Bailard Named to Financial Times’ ‘300 Top Registered Investment Advisers’ for Third Consecutive Year

Bailard is pleased to announce it has been named to the 2019 edition of the Financial Times 300 Top Registered Investment Advisers for the third consecutive year. The list recognizes top independent RIA firms from across the US that have demonstrated excellence in six areas: assets under management (AUM); AUM growth rate; years in existence; advanced industry credentials of the firm’s advisers; online accessibility; and compliance records…

Corporate Engagement Update | Spring 2019

In early May of 2019, we attended the Ceres Conference in San Francisco. The conference convened over 700 attendees including investors, policy makers, and non-profits. The purpose of this annual conference is to reaffirm the business case for sustainability, share best practices, and learn about leading innovations. A key theme of the conference was how to evaluate and act on water risks in investment portfolios.

We continue to be involved with the Climate Action 100+ initiative, which engages the worst greenhouse gas emitters on a global scale to drive clean energy adoption. Many of the targeted companies have been very cooperative with these ongoing engagements thus far. We look forward to the Annual Progress Report next quarter.Read more

the 9:05 Newsletter Q1 2019

Inside we visit whether the dismal science has become more dismal; if the bull market at ten is aging gracefully or is over the hill; emerging markets’ coming of age; how to listen to the real estate market; and our view on economic and market performance.

Standardized Environmental Investing Reporting

The Bull Market at Ten: Aging Gracefully, or Over the Hill?

Thomas J. Mudge, III, CFA is a Senior Vice President and Director of Domestic Equity Research at Bailard

March 31, 2019

The current bull market celebrated its tenth birthday this March. The reason people find that significant has a lot to do with the anatomy of the investors that have participated in the market’s rise.

Human energy and focus are both limited resources; mental and observational shortcuts save precious brainpower for other pursuits. One universal shortcut is our reliance on round numbers. It is easier to remember round numbers and they offer us satisfactory approximations of necessary information without overtaxing our brains.

Humans primarily count in base 10, and the reason why can be grasped by your fingertips. Our tendency to focus on and assign importance to anything that is a 10 or a multiple of 10 is why we’re inordinately focused on this otherwise arbitrary anniversary. So, can we at least learn something now that we have chosen to expend the energy to direct our gaze toward the stock market?

Defining a Bull Market

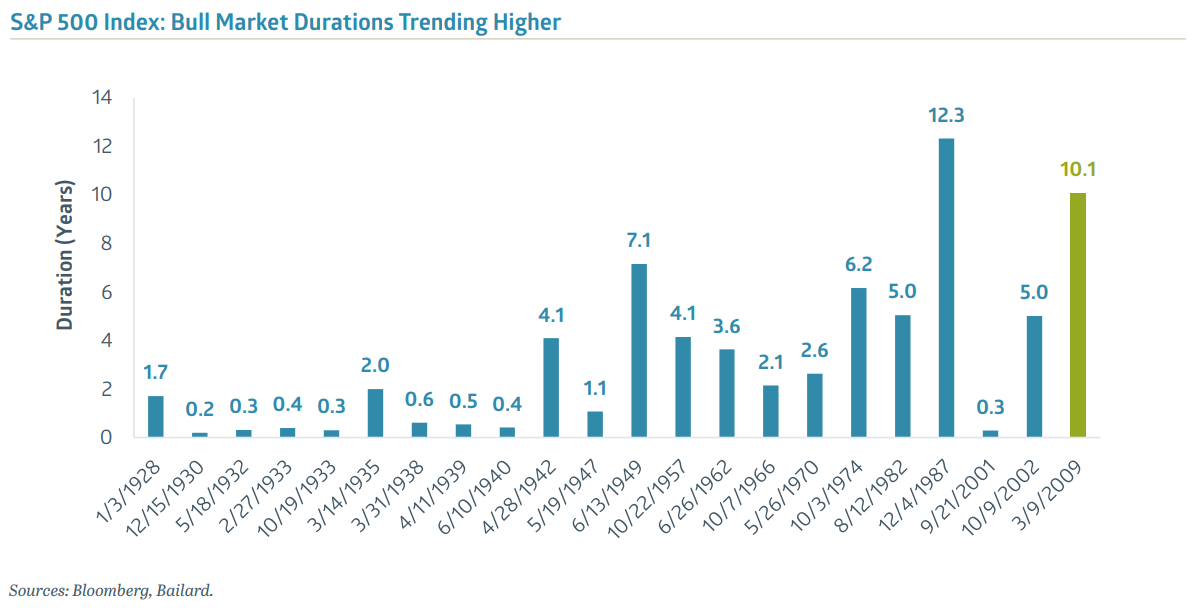

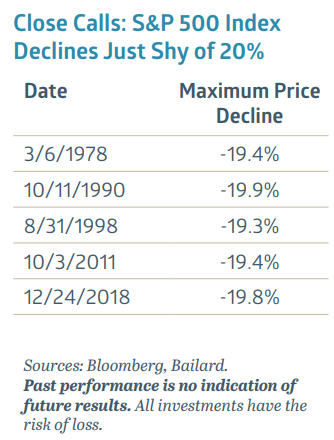

The commonly accepted definition of a bull market is a 20% or greater rise in the price of a group of stocks uninterrupted by a price decline of 20% or more. Ninety-one years of price data for the S&P 500 Index show 22 bull markets with an average duration of 3.2 years. The longest bull market lasted 12.3 years and the shortest was a brief 2.5 months. By this measure, the current bull market is the second longest ever and has lasted far longer than the 3.2-year average.

I’ll pause to point out that the 20% gain and decline definition of a bull market again uses round numbers.

In this case, that may hide as much as it reveals. The table at right reflects times when the market declines fell just shy of ending a bull market at that 20% decline cutoff.

Many investors view the S&P 500 Index as a proxy for the overall U.S. stock market but the basket of 500 public companies represents a large cap, growth-tilted slice of the entire market. This distinction is important because this portion of the market does not always move in sync with rest. While the S&P 500 Index is—by the +/-20% definition—still in a decade-long bull market, the Wilshire 5000 Total Market Index (a much more complete representation of the overall stock market) peaked in September of last year. This 5000-member index entered a bear market in late December 2018 and has rallied into a brand-new bull market as of late February 2019.

Regardless of how you define a bull market, stocks have risen substantially over the past ten years, with the S&P 500 Index returning over 17% annually over that time, far above its historical average of 10% per year (price change only). Is this a market long overdue for a major correction, or one just hitting its prime?

Perhaps dabbling in another human tendency of anthropomorphizing (or assigning human characteristics to non-human objects or animals) may reveal the bull market’s currently condition and potential fate? Just as baby boomers wistfully ask if “60 is the new 40” when it comes to life quality and expectancy, could “ten be the new seven” when it comes to bull markets?

Examining Wellness and Longevity

While chronological age is certainly a contributing factor to a person’s general health and eventual demise, the concept of biological age has gained acceptance as an important determinant of wellness and longevity. Diet, exercise, genetics, exposure to risk factors and medical treatment are just some of the influences that may differentiate between what the calendar indicates and the mirror reveals. People are generally living longer and healthier lives than at any time in history. The current bull market is long in the tooth from a chronological standpoint; could it be similarly blessed with a significantly-younger biological age?

A checkup of sorts may help to reveal just how biologically old this bull market really is. Just as people need nourishment, so does the stock market. The fuel that feeds stock prices is earnings growth, which has been positive and largely stable through most of this decade. Though productivity gains can help, the primary source of earnings growth is economic activity. A strong economy spurs robust earnings growth while a weak economy slows, or even shrinks, it.

Economic cycles are typically longer now than they have been historically and, if the current economic expansion lasts through June of 2019, this cycle will become the longest in U.S. post-war history. Due in some measure to either deft or fortuitous moves by central bankers to regulate economic activity, the boom-and bust pattern of the past has been altered in favor of longer expansions that should accommodate longer bull markets. Recently, earnings growth has slowed and brought predictions for lethargic results through the end of the year. A reacceleration in earnings may be needed to keep this bull market in good health.

Just as baby boomers wistfully ask if “60 is the new 40” when it comes to life quality and expectancy, could “ten be the new seven” when it comes to bull markets?

On the other hand, major risk factor exposures for people include smoking, excessive stress and accidents. All are bad in isolation and can trigger a cascade of other problems. Similarly, primary risk exposures for stocks include uncertainty, negative news and excessive enthusiasm. Uncertainty is ever-present but stoked by events like wars (trade or otherwise), politics, market volatility or any sort of rapid change. Negative news can be market specific, industry or economy wide. Beyond that, natural or man-made disasters, criminal behavior, accidents or simply poor or worsening corporate results can all cause investors to reassess their situations. Excessive enthusiasm usually manifests itself either through an unsustainably rapid rise in stock prices, historically high relative valuations, or both.

The bull market’s check-up reveals limited symptoms from these risks. Uncertainty has continued to be quite low, as measured by VIX, the Chicago Board Options Exchange Volatility Index that gauges the market’s anxiety level. Negative news has been sporadic and not pervasive. Enthusiasm has generally remained contained when measured by price trends or by valuation measures: the S&P 500 Index’s current price level below that of six months ago, its price-to-earnings ratio is very near the average level of the past 35 years and its earnings yield is well above the Ten-Year U.S. Treasury yield.

In Search of Treatment

Medical treatment for people can soothe, or sometimes entirely cure, ailments. For the stock market, excess monetary liquidity—driven by central bank quantitative easing (QE) and historically-low interest rates—works in a similar fashion. Spurred by the GFC, central banks flooded the market with liquidity in order to reduce panic and restore order. With the Federal Reserve (the Fed) aggressively buying bonds, cash has flowed into investors’ hands. Low interest rates made alternative investments like cash and bonds appear relatively unattractive. Eventually, stocks remained as the only liquid asset providing either yield, return or both. While the Fed kept buying, the cash kept coming. And, just as certain medications can reduce anxiety, so too can regular doses of liquidity help to keep the stock market calm and rising.

While the Fed continues to play doctor, its range of treatment options has been reduced to mostly palliative care. Interest rates that have been generally rising for several years are now well above their historical lows. The Fed is also eager to unwind some of those past bond purchases it made during quantitative easing, essentially to restore its arsenal if required to step in again in the future. Should the market need treatment, the Fed may not have a complete cure this time.

After a thorough examination, a reasonable diagnosis seems to be that—while no longer young—the bull market remains reasonably healthy for one of such an advanced calendar age. Circumstances can always change quickly but, as of this moment, ten really is the new seven for this bull market.

Q&A: Has the Dismal Science Become More Dismal?

This quarter, Eric P. Leve, CFA, Bailard’s Chief Investment Officer, chats with the firm’s CEO, Peter M. Hill about the perils of economic predictions.

March 31, 2019

The halls of higher learning can be glorious.

Except for economists. Their science has been called dismal. Their outlook is often dreary. And they are so often wrong.

Eric P. Leve, CFA: Many of us at Bailard are schooled in economics. Yet, we chose to pursue finance, which affords the luxury of picking among economic insights for the few indicators that actually translate into investment outcomes. Still, we are all consumers, residents and savers, all the things economists would call economic agents and the broader economy does affect us day-to-day. More than any time in the past century, the litany of economic theories has broadly failed to describe life after the Great Financial Crisis (GFC). Here, Peter and I ruminate on that and come to some conclusions as to the sources of this failure.

Peter M. Hill: Eric, a useful intro but I think the failure goes far beyond this post-GFC era. While the U.S. believed it had beaten the 1960’s business and economic cycle through Keynesian tools (namely, counter-cyclical fiscal policy), back home in Britain we were experiencing what would later become known in the U.S. as stagflation, or the combination of low growth and high inflation.

This was something deemed unlikely by Keynesian thinkers. It was a far cry from the levels of inflation and severity of stagflation experienced in both nations in the wake of the 1973 oil embargo.

Eric: You’re right. And that 1970’s experience also slayed the idea of the Phillips Curve: a trade-off between unemployment and inflation. This “death” of the Phillips Curve seems to describe a lot of economic theories. These theories get promulgated as a “law” of economics. Then real-time experience leads economists to recognize that the “law” is simplistic, with a limited scope or time-frame to evaluate true efficacy.

Peter: Even further, it’s funny how some of these theories get completely flipped around. Economists used to talk about “crowding out,” or the risk that indebted governments issuing too much debt would push interest rates so high that corporate borrowers would be crowded out by the interest rate levels. This would result in the government needing to again issue more debt, thus reducing the economic growth that may have been generated by that corporate borrowing. Now, it’s the inverse. We talk of “crowding in,” or the idea that, in times when economic growth is tepid, consumers and corporations rein in their spending out of fear. Government spending leads to an increase in Gross Domestic Product (GDP), which reduces the fear and brings back those animal spirits. For me, that’s a theory that sounds a lot like Keynesianism rehashed. And it certainly hasn’t passed the sniff test any time in my life.

One knee-jerk version of the crowding-in theory might be TARP (the Troubled Asset Relief Program), a program begun in the weeks after the demise of Lehman Brothers in autumn of 2008. At its peak, TARP had made loans or investments totaling more than $400 billion1 dollars to most of the major banks in the U.S., American International Group and two of the major U.S. automakers. It undoubtedly staved off some bankruptcies and provided some succor during the worst financial crisis since the Great Depression, but it is very difficult to tell if it produced a net benefit to U.S. GDP.

Eric: This brings us to the economic theory flavor of the day: Modern Monetary Theory (MMT). This one’s a non-starter from the beginning. MMT promises the world and has been promulgated by the media but yet rests on no economic orthodoxy. The theory posits that a government can create full employment by printing money and pushing its economy to full capacity without the messiness of collecting taxes. Only when the government’s Delphic oracle sees inflation on the horizon does the government then hit the brakes on the economy by imposing taxes and selling bonds to draw all those excess dollars out of circulation. Call me simple, but I can’t imagine a politician with the will to pull that lever. It defies both common sense and human behavior. That said, the seeds of MMT are painfully obvious. In 1962, the richest 1% of Americans and the bottom 90% had an equal share of the American pie, each about 33%. According to the National Bureau of Economic Research, as of 2016, the 1% held 40% of the country’s wealth and the 90% held barely over 21%. Income disparities have driven these wealth gaps as labor’s share of the riches have diminished relative to those that have accrued to capital. Policy may be able to ameliorate some of that but, through industrial revolutions of the sort we’re currently experiencing, income disparities often lasts for a generation.

Peter: Perhaps inflation is an even bigger issue for these theories. Where has it gone? Japan’s equity bubble burst late in 1989 and began a five-year path to near-zero inflation, a level it has now been stuck at for more than 20 years. Japan’s “lost decade” has become a lost generation. In that period, the rest of the world looked on with measures of schadenfreude as their own economies and financial markets continued to hum along. The GFC turned out to be a similar watershed event for the U.S. and Europe which—in spite of exceptionally-loose monetary policy—have been unable to engender either growth or inflation since then.

Eric: I think the Western world has caught up to Japan. The rapidly-aging Japanese population was a demographic time bomb that only preceded the rest of the developed world by 20 years. As consumers age (with fewer children born to replace them and/or restricted immigration), an economy’s average age also rises. Older people tend to spend less and to bias their investments more to bonds than to equities. These forces together can lead to endemically lower interest rates. Economists now think the “neutral rate of interest,” the level of short-term interest rates at which an economy experiences full employment and stable inflation,2 is much lower than it has been for most of modern history. And, given current demographic trends, it may stay low for a very long time. This may mean the traditional economic chestnut where rising levels of debt lead to higher interest rates may not play out in the short or medium term. In this case, a fresh perspective on the economic landscape is not favorable for savers: a scenario with continued, rather low interest rates coupled with the risk that future rates could spike higher than traditional models might have expected. A possible catalyst for that is the incremental changes in central bank balance sheets away from holdings of U.S. Treasury debt into other currencies and gold.

Peter: Thanks, Eric. An interesting conversation but, as you and I know, predicting economic outcomes is a very tough game. Even doing it well doesn’t necessarily tell us all that much about other markets, like equities. So far, this low interest rate environment has been a strong tailwind for global stocks, and may well continue to be.

Real Estate: Listening to the Market

Ronald W. Kaiser, CRE is Bailard’s Director of Real Estate Research

March 31, 2019

Having been with Bailard since the firm’s founding 50 years ago, I understand that long-duration “market tops” late in the cycle can be frustrating times. We know that the deeper we are into an economic expansion, the closer we get to a correction. So with a downturn potentially lurking around the corner, we certainly don’t want to rationalize an investment just before “the music stops.” We’ve identified target markets with good population and job growth, upward trending rents and balanced supply/demand fundamentals. Yet, the vast majority of investment opportunities don’t meet our return targets.

Where else should we look?

You listen to the market.

Cap rates in cities like San Francisco and Seattle have settled at historic lows of 4.9% and 4.6% (Office) and 3.6% and 4.2% (Multifamily), respectively (1). We believe that the potential returns at these pricing levels do not justify the risks inherent in those asset types in those markets. Those two metro areas, together with San Jose, Boston, Austin and Raleigh/Durham, form an economic cluster tied to Tech (“Tech Centers”).

We believe the pricing has been driven up as the larger, institutional firms have accumulated an outsized position in the cities that make up the Tech Centers cluster (2). For the past few years we have generally steered clear of the Tech Centers in large part because of our view that assets in those cities are “over-bought” and that the risk/reward balance is not in equilibrium at this point in the cycle.

But sometimes, when you listen, a potential gem reveals itself. For example, earlier this year in the course of regular conversations with our friends, allies and partners, an interesting investment opportunity surfaced. Located on the edge of a Tech Center city was a simple but sprawling community retail shopping center. The center had some vacancy and its market value had fallen well below its original development cost from just before the GFC. Yet, the market is growing, the center has outstanding access and visibility, the tenants’ sales are picking up and there are no competing shopping centers in the immediate area to draw shoppers away.

To us, “listening to the market” means both a willingness to be open-minded and an eagerness to understand a complicated story. This opportunity came with myriad moving pieces to figure out… and the current owner just wanted to move on. If we and our local operating partner can resolve the issues, this investment could be a home run. We don’t yet know if we will even be awarded the deal, but we’re intrigued by the possibility. Retail properties right now are the least favored property type for institutional investors as ecommerce puts traditional “bricks & mortar” through wrenching change. This is especially so for properties with problems to solve. For the right deal, we view that as an opportunity to create value.

Why aren’t more investors pursuing this deal? Beyond the fact that retail is an “orphaned” property type at this time, we believe it’s one or more of several reasons. First, it’s too small for the big players (3). Second, it’s too much work. Third, it’s in a smaller Tech Center city, so it’s below the radar of many of the bigger firm’s acquisitions officers. Fourth, it could be “structural.” That is, in most large firms, the research group is in a separate silo from acquisitions which, in turn, is separate from asset management. It’s not an optimal organizational structure for surfacing and vetting opportunities that require creativity, vision, effort and energy.

We enjoy the unruly process of putting our entire investment team in the same room every Monday morning to discuss all the opportunities in the “pipeline.”

We enjoy the unruly process of putting our entire investment team in the same room every Monday morning to discuss all the opportunities in the “pipeline.” Issues are vetted. Concerns are raised and discussed. Questions are posed and answered. This, we believe, allows an attractive real estate deal to be revealed. Instead of the traditional “top-down” approach of filling prescribed geographic and property-type buckets, we prefer to let opportunities bubble-up from the bottom.

The beauty of investing in private transaction markets is the opportunity to find inefficiencies. We like to listen to the market. Even if a particular metro area or property type is a little outside our “strike zone,” if we’re willing to listen, we might hear something quite appealing.

Ronald W. Kaiser, CRE, is a Co-Founder of Bailard and Director of Real Estate Research

ECONOMIC CLUSTERS

Bailard real estate research has developed an approach that organizes America’s 128 different urban areas (Combined Statistical Areas, or CSAs) into eight groups of similarly performing cities. This is not done by the standard industry geographic approaches, where cities are grouped into broad regions of East, South, Midwest and West. Instead, Bailard has grouped the CSAs into similarly-performing economic clusters, where the economic drivers in these cities are similar from city to city, and therefore the various property types tend to move in rhythms that correlate with each other. The eight clusters include Capital Metro, Heartland, Large Growth, New SoCal, New York Corridor, Old SoCal, Sun & Sand and Tech Centers.

Using a geographic screen, Tech Center cities like Austin, Boston and San Jose would appear to be diversified all around the country. Yet, the Tech industry’s continued extraordinary growth has driven rents to extreme heights that has propelled a large wave of development. This brings substantial risk of overbuilding and a subsequent downward correction in rents and market values. As a result, we believe there’s less diversification protection from this risk than geographic diversification screens would suggest.

Our research has grown from the efforts of our previous work over the past 25 years. Please see Bailard’s white paper, “Using Economic Clusters to Better Manage Risks and Enhance Returns” for further details.

Women in the C-Suite: Progress Remains Slow Issue Brief

One hundred and seventy one years ago this July, the first women’s rights conference in the United States was held in Seneca Falls, New York. The conference (which also covered religious rights and had a strong abolitionist bent) launched the women’s suffrage movement in the United States. It took another 70 years before the movement led to voting rights for women.