yield curve, and sluggish economic growth, amongst other body blows. The Federal Reserve cut its federal funds target rate three times over the back half of 2019, trying to prolong the expansion, indicative of a fragile confidence in a global economy with some engine problems. A sputtering engine is one thing, but we are now faced with an entirely new shelter-in-place (“SIP”) reality. The SIP-py Cup economy, however transitory it proves to be, has the potential to leave lasting marks, accelerating digital disruption across industries and extending the dominance of those companies on the leading edges of electronic commerce.

As avalanches go, this stock market downturn thus far appears to rhyme with prior bear markets. In the 2008 Credit Crisis, the top-performing S&P 500 Index sectors were Consumer Staples and Health Care. Those same two sectors occupy the top spots now, a month after the S&P 500 peaked on February 19, 2020. At the other end of the spectrum, the Energy sector has borne the worst of the selling, in large part due to the collapse of the shaky OPEC+ alliance. Other cyclical sectors, including Financials and Industrials, have also experienced particularly sharp declines as recession odds climb. This downdraft has been a reminder of our (relatively) new market overlords—quantitative traders. Volatility is back in a big way, and The Wall Street Journal noted recently, “In a dramatic shift since the financial crisis, the market today is dominated by computer-driven investors…” (Why Are Markets So Volatile? It’s Not Just the Coronavirus, wsj.com, March 16, 2020) Those traders relying on algorithms have added fuel to the fire, at times making the selling seem indiscriminate, but they are also creating short-term pricing inefficiencies—opportunities for an active investment style.

We feel our investment approach is well-calibrated for this type of market environment. Risk control is a key focus, whether at the sector, industry group, or stock-specific level. Further, we emphasize high-quality as a factor. The stocks in our core portfolio typically have lower debt ratios, higher credit ratings, and a track record of consistent earnings and dividends. Quality doesn’t matter until it matters, and this is one of those “matters moments”. By paying close attention to balance sheets, cash flows, and corporate governance, we have the luxury of not having to scramble in these market meltdowns to raise the quality scale.

“This time is different” is normally a dangerous phrase to use in the investment world. In the context of COVID-19, though, it seems appropriate. We don’t know ultimately what the economic and social costs of this health crisis will be. We aren’t anticipating a quick recovery, and in fact, the news may get worse before it gets better. That said, with a large-cap portfolio that is tilted toward more defensive, higher-quality companies, one focus of ours in the core segment of client portfolios over the last few weeks has been to force ourselves to think longer-term, post-epidemic, and play offense in addition to protecting downside. We’ve added stocks to our buy list which we think can be secular winners—stocks which will provide upside on the other side of the tunnel. Patience will be required, courage will be tested, but investment opportunities are emerging, and it’s our intent to participate as fully as possible while sticking to our investment knitting.

Tech: Keeping the World Connected

David H. Smith, CFA | Senior Vice President, Domestic Equities | Portfolio Manager, Technology & Science

First, our thoughts and hearts go out to all those affected by COVID-19 both by the virus itself and by the corresponding economic impact, much of which is still to come. The Smith household took a short walk on Saturday—properly social distanced, rest assured—and it was hard not to think apocalyptically on the world as we walked past San Francisco’s boarded up hotel windows and shuttered restaurants. We wish the world a rapid return to relative normalcy. As sector analysts, our world of technology stocks has—perhaps surprisingly, given the elevated valuations prior to the down cycle—broadly weathered the storm a bit better than the overall market. We believe this can be attributed to the majority of tech stocks avoiding the eye of the storm (for example, travel, restaurant, and leisure sectors were some hit the hardest), as well as many large technology companies disdaining the rush to leverage over the last few years and, as a result, entering this cycle with strong, healthy balance sheets. We are very aware that there is more pain to come, particularly as consumers and enterprises retrench and pull back on spending, leading to a possible negative feedback loop. However, part of our job is also to look around the curve, and we believe many of the long-term secular trends that had supported the technology sector are still in place, though perhaps delayed. Here, we want to take a moment and focus on two trends that may have actually seen acceleration in this unprecedented world: remote work and e-commerce.

With the number of states under shelter-in-place orders (“SIP”) rising, there has been a stunningly dramatic shift in enterprise and worker behavior over the past two weeks. In 2018, the Bureau of Labor Statistics reported that forty-two million U.S. workers, or about 29% of the U.S. workforce, had the ability to work from home, and that twenty-one million workers, or about 15% of the U.S. workforce, recently worked from home for at least one full day (https://www.bls.gov/news.release/flex2.t01.htm). Yet, only about 4% of U.S. workers stated that they worked from home three or more days a week on average (https://www.bls.gov/news.release/flex2.t03.htm). We believe these figures, while slight, have been steadily increasing over the last decade; one needs to simply attempt commuting between San Francisco and San Jose on a (normal) Monday to understand the draw of remote work. Over the past two weeks, evidence and experience suggest the trend has exploded. Search activity for ‘remote work’ and similar terms shows a distinct spike in interest over this time period, in part as the workforce adjusts to a new life of working from home.

We note two beneficiaries of this trend. The first is perhaps the most obvious and well covered: the rising popularity of collaboration software, like video conferencing and team messaging. These tools are essential in a remote work world and enable teams to effectively communicate and function. Interestingly, we are seeing these tools used in a variety of unintended ways, from schools holding digital ‘show and tells’ to the author, yours truly, organizing a virtual board game night via video chat.

In addition to collaboration software, we believe that some companies will need to face the harsh reality that they were not as prepared as they needed to be for this disaster. We expect to see a longer-term tailwind in the demand for mobile first communication platforms, next generation support for cloud security, and remote support. Our view is that the shelter-in-place orders are providing a live testing environment for remote work, and even when work returns to ‘normal’, that we will see an increase in technology investment and a spike in employers allowing workers to spend more days working remotely.

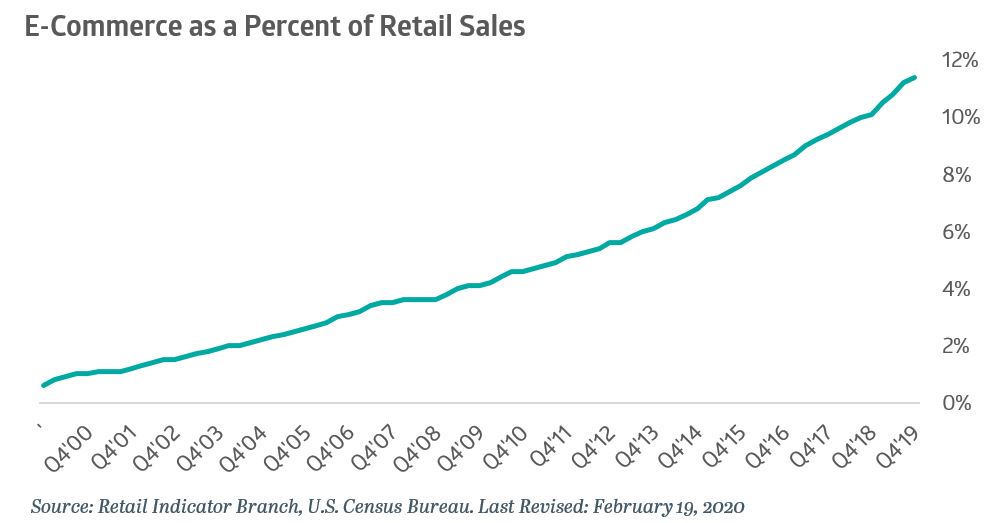

With consumers staying home, shopping from the couch is another clear beneficiary. E-commerce and food delivery app downloads have benefited, and we see the long-term trend of consumer spend moving online accelerating. App downloads for popular food delivery services have seen strength over the past two weeks, and we note that several of the largest e-commerce retailers have announced plans to rapidly increase hiring to meet a surge in demand. While the short term here certainly looks rosy, one uncertainty clouding the horizon is the expected sharp increase in unemployment. Should the U.S. enter a recession, which appears to be becoming increasingly likely with each passing day, discretionary consumer spending for both online and bricks and mortar retailers could experience a headwind.

Finally, we want to add a few notes on uncertainties to round out our thoughts. It is important to ask ourselves whether these accelerating trends are transitory in nature or will result in permanent shifts in behavior. We can envision a COVID-19 free world in which the majority of consumers return to their local grocery store in lieu of delivered groceries. We can see a world where enterprises and workers return to their normal routine and collaboration software is eschewed in favor of in person meetings. As investors, we need to challenge our priors, and these are scenarios we need to be aware of and watch carefully for, particularly as we start to see economic and social normalization. Now, if you’ll kindly excuse me, our grocery order just arrived, and I need to put away the eggs before my next video chat.

Biotech: Learning From the Past; Leading Us Into the Future

Matt Johnson | Vice President, Healthcare Investments | Portfolio Manager, Emerging Life Sciences | Portfolio Manager, Technology & Science

COVID-19 has shone a light on every nook and cranny of our world economy, and healthcare markets are ground zero. “Just in time” global supply chains are causing stress at the frontlines of our healthcare systems. The sourcing of products necessary for our initial response to this outbreak are proving difficult in the pandemic’s early days on American soil. Personal protective equipment, simple reagents for testing of the virus, and even specimen collection swabs are reportedly in short supply. Just to put a finer point on it, your authors’ wife, an infectious disease physician, has resorted to self-cleaning her single-use examination gown! The cheapest, lowest margin items have become choke points in our response to fighting the outbreak. Despite clear missteps in preparedness, we will find our way through the surge of patients with triage methods at hospitals and eventually with ubiquitous testing available throughout the nation, which will allow for the quarantining of confirmed Cornavirus positive patients. There may never be a definitive all clear without herd immunity, however behaviors will change, and we will get along with our lives.

In the meantime, there are rays of light from biotechnology advancements over the last decade that have helped with our response. New sequencing technologies mean scientists were able to characterize this virus in record time. Chinese scientists published the sequence on January 11th. With that information, it has been possible to scan libraries of old and novel therapeutics alike, which have been studied in recent Ebola/SARS/MERS outbreaks as potential treatment candidates. Drug developers have been involved in the response since the initial outbreak began, with multiple drug candidates now in clinical trials across the world. We expect data from these randomized, controlled trials over the coming weeks and months. Looking down the road, the National Institute of Health (NIH) has announced that they have initiated a potential vaccine treatment, with much of the underlying clinical data supporting the effort coming from experiments related to past SARS/MERS outbreaks. While we do not know how effective these therapies will turn out to be in fighting this virus, we are believers in matching modern medicine (rapid diagnostics, targeted therapeutics, and telemedicine) with tried and true techniques of public health measures, such as hand washing and social distancing.

The past decade of scientific breakthroughs has given us a wealth of new biotechnologies, and we are only just beginning to reap the benefits of that knowledge with new products capable of treating devastating diseases. We believe the next decade will bring an even faster pace of innovation for the treatment of all sorts of ailments despite the presence of COVID-19: cancers, cardiovascular disease, metabolic disease, neurological disorders, et al. will continue, and we need to keep striving for the betterment of all our lives. We intend to continue to invest and provide capital to promising companies doing just that.

Fixed Income: With Volatility Comes Policy Response

Linda M. Beck, CFA | Senior Vice President | Director, Fixed Income

The Coronavirus, social distancing, shelter in place, and business shutdowns are causing economic activity to come to a near standstill. Prior to this crisis, investors started envisioning an eventual end to the longest economic expansion in U.S. history, but the Coronavirus has pushed the clock ahead: the recession has begun. Global economic conditions are deteriorating simultaneously with shocks in supply and demand. The timing and amount of policy responses will impact the level of the drop in the economy. Such policy responses are required to keep our financial system functioning during this chaotic time. Policy responses are being compared to post 9/11 when we, as a nation, had to deal with the existing crises and worry about how we were going to pay for it later.

The bond market has undergone a massive repricing as it alters prices to reflect the imminent drop in GDP. The Federal Reserve Board (“The Fed”) has enacted emergency measures to keep the plumbing of our financial system, short-term funding, flowing. Having the playbook from the 2008-2009 Great Financial Crisis has proven to be incredibly useful, and many of those measures are now back into effect while other new measures will be coming shortly. However, even at this speed, the market has viewed the Fed response as too slow. Monday’s announcement of the Fed buying an unlimited amount of U.S. Treasury instruments and agency mortgage-backed debt, as well as the creation of new facilities to support some corporate and municipal debt were positive for the bond market. The moves added some liquidity back to a still highly illiquid market.

Even before Coronavirus hit our shores, the U.S. had experienced a historically long positive fundamental credit cycle that we knew at some point would need to come down in the classic cyclical fashion of the markets. Corporations had been enjoying low funding rates for years. They used the funds to fuel, among other things, mergers and acquisitions, share buyback programs, and dividends. Low funding costs enabled many highly leveraged firms to achieve an investment grade rating, despite weak profits. At the start of 2020, the lowest rated investment grade bonds, those with BBB ratings, represented about 50% of all investment grade credits. This compares to only 25% in the 1990’s. The concern that a significant slowdown in economic growth could push many of those companies to a junk rating is fueling the sharp declines we are seeing in the corporate bond market today. One seminal study by Morgan Stanley showed that a recession could lead to over $1 trillion worth of downgrades from investment grade to junk. The turmoil in oil prices is putting further pressure on energy related bonds. Many energy companies cannot survive if the price for oil remains too low.

Just as the move from slow economic growth to a deep recession arrived suddenly, the response in the bond market has been equally quick. Trading screeched to a standstill as risk positions were reassessed and firms clamped down on long term exposures. Normal hedging procedures proved less effective. Some Wall Street firms also curtailed the amount of risk they were willing to assume as trading teams began working from home, and coordination became more difficult. Individual investors, spooked by both the markets and the virus, reversed previously large inflows to the municipal bond market and became large sellers. Municipal bond mutual funds and Exchange Traded Funds were then forced to sell to meet redemptions, further exacerbating the drop in prices.

However, global central banks’ massive emergency moves are working to relieve some bond market stress. Bond levels have adjusted to much more attractive yields. At these higher levels, there have been more pockets of buying, at least for high quality bonds. We are at an interesting juncture where massive quantitative easing by the Fed (via its bond buying programs) is supporting bond prices at the same time that a large potential fiscal package could push bond prices down and yields (which move inversely to prices) up. Traditionally, large fiscal packages are viewed negatively by the bond market as they result in higher federal deficits. However, the size of the fiscal program, looking to be around $2 trillion for now, is being dwarfed by the monetary program. So the net effect of both these programs should be supportive of bond prices for the short- and intermediate-term.

The News We Might Be Missing

Eric P. Leve, CFA | Executive Vice President | Chief Investment Officer

As we face news on COVID-19 from new perspectives every day, it seems useful to take a bit of a step back to look at some of the major issues that are slipping “below the fold” during this time but should remain major drivers of the global markets this year. Along with that, I will try to give a sense of the scope of what we’re seeing globally and policy-makers’ responses in the wake of the virus-driven downturn.

The value destroyed in global equity markets is hard to fathom, something north of $20 trillion, a number broadly in line with U.S. GDP, or the amount produced by our economy annually. From an economic perspective, the early economic data from China (almost three months ahead of the rest of the world in virus impact) are not encouraging, especially given the nation’s propensity to bias economic data upward. In the first two months of 2020, China experienced a 13.5% drop in industrial production, more than a 20% decline in retail sales, and an almost one-quarter fall in fixed asset investments. It’s also probable that GDP may have declined by 10% in the first quarter. This may just be a hint of what is to come across many global markets where GDP could be hit even harder given the extent and length of anticipated shutdowns.

The policy response has already been huge but the market reaction rather tepid. Europe and the U.S. have announced stimulus that amounts to more than $7 trillion but with only about $1 trillion of that in the form of fiscal support. This is far larger than the combined global response in 2008/2009. But, it is fair to question whether monetary policy can have much impact on a global market with unwilling producers and buyers. Cheaper and more available credit may go unutilized. And so, the world awaits fiscal policy, especially here in the U.S. Several quarters ago in an issue of our economic and investment newsletter, the 9:05, our CEO, Peter Hill, and I talked about the newfangled Modern Monetary Theory. The idea of printing money to finance everything seemed fanciful at the time; now, it seems like the unspoken definition of what we are about to embark upon.

In the midst of this, Russia and Saudi Arabia began a price war in crude oil. At the beginning of this year, oil hovered near $60 per barrel; today, it is struggling to stay above $20. The fates of oil producers (including shale oil producers in the U.S.) will only be exacerbated by weak oil demand as economic activity slows. For investors, this is a double-edged sword. Oil companies will suffer greatly, but their importance in global equity indices has become minimal over recent years: in the S&P 500, oil is now the second smallest of the eleven market sectors, representing just over 2.5% of the Index. Similarly, for developed international markets, it is the smallest sector at just over 3% of the MSCI EAFE Index. The positive is that oil remains critical feedstock for industry around the world, and this price cut will act like a huge fiscal stimulus when the economy finds some traction.

This is also a time when global cooperation seems high, but in the case of China/U.S. relations, the virus has only hardened the adversarial relationship. Last week saw the largest mass expulsion of Western journalists since 1949. Before COVID took over the headlines, the two nations were working on a second round of trade deals to manage the current tariffs. By all accounts, Presidents Xi and Trump are more distant than ever, so any hope for increased trade to bolster the global economy is greatly diminished.

For now, many foreign equity markets (especially in Asia) are performing better than the U.S. on a local basis but are underperforming U.S. stocks due to a strong dollar. It is very common for investors to seek out dollar assets in times of uncertainty. In fact, from early 2008 through early 2009, the greenback rose more than 20% against a trade-weighted basket of currencies. In a little over two years after that it had fallen 17%, providing a tailwind to U.S. investors in international equities. Such a reversal seems likely again when investors engage in more risk-taking behavior. And like in the post-2009 experience, such dynamics can produce strong results both for foreign companies and for U.S. companies, which become more competitive exporters. More generally, while the negative economic and financial impact of COVID is likely to far exceed that of the Great Recession, there will be a strong bounce at some time. And likewise, there will likely be a time several years from now when investors will pat themselves on the back for remaining confident in equities over the long-term.

Stormy Seas Ahead

Preston R. Sargent | Executive Vice President, Real Estate

My how things have changed in a mere five-and-a-half weeks. The S&P 500 Index peaked on February 19, 2020, and the market gyrations (mostly downward) since then have been vertiginous. It is impossible to overstate how violent the reaction has been in debt and equities markets around the globe to the Coronavirus (COVID-19) pandemic. And, as of this writing (March 23, 2020), global markets are still in the midst of upheaval, and there’s no telling where things will settle.

Just as it is impossible to predict how far and wide COVID-19 will spread and the number of lives it will claim, we do not know when the market panic will subside and how much damage it will do to the U.S. and global economies in the process. A few things are certain: no industry will escape unscathed; the healthcare system will be pushed to (perhaps beyond) the breaking point; and the impact on investor psyches and consumer confidence will be profound. The fear is palpable and, in all likelihood, Q2 2020 will mark the beginning of an economic recession, the depth and duration of which no one knows. And because real estate houses the U.S. economy, real estate will get hurt, too. We just don’t know how badly.

At the risk of sounding nostalgic, upon entering 2020 the U.S. economy was in good shape and most economists were expecting more of the same. There were plenty of indicators that would signal reason for optimism—strong wage and personal income growth, historically-low unemployment, persistently positive consumer sentiment, and robust services sector growth— yet the data were not, in Bailard’s estimation, so wildly positive as to justify the market’s initial euphoria in early 2020.

In the “Final Word” section of the Bailard Real Estate Fund’s 2019 Annual Shareholder’s Report written on February 10th, we observed that the markets were exhibiting an insouciance that seemed irresponsible. And we concluded, “though there are still many clouds on the horizon, the profile of those clouds seems to have diminished… however, we must be prepared to be surprised.”

A month ago, the fundamentals (the supply of space and the demand for that space by tenants), were in good balance. Now that it is a near certainty that the U.S. economy will contract, perhaps dramatically, over the next few quarters, the demand side of the equation is in flux. One thing for certain is the need for space by tenants will diminish in the near/mid-term and, in all likelihood, go into reverse. Even before this crisis erupted, construction in all four property types in many markets across the country looked like it would exceed the demand for that space. Now those imbalances will be more pronounced. This will cause vacancies to go up and rents to flatten (or go down).

The other important cornerstone for real estate performance is the capital markets, i.e., the demand for real estate by equity and debt investors. In “normal” times investors are keen on real estate’s income-producing qualities, potential for appreciation, non-correlation with other asset classes, and inflation hedging characteristics. Now that economic growth is in peril, confidence will ebb, and investors will likely require higher returns to compensate for the uncertainty. For most of the past ten years, real estate capital appreciation has been driven to a great degree by capitalization rate compression. Over the past 12 to 18 months, cap rates have held steady, but further compression seemed unlikely. So the only way to get capital appreciation would be by improving operations and growing income. Driving value the old-fashioned way will be limited for a while.

People are fond of saying, “history doesn’t repeat itself, but it often rhymes”. Not sure what the current crisis rhymes with, but certainly nothing in the past 100 years… if for no other reason that the speed with which this has all happened due to our hyper-connected and social media-infused world would have been unimaginable 25 years ago, much less 50 or 100 years ago. There is a thesis circulating which we believe has some validity: because this all happened with lightning speed, once the worst part of the storm has passed, recovery could come fairly quickly as well. If that scenario plays out, the damage to the real estate sector (because it cycles at a different speed than the public markets) could be muted. Until then, however, any real estate connected with travel and leisure, as well as entertainment (e.g., hotels, restaurants, theatres, meeting/convention spaces, and the like) will be crushed. Retail, likewise, will be in for a very tough period until people are comfortable returning to their normal shopping and socializing patterns. Other real estate with longer-dated leases (e.g., multifamily, industrial, and office) will be negatively impacted more or less on a property-by-property and market-by-market basis.

So I finish where I started, without knowing the depth or the duration of the economic contraction to come, it’s impossible to predict with any certainty the damage to real estate.

All that said, the Bailard real estate team believes that in good times and bad, sticking to basics is a prudent strategy:

- Acquire good quality assets at fair prices in solid markets with sound fundamentals;

- Aggressively lease and manage all assets in the portfolio;

- Utilize conservative leverage; and

- Actively tailor portfolio diversification with regard to geographies, life cycles, property types, and economic drivers.

In summary, remain diligent, nimble, and disciplined.

Navigating the Markets with Compassion, Accountability, and Excellence

Sonya Thadhani Mughal, CFA | Executive Vice President | Chief Operating Officer | Chief Risk Officer

Broad based stock market indices have fallen anywhere from 30% to 45%. The sell-off was dramatic: sharp and swift. Looking around us we already see what economic data will be telling us over the next few months and quarters. Economic activity in many industries in the U.S. has reached a near standstill. There is no question that we are already in a recession. The trillion dollar question is how deep will this one be and how long will it last?

It is important to note that this crisis has two elements to it: there’s not only the dramatic hit to the economy which will undoubtedly take some time to recover from, but there’s the emotional and psychological hit as a result of this being a public health issue. Never before, at least in most of our lifetimes, have we had to get used to terms like “shelter-in-place” where millions of Americans are literally confined to the four walls of their homes, making minimal trips out and mostly strictly to grocery stores and pharmacies. Never before have we had to come to grips with not only a loss of income and wealth, but more importantly, the loss of lives. The uncertainty of the data that we have today is making things worse. If we only knew exactly how many people had the virus, we would have a much better estimate of the level of contagiousness as well as the actual death rate. We would be better able to project with greater confidence how many people could get sick, and how quickly our hospitals would get overwhelmed. But we don’t know that yet, so the range of possible responses is wide, from the draconian to the cavalier. The one thing we do know is that markets hate uncertainty. In the face of this uncertainty, they have sold off sharply. It’s a warning sign of catastrophic damage to the economy, but the thing to remember always is that markets lead on the way down and on the way up.

So the question to ask now is should investors run for the hills? Stock prices will always overshoot to the upside when investors are sanguine and will fall far below a “fair” value when investors are most fearful and information is most ambiguous. Economics does a good job giving us the vitals of the economy, but it is a terrible arbiter of stock prices.

Highly-leveraged companies with very low operating margins will undoubtedly suffer and could go out of business during times like this. Our investment focus, however, tends to be on higher quality firms with strong cash flow, high margins, and low levels of debt. The baby has literally been thrown out with the bath water here. While we cannot predict the extent of the economic damage, we know this as professional investors: we cannot time the bottom of the market, but we can keep our eye out for opportunities that have been, and will be, created in this carnage. Acknowledging the uncertainty is paramount, but we cannot let the uncertainty paralyze us. The best we can hope to do is to keep our eyes focused on the beacon at the far end of the horizon, making sure we build and maintain portfolios that will achieve our clients’ long-term goals, while at the same time retaining our clients’ confidence in the interim. This has never been an easy road. For over fifty years, Bailard has managed through more than our share of these. We appreciate your confidence in us to do it again, and hopefully, for your children and grandchildren as well.

This piece has been distributed for informational purposes only and is not a recommendation of any particular strategy. It does not take into account the particular investment objectives, financial situations, or needs of individual clients. All investments have risks, including the risks that they can lose money and that the market value will fluctuate as the stock and bond markets fluctuate. There is no guarantee Bailard or any investment strategy will achieve their performance or investment objectives. The information in this publication is based primarily on data available as of March 23 – 24, 2020 and has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation are not guaranteed. In addition, this piece contains the opinions of the authors as of that date and such opinions are subject to change without notice. We do not think this publication should be relied on as a sole source of information and opinion on the subjects addressed.

All investments have the risk of loss. Past performance is no indication of future results.

Client Letter: COVID-19, the Markets, and Your Team

Dear Clients,

As things continue to change rapidly, all of us at Bailard have been monitoring the situation over the course of this weekend and are writing to update you on measures that we put in place as of today. In this rapidly changing landscape, it is important that we follow the advice of the medical professionals to ensure that we are keeping each of us, and our community at large, as safe as we can. Because of new guidance being provided by federal, state and local authorities, we are instituting a mandatory work from home policy, starting today.

Bailard has invested a significant amount in our IT infrastructure over the past several years. Further measures were taken over the past few weeks to ensure that we were ready for this eventuality, and we are pleased to say that our efforts have worked. All of our employees in our client service, investment and operations teams are fully functional and are able to work remotely from their homes.

This also means that we will not be conducting any face-to-face meetings for the next few weeks, or until the situation shows signs of material improvement. This is somewhat antithetical to our high level of client service, specifically our preference for in person meetings, but it is a necessary step for us to take to keep all of you, and our employees healthy. We are however available by phone or video conference and will continue to communicate with you regularly.

Markets continue to struggle through concerns over COVID-19. Equity investors are anxious to see case counts begin to “flatten out” and, with that, a sense of scope of the pandemic and its economic impact in the U.S. With that clarity, markets will likely rebound. At a tactical level, we remain cautious, but, at the same time, confident that there will be some great opportunities in the coming months. Right now, one of the most important actions we can take for our clients with taxable portfolios is to realize losses. These become long-term assets that can be used to offset realized gains in the future. In most cases, even though we are realizing losses, we are not turning our backs on the markets, but buying “placeholder” assets to maintain our exposure to the market(s).

As we go through these challenging times we will keep you updated.

Warm Regards,

Your Bailard Team

Market Volatility: An Update on COVID-19 and Oil

The past week has seen a further increase in volatility in the markets, primarily due to the COVID-19 concerns. Since the U.S. equity market peaked on February 19th, the S&P 500 has moved more than 3% in a day eight of the thirteen trading sessions. As of mid-morning today we are experiencing the largest daily single downturn, on the order of 8%.

Today’s price action is a reminder that even in the midst of one crisis, drawing most of investors’ attention, other fundamental changes can take place. Last week, Russia refused to agree to oil production cuts proposed by OPEC, sending crude oil prices downward. Over the weekend, Saudi Arabia announced it would slash prices on its crude, thereby exacerbating this price war. Russia’s original intention was to drive the largely unprofitable U.S. domestic oil producers out. Even though these domestic companies have been able to increase U.S. oil production by more than one million barrels a day, they have failed to be profitable. At $33.30 per barrel (the price as of this morning, Monday March 9th), none of these producers can flourish. This level is so low that even Russian companies fail the profitability test, leaving Saudi Arabia with some of the lowest “lifting costs” in the world as one of few areas able to produce profitably. Lower oil prices are a positive for the global economy as petroleum products represent a cost input for many manufactured goods. That, of course, is tempered by the fact that, due to COVID-19, production is already at low levels. More critically, powerful downward moves in oil prices can cause major geopolitical disruptions. This will be a central focus for us.

From a broader macroeconomic perspective, we have few data points that inform us as to how consumers and producers are faring after the flare-up in COVID-19 on February 19th. The likelihood of recessions in the U.S., Europe and Japan have increased. We anticipate downward pressure on earnings with optimistic readings pointing to no earnings growth for the U.S. in 2020. Assuming that, today’s stock prices continue to appear a bit overvalued (but not terribly so).

As previously described, our stance remains cautious but cognizant that markets can easily overreact to events such as these. Though there will likely be opportunities to capture some of these mis-pricings, we don’t feel we have yet reached that point.

Prudent asset allocation strategies have proved their value in this environment. With interest rates heading to all-time lows, bonds have appreciated dramatically this year, providing critical ballast to portfolios.

Our research and client teams are, as ever, focused on balancing risks and opportunities, mindful of short-term disruptions, but focused on the long-term. We are here should you have any questions and we will keep you updated as circumstances change.

This piece has been distributed for informational purposes only and is not a recommendation of any particular strategy. It does not take into account the particular investment objectives, financial situations or needs of individual clients. All investments have risks, including the risks that they can lose money and that the market value will fluctuate as the stock and bond markets fluctuate. The information in this publication is based primarily on data available as of March 9, 2020 and has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation are not guaranteed. In addition, this piece contains the opinions of the authors as of that date and such opinions are subject to change without notice. We do not think this publication should be relied on as a sole source of information and opinion on the subjects addressed. All investments have the risk of loss. Past performance is no indication of future results.

COVID-19: Perspectives and Investment Implications

Global markets are reacting strongly to the spread of the COVID-19 virus. As of this writing, the U.S. equity market, as measured by the S&P 500, is down 13.9% (total return) from its peak on February 19. At the same time, bonds have represented a safe haven with the 10-year U.S. Treasury yield at an all-time low level of 1.16%. Though not significantly, the dollar is down and foreign equity markets are down nearly in line with U.S. stocks.

We wanted to share our perceptions of the COVID-19 virus, not from a public health perspective but based on our decades of experience in the markets and working with clients. Even here however, it is difficult for anyone to try to rationally assess the uncertainty of this continuously unfolding crisis. Contained within the uncertainty are the seeds of a long-observed path of human behavior. Individuals often initially underreact to bad news. When events don’t bear out their insouciance, they can quickly succumb to an overreaction, believing that the worst-case scenario is even worse than current data support. The world may currently be in the phase of over-reaction, while at the same time working hard to assess potential longer-term impacts.

What we do know is that the economic impact of the virus will unfold gradually. The first order effects are those areas of demand that will never be recovered (travel during the Asian Lunar New Year as well as other tourism and near-term consumption). Likely to swamp this are second order issues such as disruptions in supply chains. For example, as compared to eighteen years ago during the SARS epidemic, China has grown fourfold, its factories are integrated into many more supply chains, and global trade is more critical to deliver finished goods to consumers everywhere. The magnitude of the virus’ effect is also derived from human psychology; perceived diminished wealth can lead to lower spending and eventually job layoffs. Consumer demand has become the lynchpin of many economies around the world; a pullback in consumer participation puts a further brake on economic growth.

The most alarming barometer has been the market reaction. Volatility, written off for the past decade, today reached four times its level from earlier this year. That said, even with equity markets down, perspective is worthwhile. The sell-off has been sharp but as of midday Friday has only reverted to the levels of early October 2019, just five months ago. Taking a longer-term view, the S&P 500 is currently up 16.5% annualized since its trough in March 2009; that same measure taken two weeks ago showed annualized results of about 18.3%. Coming into 2020, analysts were expecting U.S. companies to generate earnings growth of 7% for the year. Some analysts now project no earnings growth. Therefore, combining the approximately 14% sell-off in the markets with 7% lower earnings means that stock valuations have broadly come down through this sell-off and are largely less expensive.

Government bond yields have fallen along with equities, bolstering the returns of bond portfolios. Based on market data, the Federal Reserve is back in the picture and likely to be increasingly accommodative this year. Expectations are now for a reduction in the Federal Funds Rate at the Federal Open Market Committee’s next meeting in March with possibly three more reductions before year-end. The value of monetary policy is questionable, and its impact takes several months to flow into the real economy. Its real benefit may be to demonstrate to investors that the government will take action to counteract risks to economic growth. As a result, improved sentiment in the stock market is likely to appear before the real economy recovers.

For fifty years, Bailard has been a strong proponent of diversification. Today’s environment makes diversification’s value clear. Bond prices are up strongly and areas such as real estate may provide some stability unless this downturn becomes extremely protracted. Since early 2009, large-cap U.S. stocks, especially those with high earnings growth, have outperformed the rest of the equity markets in the U.S. and elsewhere. The market may use this set back as an opportunity to positively reevaluate other segments such as smaller and more value oriented stocks. In some cases, we have moved to incrementally more conservative postures over the past couple of weeks. That said, we generally believe our role is to keep our hand firmly on the tiller, recognizing that equity markets can find new footing as quickly as they lost it. Violent periods such as the past two weeks can shift investor perceptions and actions. While we will further reduce risk in our clients’ portfolios if we think it is necessary, we are equally as likely to look for opportunities in the eventual rebound in stocks.

We, like you, remain concerned about the virus’ impact to the world’s population and remain vigilant in our focus of preserving and growing wealth for you through this crisis and always. We, of course, continue to monitor the issue and its impacts to our clients and remain prepared to act with prudence in navigating this situation.

This piece has been distributed for informational purposes only and is not a recommendation of any particular strategy. It does not take into account the particular investment objectives, financial situations or needs of individual clients. All investments have risks, including the risks that they can lose money and that the market value will fluctuate as the stock and bond markets fluctuate. The information in this publication is based primarily on data available as of February 28, 2020 and has been obtained from sources believed to be reliable, but its accuracy, completeness and interpretation are not guaranteed. In addition, this piece contains the opinions of the authors as of that date and such opinions are subject to change without notice. We do not think this publication should be relied on as a sole source of information and opinion on the subjects addressed. All investments have the risk of loss. Past performance is no indication of future results.

The 2020s in Real Estate: Predicting the Unpredictable

Ten years ago, the outlook for the real estate market was grim: After being clobbered by the Great Recession in 2008-09, property values were down about 40% on average. Once the economy struggled back to its feet, one would have expected real estate operations to gradually improve. But for the NFI-ODCE Index to post an 11.4% compound annual return for an entire decade? Unlikely. And yet, contrary to many people’s expectations, the last ten years have been a near-perfect decade for real estate.

the 9:05 Newsletter Q4 2019

This quarter features a thematic edition of the 9:05 by looking back at the 2010s and considering what the next decade holds.

Expectation vs. Reality in Equity Styles

Thomas J. Mudge, III, CFA, Senior Vice President and Director of Domestic Equity Research

December 31, 2019

Diversification is the only free lunch in finance. And it’s no state secret that a diversified portfolio generally includes exposure across the domestic equity styles of large and small capitalization companies as well as those in growth and value lifecycle stages. In the context of diversification and long-term performance, let’s take a moment to walk through one of the historically-unexpected outcomes of the 2010s.

For the first ten years of the 21st century, small cap value stocks trounced the other domestic equity styles, as shown in Exhibit 1. Now, here on the cusp of the 2020s, it has been a different story. Instead of winning, small cap value came near the bottom of the four style types for the decade ending in 2019.

Was this just a case of what goes around, comes around? Because small cap value had performed so much better for a decade perhaps it only made sense that the other equity styles did better more recently? A look at a longer performance history in Exhibit 2 suggests that the most recent decade was not typical. Over the past 90-plus years of available data, small cap value was the clear winner. Moreover, evaluating rolling 10-year periods for the same time frame, small cap value has outperformed the most recent decade’s winner (large cap growth) 80% of the time.

Something happened over the past decade that at least temporarily flipped the historically-natural performance order of things, and most readers can guess what that something is. The past ten years could easily be called the “Tech Decade,” as technology and its applications caused major disruption across the economic spectrum. E-commerce profoundly altered retail shopping behavior, streaming crushed broadcast and cable TV, ridesharing decimated the traditional taxicabs business, smartphones largely replaced both landline calls and letters, and social media seriously wounded actual in-person socializing. Investors took notice and drove technology stocks ever higher, up over 400% for the decade as shown in Exhibit 3.

Lost in the shuffle were small cap value stocks. While unable to match the S&P tech sector’s sales gains, small cap value still handily beat the overall S&P 500 Index’s revenue growth for the period. Yet somehow, this superior revenue growth did not translate into better relative returns. Valuation discrepancies that were wide to begin the period got much wider as the decade unfolded, as evidenced by the price-to-sales ratio. Exhibit 4 shows that the S&P tech sector began the decade trading at a ratio just over 2x sales, and finished trading at well over 4x. The S&P 500 Index overall started the 2010s trading below 1.5x sales, and rose to almost 2.5x. In stark contrast, small cap value stocks (as measured by the MSCI US Small Cap Value Index) began the decade trading at below a 1x ratio and ended in almost an identical position ten years later.

The reason for this discrepancy is relative expectations. The S&P 500 exceeded expectations, with large technology companies leading the way. Yet, tech stocks are comparatively scarce in the world of small cap value and, by definition, large and mega cap tech stocks are missing entirely.

If the largest technology stocks can continue to produce relative revenue gains far into the future, their current substantial valuation premiums may be justified. Historically, investor expectations have tended to rise faster than underlying fundamentals often warrant. Whether that is the case now—or will be in the future—remains to be seen, but it is something for stock market participants to consider.

This past decade saw low and generally falling interest rates, easy monetary policy, low inflation, and historically-low stock market volatility. All of these conditions typically have tended to lengthen investor time horizons and therefore have favored growth stocks. Will most or even many of these favorable tailwinds for growth stocks prevail for another decade? Time will tell.

While smaller companies certainly come with their own risks, some of their historical performance benefits may come from advantages inherent in their size. Small cap companies usually exhibit higher insider ownership percentages that reduce principal/agent problems. Moreover, there tends to be a greater focus on doing fewer things well in addition to a nimbleness and flexibility driven by better communication and less hierarchy, bureaucracy, and red tape.

A company’s return on equity (ROE, a measure of profitability) tends to revert toward average over time. Highly-profitable companies usually attract competition, which generally reduces profitability. Conversely, barely profitable and unprofitable companies tend to lose competition over time, and those that can stay afloat tend to become more profitable as a result.

Think about investors in either high profitability (growth) or low profitability (value) companies over time. Which group is more likely to have their expectations exceeded or is more likely to be disappointed?

No one knows what the future holds, or which asset class or equity style will perform the best over the next decade. There are too many unknowns, and too many possibilities. However, when facing an uncertain future and needing to invest, why not play the odds? According to the wisdom of Damon Runyon: “The race is not always to the swift, nor the battle to the strong, but that’s the way to bet.”

In addition to style risk and the normal risks of equity investments, small cap value stocks are usually more volatile, less liquid, and more vulnerable to adverse business and economic developments than those of larger companies. Past performance is no guarantee of future results. All investments have the risk of loss.

Corporate Engagement Update | Winter 2019

On November 5th, the Securities and Exchange Commission (SEC) voted in favor of a proposed rule that would limit shareholders’ ability to engage management. Ahead of the official vote, the SEC is soliciting public comments through February 3rd. We did submit our comments on the proposed changes.

Bailard Named to CNBC’s FA 100

We were honored to learn we were included on CNBC’s FA 100, a ranking of the 100 top-rated financial advisory firms of 2019. According to CNBC, these rankings take into account a variety of data, including disclosures, years in business, average account size, total accounts under management, number of investment advisors and more. We were ranked #54, from an initial list of 35,511 RIA firms.

The Strength of our Values in Unprecedented Times

Just six months ago, we wrote in the 9:05 about our firm-wide values: accountability, compassion, courage, excellence, fairness, and independence. These values have always been core to who we are and today, in these testing times, they are more important than ever.

Bailard, with our clients, has overcome numerous economic shocks over the 50 years since our founding. And while 2020 has brought us extraordinary, previously-unthinkable times, we are confident we will overcome this too. Within the pages of this quarter’s 9:05, you’ll find the same relevant, measured perspective on the markets and economy that you have come to expect from your Bailard team. We continue to take a long-term perspective on the market, yet are mindful of short-term opportunities to minimize losses or even uncover possible gains. And, as always, we work tirelessly to ensure the needs of our clients are first and foremost.

This unprecedented health crisis presents a unique challenge for we, as humans, thrive on social connection. While the pandemic has in some cases brought generations of families together under one roof, in other cases we are separated and far away. And we cannot see our friends (or at least, not in-person). With that in mind, we thought to share a little of our experience, and you’ll find the back cover of this newsletter offers a peek into our lives as we shelter-in-place.

It shouldn’t have come as a surprise, but we are so pleased to witness the strength of our team during this time. We hope you share in the pride that we feel as our colleagues exhibit not only the excellence you might expect but exceptional compassion for our clients and our communities. We thank you for your partnership and, more importantly, wish safety and good health for you and your families. If you have any questions or concerns and want to discuss more, please reach out to us.

Peter M. Hill

Chairman and Chief Executive Officer

Sonya Thadhani Mughal, CFA

Executive Vice President

Chief Operating Officer, Chief Risk Officer