Country Indices Flash Report – March 2023

Global banking was rocked by failures of two major U.S. banks and the rescue of Credit Suisse by UBS. Regulators protected creditors and provided emergency liquidity, but worries remain about the impact of rate hikes on lenders. Central banks worldwide must now consider financial stability, in addition to inflation and economic growth, when setting interest rates.

The Demand for "Attainable A" Multifamily Housing

Jamil Harkness, Research and Performance Associate, offers a broad introduction to the potential for attractive investment opportunities in a segment of the multifamily property type that Bailard defines as “Attainable A.”

The Bailard real estate team has long believed in the advantages of investing in multifamily properties, mainly for the consistent cash flow, manageable volatility, lower capital intensity, and the asset type’s ability to adjust to broader economic conditions more quickly.

Supply & Demand

In the largest 40 U.S. metropolitan areas, roughly one-third or 4.5 million units of the multifamily housing inventory (defined as apartment complexes of 20 or more units) comprise Class A units. Within this category, the more expensive “trophy luxury A” and “luxury A” tiers represent 11% and 52%, respectively. The lower-cost end of the Class A spectrum, the remaining 37%, represents what the Bailard team defines as “Attainable A” properties.

According to CoStar, multifamily supply and demand dynamics at the end of 2022 favored Attainable A properties. As a result, despite a general slowdown in demand across all segments and geographies in the past year, the vacancy rate for Attainable A only increased by 1%, reaching 6.4% by year-end 2022. In contrast, the vacancy rate for trophy luxury A and luxury A properties increased by 1.2% and 1.1%, respectively, ending the year at 8.7% and 9.2%.

Rents for Attainable A increased 3% year-over-year in 2022, with the average asking rent for all unit types within this segment reaching $1,726 per month. Comparatively, average asking rents for trophy luxury A and luxury A reached $3,425 and $2,250 per month, respectively: rent growth of 2.6% and 2.3%, substantially lagging Attainable A.

Defining Attainable A

The Bailard Real Estate team defines Attainable A as high-quality, well-amenitized, recent-vintage, moderately priced multifamily properties generally located in close-in and first-ring suburban markets. Attainable A differs from trophy luxury A and luxury A in several respects, including design, materials, finishes, amenities, and locational attributes. Exhibit 1 enumerates a variety of features that help frame the similarities and differences of the three Class A apartment segments.

Middle-income renters account for 54.3% of U.S. renters and the majority fall within the 22 to 45 age group, which comprises Gen Z, Millennials, and Gen X. Almost half, 49.6%, either live alone or with roommates. A sample of the kinds of occupations that provide the foregoing levels of compensation are as follows: carpenters, plumbers, firefighters, police officers, office managers, nurses, teachers, sales associates, marketing managers, surgical technologists, IT professionals, project managers, and real estate agents.

Data obtained from Costar indicates trophy luxury A and luxury A one-bedroom apartments in urban or in-fill neighborhoods average $3,000 and $2,100 per month, respectively, making them unaffordable for most middle-income individuals. However, an Attainable A one-bedroom apartment in a first-ring suburban market rents for approximately $1,440 per month. To qualify using the traditional “35% of salary” rent affordability metric, a $49,000 annual income is needed for Attainable A, while $102,000 and $75,000 per year is the baseline for trophy luxury A and luxury A properties.

The Case for Attainable A

Over the past decade, the 40 largest metropolitan areas have seen completed construction of 2.9 million multifamily units. Class A apartments, across all segments, accounted for 86% of these new deliveries. However, only 587,000 Attainable A apartments were constructed, only a quarter of that large Class A pie slice. Many middle-income Americans are experiencing limited affordable housing options.

Despite the modest number of Attainable A apartments completed in the last ten years, the middle-income renter pool remains sizable. In fact, the proportion of middle-income earners in the U.S. has remained stable at around 51% of all workers, versus 52% in 2012. However, due to employment and population growth, the absolute number of full-time working earners has substantially increased in that same period. According to data from the Census Bureau and Pew Research, across the 40 largest metropolitan areas, 3.5 million new middle-income earners were added to the workforce over the past decade. Given the sheer size of the pool of working adults in the middle-income bracket—which is growing and constantly being refreshed by new (and younger) workers entering the labor force—Attainable A product is an attractive and affordable option.

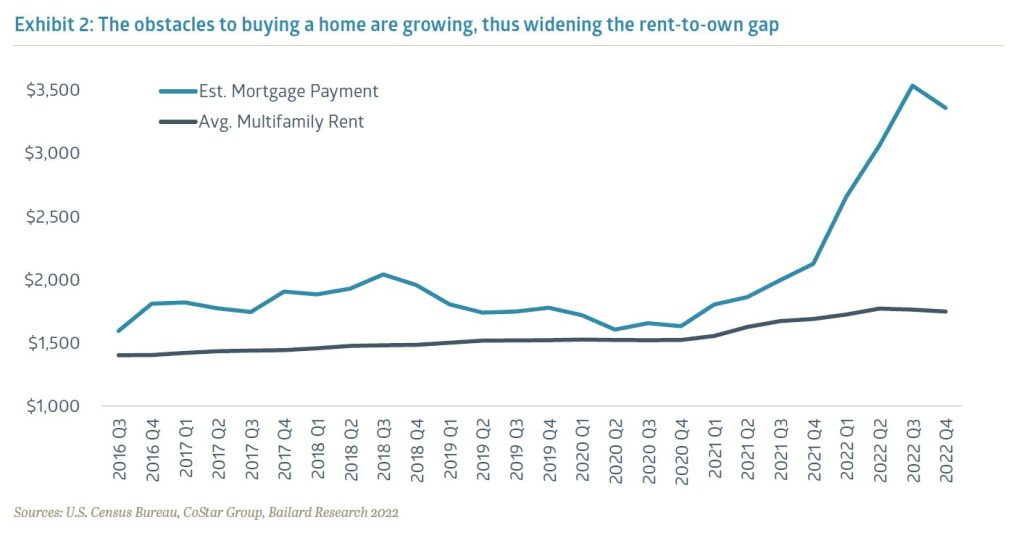

Another crucial factor that has recently expanded the growing renter pool, especially for those in the middle, is the declining affordability of single-family homes. Due to the recent increases in interest rates, the average 30-year mortgage rate reached 6.5% in Q4 2022, up from 2.7% in 2020.1 Average home prices have also increased dramatically (33%) over that same two-year period, from $403,900 to $535,800. Assuming a 90% loan-to-cost, 30-year amortizing mortgage, the average monthly mortgage payment is $1,570 higher than average multifamily rents. The widening rent-to-own gap is illustrated in Exhibit 2; the pool of renters is expanding beyond middle-income earners to higher-income earners who may have previously considered buying a home, but can no longer afford to do so.

Beyond that, local zoning regulations remain resistant to new multifamily projects in favor of single-family housing in nearly every state nationwide. And, last but not least, labor availability has the potential to curtail housing development generally, particularly multifamily construction, as the workforce is not expanding at the rate necessary to meet demand.

Conclusion

Attainable A multifamily properties offer good value within the Class A universe, providing high-quality residential options to millions of renters who either cannot afford, or do not wish to live in, trophy luxury A or luxury A apartments. The Attainable A product segment is well positioned to continue to be a strong performer due to population/demographic trends, favorable supply/demand dynamics, and the unfavorable affordability challenges for single-family home ownership. And, given the expected growth of the target renter pool across the country for the foreseeable future, the need for housing, especially affordable housing, is more acute than ever.

1 https://fred.stlouisfed.org/series/ASPNHSUS , https://fred.stlouisfed.org/series/MORTGAGE30US, CBRE-EA

2 CBRE-EA: Construction Costs Trends, Released November 2022

Our Values in the Midst of the Pandemic

Having accepted the post of CEO in the depths of a pandemic, I was optimistic that once we got past the worst, the next couple of years would at least be on a somewhat more upward trajectory. That was wishful thinking, in hindsight. The last 36 months have been challenging for all investment professionals. From dealing with the pandemic and inflation worries that have persisted longer than most thought, to an aggressive and very hawkish Federal Reserve Bank that raised interest rates at the fastest clip than most of us have seen in our careers, not to mention major market sell-offs in the equity and fixed income markets, and finally to classic “runs on banks” that bring back memories of the 1930s, this has been a challenging time. And it’s important to acknowledge that.

Several years ago, in connection with Bailard’s 50th anniversary, we set about codifying the values that are foundational to our company. Several were not unexpected—like Excellence, Fairness, and Accountability—but two stood out as different and important. I speak often to my colleagues about Compassion. It plays an instrumental role in how we treat each other and how we care for our clients, partners, and community. But, as the world continues to raise new challenges, the value of Courage keeps bobbing up to the surface.

Courage takes many forms in work and in life. Sometimes, Courage means holding steadfast to a sound plan in the face of adversity. On the other hand, it speaks to the willingness to challenge one’s thinking and take calculated risks when warranted. And, at its core, Courage is the backbone to stand up and do what is right, even when it is hard.

Crucially, I find that courage begets courage. When we push outside our comfort zones, we grow professionally and personally. It then compounds, building trust and serving as inspiration and creating a community where we motivate each other in the pursuit of greatness. I am inspired every day by this team. I see how their courage creates a workplace that is innovative and thriving, but also brave and caring.

With the words of Jim Collins in mind, it is impossible to foretell exactly what lies ahead and we, instead, rely on each other. For over five decades, individuals, families, and institutions alike have entrusted Bailard. We have weathered challenges together and forged new paths. The undercurrents of Compassion and Courage run deep and provide the wind at our backs, allowing us to look ahead in preparation for the next challenge.

Fintech: The Engine Accelerating Financial Inclusion

Eric Greco, Equity Analyst, explains how the advancements of fintech companies are helping to provide the unbanked and underbanked with access to a broader range of often-crucial financial services.

While substantial progress has been made in the 15 years following the Great Financial Crisis—largely attributable to socioeconomic gains—significant barriers remain within the U.S. financial services industry. There is a need to address the millions of unbanked and underbanked Americans who lack adequate access to traditional banking services. The unbanked and underbanked populations are disproportionately low-income, minority, and immigrant households. They face a range of obstacles from high banking fees and minimum balance requirements, to limited branch access. These barriers largely keep them confined to an ecosystem outside the conventional financial system.

According to the Federal Deposit Insurance Corporation’s (FDIC’s) 2021 National Survey of Unbanked and Underbanked Households survey, 4.5% of U.S. households (or 5.9 million) were unbanked in 2021, meaning that no one in the household had a checking or savings account. This represents a decline from 5.4% or 7.1 million households who fell into the unbanked category in 2019, the lowest since the survey began in 2009. Additionally, an estimated 14.1% or 18.7 million households were underbanked, meaning that they had a bank account, but also used alternative financial services like money orders or payday loans. This represents a decline from 16.0% or 21.0 million households who fell into the underbanked category two years prior.1

The Rise of Nonbanks

In recent years, there has been a surge in the popularity of digital payments and mobile banking platforms (“nonbanks”) that offer peer-to-peer payment and banking services, such as PayPal, CashApp, (subsidiary of Block), Chime, and Venmo (subsidiary of PayPal). These platforms, which allow users to send and receive money electronically, have been a gamechanger for many individuals who have historically been underserved by traditional banking institutions.

Coinciding with the rise of smartphone ownership in the U.S.—over 85% of adults in 2021 reported smartphone ownership according to the Pew Research Center—digital payments and mobile banking utilization have skyrocketed. Mobile banking usage rose from 15.1% of households in 2017 to 43.5% in 2021.2 This provides a unique opportunity for mobile payment and banking platforms to service the very members of our society who lack basic access to traditional banking services. Look no further than the global remittances commonly used by immigrants to send or receive funds cross-border to family and friends. Visa recently published data showing 53% of consumers are now leveraging mobile, peer-to-peer apps to send funds globally, versus 34% utilizing a physical bank and the remaining 12% sending cash, checks, or money orders by mail.3

Addressing Financial Inclusivity

Fintechs, leveraging AI and predictive analysis tools, have not only made certain features more ubiquitous—such as free debit card issuance, early direct deposit, no account minimums, no monthly fees, and zero overdraft fees—but have also disrupted and triggered significant change across the digitally-enabled-user banking experience provided by traditional banks. Additionally, nonbanks often have less stringent requirements for opening an account than conventional banks. Chime, for example, does not require a credit check to open an account, making it more accessible to those with poor credit or no credit history.

Fintechs have not solved every issue of financial inclusion across the financial services industry, but they certainly have driven innovation, inclusivity, and disruption. These are key characteristics Bailard’s Technology Equity Research team looks for as it screens investment opportunities in the financial services industry.

In addition to offering low-cost financial services, nonbank providers also offer financial education and literacy for the unbanked and underbanked. Many platforms offer educational resources and tools that help users understand financial concepts and manage money more effectively. This is particularly useful for people who are new to financial services and may not have the knowledge or experience to make informed decisions. For example, CashApp offers a free financial education program called CashApp Boost, with tips on budgeting, saving, and investing. Similarly, Venmo provides resources and information on personal finance, such as how to build credit and manage debt. These enhancements can be particularly valuable for the unbanked and underbanked, who often lack access to financial education.

Fintech Product Development

We also note a trend in nonbanks driving financial inclusion through new products that are more tailored to the unbanked and underbanked. Many of these new offerings have provided an avenue towards escaping the predatory payday loan industry. It has not been uncommon for payday lenders and loan sharks to take advantage of financially-vulnerable individuals by offering cash-strapped customers exorbitantly high interest rate loans, ultimately making repayment burdensome.

Anecdotally, it is more common for digital payments platforms and mobile banks to offer loans and credit payment products—such as buy now, pay later—to consumers with limited access to broader banking services. While certain aspects of the terms behind these products have received scrutiny, these loans are typically more favorable and more accessible to low-income individuals. Offerings such as buy now, pay later, are generally structured to allow a consumer to make four interest-free payments every two weeks. Again, while fintechs may not be reinventing the wheel as it pertains to loans and credit offerings, they are forcing traditional banks to optimize their products in order to be more competitive.

CashApp’s free debit card (called Cash Card) offers “Boosts,” allowing users to earn discounts and rewards at select merchants. This rewards-like feature linked to a user’s debit card is still relatively nascent. The benefit of helping users save money on everyday purchases can be particularly valuable for low-income households. As another example, Venmo offers Venmo Credit, which is a line of credit that can be used to make purchases. With often limited access to credit, the underbanked segment is likely to find this especially useful. Usage of Venmo Credit allows the underbanked an avenue to make purchases and build credit history, both of which can greatly aid future financial stability.

All that said, it’s imperative we highlight the importance of ensuring accounts are FDIC-insured in light of the recent volatility in the banking sector surrounding bank deposits. Users of mobile payment and/or banking platforms should be aware that not all banking institutions are insured by the FDIC. Numerous fintechs catering to digital payments and mobile banking are registered banks or leverage partner banks for FDIC insurance. However, this is not always the case and may often depend on the type of product and services being utilized. Nonbank payment companies are typically subject to less rigorous regulatory oversite than traditional banks. Users of nonbanks may be subject to contractual rules and procedures that are not supported by federal statutory or regulatory standards, resulting in fewer of the protections afforded to bank customers.

In Summary

Nonbanks have emerged as key players in promoting financial inclusion for the unbanked and underbanked in the U.S. Through digital payment services, savings accounts, loans, and educational resources, nonbanks have made it easier for individuals to access more traditional financial services.

Make no mistake about it, many of the consumer-friendly banking and financial services brought to market by fintechs have forced traditional financial institutions to reevaluate product offerings and adopt more consumer-friendly policies, while also modernizing user experiences to mitigate attrition across business lines. In our view, this has the potential to continue improving financial stability and increase economic opportunities for millions of Americans who are currently excluded, in some form, from traditional banking services. As such, emerging fintechs and nonbanks are likely to play an increasingly important role in promoting financial inclusion with a strong positive societal benefit for years to come.

1 https://www.fdic.gov/analysis/household-survey/2021execsum.pdf

Meadowville Distribution Center

Meadowville Distribution Center is a newly constructed warehouse/distribution property totaling 353,044 square feet, located in Chester VA, a high-performing submarket just south of Richmond. It sits on 54.3 acres that includes 207 auto parking spaces and an above-market 83 trailer spaces. The Class A property is finished with 36′ clear heights, all concrete truck courts and 62 dock-high doors.

Bailard Named a 2023 Best Places to Work for Financial Advisors

San Francisco, CA (March 2023) – Bailard has been recognized as a 2023 Best Places to Work for Financial Advisors as announced by InvestmentNews this week. The award recognizes firms that demonstrate a commitment to creating a positive work environment.

Bailard was chosen as one of this year’s top 75 firms based on employer and employee surveys delving into everything from company culture, benefits, career paths, and more. This serves as a testament of Bailard’s dedication to its stated core principles of accountability, compassion, courage, excellence, fairness, and independence.

“Our employees are the heart of Bailard, and we are thrilled to receive this honor for the fourth year in a row,” says CEO Sonya Mughal, CFA. “Bailard is fiercely committed to maintaining an environment where our colleagues feel empowered and valued. By encouraging our employees to grow and thrive, both professionally and personally, we bring our best to our clients and our community.”

Bailard’s dedication to providing exceptional service and guidance to clients remains steadfast, and the firm is honored to be recognized yet again by InvestmentNews. This is part of Bailard’s longstanding acknowledgement by the industry as a leading firm and a top workplace. In the past year, Bailard was also named one of the Pensions & Investments’ Best Places to Work in Money Management, as well as CNBC’s Financial Advisor 100.

InvestmentNews partnered with Best Companies Group, an independent research firm specializing in identifying great places to work, to compile the survey and recognition program.

“Every year, InvestmentNews is proud to profile those who prioritize taking care of their own. We applaud this year’s Best Firms for Advisors winners for investing in their most precious resource: their people,” said Paul Curcio, executive editor of InvestmentNews.

To learn more about the InvestmentNews 2023 Best Places to Work for Financial Advisors, please visit bestplacesforadvisors.com.

About Bailard Inc.

Founded in 1969, Bailard is an independent asset and wealth management firm serving individuals, families, and institutions alike. Bailard has built a long‐term asset management track record across domestic and international equities, fixed income, and private real estate, as well as robust, in-house ESG expertise. Through it all—and in line with its core principles and strong ESG mindset—Bailard works with clients to align their financial goals with their values. With over $5 billion in assets under management as of 12/31/2022, Bailard is a majority employee-owned and women-led firm, and a Principles of Responsible Investing (PRI) signatory. A values-driven firm based in the San Francisco Bay Area, Bailard has its own private charitable foundation* and is deeply committed to its core values of accountability, compassion, courage, excellence, fairness, and independence.

About InvestmentNews

InvestmentNews is the leading source for news, analysis, and information essential to the financial advisory community. Since 1998, our standard of editorial excellence and deep industry knowledge has allowed us to educate, inform and engage the most influential financial advisors. Through a weekly newspaper, website, newsletters, research, events, videos, and webcasts, InvestmentNews provides exclusive and up-to-the-minute news, as well as actionable intelligence, that empowers financial advisors to serve their clients and run their businesses more effectively whenever, however, and wherever they need it.

About InvestmentNews Best Places to Work for Financial Advisors

The 2023 ranking was released by InvestmentNews in March 2023. Each year, this project is conducted in partnership with employee survey firm Best Companies Group. Winners are selected from a two-part survey completed by employers and employees. Employers report their organization’s workplace policies, practices and demographics, and employees complete a survey designed to measure the employee experience. Scores from the employee survey represent three-quarters of the weight of the final rankings. To qualify as one of InvestmentNews Best Places to Work for Financial Advisors, an advice firm must have at least 15 employees and have been in business for one year. This award does not evaluate the quality of services provided to clients and is not indicative of Bailard’s future performance. There was no cost for Bailard to enter. In 2023, 75 firms were ranked, with 17 managers in Bailard’s category of 50+ employees. 2022’s ranking including 75 firms, 21 of which were in Bailard’s category. 2021’s ranking including 75 firms, 25 of which were in Bailard’s category. 2020’s ranking including 75 firms, 25 of which were in Bailard’s category.

*The Bailard Foundation has a board of directors that is led by chairwoman Terri Bailard, widow of firm co-founder Tom Bailard, and features both friends of Bailard, Inc. and employees.

Country Indices Flash Report – February 2023

The latest U.S. inflation reading was higher than expected, raising expectations for further rate hikes. Still, it’s 6.4% year-over-year rate was lower than Britain (10.1%) and the Eurozone (8.5%), and slightly falling, unlike Japan.

Economic Brief: Alphabet Soup

This quarter, we feature the economic perspective of Jon Manchester, CFA, CFP®, Senior Vice President, Chief Strategist – Wealth Management, and Portfolio Manager – Sustainable, Responsible and Impact Investing.

March 31, 2023

When U.S. president Franklin Delano Roosevelt (FDR) first took office in March 1933 he was 51 years old and tasked with the monumental challenge of somehow lifting the country out of the Great Depression. He had work to do on nearly every front. At the top of that list, however, was shoring up the nation’s beleaguered banking system. Roughly 4,000 banks had closed in the first few months of 1933 alone, adding to a series of bank runs and failures in prior years.1 One of FDR’s first moves was to declare a national banking holiday, a euphemism for temporarily shutting down the banking system. That was followed days later by the passage of the Emergency Banking Act (EBA), which importantly gave Federal Reserve Banks the right to issue emergency currency to struggling banks in the form of Federal Reserve Bank Notes. His inaugural “Fireside Chat” took place on March 12, 1933 and began with FDR calmly saying over the airwaves, “My friends, I want to talk for a few minutes with the people of the United States about banking.”2

One of those 15 landmark bills was the Banking Act of 1933, enacted that June. It established the Federal Deposit Insurance Corporation (FDIC), another of the alphabet agencies, and a particularly critical one viewed from the lens of today, 90 years later. Informally called the Glass-Steagall Act after its sponsors—Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama—its main purpose was to separate commercial banking from investment banking. Interestingly, the provision that created the FDIC was much more controversial, even drawing veto threats from FDR.4 He signed the bill, however, and the FDIC was born, with deposits insured up to $2,500 initially at member banks. That coverage was soon doubled to $5,000 in 1935 and is $250,000 today.

The sudden demise of both Silicon Valley Bank (SVB) and Signature Bank in March 2023 were stark reminders of both the importance of FDIC insurance and its limitations. As the second and third-largest bank failures in U.S. history, trailing only Washington Mutual in 2008, government officials determined the one-two punch required a new approach to stabilize the banking system. In a joint statement between the Treasury department, the Federal Reserve, and the FDIC, it was announced all depositors would be made whole as a “systemic risk exception.”5 In other words, the $250,000 FDIC insurance cap was waived, in an effort to prevent a widespread banking panic. The FDIC has travelled a great deal from its humble roots as a late add-on to the Glass-Steagall Act.

Available for Sale

Whether the banking turmoil ultimately proves a tempest in a teapot seems largely dependent on the same variables we’ve been discussing for a while now: inflation and interest rates. Persistently high inflation and a sharply inverted yield curve is not the desired formula. Shortly after the bank failures, the Federal Open Market Committee (FOMC) decided to continue the inflation fight by raising the target Fed Funds rate to an upper limit of 5.00%. Some expected the Fed to pause in the wake of the banking instability, but in their statement the Committee said they remain highly attentive to inflation risks. They did acknowledge that “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation.”6 Meanwhile, longer-term interest rates declined in March. The benchmark 10-year U.S. Treasury Note yield fell from nearly 4% at the beginning of the month to below 3.5% when the first quarter hit the finish line.

Nonetheless, the 10-year U.S. Treasury Note yield remains well above its levels from 2020-21, when it didn’t top 2% and spent much of 2020 below 1%. Therein lies a significant part of the problem for Silicon Valley Bank and other banks who invested heavily in low-yielding government paper during that time frame. According to the Federal Reserve Bank of St. Louis, just prior to the pandemic, roughly 20% of bank assets consisted of investment securities – primarily mortgage-backed and U.S. Treasury bonds.7 By the end of 2021, security holdings had increased to 25%, and many of the purchases were longer maturity bonds, which are more vulnerable to rising interest rates. When Silicon Valley Bank depositors fled in mass, the bank was left technically insolvent due to significant losses on the bonds in its investment portfolio. Although you can argue that uninsured SVB depositors were acting rationally, it brings to mind the famous quote often attributed (perhaps wrongly) to famed British economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

The tighter credit conditions mentioned by the Fed could pose a challenge for economic growth and corporate earnings. Notably, after an enormous spike in money supply during 2020—as measured by M2, which includes cash, bank deposits, money market funds, and other types of deposits readily convertible to cash including certificates of deposit—it is now falling at the fastest rate since the 1930s.8 This can be partly attributed to a normalization of money supply following the extraordinary fiscal and monetary stimulus measures during the pandemic, but it is something to monitor as 2023 progresses.

Higher borrowing rates and tighter lending standards have the potential to dampen economic growth in a hurry. The Chicago Fed’s National Financial Conditions Index takes into account 105 indicators of financial activity, a wide variety of interest rate and credit spreads, plus other metrics. It has been moving higher over the past year, indicating tighter financial conditions, which the Fed wants to see for the inflation fight, but runs the risk of inducing the much anticipated recession.

Market Incongruences

While the yield curve continues to suggest a slowdown lies ahead, equities shrugged off the banking tremors and put together a surprisingly strong first quarter. In fact, in case your phone didn’t notify you, the tech-heavy Nasdaq 100 Index hit bull market territory near the end of March. The Standard & Poor’s 500 Index returned 7% price-only in Q1-23, with last year’s sector laggards—Communication Services, Technology, and Consumer Discretionary—the leaders as part of a fairly strong rotation into growth stocks.

The equity market’s resilience seems underpinned by a familiar carrot: the promise of lower interest rates. According to the CME FedWatch Tool, Fed Funds futures are now pricing in a greater than 50% probability that the FOMC pauses at 5.00% over the next two meetings in May and June, respectively, before potentially cutting the target rate in the back half of 2023.9 The highest probability currently assigned to the December FOMC meeting is 4.25%. This rising expectation that the Fed will reverse course has encouraged investors to move into longer duration, growth stocks.

History shows that equities tend to perform well following a peak in the Fed Funds rate. This doesn’t hold 100% of the time, however, and there are reasons to be cautious this time around. Inflation isn’t kicked yet, for starters. The Consumer Price Index (CPI) was still running at +6.0% year-over-year as of February, and the Personal Consumption Expenditures (PCE) core price index at +4.6%. Both have improved, but the Fed knows it isn’t time to declare victory yet. They may be able to pause, but the futures market could be mistaken in projecting a lower Fed Funds rate this year. Equity market valuations are another potential headwind. The S&P 500 Index closed Q1-23 at nearly 19x projected 2023 operating earnings. The excess valuation levels of 2021 have been corrected, but U.S. large-cap stocks are not cheap. In fact, Goldman Sachs Research said in late March that the S&P 500’s forward valuation ranked in the 82nd percentile since 1980.10 Other areas of the equity markets are less demanding from a valuation perspective.

With the fixed income and equity markets offering contrasting signals, it would seem one group of investors has to be wrong, assuming returns don’t move in tandem as they did in 2022. The odds appear more stacked against equities given restrictive monetary policy and what’s expected to be a more cautious lending environment, plus modestly elevated valuations as a starting point. Economic growth in the U.S. may be muted. The Conference Board’s Leading Economic Indicators (LEI) Index declined for an eleventh-straight month in February 2023. Per the release: “The Conference Board forecasts rising interest rates paired with declining consumer spending will most likely push the US economy into recession in the near term.”11 They expect just 0.7% real GDP growth this year.

It is safe to assume that FDR would strike an optimistic tone at this moment. Perhaps we could all use a genial Fireside Chat to remind us that the employment picture is exceedingly strong, housing prices were up 3.8% year-over-year in January, according to the S&P Case-Shiller Home Price Index, and the banking system remains sound in part thanks to an alphabet agency created 90 years ago. This doesn’t look like another credit crisis, but even FDR would admit there are obstacles to overcome if risky assets are to perform well.

1 “The First Fifty Years: A History of the FDIC 1933-1983,” www.fdic.gov

2 FDR Fireside Chat, www.fdr.blogs.archives.gov, 3/12/1933

3 “Safire’s Political Dictionary,” William Safire

4 “Banking Act of 1933 (Glass-Steagall),” www.federalreservehistory.org

5 “Joint Statement by Treasury, Federal Reserve, and FDIC,” www.federalreserve.gov, 3/12/23

6 “Federal Reserve issues FOMC statement,” www.federalreserve.gov, 3/22/23

7 “Rising Interest Rates Complicate Banks’ Investment Portfolios,” www.stlouisfed.org, 2/9/23

8 “Column: US money supply falling at fastest rate since 1930s,” www.reuters.com, 3/30/23

9 FedWatch Tool,” www.cmegroup.com, 4/4/23

10 “US Weekly Kickstart,” Goldman Sachs Research, 3/24/23

11 “LEI for the U.S. Continued to Decline in February,” www.conference-board.org, 3/17/23