Country Indices Flash Report – July 2023

All emerging market regions enjoyed a month of results in excess of EAFE’s. While a Fed rate hike cycle typically causes economic distress across emerging economies, EMs look relatively unscathed as the FOMC nears the end of sixteen months that brought the Fed Funds rate from near-zero to 5.5%.

Quarterly International Equity Strategy Q2 2023

Non-U.S. stocks traversed an unusual landscape during the year’s second quarter. Wages continue to drive inflation globally, although the pressure is lessening in the U.S. relative to Europe. Policymakers everywhere need to remain vigilant as inflation is notoriously challenging to defeat. China’s underwhelming economic reopening may help dampen global inflation but also diminish the nation’s imports and exports in the near term. More broadly, emerging markets have weathered the developed world’s rate hike cycle better than history would suggest, potentially leading investors back to this long-ignored sector. Japan remains high in our Strategy’s model rankings, as higher-than-historical inflation may provide a backdrop for stronger spending. Local conditions broadly, combined with an overvalued dollar, provide long-term support for non-U.S. equities.

Quarterly Small Value ESG Equity Strategy Q2 2023

Generative Artificial Intelligence (AI) was a continuing theme in Q2, as interest in stocks exposed to AI has skyrocketed since ChatGPT launched in November of last year. Many investment strategists are enamored by the productivity enhancing promise of AI and don’t feel the hype surrounding it has gotten out of hand (yet). Indices with greater AI exposure trounced those with lesser representation, making Q2 a large cap growth stock paradise, with everything else rising at a lesser pace.

After a lengthy string of rate hikes, the Fed held steady in June but warned of potential hikes later this year should inflation continue to linger. The prospect of eventual interest rate declines gave further ammunition to growth stock enthusiasts, even though the reality was that interest rates rose throughout the quarter, which should benefit value stocks.

Value-Based Healthcare: A Transformative Approach

There’s an alternative to the traditional fee-for-service healthcare model. Ryan Vasilik, CFA, Equity Analyst, sheds light on the opportunities that abound with value-based care.

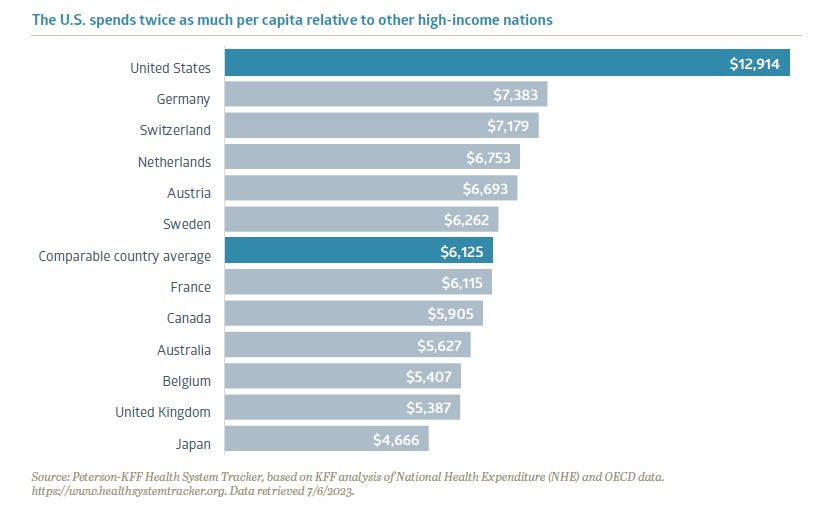

For decades, narratives about the escalating costs of healthcare and its impact on affordability have remained at the forefront of American concerns. Most people either know of, or have personally experienced, financial hardship when dealing with medical issues. In fact, medical bills are the leading cause of personal bankruptcy in the U.S.1 Compared to other industrialized nations, the U.S. spends twice as much per capita on healthcare services. High healthcare spending by itself isn’t necessarily a negative; shockingly though, despite spending twice as much as its peers, the U.S. also ranks dead last on measures like life expectancy and patient satisfaction.

While there are many stakeholders involved in our healthcare system, there is no single villain responsible for driving up costs and there is no silver bullet solution. Fortunately, new healthcare delivery alternatives are emerging to help bend the cost curve and substantially improve patient outcomes. One new healthcare paradigm to address these challenges is value-based care. We believe the emergence of value-based care will revolutionize our perception of the U.S. healthcare system and holds the potential to enhance cost efficiency, patient outcomes, and open new horizons for entrepreneurs and established companies alike.

A Game-Changing Approach

Value-based care (VBC) is a transformative approach to delivering healthcare, where stakeholders compete on the quality of patient outcomes instead of quantity. All parties have skin in the game and are financially at risk if patient results deteriorate. VBC healthcare providers receive a risk-adjusted annual fee per patient from insurance payors and are responsible if patient complications arise. Healthcare providers and payors are aligned to properly diagnose, direct, and treat patients throughout the medical episode, thus focusing on preventative care and keeping patients out of the hospital.

Under this new model, healthy patients and provider profitability go hand-in-hand. The goal for the provider is to generate excess profit by managing patient pools in a more efficient manner. Traditionally, the U.S. healthcare system has employed a “fee for service” delivery model, where providers are paid on patient visits. This model has been criticized due to the potential for conflicts of interest where the provider benefits the more a patient utilizes medical care. Insurance companies complicate the issue, as they are often responsible for covering the medical bills of patients and may attempt to ration care or shift costs to protect their bottom line. Value-based care is a new form of competition that focuses on long-term medical outcomes for patients and lowers costs for payors in a sustainable way. The beauty is that it corrects the downfalls of the fee-for-service model. While fee-for-service treatment is frequently criticized for waiting for a patient to get sick before receiving care, value-based medicine relies on investing in systems to help providers diagnose or even prevent illnesses early and match patients to the appropriate care facilities to improve their lives throughout the healthcare continuum.

Beginning with the PCP

The foundation of value-based care begins with the primary care physician (PCP). Providing concierge-level care, primary care physicians and their team interact with patients up to ten times per year at no additional cost to patients. Doctors spend a greater amount of time with their patients to monitor their health and provide follow-up care to make sure patients are achieving their health goals. These additional interactions are not trivial; for example, doctors found that weighing patients who have congestive heart failure once a day can help identify whether a patient’s heart failure is deteriorating. This additional data can help the patient’s medical team intervene earlier, potentially halt the deterioration, and keep the patient out of the emergency room.

Unfortunately, data has shown that under the current system, many patients use the emergency room as their primary care doctor, racking up thousands in unnecessary medical bills and often leading to an expensive downward spiral. Some of the lowest hanging fruit for cost reduction is directing patients to the appropriate center as an alternative to expensive emergency room visits. Steering patients to lower-cost locations, such as suburban offices instead of city centers or even coming to the patient’s own home, can achieve the same or potentially superior medical benefit at a fraction of the cost. Ultimately, under VBC, a healthier patient leads to less medical spending that needs to be reimbursed by payors, leading to better healthcare outcomes at lower costs.

Nearing an Inflection Point

The value-based care industry has experienced enormous growth over the past few years, and we are now reaching an inflection point. As the healthcare industry gets more comfortable with VBC models, we believe the next evolution will be focused on three key areas: optimizing care coordination, broadening data capture, and expanding VBC to reach new patient populations.

The move towards VBC within specialty chronic conditions, like kidney disease or diabetes, is a logical next step. Managing chronic diseases involves interacting among multiple specialty physicians and teams. By organizing care coordination specifically around these diseases, we can break down information barriers and eliminate redundant treatments.

Payors will increasingly demand clinical studies from drug and medical device companies that not only demonstrate the efficacy of the product, but also quantify the total lifetime savings generated by these products. Companies that present data showing how their drugs or devices both directly and indirectly prevent future complications will earn higher status in formularies.

The principles of value-based care can also be applied to younger patient demographics. Helping facilitate this demographic expansion are private healthcare information technology companies who provide software and patient management insights that enable providers to enter into value-based relationships at minimal financial risk. As healthcare providers and payors accumulate more data, they can adopt best practices and realize the benefits observed in senior populations.

Change is Not Impossible

As a nation, we all have a stake in healthcare reform and improving patient care. The destiny of the U.S. healthcare system is not predetermined, and it would be a mistake to assume that change is insurmountable. Each year, a new class of visionaries sets out to tackle the healthcare cost dilemma.

While still in early days, we believe value-based care can materially shift the U.S. healthcare delivery model. Given the nascent state and dynamic evolution of the model, it presents a golden opportunity for entrepreneurs and investors, promising lucrative rewards for those who emerge as winners. Monumental progress has been made since the beginning days, and we have real world data measured over years that shows VBC works. The shift towards this new model will not happen overnight, but the evidence is clear that our path forward to reimagining healthcare is through value-based care.

1 Bedayn, J. (2023, April 17). States confront medical debt that’s bankrupting millions. AP News. https://apnews.com/article/medical-debt-legislation-2a4f2fab7e2c58a68ac4541b8309c7aa.

2 U.S. Centers for Medicare & Medicaid Services. (2023, April 5). Medicare Advantage Value-Based Insurance Design Model Extension Fact Sheet: CMS Innovation Center. Innovation Center. https://innovation.cms.gov/vbid-extension-fs.

3 King, R. (2022, April 29). CMMI’s Liz Fowler calls for better approach to educating public, lawmakers on value-based care. Fierce Healthcare. https://www.fiercehealthcare.com/providers/cmmis-liz-fowler-calls-better-approach-educating-public-lawmakers-value-based-care.

Country Indices Flash Report – June 2023

Global central bank policies diverged during the month. The U.S. paused rate increases, while Australia, Canada, the European Union and the UK continued to raise rates. Notably, the UK surprised markets by increasing rates another 50 basis points in response to headline inflation at a stubbornly high 8.7%. U.S. year-over-year inflation fell to 4%, its lowest level since March 2021.

Country Indices Flash Report – May 2023

The debt ceiling crisis weighed on equities and currencies globally. All but two EAFE markets declined on a local basis and all currencies (except the pegged Hong Kong dollar) fell versus the dollar in May. The crisis briefly pushed near-term U.S. Treasury Bill yields above 7% for the first time in more than 30 years.

Exploring the Possibilities of Generative AI

Dave Harrison Smith, CFA, Executive Vice President, Domestic Equities, and Head of Technology Research delves into—both massive and more mundane—potential advancements, impacts, and risks as generative AI leaps forward.

“ChatGPT just saved me,” my wife exclaimed earlier this week. As a legal manager she is often tasked with communicating complex issues, and in the past has found that she too often can come off as brusque and overly direct. She found herself spending hours wordsmithing memo introductions to strike a warmer tone while still maintaining a professional manner. This week, she dropped a draft introduction into the prompt box for the generative AI superstar ChatGPT and asked it to soften the tone and spin up a novel, friendlier introduction. Thirty seconds later her memo was complete, and she was thrilled.

While the Artificial Intelligence (AI) field has been under development since the 1950s, over the past year we have witnessed a monumental leap forward in a sub-branch of AI called generative AI. Specifically, the private company OpenAI released a revolutionary interface, ChatGPT, which comprised a powerful large language model (LLM) and a modern chat-based user interface. The readily accessible, easy to use interface—combined with the power of a learning model with hundreds of billions of parameters—had one AI expert saying it was akin to “looking into the face of God.” What has followed has been nothing short of remarkable: ChatGPT became the fastest consumer product to reach 100 million users (in a mere two months), academic scholars and open-source developers have made incredible strides with almost daily breakthroughs in generative AI research, and massive, trillion-dollar companies and well-known start-ups have rapidly pivoted strategies to embrace the potential of generative AI.

ChatGPT saving my wife a half hour of work writing an email introduction may not sound groundbreaking, but it’s our belief that generative AI has the capacity to make a powerful difference in the world. The average individual’s perception of economic progress is unfortunately frequently tied to the business cycle or stock market returns. Ask a person on the street how humanity has done over the past 40 years and the answer may well depend on the state of their local economy. Economists would argue that, in the long run, prosperity is tied directly to productivity growth. An increase in the average output per hour of labor worked means that the economy is growing, with our per capita income similarly increasing. Unfortunately, by many measures, productivity growth has stalled since the early 2000s. Disappointed economists have offered a myriad of reasons for the slowdown, including demographics and the lack of life-changing inventions, like the internal combustion engine, but the growth stagnation has continued unabated.

Enter Generative AI

Through our research, we have come to believe generative AI technology is key to unlocking a step function increase in productivity growth and, longer term, our quality of life. News and social media feeds alike are already flooded with peers using generative AI to save immense amounts of time. Professors are generating the framework of a new paper in hours rather than days. Programmers are debugging code in minutes rather than hours. Marketers are creating content drafts in seconds rather than minutes or hours.

These productivity gains are showing in academic studies, as well. Scholars Brynjolfsson, Li, and Raymond found that access to a generative AI tool increased call center worker productivity by 14% and by 30% for lower skilled and newer employees.1 Kazemitabaar et al found that the productivity of programmers was increased by 1.8x when they were paired with a code generating AI co-pilot.2 Incredibly, we believe we are just scratching the surface of what this technology can do, and we expect to see a Cambrian explosion of uses and products over the coming months and years. In a thought piece from its research team, Goldman Sachs stated that the “…proliferation of consumable machine learning and AI has the potential to dramatically shift the productivity paradigm across global industries, in a way similar to the broad scale adoption of internet technologies in the 1990s.”3 Like the early days of the internet, many of these products will sputter, but we believe the next crop of great technology products is poised to rise from this new ecosystem.

Acknowledging the Ghosts in the Machine

The benefits of generative AI have the potential to be profound. Yet, it is important to recognize the risks as well. The media is already awash with stories of students using ChatGPT to generate essays. While cheating should never be excused, these stories may one day seem trivial to larger threats that are far more dangerous. We are just beginning to grasp the impact of disinformation in the democratized media world of Twitter and Facebook. Imagine now, that bad actors can generate AI optimized content in text, image, and even video form that appears accurate and true. Unfriendly nations and terrorist organizations will gain a powerful new weapon when the cost of generating new falsehoods falls to zero.

Potential Effects of Productivity Change

The impact on employment is another topic of significant debate. We have argued in the past that technological shifts are not zero sum games. If call center employees are 15% more productive, that may mean a company needs to employ fewer call center agents. However, these agents are now able to find employment in other jobs and, from an aggregate standpoint, the overall economy grows. Yet, this line of reasoning can feel heartless and myopic; looking at aggregate numbers ignores the fact that these are real people with real families losing their jobs. “The productivity effects of generative AI are likely to go hand in hand with a significant disruption in the job market as many workers may see downward wage pressures,” according to the Brookings Institute.4

We are reminded of John Steinbeck’s famous work The Grapes of Wrath, where the breakthrough technology of the tractor enabled one farmer to do the work of 15, displacing tens of thousands of poor farmers and sharecroppers. The misery of these families is chronicled in detail, despite the long-term economic growth the technology enabled. It is critical that our society recognizes the pain that frictional unemployment can cause and ensures that proper investments in job training and safety nets are in place.

There is still a great deal of uncertainty surrounding generative AI. The common maxim that we are overestimating the impact in one year and underestimating the impact in ten years will likely hold true. As investors, we need to be aware of the hype surrounding the technology, as it can create bubbles of over-valuation, a la countless transformational technologies in the past. As users and as a society, we need to be aware of the risks and threats that the new technology can precipitate.

It’s our belief that this represents the next great technological evolution and, in the medium to long term, has the potential to meaningfully impact worker productivity and significantly enhance our daily lives, perhaps on par with some of the great technological leaps of the past century. We also believe there will be a significant opportunity set created for entrepreneurs and savvy investors over time. Bill Gates called generative AI the most revolutionary technology he has seen since the graphical user interface,5 which spawned the Windows operating system. Certainly, Gates knows a thing or two about generational technological shifts. We can’t wait to see what the future holds.

1 Brynjolfsson, E., Li, D., & Raymond, L. R. (2023, April 24). Generative AI at work. NBER. https://www.nber.org/papers/w31161.

2 Kazemitabaar, M., Chow, J., Ma, C. K., Ericson, B. J., Weintrop, D., & Grossman, T. (2023, April 19). Studying the effect of AI Code Generators on Supporting Novice Learners in Introductory Programming. ACM Digital Library. https://doi.org/10.1145/3544548.3580919.

3 Goldman Sachs Global Investment Research. (2016, November 14). Profiles in Innovation: Artificial Intelligence. https://www.gspublishing.com/content/research/en/reports/2019/09/04/a0d36f41-b16a-4788-9ac5-68ddbc941fa9.pdf.

4 David Kiron, E. J. A., David Autor, A. S., Sanjay Patnaik, J. K., Ajay Agrawal, J. S. G., Sukhi Gulati-Gilbert, R. S., & Nicol Turner Lee, A. K. (2023, June 29). Machines of mind: The case for an AI-powered productivity boom. Brookings. https://www.brookings.edu/articles/machines-of-mind-the-case-for-an-ai-powered-productivity-boom/.

5 Gates, B. (2023, March 21). The age of AI has begun. GatesNotes. https://www.gatesnotes.com/The-Age-of-AI-Has-Begun.